A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Massachusetts Articles of Incorporation for Church Corporation

Description

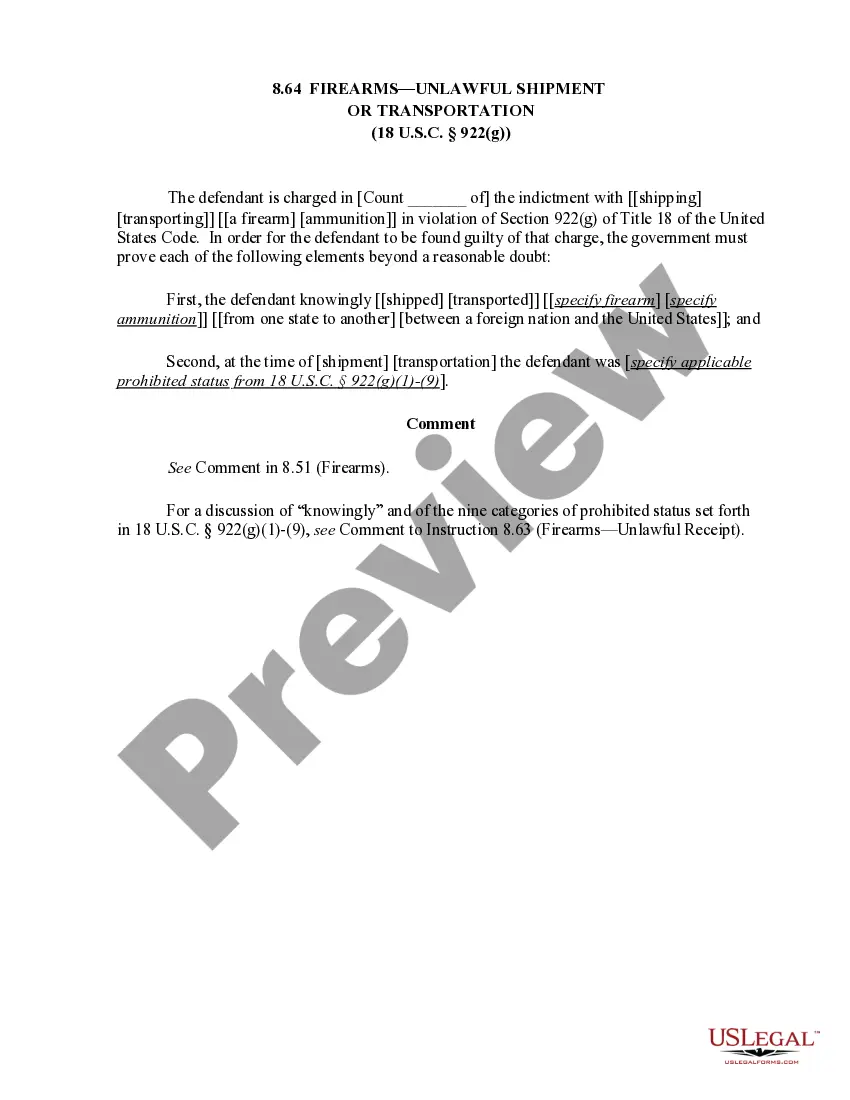

How to fill out Articles Of Incorporation For Church Corporation?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a vast selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Massachusetts Articles of Incorporation for Church Corporation within minutes.

If you already have a subscription, Log In to download the Massachusetts Articles of Incorporation for Church Corporation from the US Legal Forms catalog. The Download button will appear on each form you view. You can access all previously obtained forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Massachusetts Articles of Incorporation for Church Corporation. Each template saved in your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Massachusetts Articles of Incorporation for Church Corporation with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have chosen the correct form for your specific city/state.

- Click the Preview button to examine the form's contents.

- Review the form description to confirm that you have chosen the right form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find the one that does.

- When you're satisfied with the form, verify your choice by clicking the Buy now button.

- Select the pricing plan you desire and provide your information to register for an account.

Form popularity

FAQ

To obtain Massachusetts Articles of Incorporation for Church Corporation, you must start by preparing the necessary documents. This typically includes your church's name, address, and purpose. Afterward, you can file your articles online or by mail through the Massachusetts Secretary of the Commonwealth's office. Utilizing platforms like USLegalForms can streamline this process by providing templates and guidance tailored to church organizations, ensuring you complete this step correctly and efficiently.

Incorporating a church is often preferred over forming an LLC, primarily due to tax benefits and legal protections. A corporation can provide a clearer structure for governance and fundraising, which is vital for a church's long-term stability. Additionally, churches that incorporate may have an easier time obtaining grants and donations. Consider leveraging the Massachusetts Articles of Incorporation for Church Corporation to make the best choice for your ministry.

The articles of incorporation in Massachusetts serve as the foundational documents needed to legally establish a corporation, including a church. This document outlines the church's purpose, structure, and operational framework. Filing the articles is crucial for obtaining legal recognition and tax-exempt status for your church. Utilizing the Massachusetts Articles of Incorporation for Church Corporation can simplify this process immensely.

A church can be classified as either an S or C corporation, but it typically operates as a C corporation. The designation depends on the church's tax structuring and filing choices with the IRS. It's important to understand how these classifications affect your tax responsibilities and benefits. When you focus on Massachusetts Articles of Incorporation for Church Corporation, ensure you choose the right structure for your congregation's needs.

Letters patent are legal instruments that grant special privileges, often related to a corporation's rights and powers. In contrast, Articles of Incorporation serve as the primary founding document that outlines the church's structure and purpose. For your church, focusing on the Massachusetts Articles of Incorporation for Church Corporation is essential, as it establishes your organization's legal foundation.

Incorporating your church offers protection for its members and assets, separating personal liabilities from the church's liabilities. Additionally, incorporation helps enhance credibility and fosters trust within the community. By filing for Massachusetts Articles of Incorporation for Church Corporation, your church can also qualify for tax-exempt status and unlock potential funding opportunities.

Most churches are classified as nonprofit corporations, as they operate primarily for religious purposes and do not distribute profits to owners or shareholders. This classification helps protect the church's assets and provides tax benefits under the IRS 501c3 designation. Incorporating as a Massachusetts Articles of Incorporation for Church Corporation solidifies this status for your church.

The Articles of Incorporation typically include the church's name, address, mission, and the names of the initial directors. Additionally, these documents may specify the purpose of the church and any provisions related to asset distribution in the event of dissolution. In Massachusetts, following the required format in the Articles of Incorporation for Church Corporation helps ensure compliance with state regulations.

To incorporate a church in Massachusetts, follow a simple process. First, prepare the articles of incorporation, ensuring they align with state requirements. After that, submit these articles to the Massachusetts Secretary of the Commonwealth while also obtaining any necessary licenses or permits. Resources like U.S. Legal Forms offer guidance and templates that can facilitate this process, making the steps to file the Massachusetts Articles of Incorporation for Church Corporation more manageable and efficient.

Yes, a 501c3 organization must have articles of incorporation as part of its formation process. This legal document outlines the purposes and governance of the organization, which is necessary to satisfy IRS requirements for tax-exempt status. When a church files the Massachusetts Articles of Incorporation for Church Corporation, it demonstrates a commitment to following legal standards and operating transparently, which can help in its pursuit of donations and grants.