Transfer Under The Massachusetts Uniform Custodial Trust Act

Description

How to fill out Transfer Under The Massachusetts Uniform Custodial Trust Act?

You are invited to the most extensive legal documents repository, US Legal Forms. Here, you can obtain any template such as Transfer Under The Massachusetts Uniform Custodial Trust Act forms and download them (as many of them as you desire or require). Prepare official documents within a few hours, rather than days or even weeks, without spending a fortune on a lawyer.

Acquire the state-specific template in just a few clicks and be assured knowing that it was created by our licensed lawyers.

If you’re already a registered user, simply Log In to your account and then click Download next to the Transfer Under The Massachusetts Uniform Custodial Trust Act you wish. Since US Legal Forms is internet-based, you’ll consistently have access to your stored documents, regardless of the device you’re using. Locate them in the My documents tab.

Print the document and fill it in with your or your business’s information. After you’ve finalized the Transfer Under The Massachusetts Uniform Custodial Trust Act, submit it to your lawyer for confirmation. It’s an additional step but a necessary one for ensuring you’re completely protected. Register for US Legal Forms today and gain access to a multitude of reusable templates.

- If you don't yet have an account, what are you waiting for? Refer to our guidelines below to get started.

- If this is a state-specific template, verify its applicability in the state where you reside.

- Review the description (if available) to determine if it’s the correct form.

