Massachusetts Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005

Description

How to fill out Current Expenditures Of Individual Debtors - Schedule J - Form 6J - Post 2005?

If you need to complete, down load, or print out authorized document themes, use US Legal Forms, the largest selection of authorized kinds, which can be found on the web. Take advantage of the site`s simple and handy lookup to discover the paperwork you require. Various themes for business and specific reasons are sorted by groups and suggests, or keywords. Use US Legal Forms to discover the Massachusetts Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 with a couple of click throughs.

When you are presently a US Legal Forms customer, log in to the bank account and click on the Download switch to obtain the Massachusetts Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005. You may also access kinds you earlier delivered electronically in the My Forms tab of the bank account.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for your appropriate area/region.

- Step 2. Use the Preview method to look over the form`s information. Do not forget about to learn the explanation.

- Step 3. When you are unhappy together with the type, utilize the Look for discipline on top of the display screen to get other models in the authorized type format.

- Step 4. When you have found the shape you require, click the Acquire now switch. Choose the costs strategy you prefer and add your references to sign up on an bank account.

- Step 5. Procedure the deal. You should use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Pick the formatting in the authorized type and down load it on the system.

- Step 7. Total, revise and print out or indication the Massachusetts Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005.

Every authorized document format you get is yours permanently. You might have acces to each type you delivered electronically in your acccount. Go through the My Forms portion and choose a type to print out or down load again.

Contend and down load, and print out the Massachusetts Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 with US Legal Forms. There are thousands of expert and express-particular kinds you may use for your personal business or specific requirements.

