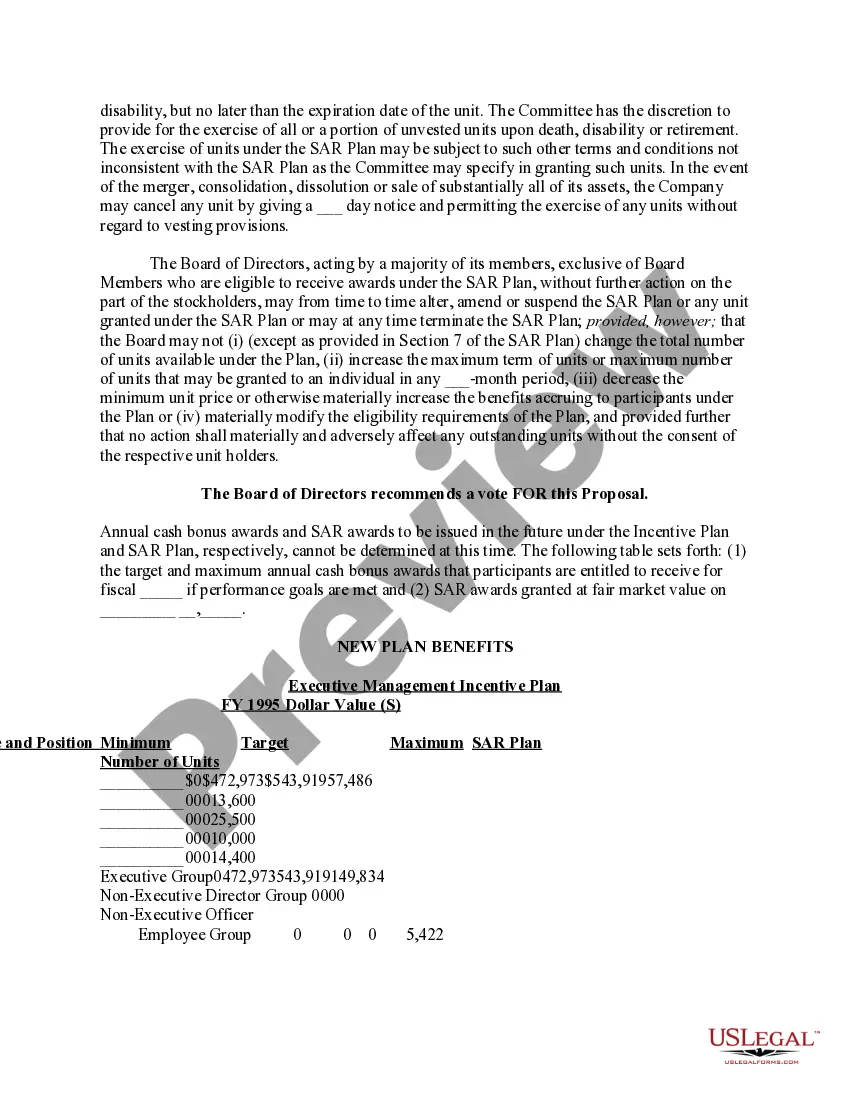

Massachusetts Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Are you presently inside a place that you will need files for either organization or specific reasons virtually every working day? There are plenty of authorized papers layouts available online, but locating versions you can rely isn`t easy. US Legal Forms gives a huge number of kind layouts, just like the Massachusetts Proposal to approve material terms of stock appreciation right plan, that are written in order to meet state and federal needs.

If you are presently informed about US Legal Forms internet site and get an account, simply log in. Following that, you are able to obtain the Massachusetts Proposal to approve material terms of stock appreciation right plan template.

Should you not offer an accounts and wish to begin using US Legal Forms, abide by these steps:

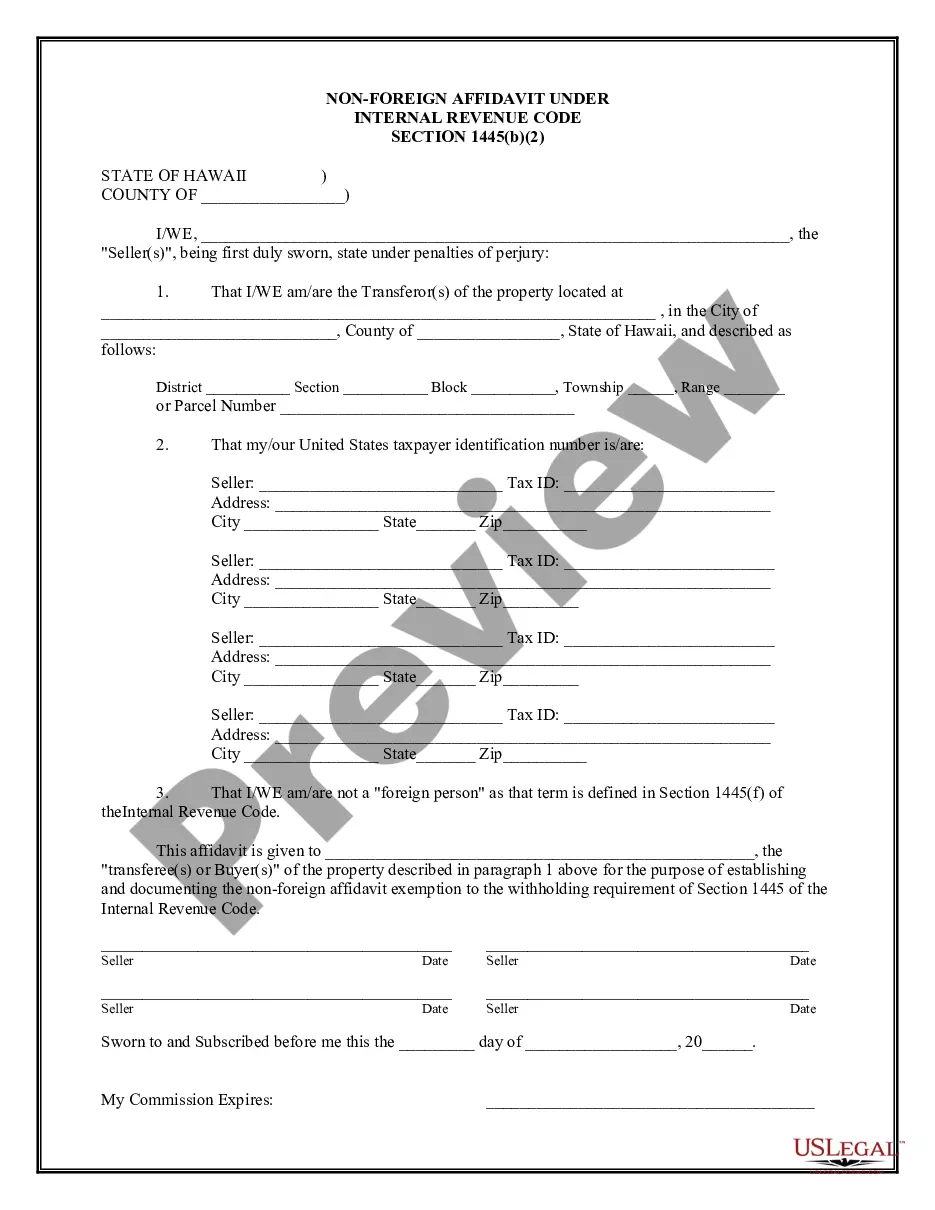

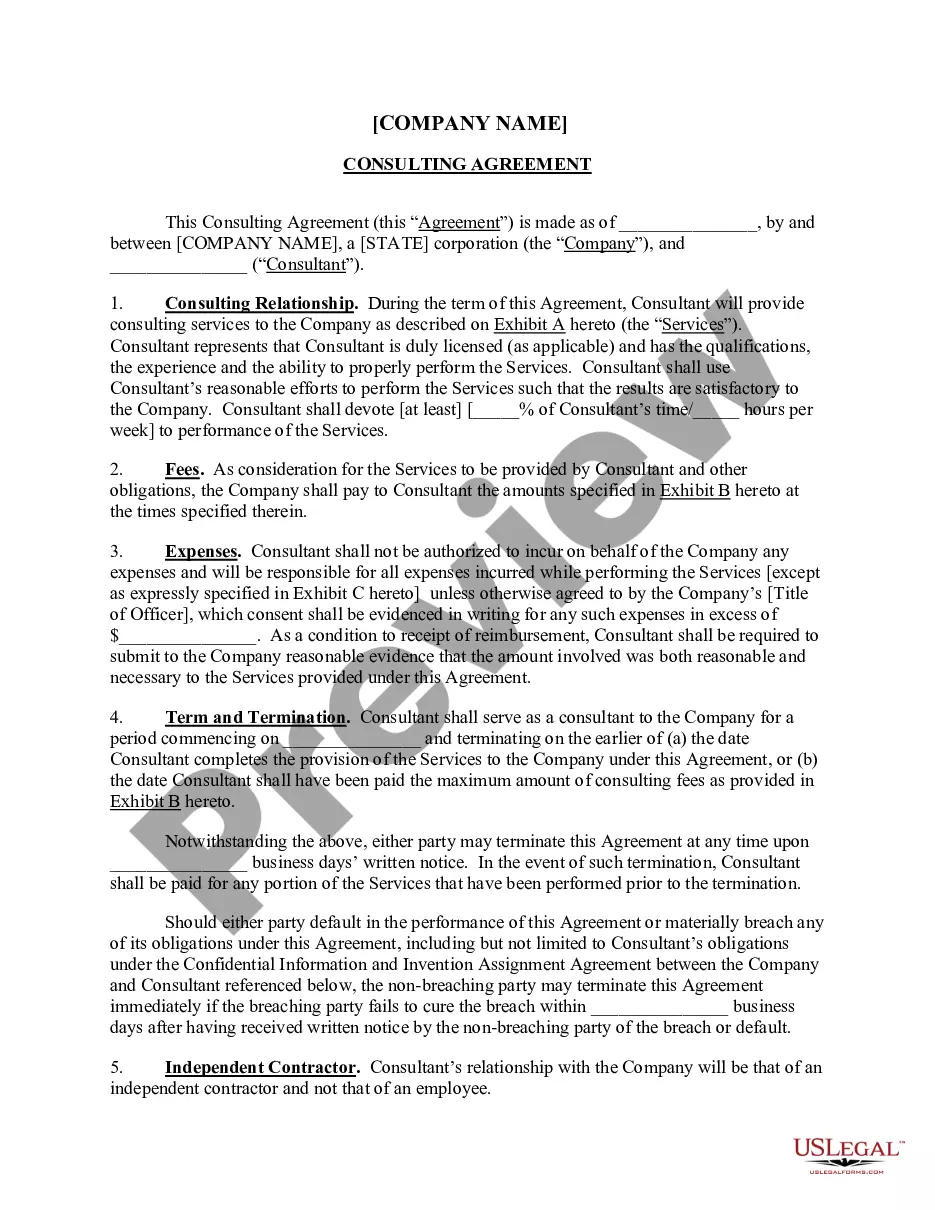

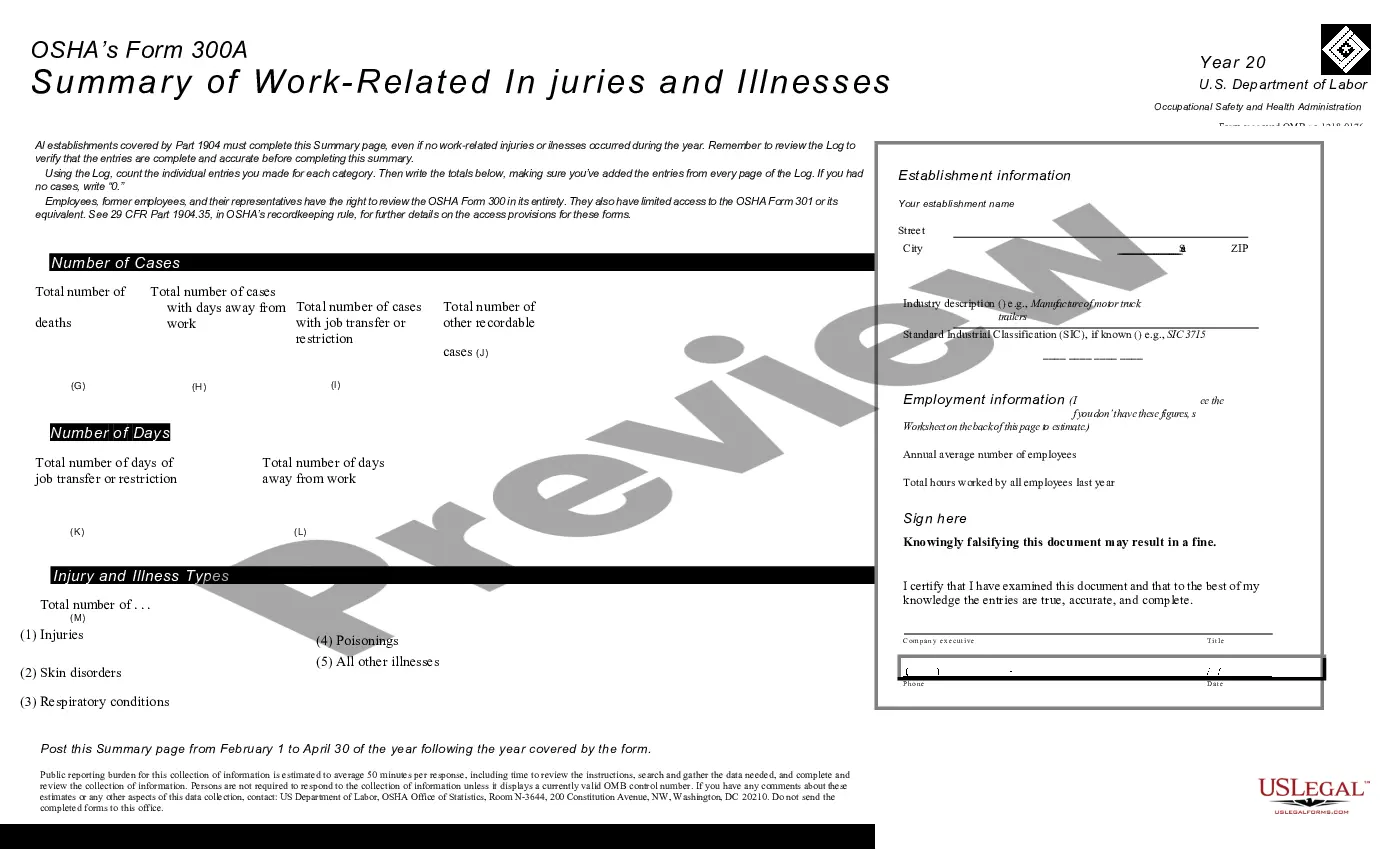

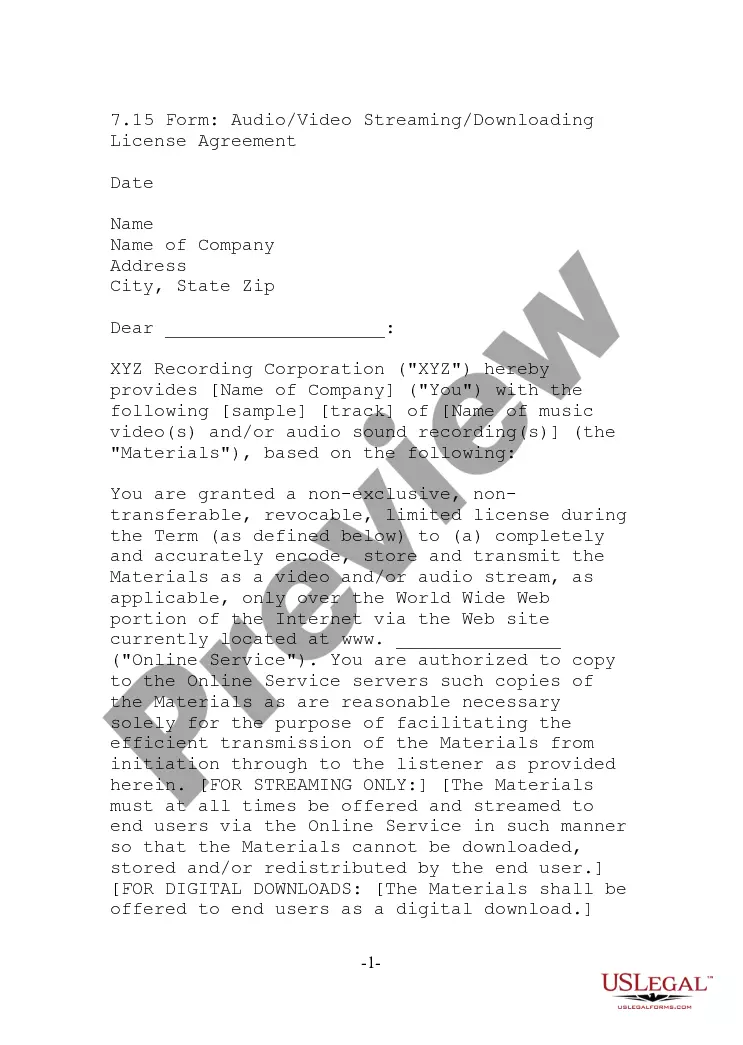

- Get the kind you need and ensure it is to the right area/county.

- Utilize the Preview switch to analyze the form.

- Look at the information to ensure that you have selected the appropriate kind.

- In case the kind isn`t what you`re seeking, take advantage of the Look for field to discover the kind that meets your needs and needs.

- Once you get the right kind, click Acquire now.

- Pick the pricing program you desire, submit the desired information to produce your money, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free data file formatting and obtain your duplicate.

Locate each of the papers layouts you have purchased in the My Forms menu. You may get a additional duplicate of Massachusetts Proposal to approve material terms of stock appreciation right plan anytime, if possible. Just click the needed kind to obtain or printing the papers template.

Use US Legal Forms, probably the most extensive selection of authorized varieties, to save efforts and prevent errors. The support gives appropriately manufactured authorized papers layouts which can be used for a selection of reasons. Produce an account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an ?exercise price? or ?grant price? over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant. Stock Appreciation Rights Fundamentals Meridian Compensation Partners ? uploads ? Stoc... Meridian Compensation Partners ? uploads ? Stoc... PDF

Employees can only exercise the stock appreciation rights after the shares have vested. The vesting period is the minimum period employees must hold the stocks before they can exercise the stock appreciation rights. Generally, employers offer stock appreciation rights along with stock options.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Employee stock ownership plans (ESOPs), which can be stock bonus plans or stock bonus/money purchase plans, are qualified defined contribution plans under IRC section 401(a). Similar to stock options, stock appreciation rights are given at a predetermined price and often have a vesting period and expiration date.