Massachusetts Articles of Association of Unincorporated Charitable Association

Description

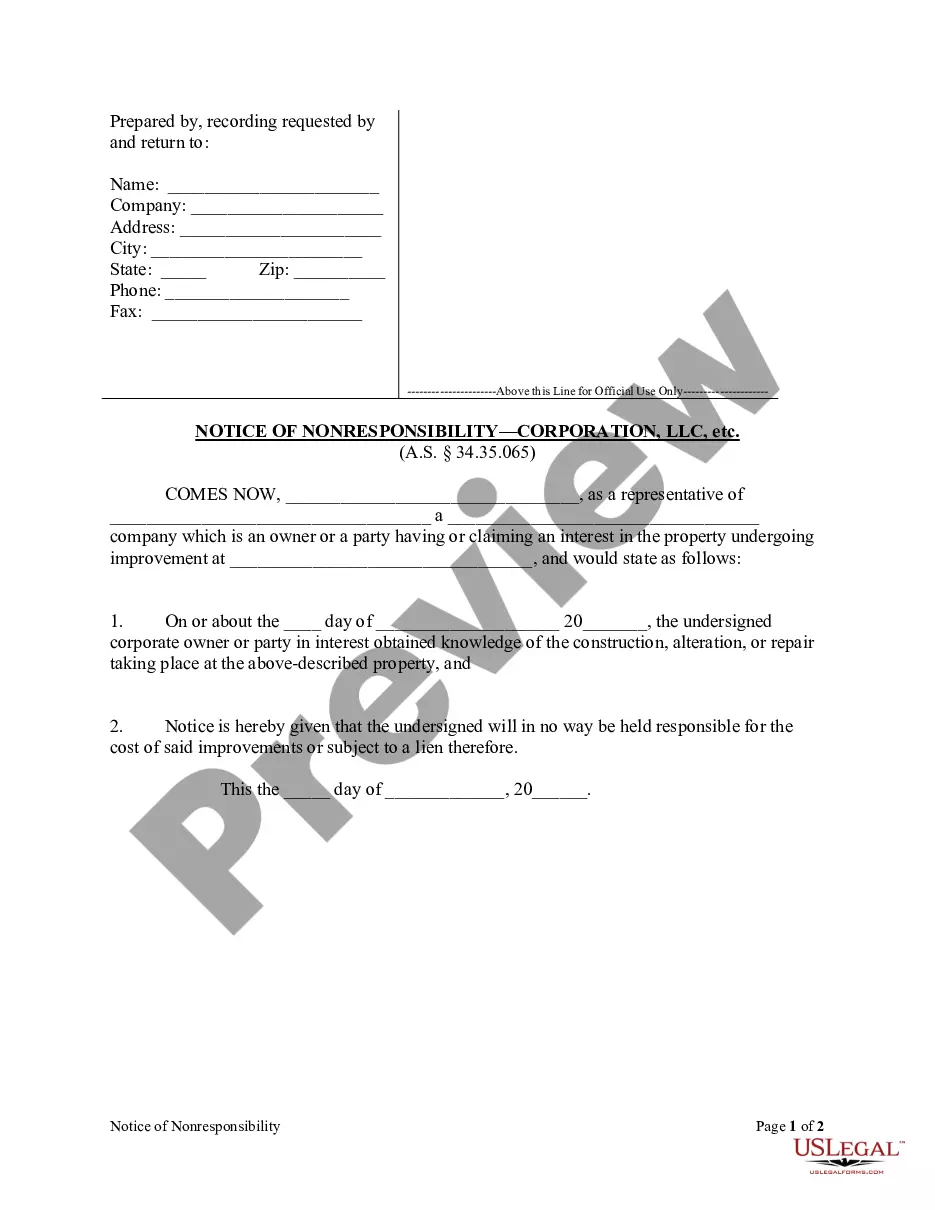

How to fill out Articles Of Association Of Unincorporated Charitable Association?

US Legal Forms - one of the most significant collections of legal forms in the USA - provides a range of legal document templates you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest editions of forms such as the Massachusetts Articles of Association of Unincorporated Charitable Association in moments.