Form popularity

FAQ

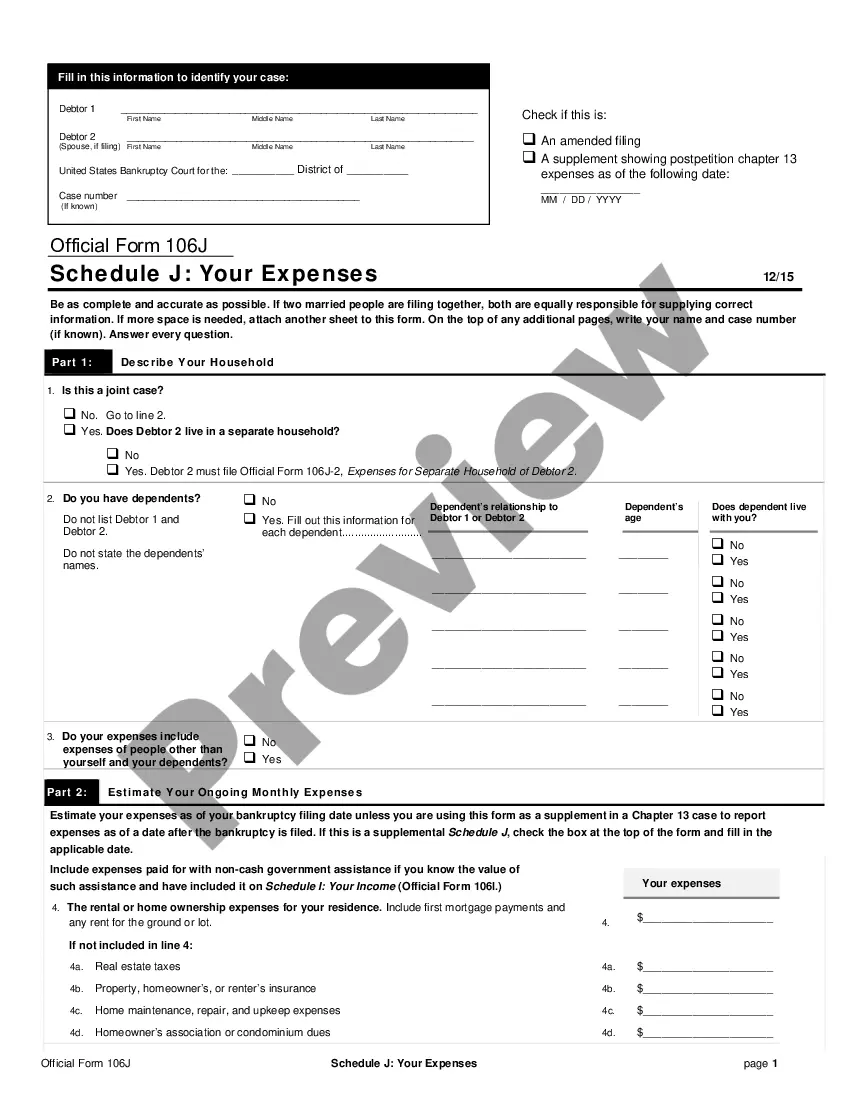

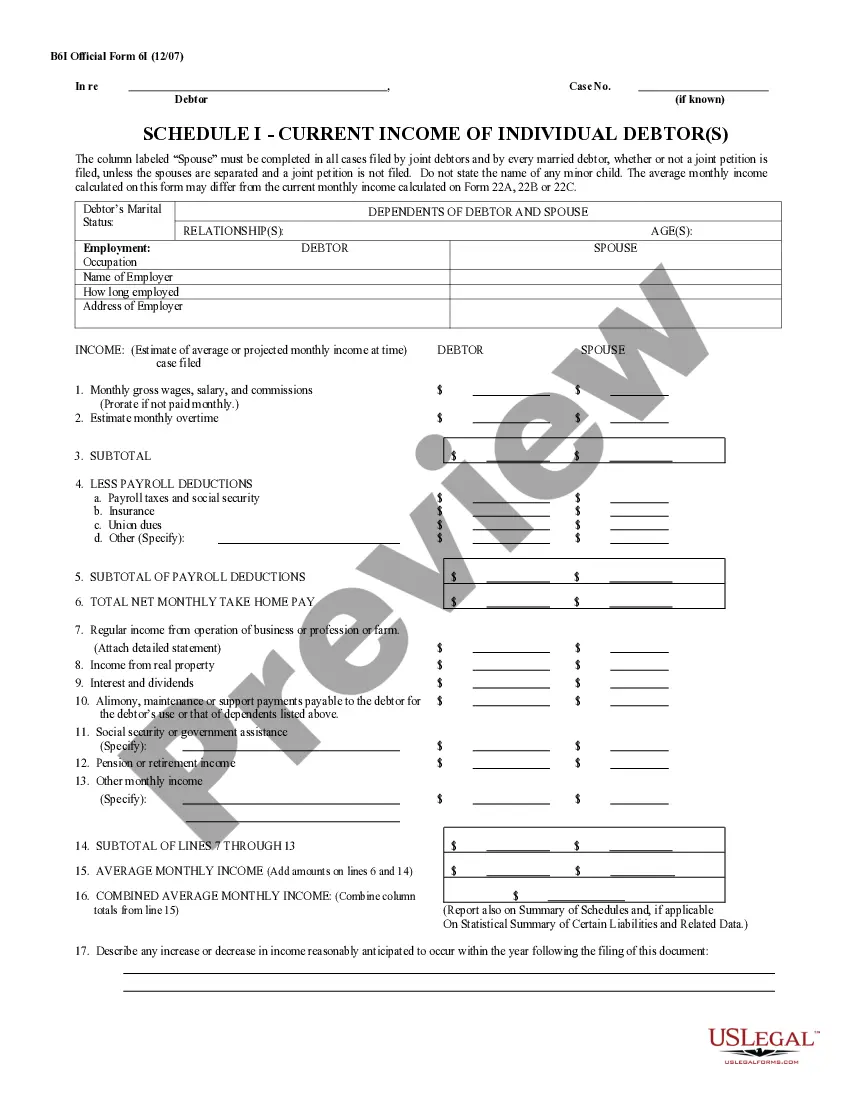

Schedule J: Your Expenses (Official Form 106J) provides an estimate of the monthly expenses, as of the date you file for bankruptcy, for you, your dependents, and the other people in your household whose income is included on Schedule I: Your Income (Official Form 106I).

