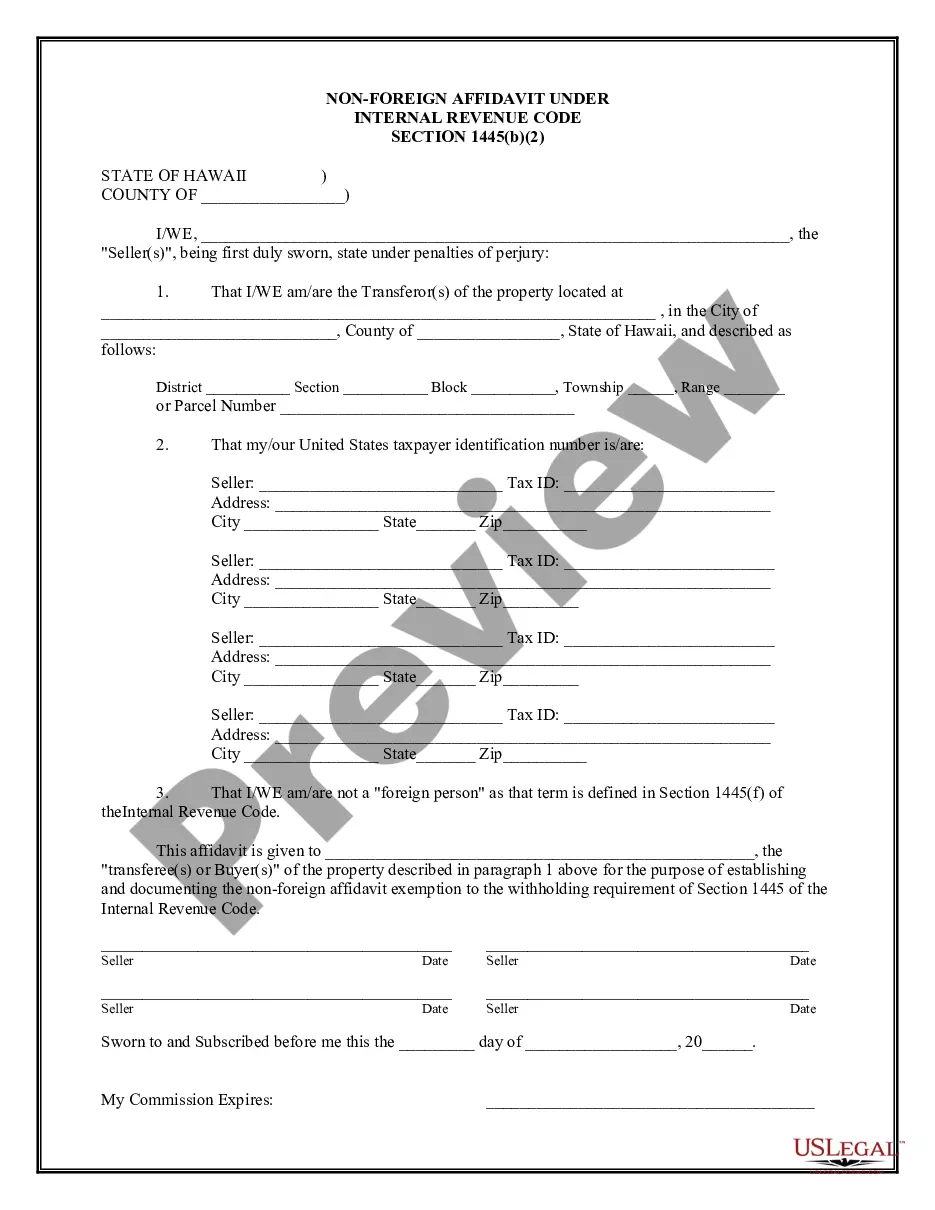

This form is for a seller to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. Upon

Hawaii Non-Foreign Affidavit Under IRC 1445

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Non-Foreign Affidavit Under IRC 1445?

Obtain one of the most comprehensive collections of legal documents.

US Legal Forms is a platform where you can locate any state-specific file in a few clicks, such as Hawaii Non-Foreign Affidavit Under IRC 1445 templates.

There's no need to waste your time searching for a court-admissible form.

