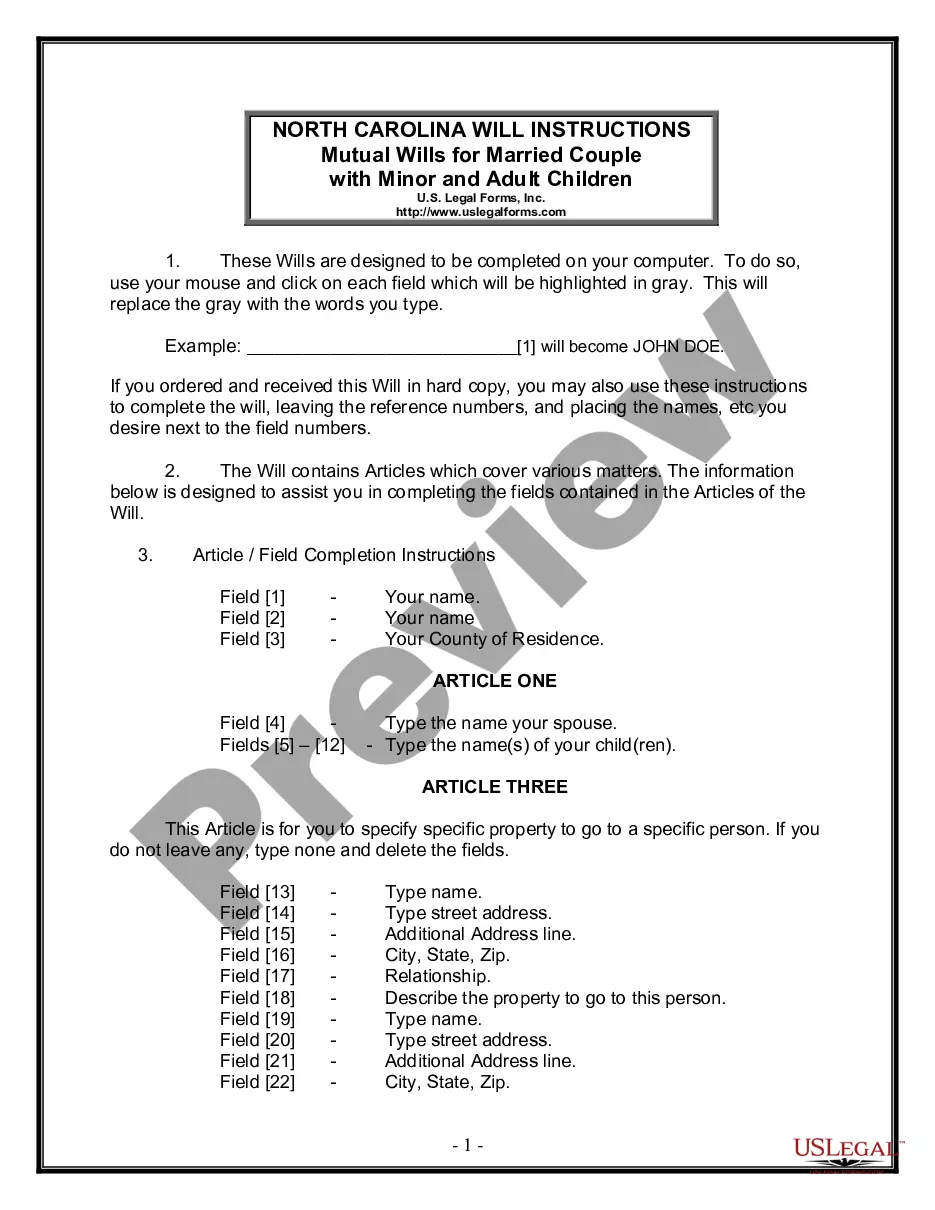

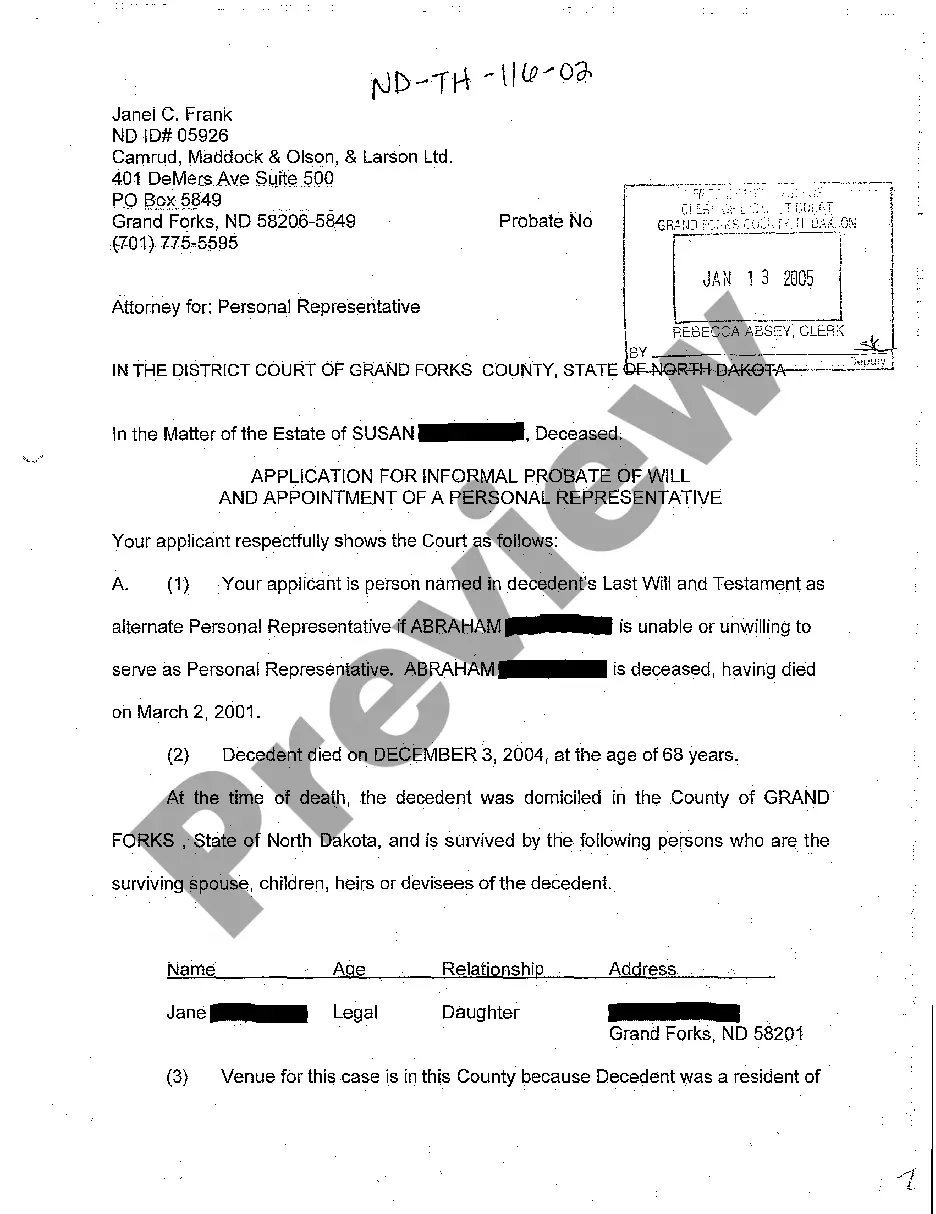

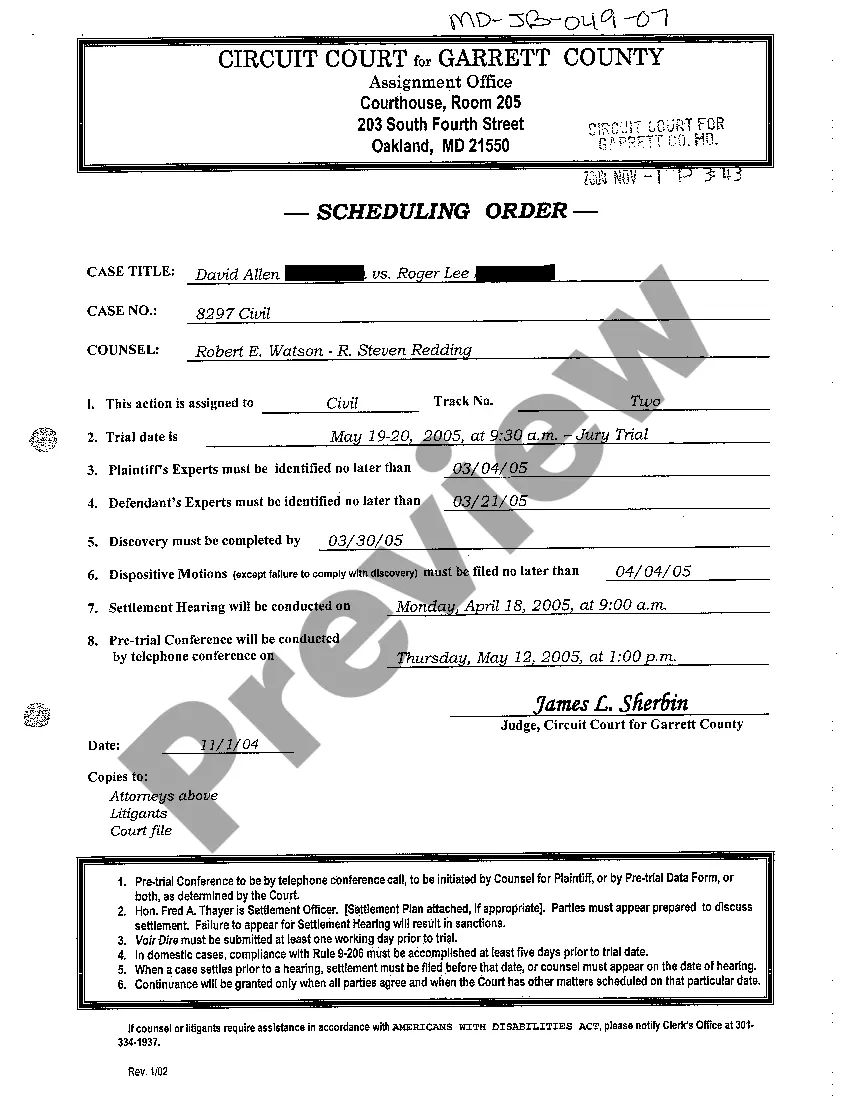

Massachusetts Instructions for Use of Forms is a comprehensive set of guidelines and procedures from the Massachusetts Department of Revenue that provides instructions for the correct use of forms related to taxation and filing. There are different types of Massachusetts Instructions for Use of Forms, including forms related to sales and use tax, income tax, corporate excise, meals tax, and motor vehicle excise. Each form comes with detailed instructions on how it should be filled out and filed. The forms also provide information on when the forms are due, how to submit them, and any applicable penalties for late filing. The Instructions also provide guidance on how to properly calculate taxes and credits, as well as information on how to obtain refunds or appeal a decision.

Massachusetts Instructions for Use of Forms

Description

How to fill out Massachusetts Instructions For Use Of Forms?

If you’re looking for a method to suitably prepare the Massachusetts Instructions for Use of Forms without enlisting a legal professional, then you’re in the correct location.

US Legal Forms has established itself as the most comprehensive and esteemed repository of official templates for every personal and business scenario. Every document you discover on our online platform is crafted in alignment with federal and state laws, allowing you to ensure that your paperwork is accurate.

