Massachusetts Approval of Stock Option Plan

Description

How to fill out Approval Of Stock Option Plan?

US Legal Forms - among the most significant libraries of authorized types in America - provides an array of authorized file web templates you may obtain or printing. While using site, you will get thousands of types for business and personal reasons, sorted by categories, says, or keywords and phrases.You can get the newest versions of types just like the Massachusetts Approval of Stock Option Plan within minutes.

If you already possess a monthly subscription, log in and obtain Massachusetts Approval of Stock Option Plan from the US Legal Forms library. The Down load option will show up on every develop you view. You have access to all earlier saved types within the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, allow me to share straightforward recommendations to help you get started off:

- Make sure you have selected the best develop for the metropolis/county. Click the Review option to check the form`s information. See the develop information to actually have selected the proper develop.

- In case the develop does not fit your specifications, make use of the Lookup discipline towards the top of the display screen to obtain the one which does.

- If you are happy with the form, validate your decision by clicking on the Buy now option. Then, choose the costs strategy you prefer and supply your references to sign up on an profile.

- Procedure the transaction. Make use of your bank card or PayPal profile to complete the transaction.

- Find the format and obtain the form on your own device.

- Make alterations. Fill out, change and printing and signal the saved Massachusetts Approval of Stock Option Plan.

Each and every format you put into your account lacks an expiry particular date which is your own property forever. So, in order to obtain or printing another version, just go to the My Forms area and then click around the develop you require.

Obtain access to the Massachusetts Approval of Stock Option Plan with US Legal Forms, probably the most extensive library of authorized file web templates. Use thousands of specialist and status-distinct web templates that meet up with your small business or personal needs and specifications.

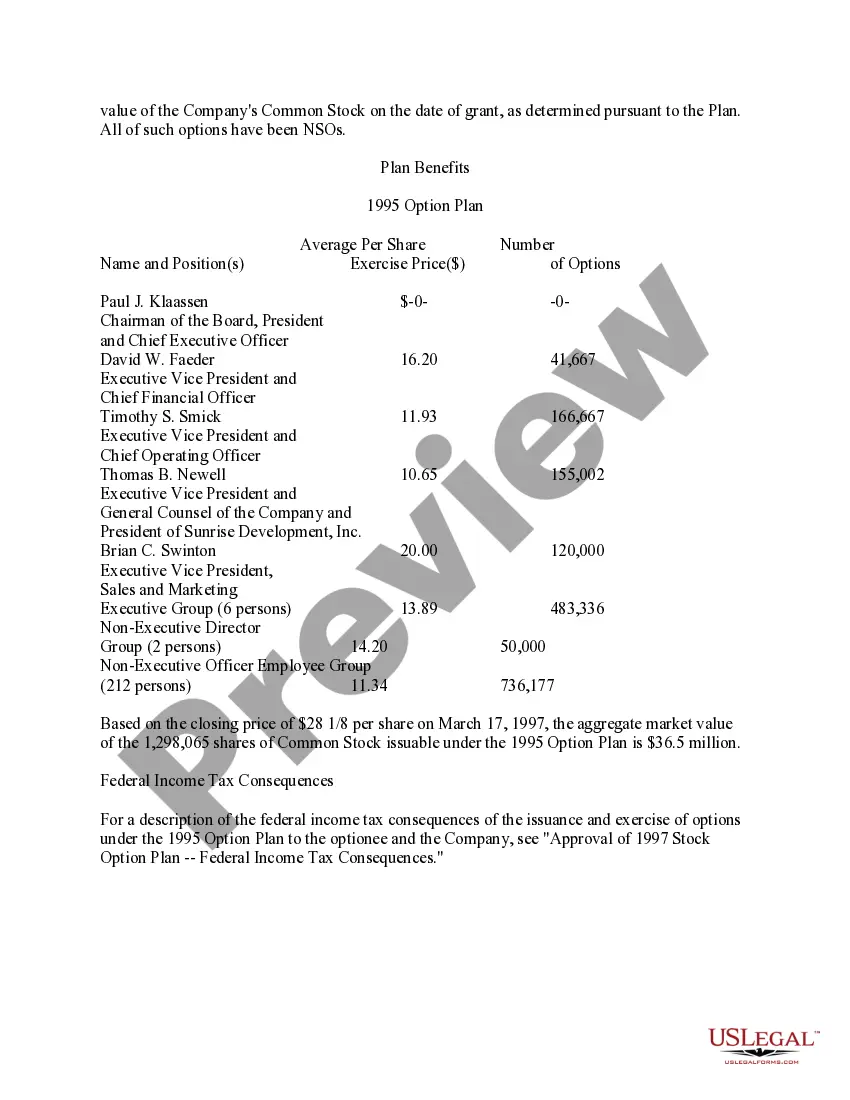

Form popularity

FAQ

The excess of the fair market value of the stock at the date the option was exercised over the amount paid for the stock is taxed as compensation at the time the stock is sold. Any additional profit is taxed as capital gain.

Traders write an option by creating a new option contract that sells someone the right to buy or sell a stock at a specific price (strike price) on a specific date (expiration date). In other words, the writer of the option can be forced to buy or sell a stock at the strike price.

When you get an option to buy securities through your employer, it does not immediately affect your tax situation. An option is an opportunity to buy securities at a certain price. The securities under the option agreement may be shares of a corporation or units of a mutual fund trust.

Key Takeaways. Before options can be written, a stock must be properly registered, have a sufficient number of shares, be held by enough shareholders, have sufficient volume, and be priced high enough. The specifics of these rules can change, but the general idea is to protect investors.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Depending upon the tax treatment of stock options, they can be classified into qualified and non-qualified stock options. Qualified stock options are also called Incentive Stock Options (ISO).