Massachusetts FMLA Tracker Form - Rolling Method - Variable Schedule Employees

Description

How to fill out FMLA Tracker Form - Rolling Method - Variable Schedule Employees?

You might spend numerous hours online searching for the legal document template that suits the state and federal requirements you have.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can download or print the Massachusetts FMLA Tracker Form - Rolling Method - Variable Schedule Employees from their service.

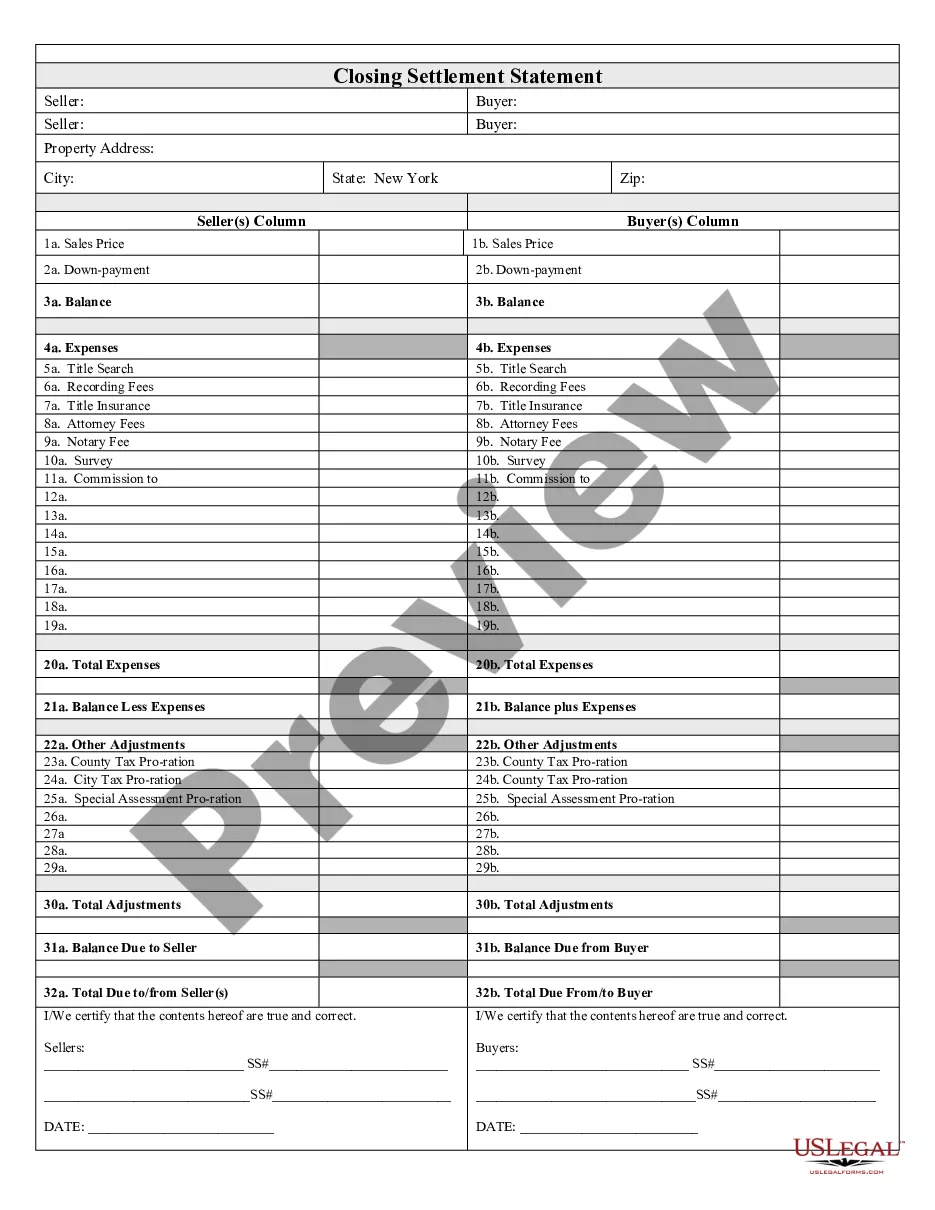

Check the form description to ensure you have selected the right document. If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can fill out, modify, print, or sign the Massachusetts FMLA Tracker Form - Rolling Method - Variable Schedule Employees.

- Every legal document template you obtain is yours permanently.

- To access another version of a obtained form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the region/city of your choice.

Form popularity

FAQ

When reporting Massachusetts PFML on your W-2, employers must include the amount withheld for the PFML contributions in Box 14. This helps ensure that employees receive credit for their contributions to the PFML fund. Additionally, you should keep accurate records to verify the withheld amounts, especially for variable schedule employees. Utilizing the Massachusetts FMLA Tracker Form - Rolling Method simplifies your tracking process and helps prepare for any reporting.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

Therefore monthly attrition will be total leavers during a month divided by average headcount during the month. However 12 month rolling attrition will be the total leavers during the last 12 months divided by the average active headcount during the same period.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022 Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

If you want to compare the running 12 months sales to the prior 12 months sales, create a new calculation for =Calculate(Sum(Sales),Filter(Range,RangeDate<=EOMONTH(TODAY(),-13) && RangeDate>=EOMONTH(TODAY(),-25)+1)).

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.