Massachusetts Return Authorization Form

Description

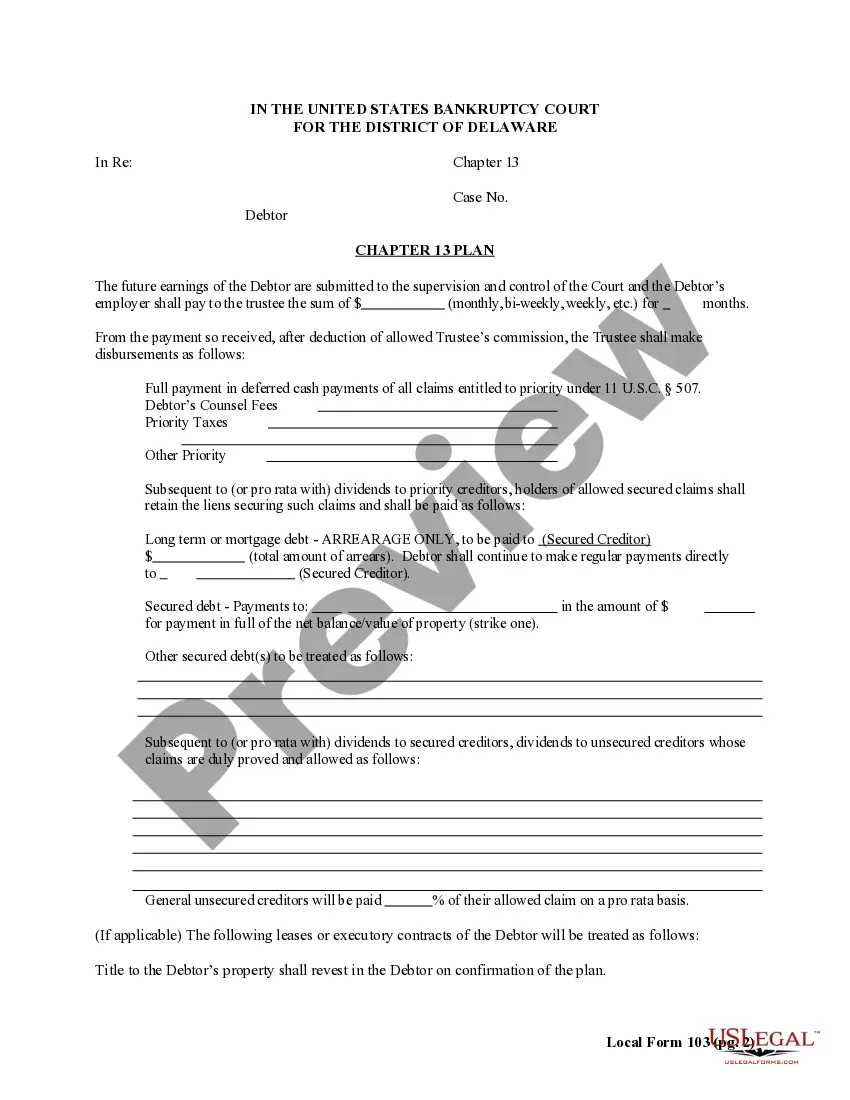

How to fill out Return Authorization Form?

If you want to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the payment process. You may use your Visa, Mastercard, or PayPal account to finish the purchase.

- Utilize US Legal Forms to access the Massachusetts Return Authorization Form with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to acquire the Massachusetts Return Authorization Form.

- You can also view forms you previously purchased in the My documents section of your account.

- If you are a new user of US Legal Forms, follow the steps below.

- Step 1. Ensure that you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s details. Don't forget to read the description.

- Step 3. If you’re dissatisfied with the form, take advantage of the Search bar at the top of the screen to find alternative versions of the legal form design.

Form popularity

FAQ

Form M8453 is the signature authorization form for electronic filing of Massachusetts tax returns. This form is necessary for validating your e-filed returns and ensures the Department of Revenue has your consent to process them electronically. To make your filing smoother, consider completing your Massachusetts Return Authorization Form through the reliable tools offered by US Legal Forms.

Form 1 py, also known as the Massachusetts Personal Income Tax return form for part-year residents, is used by individuals who moved in or out of Massachusetts during the tax year. This form helps you report your income earned while being a resident. If you're filing along with a Massachusetts Return Authorization Form, staying organized with US Legal Forms can simplify your tax return process.

Massachusetts Form 355S is designed for certain corporations that qualify as small businesses. It allows these entities to report their income and taxes in a straightforward manner. If you require assistance with this or the Massachusetts Return Authorization Form, US Legal Forms can provide user-friendly resources.

Form 355 ES is an estimated tax payment form for corporations in Massachusetts. Businesses use this form to calculate and submit their estimated tax payments throughout the year. When combined with the Massachusetts Return Authorization Form, it helps ensure your tax obligations are met without penalties.

You can file MA Form 355 at the Massachusetts Department of Revenue. It is important to ensure that you send your form to the correct address based on your location. If you are also submitting your Massachusetts Return Authorization Form, consider using the resources provided by US Legal Forms to simplify the filing process.

MA Form 355S is a simplified tax return form used by small businesses and corporations in Massachusetts. This form allows eligible taxpayers to report income, calculate taxes owed, and claim deductions. If you need to submit a Massachusetts Return Authorization Form, understand how Form 355S can streamline your filing process efficiently.

Like many tax forms, you should avoid stapling your Massachusetts tax return. Instead, refer to the Massachusetts Return Authorization Form for the correct submission procedures. Keeping your return flat inside the envelope ensures it is processed effectively. Clear organization will benefit your overall filing experience.

You do not need to send a copy of your federal return with your Massachusetts state return. The Massachusetts Return Authorization Form clarifies that only your state-specific documents need submission. While some may choose to keep a copy for their records, it is not a necessary step for state processing. Focus on providing the forms required for a smooth submission.

Filling out the Massachusetts employee's withholding exemption certificate requires careful attention to details. Start by gathering the necessary personal information and refer to the Massachusetts Return Authorization Form for specific instructions on each section. Accurate completion ensures proper withholding from your paycheck. If you're unsure, it might be helpful to consult with a tax professional.

To mail your Massachusetts tax return, place it in an envelope addressed as directed on the Massachusetts Return Authorization Form. Make sure to include any required documents, like your W-2. After sealing the envelope, affix the appropriate postage, and drop it off at your local post office. Using registered mail can provide added security.