Another fantastic feature of US Legal Forms is that you will never lose the documents you purchased - you can access any of your downloaded forms in the My documents tab of your profile whenever you require it.

- Confirm that the document presented on the page aligns with your legal circumstances and state laws by reviewing its text description or browsing through the Preview mode.

- Enter the document name in the Search tab at the top of the page and select your state from the dropdown to find an alternate template in case of any discrepancies.

- Repeat the content verification process and click Buy now when you are certain the paperwork complies with all requirements.

- Log in to your account and click Download. Enroll in the service and select a subscription plan if you are not already a member.

- Utilize your credit card or PayPal option to settle your US Legal Forms subscription. The document will be ready for download immediately afterward.

- Choose the format you wish to save your Massachusetts Instructions for Use of Forms in and download it by clicking the relevant button.

- Import your template into an online editor for quick completion and signing or print it out for manual preparation of your physical copy.

Form popularity

FAQ

If you were a resident of Massachusetts and your gross income was more than $8,000 ? whether received from sources inside or outside of Massa- chusetts ? you are required to file a Massachu- setts income tax return. If your gross income was $8,000 or less, you do not need to file a return.

You may need the following: Copies of last year's federal and state tax returns. Personal information including:Records of your earnings (W-2 forms from each employer or 1099-MISC forms if you're a contractor) Records of interest and dividends from banks (1099 forms: 1099-INT, 1099-DIV, etc.)

This form is solely for the use of clubs, labor unions, political committees, taxable fraternal organizations, certain unincorporated homeowners as- sociations and all other similar organizations not engaged in business for profit, and consequently having only taxable dividends, interest, capital gains, Massachusetts

For tax year 2022, Massachusetts has a 5.0% tax on both earned (salaries, wages, tips, commissions) and unearned (interest, dividends, and capital gains) income. Certain capital gains are taxed at 12%.

Form 1: Massachusetts Resident Income Tax Return. Form 1-NR/PY: Massachusetts Nonresident or Part-Year Resident Income Tax Return.

A business corporation will only file a separate Form 355 or 355S to calculate its non-income measure of excise tax, if its year ends at a different time than the common year used to determine the combined group's income.

Get the current filing year's forms, instructions, and publications for free from the IRS. Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Massachusetts forms and instructions are also available online at: mass.gov/dor/forms. You can contact the MA Department of Revenue for general help and informaton, or to order forms, by calling 1-800-392-6089. Tax forms can be printed for you free of charge at the Reference Desk.