New Mexico Dissolution Package to Dissolve Limited Liability Company LLC

What is this form?

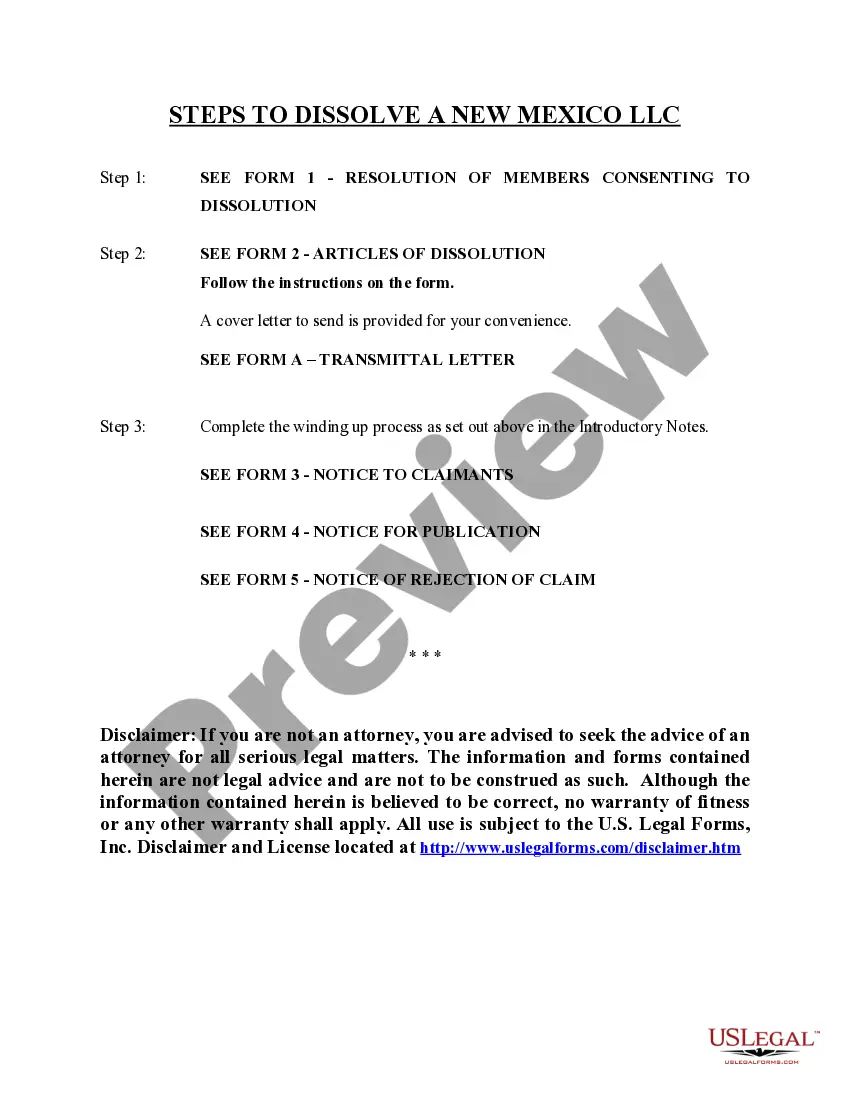

The New Mexico Dissolution Package to Dissolve Limited Liability Company (LLC) is a comprehensive set of legal documents designed to officially dissolve a limited liability company in New Mexico. This package provides all necessary forms, step-by-step instructions, and supplementary letters to ensure a complete and compliant dissolution process. It differs from similar forms by offering a structured method for closing an LLC while fulfilling all state requirements.