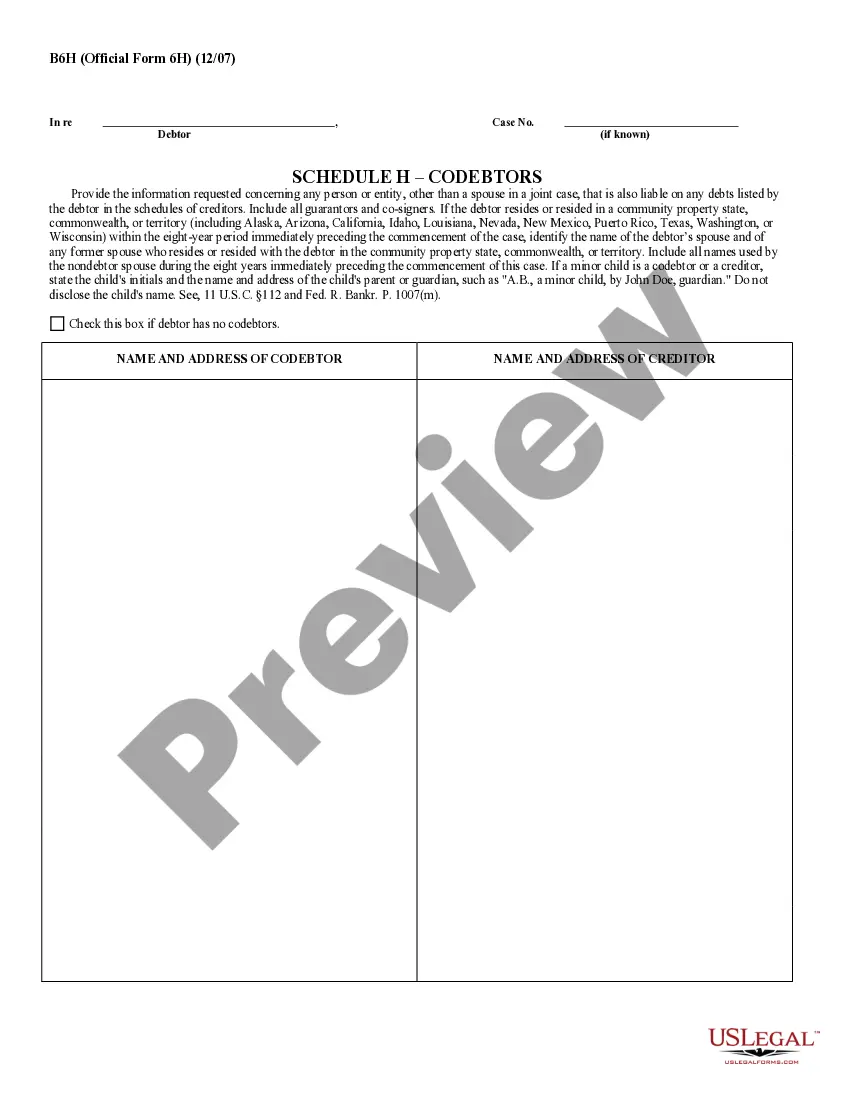

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.

?There are ways to qualify for a Chapter 7 bankruptcy even if your income is higher than the state median for a family your size,? Latham said. ?For example, you can deduct eligible expenses, such as your mortgage, car payments, health and life insurance premiums, taxes, child care, and charitable contributions.?

Some of the monthly expenses that are listed on your Schedule J include your rent or mortgage payments, upkeep expenses on your home, utilities, food, gas, telephone, water, car maintenance, childcare, clothing, laundry, and vehicle maintenance. Basically, the money you spend just to live each month is listed here.

Schedule J and its instructions guide you through calculation of tax on your current year elected farm income as well as the three base years to calculate your averaged income.

Schedule J helps the bankruptcy trustee determine your disposable income, which is the amount of money you have left over each month after paying your necessary expenses.

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.