Massachusetts General Partnership for Business

Description

How to fill out General Partnership For Business?

Are you presently in a circumstance where you require documents for an organization or individual you often use.

There are numerous trustworthy document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of document templates, including the Massachusetts General Partnership for Business, which can be drafted to meet federal and state regulations.

Once you find the correct document, click Get now.

Select the pricing plan you wish, enter the necessary information to create your account, and pay for the order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can obtain the Massachusetts General Partnership for Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you need and ensure it is for the correct city/state.

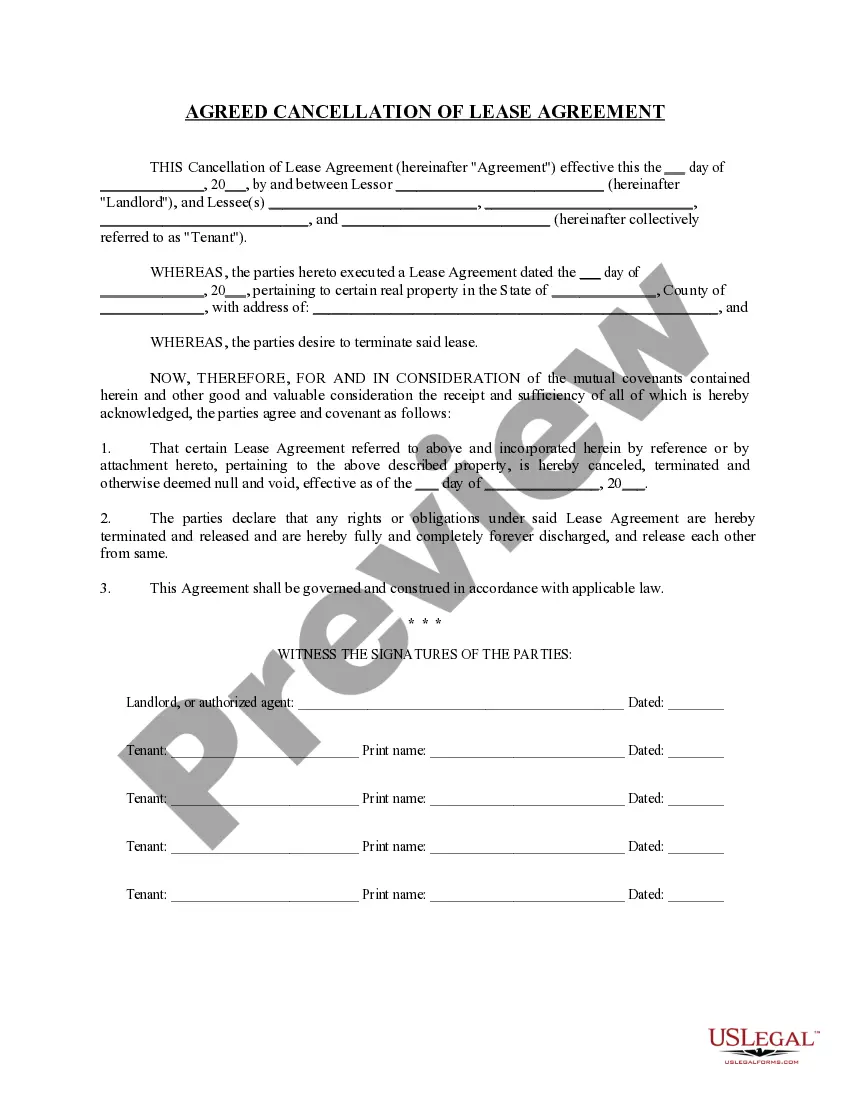

- Use the Review button to evaluate the document.

- Check the description to confirm that you have chosen the right template.

- If the document is not what you are looking for, utilize the Search field to find the template that fits your needs.

Form popularity

FAQ

A limited partnership is required to have both general partners and limited partners. General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

The state of Massachusetts doesn't require any official formation for general partnerships, and they're also not required to pay any formation fees or participate in ongoing maintenance filings like annual reports.

For example, let's say that Dottie and Dave decide to open a clothing store. They decide to name the store D.D.'s Duds. Dottie and Dave don't need to do anything special in order to form a general partnership. Once Dottie and Dave agree to form the business, it's automatically considered to be a general partnership.

It is not mandatory to register a partnership firm as per the provisions of the Partnership Act, 1932. However, it is better to register a partnership firm. If the firm is not registered it cannot avail any legal benefits provided to the firm under the Partnership Act, 1932.

Aside from formation requirements, the main difference between a partnership and an LLC is that partners are personally liable for any business debts of the partnership -- meaning that creditors of the partnership can go after the partners' personal assets -- while members (owners) of an LLC are not personally liable

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

A general partnership must satisfy the following conditions: The partnership must minimally include two people. All partners must agree to any liability that their partnership may incur. The partnership should ideally be memorialized in a formal written partnership agreement, though oral agreements are valid.

To form a partnership in Massachusetts, you should take the following steps:Choose a business name.File an assume business name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

A general partnership has no separate legal existence distinct from the partners. Unlike a private limited company or limited liability partnership, it does not need to be registered at or make regular filings to Companies House, which can help keep things simple.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.