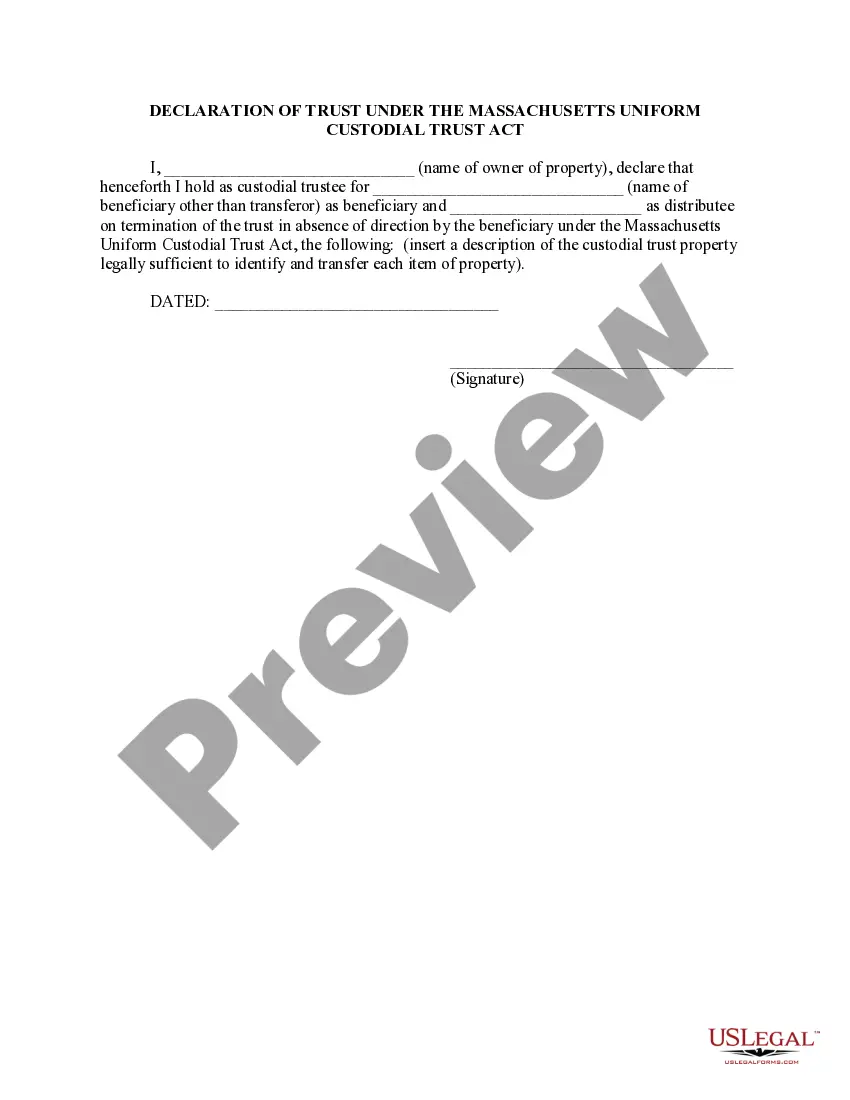

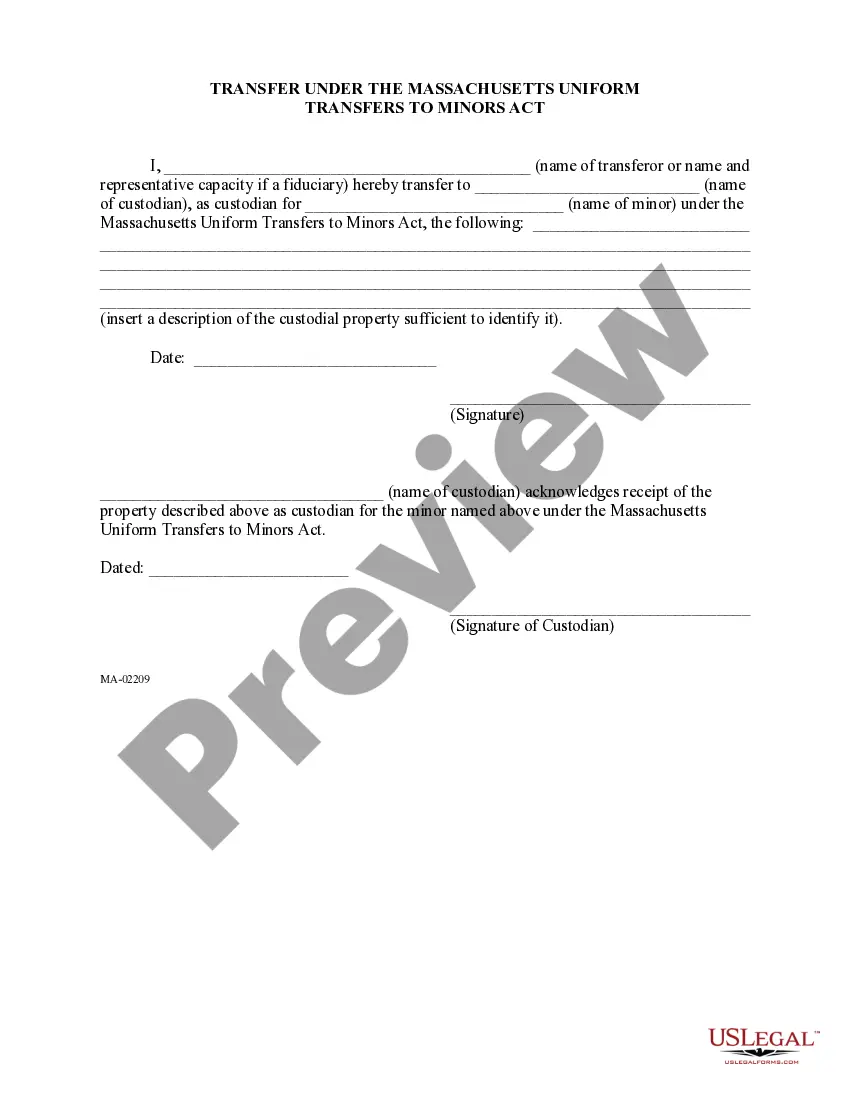

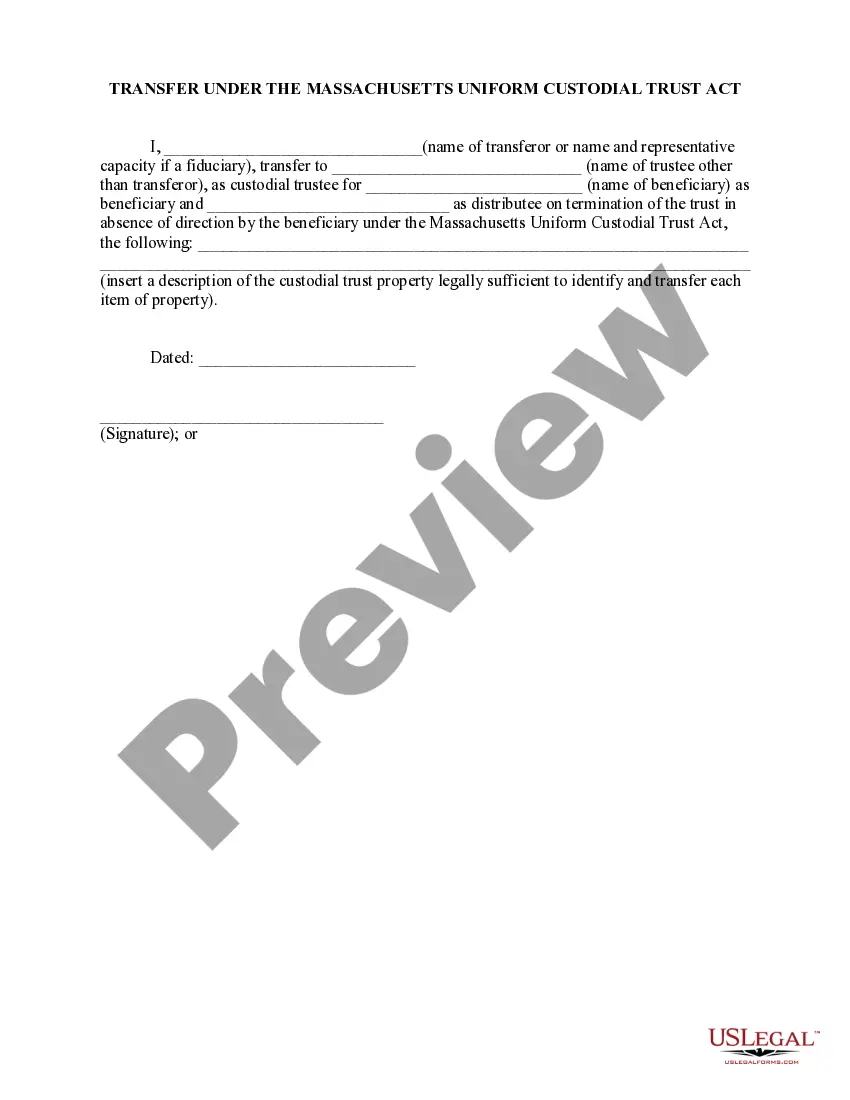

- Inspect additional information with the Preview feature.

- If the template fulfills all of your conditions, click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the document in your preferred format (Word or PDF).

Form popularity

FAQ

To transfer a UTMA account, you must first complete the necessary transfer forms, which typically include the minor's details and the account information. You will need to provide documentation verifying the original custodian's identity and their intent to transfer the account. It's essential to follow the guidelines outlined under the Massachusetts Uniform Custodial Trust Act for a smooth transition. Check uslegalforms for resources that guide you through the process and ensure compliance with state regulations.

When a Trust owns a home the Trustee acts as the legal owner and makes all the management decisions, the beneficiaries only get the enjoyment partliving there (if that is allowed under the Trust terms).

A living trust in Massachusetts is created by the grantor, the person putting things into trust. As the grantor you must choose a trustee who is charged with managing the trust for your benefit while you are alive and distributing your assets to your beneficiaries after your death.

Prior to enacting G.L.c. 184, §35, Massachusetts was among the few states requiring the full trust document for trusts containing real property to be recorded.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

In order to create a general petition for the creation of a trust, the filing fee is $375 with a surcharge of $15. Once the trust has been created, there will be a great deal of paperwork involved, since every asset that is added to the trust will need to be signed for.

In California, a trust does not have to be recorded to be legal unless it holds title on real estate. If a trust does not hold title on real estate property, all assets held in the name of the trust are kept private. The trustee maintains a record of all trust property in a trust portfolio.

Since the Schedule of Beneficiaries to a trust is not recorded with the Declaration of Trust at the Registry of Deeds, the identity of the Beneficiaries is not a matter of public record.There are two types of Trusts in Massachusetts.

An unrecorded deed is a deed for real property that neither the buyer nor the seller has delivered to an appropriate government agency. Unrecorded deeds can present many issues for sellers (or grantors) and buyers (or grantees) such as proof of ownership and tax implications.