Massachusetts Nonexempt Employee Time Report

Description

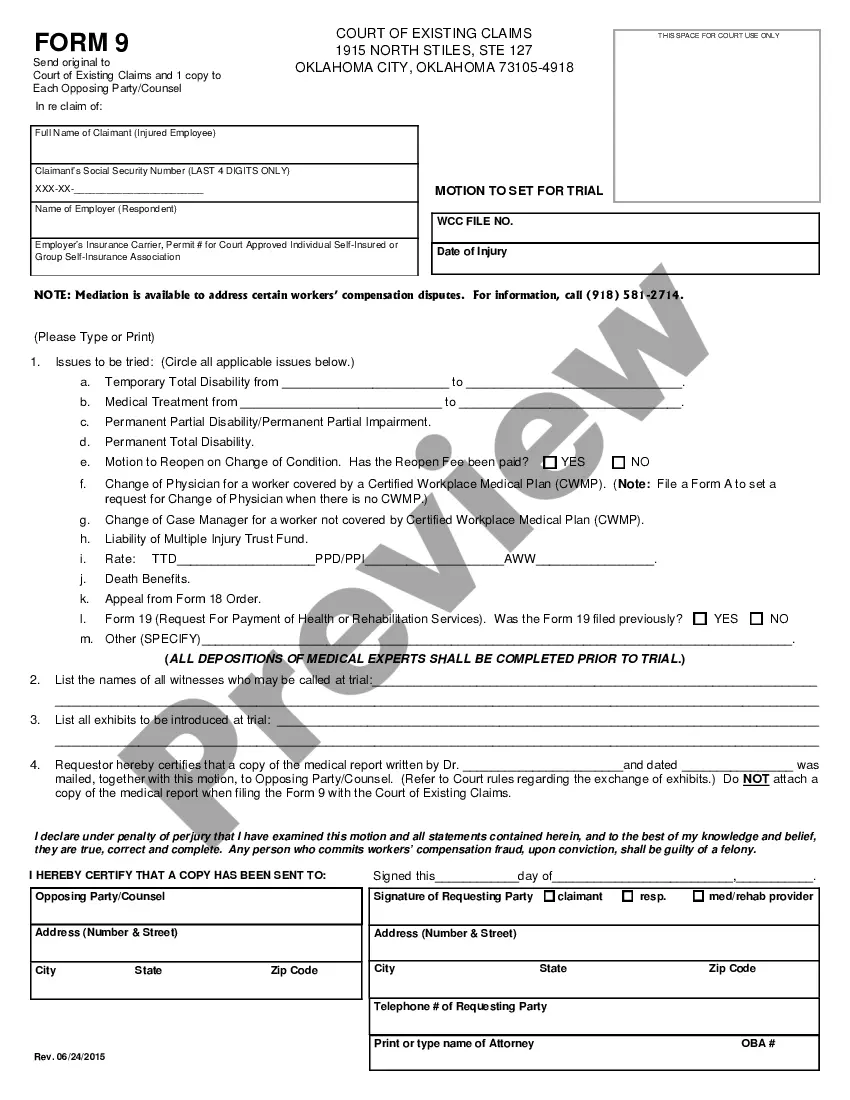

How to fill out Nonexempt Employee Time Report?

If you need to acquire, download, or print officially recognized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search function to find the documents you require. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to quickly retrieve the Massachusetts Nonexempt Employee Time Report with just a few clicks.

Step 4. Once you have found the form you desire, click on the Buy now button. Choose the pricing plan you prefer and enter your details to sign up for the account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, print, or sign the Massachusetts Nonexempt Employee Time Report.

Every legal document template you purchase is yours indefinitely. You will have access to each form you acquired in your account. Click on the My documents section and select a form to print or download again.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to access the Massachusetts Nonexempt Employee Time Report.

- You can also retrieve forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct town/state.

- Step 2. Utilize the Review option to examine the form’s details. Don’t forget to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Workers have a right to at least a 30-minute meal break for each 6 hours worked in a calendar day. During their meal break, workers must be free of all duties and free to leave the workplace. This break may be unpaid. Employers may require workers to take their meal breaks.

(c) The employer shall post 7 days in advance of the start of each week in writing a schedule that includes the shifts of all current employees at that worksite, whether or not they are scheduled to work or be on call that week. The employer shall update that posted schedule within 24 hours of any change.

From Boston.com: Massachusetts does not require employers to offer rest breaks other than the 30-minute lunch break2026 There is no federal law which requires an employer to provide rest breaks2026 Some bargaining agreements may require breaks during the work day.

The distinction between these two classifications is that nonexempt employees must be paid overtime for all hours worked beyond forty in a workweek, while exempt employees do not receive overtime regardless of how many hours they work.

Employers must provide employees with a written work schedule, including on-call shifts, before the schedule begins (commonly around 14 days preceding the first day of the schedule).

Massachusetts Law: Meal Breaks RequiredMost Massachusetts employers must allow employees to take a 30-minute meal break, if they will work for more than six hours. This time is unpaid, unless the employer chooses to pay employees for breaks.

An employer should give an employee who works an irregular shift pattern reasonable notice of their hours. Normally this would be included in the contract of employment and the standard notice period is around 7 days.

Employers must provide employees with prompt notice of any schedule changes. Schedule changes can occur in a smaller than 14-day window. Most scheduling laws require at least a 24-hour notice, however. Some laws require the employer to give the employee the right to accept or refuse.

Your employer must give you reasonable notice of any changes to your working hours, such as cancelling your shifts. They may request last minute changes, such as ringing you that morning to say that they do not require you to work. You can choose to agree to this change.

Employees can be required to work overtime, whether paid or unpaid, only if this is provided for in their contract of employment.