Form components explained

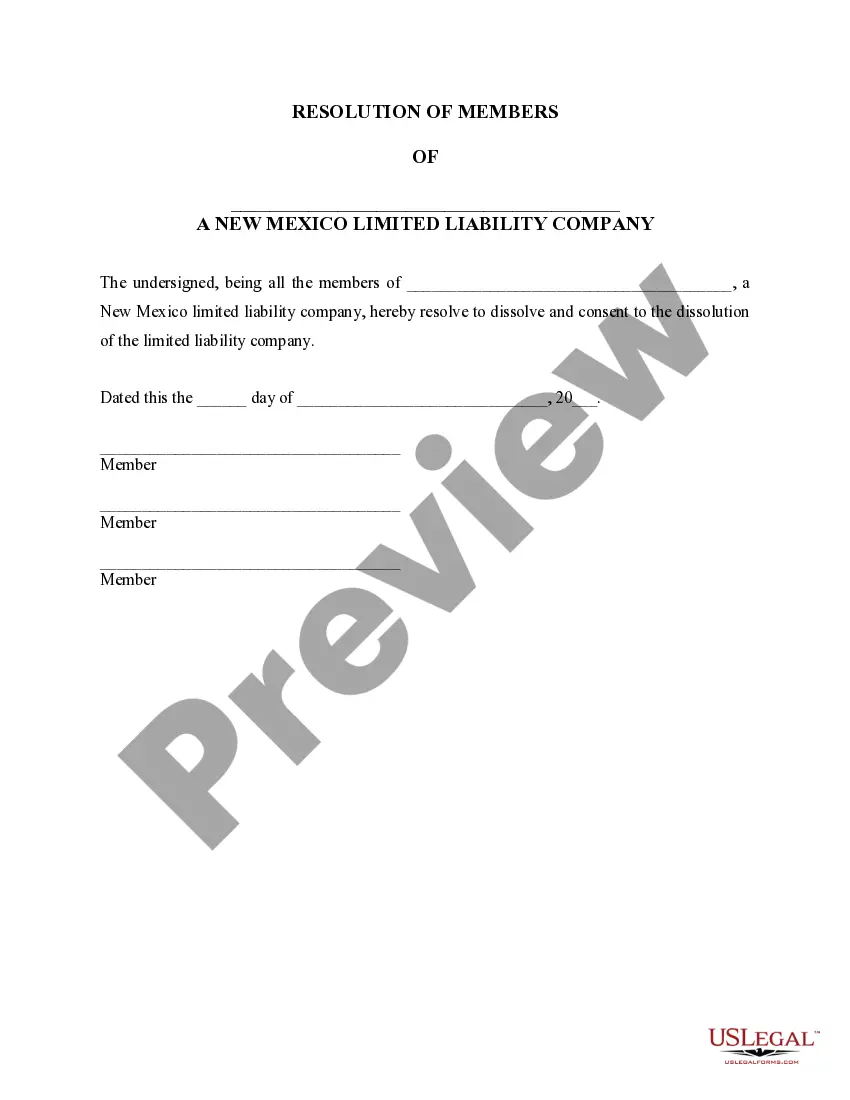

- Resolution of Members: Document indicating consent from members to dissolve the LLC.

