Massachusetts Retirement Plan for Outside Directors

Description

How to fill out Retirement Plan For Outside Directors?

Finding the right legitimate record template might be a have difficulties. Of course, there are a variety of themes available on the net, but how will you obtain the legitimate kind you will need? Make use of the US Legal Forms site. The support gives 1000s of themes, for example the Massachusetts Retirement Plan for Outside Directors, which you can use for business and private requires. All the varieties are inspected by pros and meet state and federal requirements.

Should you be already signed up, log in to your accounts and click on the Down load key to have the Massachusetts Retirement Plan for Outside Directors. Utilize your accounts to check from the legitimate varieties you have ordered earlier. Go to the My Forms tab of your accounts and get one more duplicate of your record you will need.

Should you be a fresh customer of US Legal Forms, listed below are basic instructions so that you can stick to:

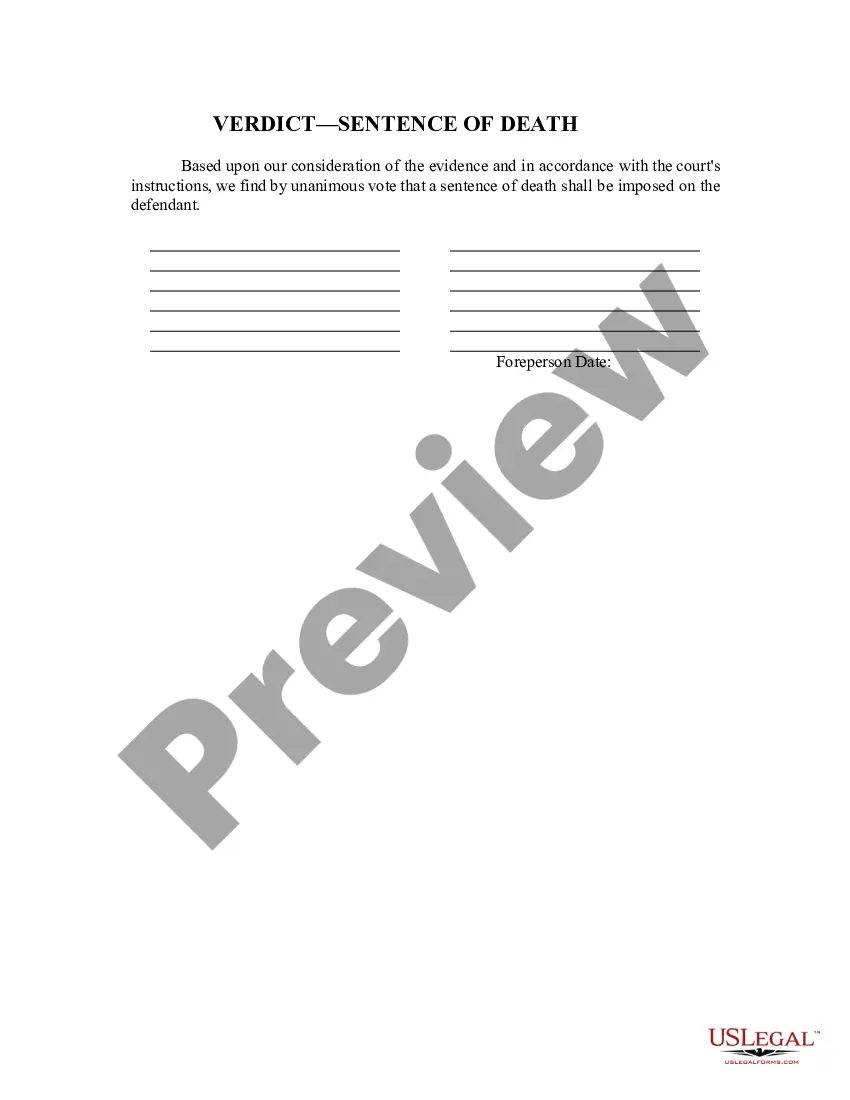

- Very first, be sure you have chosen the proper kind for the area/region. You may look through the shape using the Preview key and study the shape outline to ensure it is the right one for you.

- If the kind fails to meet your needs, utilize the Seach field to discover the correct kind.

- When you are positive that the shape is proper, go through the Acquire now key to have the kind.

- Pick the prices plan you need and enter the essential information and facts. Design your accounts and pay money for your order using your PayPal accounts or credit card.

- Opt for the data file file format and down load the legitimate record template to your product.

- Full, change and print out and sign the obtained Massachusetts Retirement Plan for Outside Directors.

US Legal Forms is the greatest library of legitimate varieties for which you can see a variety of record themes. Make use of the company to down load expertly-produced papers that stick to express requirements.

Form popularity

FAQ

You can access all the funds in your account, including employee and employer contributions, at age 59½. You can do this even if you are actively working and contributing to the plan.

You are eligible for retirement from the Massachusetts State Employee Retirement System (MSERS) at any age with twenty or more years of state service or at age 55 or 60 (depending on hire date) with 10 or more years of state service.

Qualifying for a Retirement Benefit For most members, that means you have a minimum of 10 years of full-time creditable service.

You are ultimately responsible in the ORP for your outcomes. It is important to have a strategy and plan if you are in the ORP plan. The pension may be a better choice if you do want the State to be in charge of the funds and ultimately your payout at your retirement.

Correctional employees of the Department of Correction seeking a ?20/50? retirement benefit must have 20 years of creditable service with the department and must be classified in Group 4 to retire at any age.

The other main benefit of the ORP is its flexibility during retirement. Unlike the TRS plan, which will pay out based on a defined formula, the ORP's payout can be tailored to meet your spending needs as they rise and fall.

ORP funds may be reinvested by you regardless of when you leave employment. SERS funds are portable should you leave before reaching 10 years of state service. However, should your employment end after 10 years of service, SERS funds and benefits will be frozen, but you can access them upon retirement.

The ORP is a 401(a) defined contribution plan. Your account balance is based upon contributions from you and USG, plus accumulated earnings. You select your investment elections and can manage those elections within your selected vendor's platform.