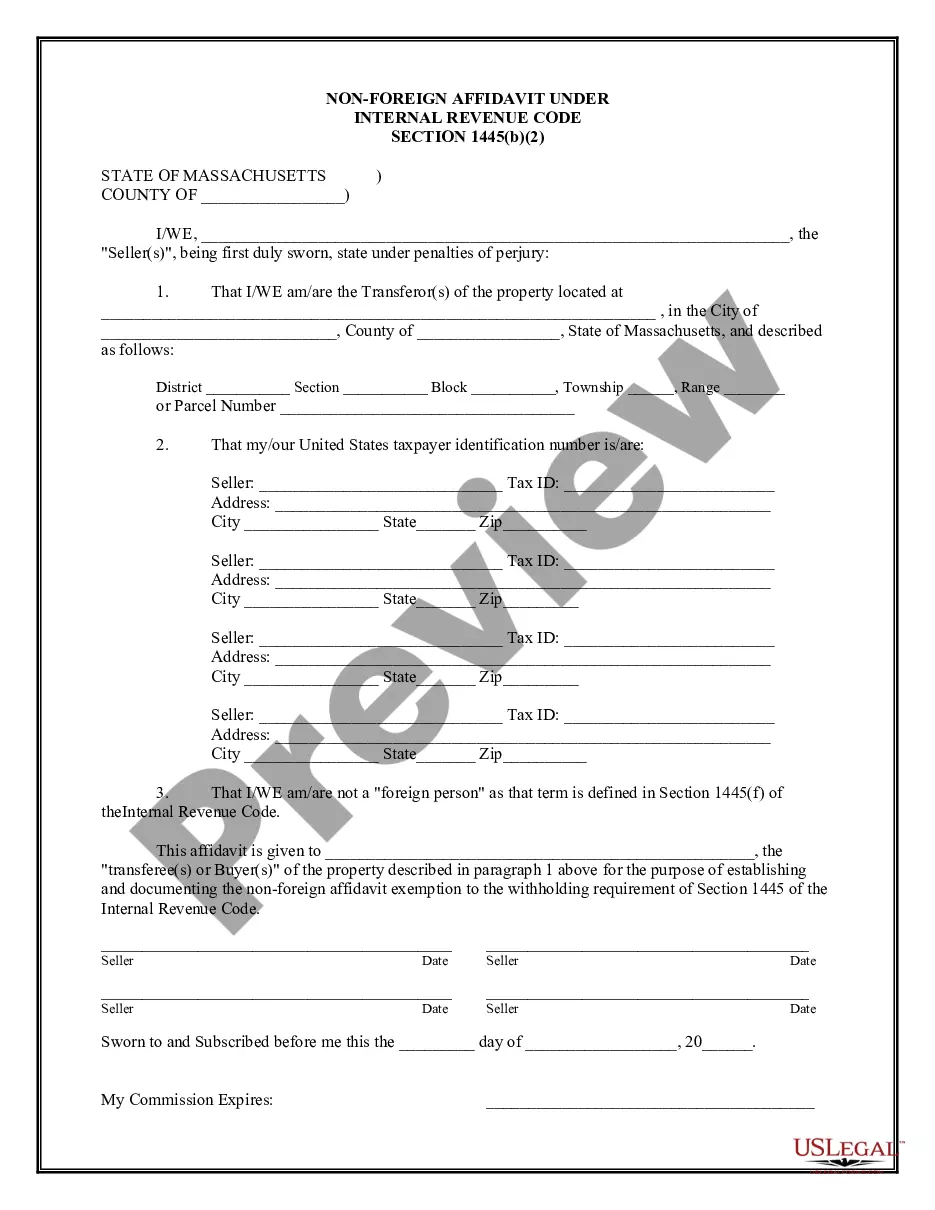

Massachusetts Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Massachusetts Non-Foreign Affidavit Under IRC 1445?

You are invited to the most crucial legal documentation library, US Legal Forms. Here, you can discover any template, including Massachusetts Non-Foreign Affidavit Under IRC 1445 templates, and save them (as many as you desire). Create official documents in a few hours, rather than days or weeks, without the need to pay a fortune to an attorney. Obtain your state-specific sample with just a few clicks, and rest assured knowing it was crafted by our state-licensed attorneys.

If you’re already a subscribed client, simply Log In to your account and then click Download next to the Massachusetts Non-Foreign Affidavit Under IRC 1445 you wish to access. Since US Legal Forms is an online service, you’ll consistently have access to your stored templates, no matter what device you’re using. Find them in the My documents section.

If you haven't created an account yet, what are you hesitating for? Review our guidelines below to get started.

Once you’ve finalized the Massachusetts Non-Foreign Affidavit Under IRC 1445, submit it to your attorney for validation. It’s an extra step, but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to a vast array of reusable samples.

- If this is a state-specific document, verify its relevance for your state.

- Examine the description (if available) to ascertain if it’s the appropriate template.

- View more information with the Preview feature.

- If the document fits all your requirements, simply click Buy Now.

- To create your account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Save the file in your preferred format (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

collusive affidavit is a legal statement confirming that the parties involved in a transaction have not coerced or influenced each other unfairly. This affidavit is essential in various legal contexts, including those related to the Massachusetts NonForeign Affidavit Under IRC 1445. It helps establish trust and transparency in real estate transactions, protecting all parties involved.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.