Louisiana UCC1 Financing Statement Addendum

Description

How to fill out Louisiana UCC1 Financing Statement Addendum?

Greetings to the largest library of legal documents, US Legal Forms. Here, you can acquire any template, including Louisiana UCC1 Financing Statement Addendum samples, and download as many as you need or desire.

Create official documents within hours instead of days or weeks, all without incurring hefty expenses with a lawyer. Obtain the state-specific template in just a few clicks, assured by the expertise of our state-certified legal professionals.

If you are already a registered user, simply Log In to your account and select Download next to the Louisiana UCC1 Financing Statement Addendum you need. Since US Legal Forms operates online, you will have continuous access to your saved documents, no matter the device you are using. You can find them in the My documents section.

Once you have completed the Louisiana UCC1 Financing Statement Addendum, present it to your attorney for verification. While this is an additional measure, it is essential to ensure you are fully protected. Sign up for US Legal Forms today and gain access to thousands of reusable templates.

- If you do not have an account yet, what are you waiting for? Follow our steps below to get started.

- If this document pertains to state-specific needs, verify its legality in your state.

- Review the description (if available) to determine if it suits your needs.

- Explore additional details using the Preview feature.

- If the sample meets your criteria, select Buy Now.

- To create an account, choose a subscription plan.

- Register using a credit card or PayPal account.

- Save the document in your preferred format (Word or PDF).

- Print the file and complete it with your or your company's information.

