Massachusetts Proposal Approval of Nonqualified Stock Option Plan

Description

How to fill out Proposal Approval Of Nonqualified Stock Option Plan?

US Legal Forms - among the most significant libraries of legitimate types in America - delivers a wide range of legitimate document templates you may down load or print out. While using internet site, you can find a large number of types for company and person purposes, categorized by classes, suggests, or keywords and phrases.You can get the newest variations of types such as the Massachusetts Proposal Approval of Nonqualified Stock Option Plan within minutes.

If you currently have a membership, log in and down load Massachusetts Proposal Approval of Nonqualified Stock Option Plan from the US Legal Forms catalogue. The Down load switch will appear on each form you look at. You get access to all formerly saved types in the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, allow me to share basic guidelines to obtain started off:

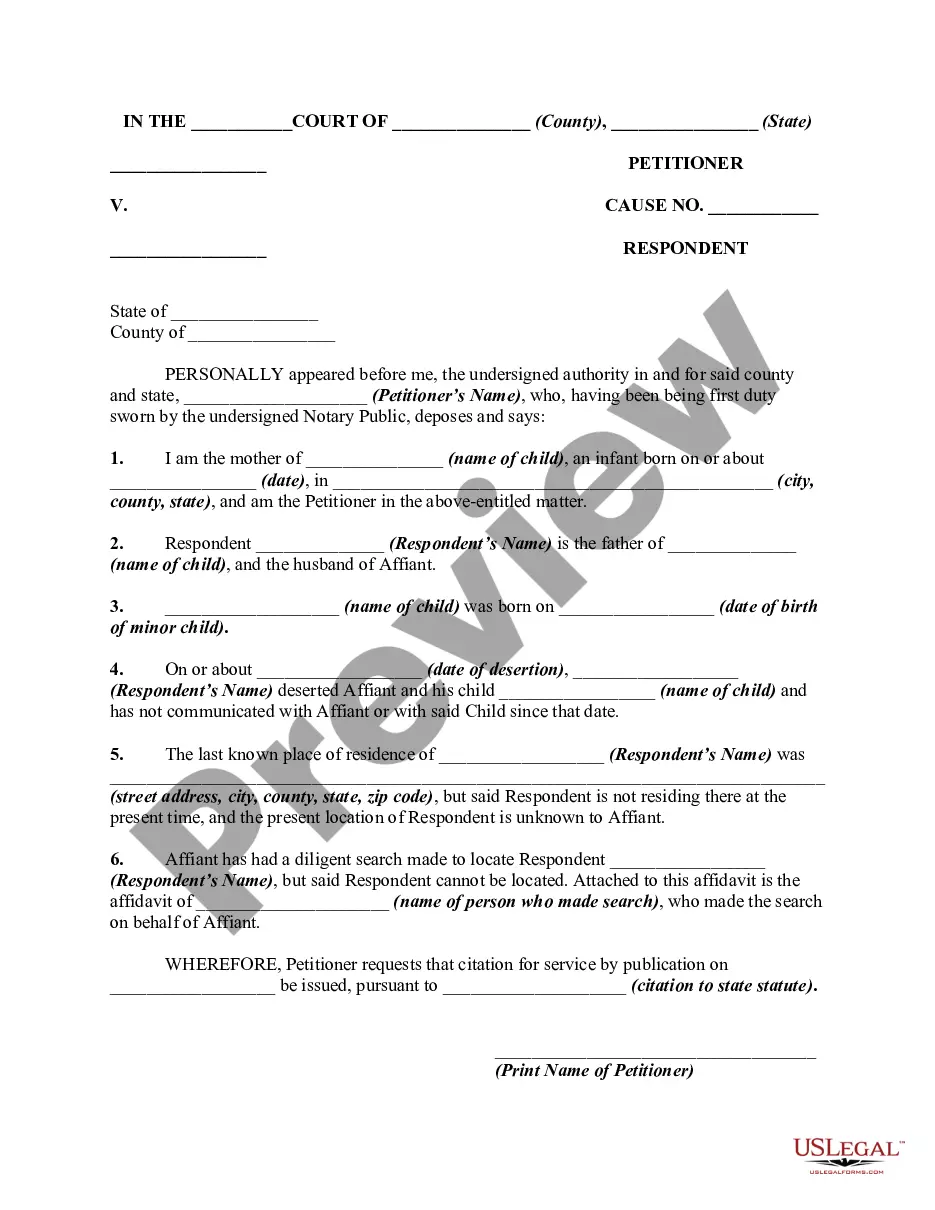

- Be sure to have picked the best form for the metropolis/area. Go through the Preview switch to check the form`s content. Read the form outline to actually have chosen the correct form.

- If the form does not satisfy your needs, make use of the Research field towards the top of the screen to discover the the one that does.

- If you are content with the form, verify your option by visiting the Purchase now switch. Then, choose the rates program you prefer and offer your references to sign up for an accounts.

- Procedure the deal. Make use of your bank card or PayPal accounts to perform the deal.

- Find the structure and down load the form on the device.

- Make alterations. Load, modify and print out and indication the saved Massachusetts Proposal Approval of Nonqualified Stock Option Plan.

Every single template you put into your money does not have an expiration particular date and is also your own permanently. So, if you want to down load or print out yet another duplicate, just go to the My Forms portion and click on about the form you will need.

Obtain access to the Massachusetts Proposal Approval of Nonqualified Stock Option Plan with US Legal Forms, by far the most extensive catalogue of legitimate document templates. Use a large number of skilled and express-particular templates that satisfy your organization or person requires and needs.

Form popularity

FAQ

Board Approval The Company's board of directors must approve all stock option grants, including the name of the recipient, the number of shares, the vesting schedule and the exercise price. This can be done either in a board meeting or via unanimous written consent.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.