Massachusetts FLSA Exempt / Nonexempt Compliance Form

Description

How to fill out FLSA Exempt / Nonexempt Compliance Form?

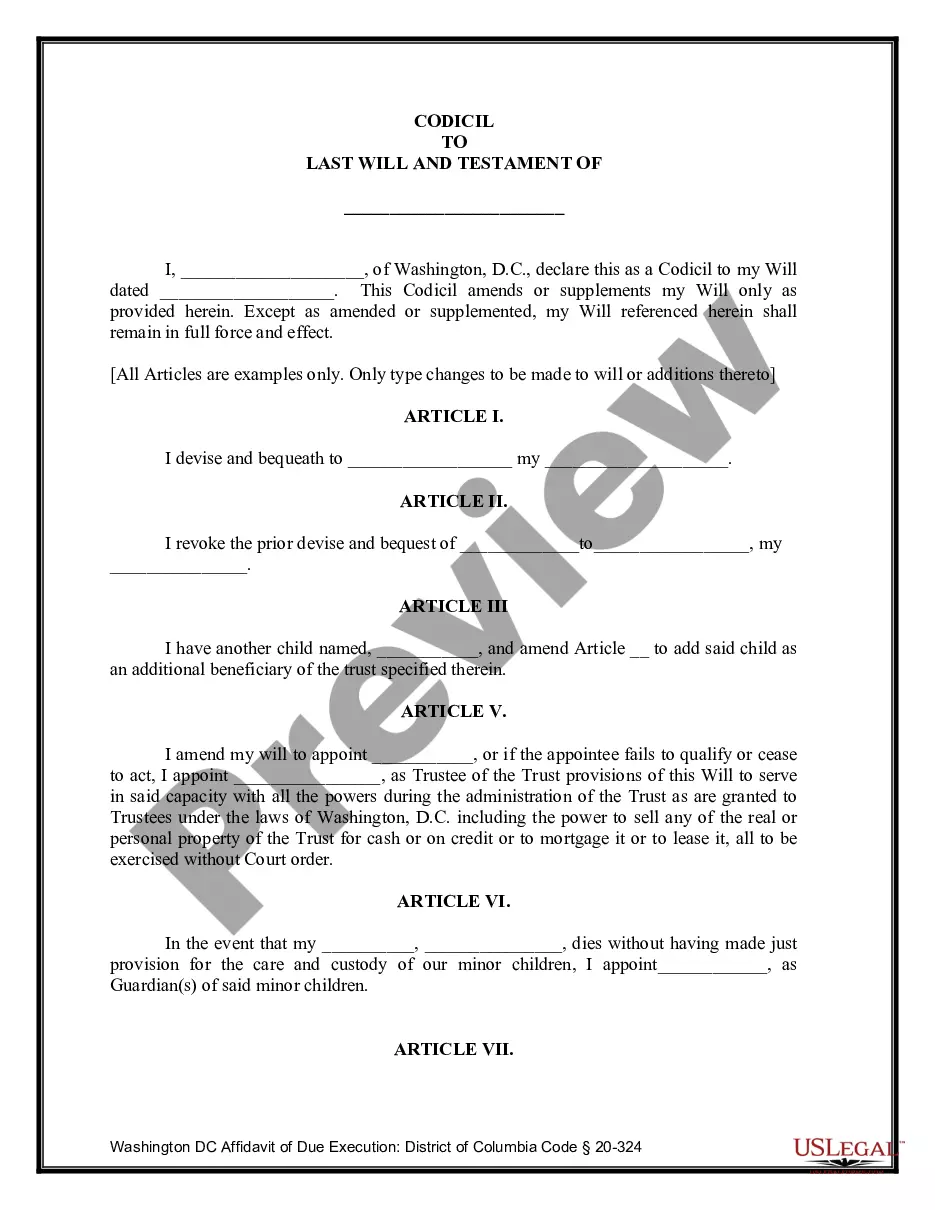

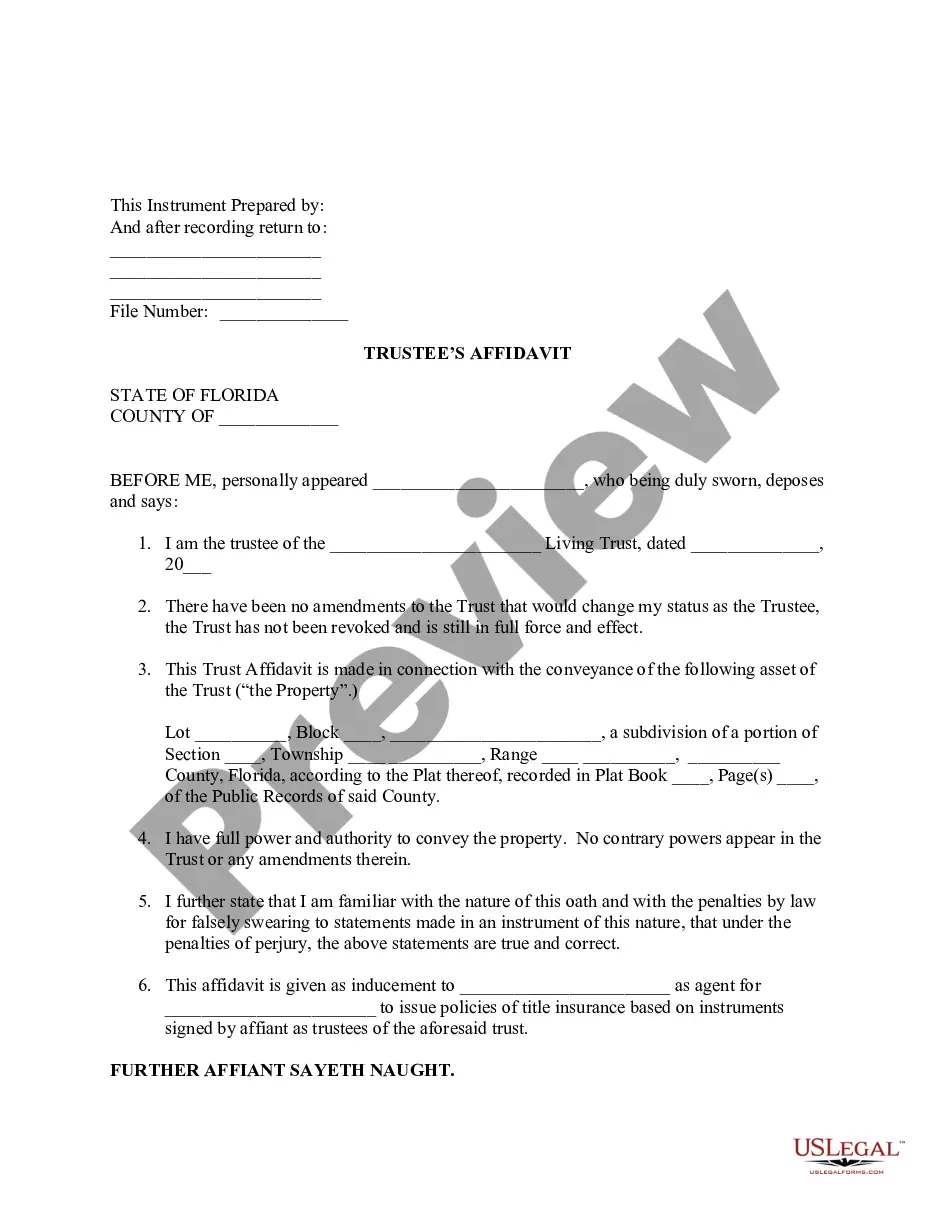

You can dedicate time online trying to find the legal document template that fulfills the state and federal requirements you require.

US Legal Forms provides thousands of legal documents that can be reviewed by experts.

You can download or print the Massachusetts FLSA Exempt / Nonexempt Compliance Form from my services.

If applicable, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, modify, print, or sign the Massachusetts FLSA Exempt / Nonexempt Compliance Form.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form details to ensure you have chosen the correct document.

Form popularity

FAQ

To fill out the Massachusetts M-4 form, begin by entering your personal information, including your name and Social Security number. Next, indicate the number of exemptions you wish to claim, based on guidance from the Massachusetts FLSA Exempt / Nonexempt Compliance Form. Finally, ensure all information is accurate and submit the form to your employer, which will help them determine the appropriate withholding amount from your paycheck.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

The distinction between these two classifications is that nonexempt employees must be paid overtime for all hours worked beyond forty in a workweek, while exempt employees do not receive overtime regardless of how many hours they work.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

Standards Act (FLSA) However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees.

While there has been no change regarding what duties make one eligible to be exempt and paid a salary, effective January 1, 2020, the minimum weekly salary an employee must receive if he or she is to remain or become exempt will increase from the current minimum of $455 per week to $684 per week -- the annual salary

Under the new regulations, an employee who is paid a guaranteed salary of not less than $455 per week can be classified as exempt if the employee meets the duties tests for an executive or administrative or professional employee as described below.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

State law does not call for overtime after 8 hours in a day. Some employees are exempt from overtime, such as executives, professionals, and some seasonal workers.

Executive, administrative, professional and outside sales employees: (as defined in Department of Labor regulations) and who are paid on a salary basis are exempt from both the minimum wage and overtime provisions of the FLSA.