Form popularity

FAQ

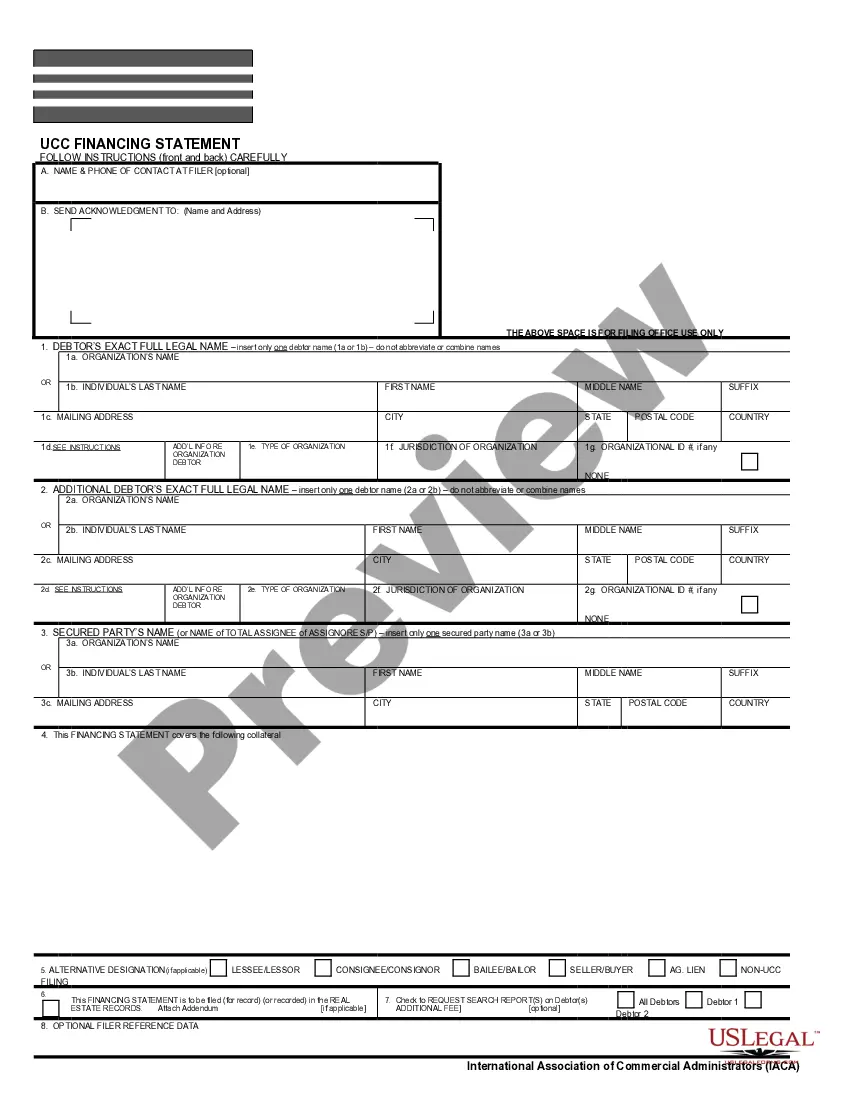

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

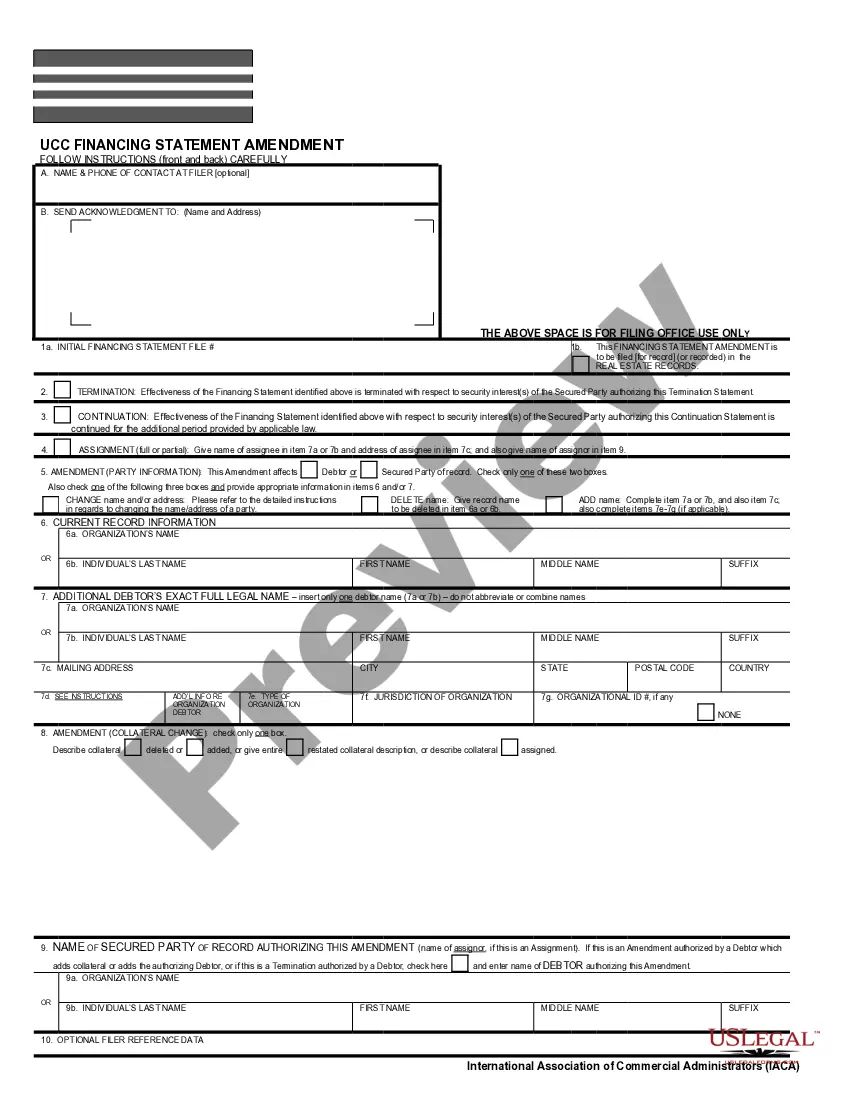

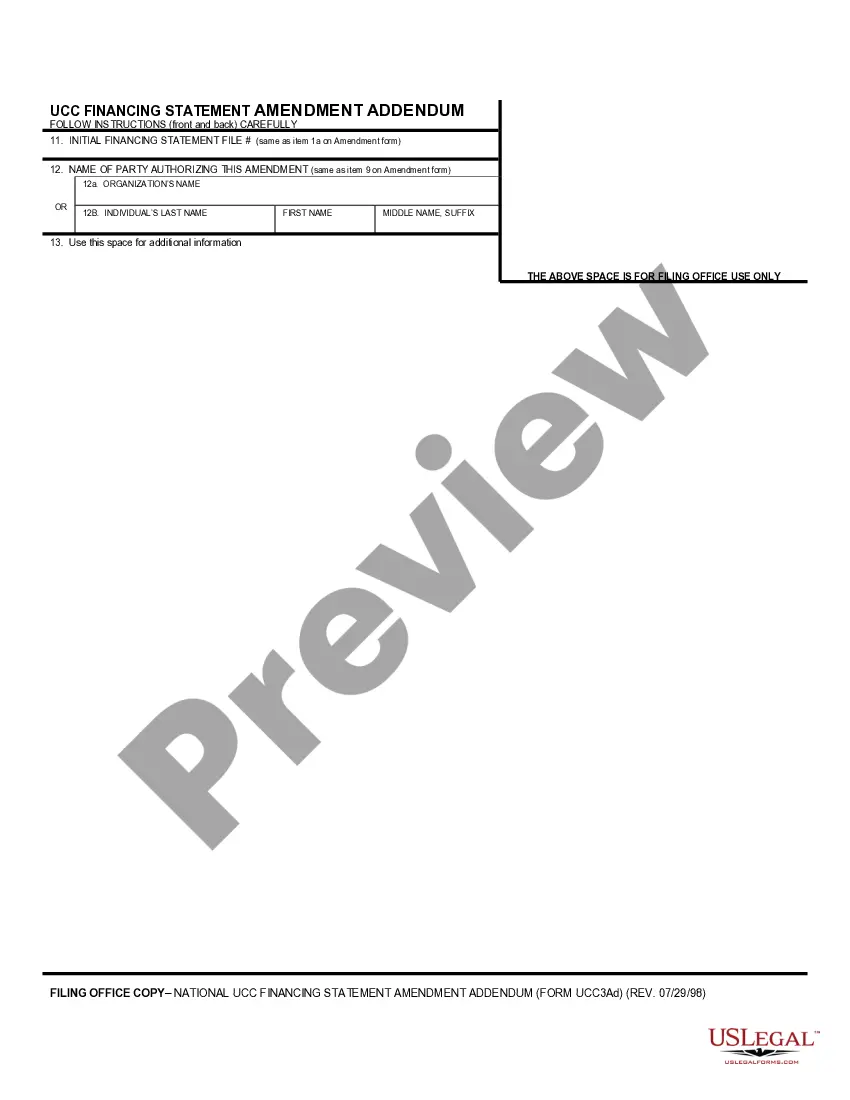

Form UCC3 is used to amend (make changes to) a UCC1 filing.However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed. Box 3 Continuation A UCC1 filing is good for five years.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a