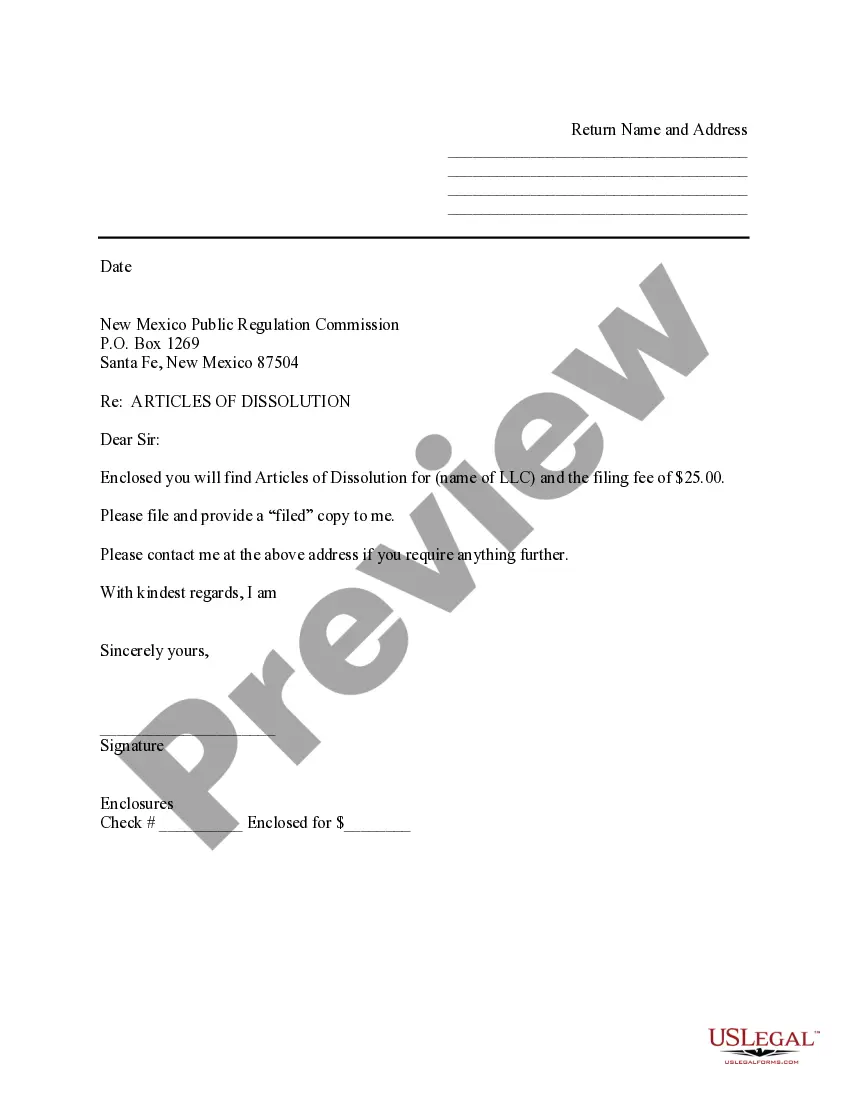

- Articles of Dissolution: Required filing with the New Mexico Public Regulation Commission to officially dissolve the LLC.

- Notice to Claimants: Notification to potential claimants about the dissolution and their rights to assert claims.

- Notice for Publication: Public announcement of dissolution published in a local newspaper.

- Notice of Rejection of Claim: Form to inform claimants of the acceptance or rejection of their claims.

When to use this document

This form should be used when members of a limited liability company in New Mexico decide to formally terminate the business. Scenarios include the end of business operations, the conclusion of a partnership, or a mutual agreement by members to dissolve the company. It is crucial to use this form to comply with legal requirements and protect the interests of all members and creditors.

Who should use this form

- Owners of a limited liability company (LLC) or professional limited liability company (PLLC) seeking to dissolve their business in New Mexico.

- Members of the LLC who have reached an agreement on dissolution.

- Business partners requiring a structured guide to manage the dissolution process effectively.

How to prepare this document

- Gather consent from members: Complete the Resolution of Members consenting to dissolution.

- Fill out the Articles of Dissolution: Provide necessary details about the LLC and causes for dissolution.

- Prepare the Notice to Claimants: Outline any claims that might arise during the winding-up process.

- Publish the Notice for Publication: Ensure it appears in a newspaper as required by state law.

- Send Notices of Rejection of Claims: Inform any claimants of the outcomes concerning their claims post-dissolution.

Does this form need to be notarized?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to obtain proper consent from all members before dissolving the LLC.

- Not filing the Articles of Dissolution with the New Mexico Public Regulation Commission.

- Neglecting to notify claimants or publish dissolution notices as required by law.

- Assuming that all assets and obligations will be resolved automatically after dissolution.

Why use this form online

- Convenient access to all necessary documents for dissolution in one package.

- Edit forms easily to reflect specific details of your LLC and dissolution process.

- Reliable templates drafted by licensed attorneys to ensure compliance with New Mexico laws.

Summary of main points

- The New Mexico Dissolution Package includes all necessary forms and instructions to legally dissolve an LLC.

- Proper consent from members is essential before initiating the dissolution process.

- Notifying creditors and following state-required procedures are critical steps in the dissolution process.

- Using this package can streamline the closure of your business and help prevent future legal issues.

Looking for another form?

Form popularity

FAQ

Tell Customers and Creditors You Are Going Out of Business. Pay Off Debts to Your Creditors. Vote to Dissolve Your Business. Complete and File the Necessary Forms. Inform the IRS of Your Dissolution. Cancel Foreign Qualifications.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.