Massachusetts Estate Planning Data Letter and Employment Agreement with Client

Description

How to fill out Estate Planning Data Letter And Employment Agreement With Client?

US Legal Forms - one of the largest collections of legitimate documents in the United States - provides a broad array of legitimate file templates that you can obtain or print.

By utilizing the site, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can retrieve the most recent versions of forms such as the Massachusetts Estate Planning Data Letter and Employment Agreement with Client in moments.

Check the form outline to confirm you have picked the correct document.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and obtain the Massachusetts Estate Planning Data Letter and Employment Agreement with Client from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously saved forms in the My documents tab of your account.

- If you're using US Legal Forms for the first time, here are simple instructions to get you started.

- Make sure you have selected the correct form for your area/region.

- Select the Preview option to review the content of the form.

Form popularity

FAQ

Grounds for a motion to dismiss in Massachusetts can include lack of jurisdiction, failure to state a claim, or the existence of a prior judgment. These grounds aim to eliminate cases that do not meet legal requirements early in the process. As you navigate your legal matters, including those related to the Massachusetts Estate Planning Data Letter and Employment Agreement with Client, knowing these grounds can be beneficial when evaluating the viability of a case.

An affidavit is a written statement confirmed by oath or affirmation, while a declaration is a statement made under penalty of perjury without an oath. Both serve important roles in legal proceedings, but they differ in formality and usage. When drafting your Massachusetts Estate Planning Data Letter and Employment Agreement with Client, understanding this distinction can help you select the appropriate document for your specific needs.

Yes, in Massachusetts, you must file a will with the probate court after the individual's death if you seek to initiate the probate process. This step is essential to validate the will and begin settling the estate. When creating your Massachusetts Estate Planning Data Letter and Employment Agreement with Client, it is crucial to consider this requirement to ensure your estate plan is executed properly.

Rule 1.15 A in Massachusetts pertains to the ethical obligations of attorneys regarding the handling of client funds. Attorneys must maintain accurate records of client property and adhere to trust account regulations. If you are drafting a Massachusetts Estate Planning Data Letter and Employment Agreement with Client, ensure your legal representative abides by this rule to protect your interests.

In Massachusetts, the rental deduction limit allows tenants to deduct certain expenses associated with renting property on their state taxes. This limit can impact your financial planning when preparing your Massachusetts Estate Planning Data Letter and Employment Agreement with Client. It is essential to be aware of these limits to optimize your tax situation efficiently.

A letter of authority is a legal document issued by the probate court in Massachusetts, granting the executor or administrator the power to manage the estate of a deceased individual. This letter allows you to handle affairs such as settling debts and distributing assets according to the will. For those creating a Massachusetts Estate Planning Data Letter and Employment Agreement with Client, obtaining this letter is critical to executing estate plans smoothly.

The 3 hour rule in Massachusetts refers to a guideline for service providers to complete their tasks within three hours. This ensures efficiency and timely execution of work related to Massachusetts estate planning. Understanding this rule will help you manage your time effectively, especially when preparing documents such as the Massachusetts Estate Planning Data Letter and Employment Agreement with Client.

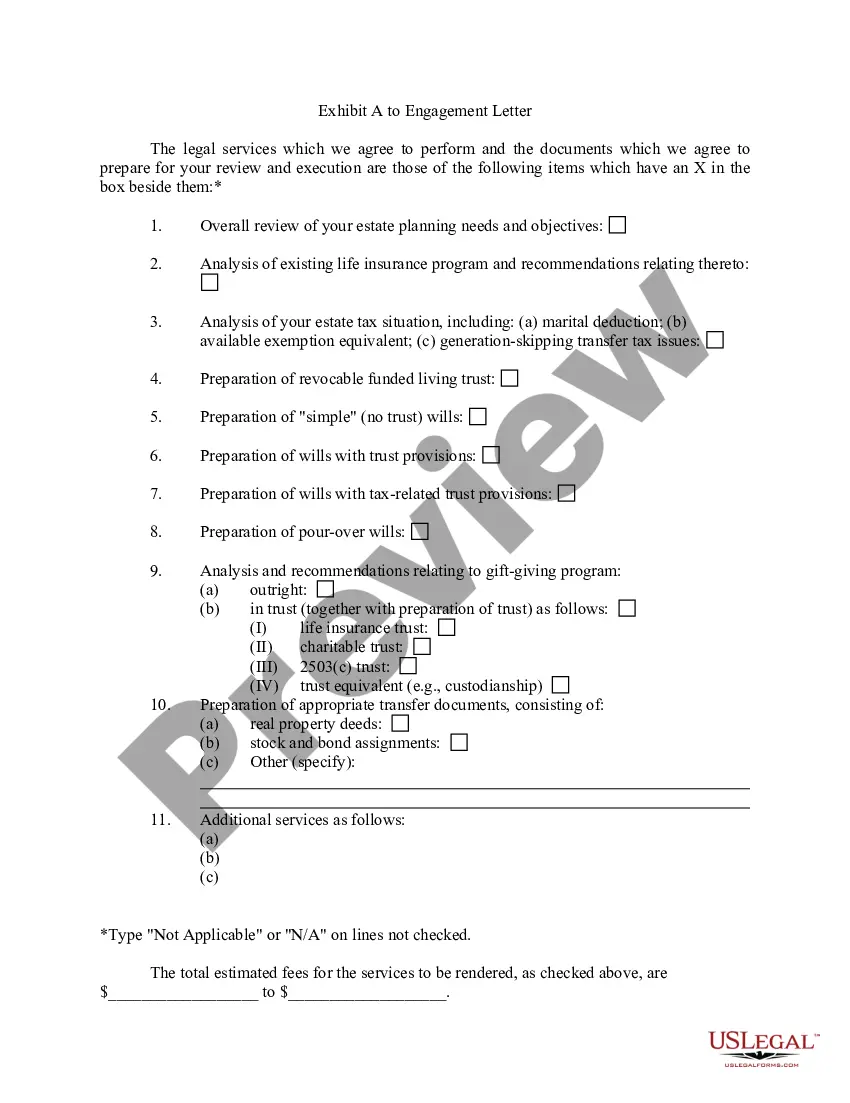

The two key documents used to prepare an estate plan are a will and a trust. A will specifies how your assets should be distributed, while a trust holds your assets for your beneficiaries. To complement these essential documents, consider the Massachusetts Estate Planning Data Letter and Employment Agreement with Client for enhanced clarity and guidance regarding your wishes.

An estate planning document is any legal paper that outlines how your affairs should be handled after your death. This typically includes wills, trusts, and letters of intent. By incorporating a Massachusetts Estate Planning Data Letter and Employment Agreement with Client, you can ensure that all aspects of your estate plan are precise and clearly communicated, which ultimately supports your family during a challenging time.

An estate letter refers to any document that provides guidance on managing your estate after you pass away. This can include a letter of intent, which communicates your wishes to your loved ones. Using a Massachusetts Estate Planning Data Letter and Employment Agreement with Client helps create a comprehensive estate plan that leaves little room for confusion for your family and executors.