Massachusetts Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

How to fill out Pledge Of Personal Property As Collateral Security?

If you need to finalize, acquire, or create valid record templates, utilize US Legal Forms, the largest assortment of valid forms, which are accessible online.

Take advantage of the site’s user-friendly search feature to find the documents you require. Various templates for business and personal purposes are categorized by categories and states, or keywords.

Make use of US Legal Forms to access the Massachusetts Pledge of Personal Property as Collateral Security with just a few clicks.

Each legal document template you acquire is yours permanently. You have access to every form you saved in your account. Browse the My documents section and select a form to print or download again.

Complete, acquire, and print the Massachusetts Pledge of Personal Property as Collateral Security with US Legal Forms. There are numerous professional and state-specific forms you can use for your personal business or individual needs.

- If you are already a US Legal Forms member, sign in to your account and then click the Download button to obtain the Massachusetts Pledge of Personal Property as Collateral Security.

- You can also access forms you previously saved from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form applicable to the correct city/state.

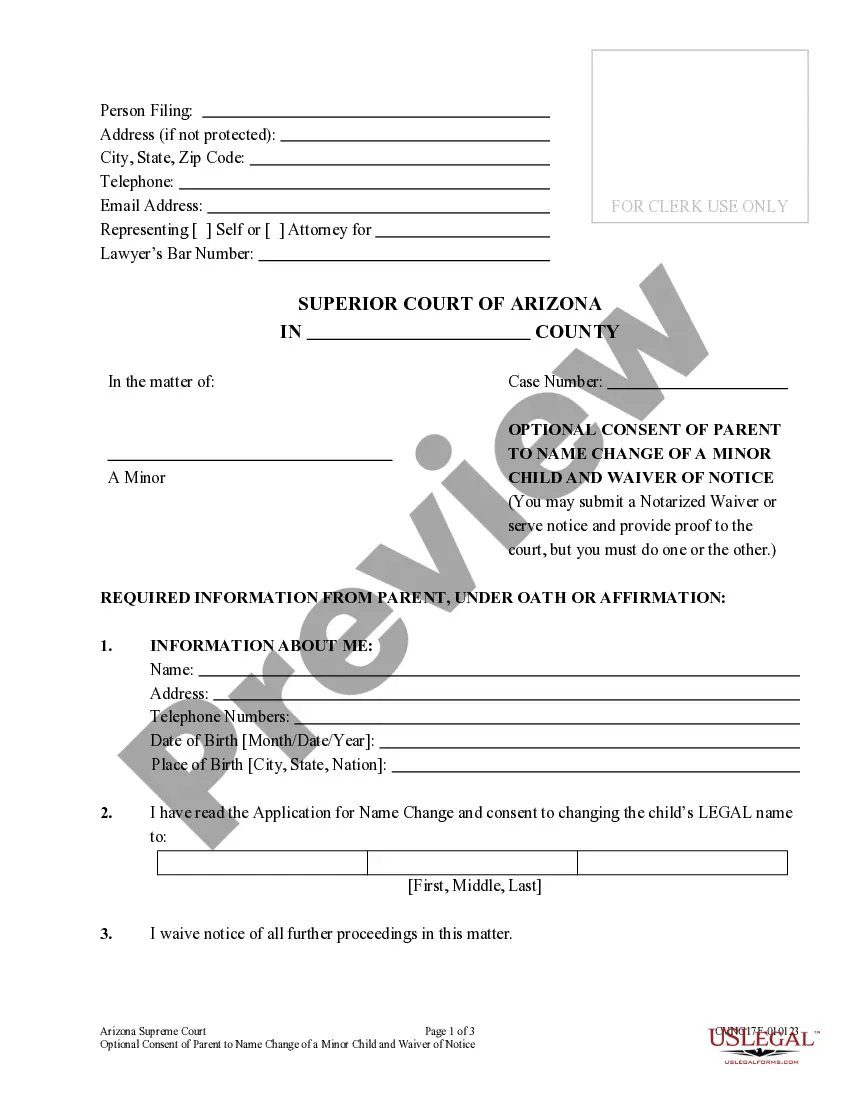

- Step 2. Utilize the Preview feature to review the form’s content. Don't forget to read through the overview.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit and print or sign the Massachusetts Pledge of Personal Property as Collateral Security.

Form popularity

FAQ

To use your property as collateral, first determine the value and type of the property eligible under the Massachusetts Pledge of Personal Property as Collateral Security. Next, prepare a formal agreement that clearly outlines the terms, including the amount borrowed and the consequences of default. Engage with a lender who accepts such collateral and consider using platforms like US Legal Forms to access the necessary legal documents to streamline the process.

Certain items cannot be used as collateral under the Massachusetts Pledge of Personal Property as Collateral Security. Typically, intangible assets like stocks or intellectual property may not qualify. Additionally, items that are illegal or heavily regulated, such as stolen goods or narcotics, cannot be accepted. It's crucial to review your property and consult with a legal expert to determine eligibility.

Holding someone's personal property as collateral is legal in Massachusetts as long as you have a mutual agreement. This practice is governed by the Massachusetts Pledge of Personal Property as Collateral Security. It is vital to ensure that all parties understand the terms to avoid potential disputes. Always consider consulting legal advice to navigate this process effectively.

Creating personal security involves identifying valuable assets that can be pledged as collateral for loans or obligations. This typically requires a formal agreement outlining terms, asset valuation, and consent to appropriate legal filings. Understanding the Massachusetts Pledge of Personal Property as Collateral Security can significantly streamline this process, providing a solid foundation for personal financial security.

A security interest is created through a formal agreement that includes clear terms and conditions regarding the collateral. The debtor must agree to the conditions, and the creditor must ensure the interest is perfected, often through registration. These actions align with the principles of the Massachusetts Pledge of Personal Property as Collateral Security, ensuring legal recognition and protection.

Creating a valid security interest requires three essential elements: a written agreement, the proper identification of the collateral, and the debtor's consent. The creditor must also perfect the security interest, often through filing. Each of these steps is crucial for establishing a robust arrangement under the Massachusetts Pledge of Personal Property as Collateral Security.

Certain financial instruments and agreements pledge specific assets of the issuer as collateral, often referred to as secured transactions. The Massachusetts Pledge of Personal Property as Collateral Security outlines how these assets provide a safety net for lenders. This legal framework protects both sides and ensures that obligations are met. Programs that utilize this pledge can help streamline borrowing processes and enhance the availability of funds.

Assets pledged as collateral can vary widely and may include inventory, vehicles, equipment, or any valuable personal property. In the context of the Massachusetts Pledge of Personal Property as Collateral Security, these assets become security for the lender. By pledging these items, borrowers can secure loans with better interest rates or terms. It’s vital to understand the implications of your pledged assets to manage your finances effectively.

Yes, personal property can be used as collateral in loans and financing agreements. The Massachusetts Pledge of Personal Property as Collateral Security specifically covers various types of personal items, such as vehicles, jewelry, and securities. By pledging personal property, borrowers can access larger loans or better terms, making it a beneficial strategy for securing financing. It’s important to ensure the value of the collateral meets the lender's requirements.

A pledge of personal property as collateral for a debt is typically referred to as a security interest. This legal arrangement allows the lender a right to the pledged assets should the borrower fail to meet their payment obligations. The Massachusetts Pledge of Personal Property as Collateral Security formalizes this agreement, providing clarity and protection for both parties involved. Thus, it serves as a crucial element in many lending situations.