If you currently have a monthly subscription, Log In and download the Massachusetts Articles of Association of Unincorporated Charitable Association from the US Legal Forms database. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Select the format and download the form to your device.

Edit. Complete, modify, print, and sign the downloaded Massachusetts Articles of Association of Unincorporated Charitable Association. Each template added to your account has no expiration date and is yours permanently. So, if you want to download or print another version, simply go to the My documents section and click on the form you need.

Access the Massachusetts Articles of Association of Unincorporated Charitable Association with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your city/state.

- Click on the Review button to examine the contents of the form. Review the form details to ensure you have picked the right one.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your information to create an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

Form popularity

FAQ

To write articles of incorporation for a nonprofit, include essential information such as the organization name, purpose, and registered agent details. Clearly outline your nonprofit's mission and activities, ensuring compliance with state regulations. Additionally, you may want to consult templates provided by platforms like US Legal Forms to help streamline the process. This will ensure your Massachusetts Articles of Association of Unincorporated Charitable Association reflect your organization's goals accurately.

Board requirements for a 501c3 include having a minimum of three directors who are not related to each other, ensuring independence and diverse input. Additionally, the board is responsible for setting policies, overseeing finances, and ensuring compliance with state and federal laws. A well-structured board can significantly impact the success of your nonprofit. Familiarize yourself with these requirements when drafting your Massachusetts Articles of Association of Unincorporated Charitable Association.

A 501c3 nonprofit should have a minimum of three board members to meet IRS requirements. However, having a larger board can enhance diverse viewpoints and decision-making. Many organizations aim for between five and seven members for effective governance. When preparing your Massachusetts Articles of Association of Unincorporated Charitable Association, consider establishing a robust board structure to support your mission.

The 33% rule for nonprofits refers to a guideline where at least one-third of a nonprofit organization's board members should be non-family members. This helps maintain diverse perspectives and reduces potential conflicts of interest. By adhering to this guideline, organizations can ensure better governance, transparency, and accountability. Understanding governance rules, such as the 33% rule, is essential when forming your Massachusetts Articles of Association of Unincorporated Charitable Association.

The purpose of articles of incorporation is to formally establish an organization as a legal entity. This document outlines the nonprofit's purpose, structure, and governance, providing clarity and accountability. Additionally, they are often necessary for opening a bank account and applying for grants. Understanding the Massachusetts Articles of Association of Unincorporated Charitable Association can greatly assist in navigating these requirements.

To qualify as a 501c3, an organization must meet several requirements. It must operate exclusively for charitable purposes, be organized as a corporation or association, and ensure that no part of its earnings benefits any individual. Additionally, the organization must adhere to the regulations set forth in the Massachusetts Articles of Association of Unincorporated Charitable Association to maintain good standing and compliance.

Yes, in Massachusetts, a form PC can be filed electronically. This process simplifies the submission of required documents for charitable organizations. By filing online, you can expedite approval and ensure your organization is officially recognized. Consider using resources available on the Massachusetts Articles of Association of Unincorporated Charitable Association to guide you through this process.

Yes, nonprofits must file articles of incorporation to obtain legal status. This document is essential for the organization to operate legally and to gain tax-exempt status. Failing to file can lead to fines or the inability to receive funding. To ensure all aspects are covered, consult the Massachusetts Articles of Association of Unincorporated Charitable Association for insights into the incorporation process.

Filing articles of organization in Massachusetts is a straightforward process. You need to prepare the required documents, which include the organization's name, purpose, and structure. Once drafted, you can submit your articles online through the Secretary of the Commonwealth's website or by mailing the documents. Be sure to also review the Massachusetts Articles of Association of Unincorporated Charitable Association to ensure compliance with state requirements.

Yes, articles of incorporation are crucial for establishing a nonprofit organization. These documents formalize the organization's structure and purpose, and they are often required for state and federal recognition. In Massachusetts, having articles of incorporation simplifies compliance and allows the organization to apply for tax-exempt status. Therefore, considering the Massachusetts Articles of Association of Unincorporated Charitable Association is key to your nonprofit's foundation.