Massachusetts Single Member Limited Liability Company LLC Operating Agreement

Description

Key Concepts & Definitions

Single Member Limited Liability Company (LLC): A business structure allowing one owner to benefit from the companys limited liability while being taxed as a sole proprietorship, known as a 'disregarded entity' for tax purposes. Disregarded Entity: For federal income tax purposes, a Single Member LLC is treated as a disregarded entity, meaning the business itself is not taxed separately, instead, all profits or losses are reported on the owners personal tax return.

Step-by-Step Guide to Forming a Single Member LLC

- Choose a unique business name compliant with your state's LLC regulations.

- Appoint a registered agent who will receive official papers and legal documents on behalf of your LLC.

- File the Articles of Organization with your state's business filing agency and pay the filing fee.

- Create an Operating Agreement even though it's not mandatory, as it delineates your LLC's operations and helps in maintaining its limited liability protection.

- Obtain necessary permits and licenses needed to legally operate your business.

- Open a business bank account and consider applying for business credit cards to help separate personal and business finances.

Risk Analysis

- Limited liability may be jeopardized by failing to maintain the separation of personal and business finances, often referred to as 'piercing the corporate veil.'

- Being a single owner can lead to challenges in funding opportunities as investors may prefer companies with multiple stakeholders.

- The simplicity of tax reporting as a 'disregarded entity' may overlook necessary deductions or tax planning strategies beneficial for larger businesses.

Key Takeaways

Single Member LLCs offer significant flexibility and protection for small business owners. Proper setup and management are crucial for maintaining limited liability and operational effectiveness.

Pros & Cons

- Pros: Limited personal liability, simple tax reporting, fewer formalities compared to other business structures.

- Cons: Potential risk of losing limited liability due to improper financial management, less appealing to investors compared to multi-member LLCs or corporations.

Best Practices

Maintain a clear separation of personal and business finances. Regularly review and update your operating agreement. Use formal accounting practices from the start.

Common Mistakes & How to Avoid Them

- Commingling personal and business finances can risk your LLC's limited liability protection. Always use a dedicated business banking account and credit cards.

- Failing to maintain an operating agreement or formal business records. Even as a single-member, these documents can be vital in legal matters.

How to fill out Massachusetts Single Member Limited Liability Company LLC Operating Agreement?

You are invited to the largest repository of legal documents, US Legal Forms. Here, you can obtain any example, including Massachusetts Single Member Limited Liability Company LLC Operating Agreement templates, and download as many as you desire or require.

Draft official documents in just a few hours instead of days or even weeks, without spending excessively on a lawyer or attorney. Acquire your state-specific form in a matter of clicks, assured in the knowledge that it was prepared by our qualified legal professionals.

If you are already a registered user, simply sign in to your account and then select Download next to the Massachusetts Single Member Limited Liability Company LLC Operating Agreement you require. Since US Legal Forms is an online service, you will always have access to your saved templates, no matter the device you are using. Find them within the My documents section.

Print the document and complete it with your or your business’s information. Once you’ve filled out the Massachusetts Single Member Limited Liability Company LLC Operating Agreement, submit it to your attorney for confirmation. It’s a necessary step to ensure you’re fully protected. Join US Legal Forms today and access thousands of reusable samples.

- If you haven’t established an account yet, what are you waiting for.

- Verify the applicability of this state-specific form in your state.

- Review the description (if available) to determine if it’s the correct template.

- Examine additional content with the Preview feature.

- If the sample meets all your needs, simply click Buy Now.

- To create an account, choose a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the template in your preferred format (Word or PDF).

Form popularity

FAQ

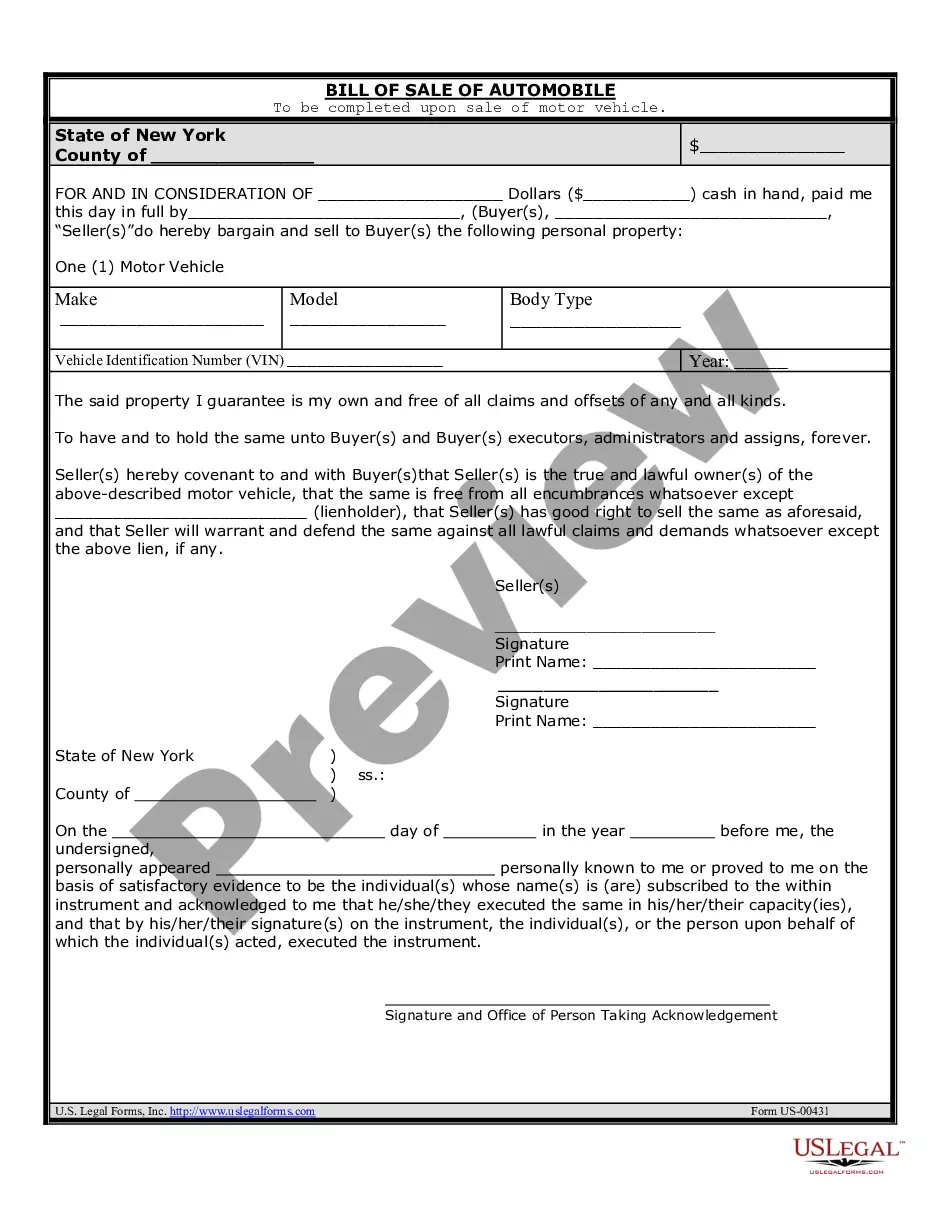

The single-member LLC articles of organization is a document that you need to file with the state when forming your LLC. LLC stands for limited liability company, and it is a business structure that state law allows you to form.A single-member LLC has special consideration, however, since it is a one-owner company.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

It can secure your liability protection. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.In order to keep this liability protection, you need to keep your business affairs and personal affairs separate.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.