If everything is accurate, click Buy Now. After choosing a pricing plan, create an account. Pay via credit card or PayPal. Save the sample to your computer by pressing Download. That's it! You need to submit the Hawaii Non-Foreign Affidavit Under IRC 1445 form and verify it. To ensure everything is correct, consult your local legal advisor for assistance. Sign up and easily explore 85,000 useful forms.

- To utilize the document library, select a subscription, and create an account.

- If you have previously created it, just Log In and click Download.

- The Hawaii Non-Foreign Affidavit Under IRC 1445 document will automatically be saved in the My documents section (a section for every form you download on US Legal Forms).

- To create a new profile, follow the simple instructions below.

- If you plan to use a state-specific document, ensure you select the correct state.

- If possible, review the description to comprehend all the details of the form.

- Use the Preview option if it’s available to examine the document's information.

Form popularity

FAQ

Typically, the seller provides the FIRPTA affidavit during a real estate transaction. In line with the Hawaii Non-Foreign Affidavit Under IRC 1445, this document demonstrates that the seller is not a foreign entity, thus protecting the buyer from unexpected tax liabilities. It is advisable for sellers to prepare this affidavit ahead of time to avoid delays. Consider using uslegalforms for templates and support in preparing your FIRPTA affidavit.

The FIRPTA is usually signed by the seller of the property. For the Hawaii Non-Foreign Affidavit Under IRC 1445, it is crucial that the seller provides accurate information regarding their foreign status. This form helps affirm that the seller is not subject to withholding because they are a U.S. person. Engaging with professionals or platforms like uslegalforms can ensure this process is completed correctly.

In the context of the Hawaii Non-Foreign Affidavit Under IRC 1445, the seller of the property typically signs the FIRPTA certificate. This certificate is essential to confirm that the seller is not a foreign person for tax purposes. By signing, the seller certifies their non-foreign status, which helps facilitate a smoother transaction. Remember, accurately completing this form can save potential tax implications for both parties.

A FIRPTA statement is a declaration made by a property seller regarding their tax status under the Foreign Investment in Real Property Tax Act. This statement is essential for both the seller and buyer during property transactions, providing clarity about withholding requirements. To avoid misunderstandings, utilizing the Hawaii Non-Foreign Affidavit Under IRC 1445 will help facilitate a smoother transaction. Make sure to include this statement in your real estate dealings.

Yes, a FIRPTA Affidavit typically requires notarization. This process adds a layer of authenticity and validity to the document, ensuring all parties accept its contents as true. By notarizing the Hawaii Non-Foreign Affidavit Under IRC 1445, you protect both yourself and the buyer from future disputes regarding the seller's tax status. Be sure to have your affidavit notarized before finalizing any property sale.

Under section 1445, a foreign person is defined as any individual or entity that is not a U.S. citizen and does not hold U.S. residency. This classification is crucial because it establishes whether FIRPTA withholding applies during property transactions. Recognizing your status is vital when dealing with the Hawaii Non-Foreign Affidavit Under IRC 1445 to ensure compliance. Seek guidance to clarify your status and fulfill your obligations properly.

The FIRPTA Affidavit serves as a declaration that the seller is not considered a foreign entity as defined under FIRPTA. By submitting this affidavits when selling property, sellers can avoid triggering withholding requirements. This document simplifies the process, making it clear to both parties that the seller is compliant with the tax regulations. Use the Hawaii Non-Foreign Affidavit Under IRC 1445 to streamline your property transactions.

To claim FIRPTA withholding, you must file an income tax return with the IRS. You can report the withheld amount as a credit against your tax liability for that year. Depending on your situation, you may qualify for a refund after filing your return. It's advisable to utilize the Hawaii Non-Foreign Affidavit Under IRC 1445 to demonstrate your eligibility for the withholding exemption.

The FIRPTA Affidavit is typically signed by the seller of the property. This document certifies that the seller is not a foreign person under section 1445 of the Internal Revenue Code. By signing the Hawaii Non-Foreign Affidavit Under IRC 1445, the seller ensures that no withholding tax applies to the sale. It's crucial for sellers to provide accurate information to avoid any legal issues.

FIRPTA Affidavits are typically prepared by the seller of the property or their legal representatives. Real estate professionals involved in the transaction may also assist in drafting these documents. Ensuring that you have the right affidavit, such as a Hawaii Non-Foreign Affidavit Under IRC 1445, is crucial for confirming your non-foreign status and safeguarding against unnecessary tax withholding.