Louisiana Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Self-Employed Independent Contractor Consulting Agreement - Detailed?

Have you found yourself in a situation where you require documents for both corporate or personal purposes almost every day at work.

There is a diverse array of legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Louisiana Self-Employed Independent Contractor Consulting Agreement - Comprehensive, designed to comply with federal and state regulations.

Once you have found the appropriate form, click on Buy now.

Choose the pricing plan you desire, complete the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient format and download your version. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Louisiana Self-Employed Independent Contractor Consulting Agreement - Comprehensive at any time, if required. Just click the desired form to download or print it. Use US Legal Forms, the largest collection of legal forms, to save time and avoid errors. This service offers professionally crafted legal document templates that can be utilized for a broad range of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Louisiana Self-Employed Independent Contractor Consulting Agreement - Comprehensive template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is suited for the correct city/state.

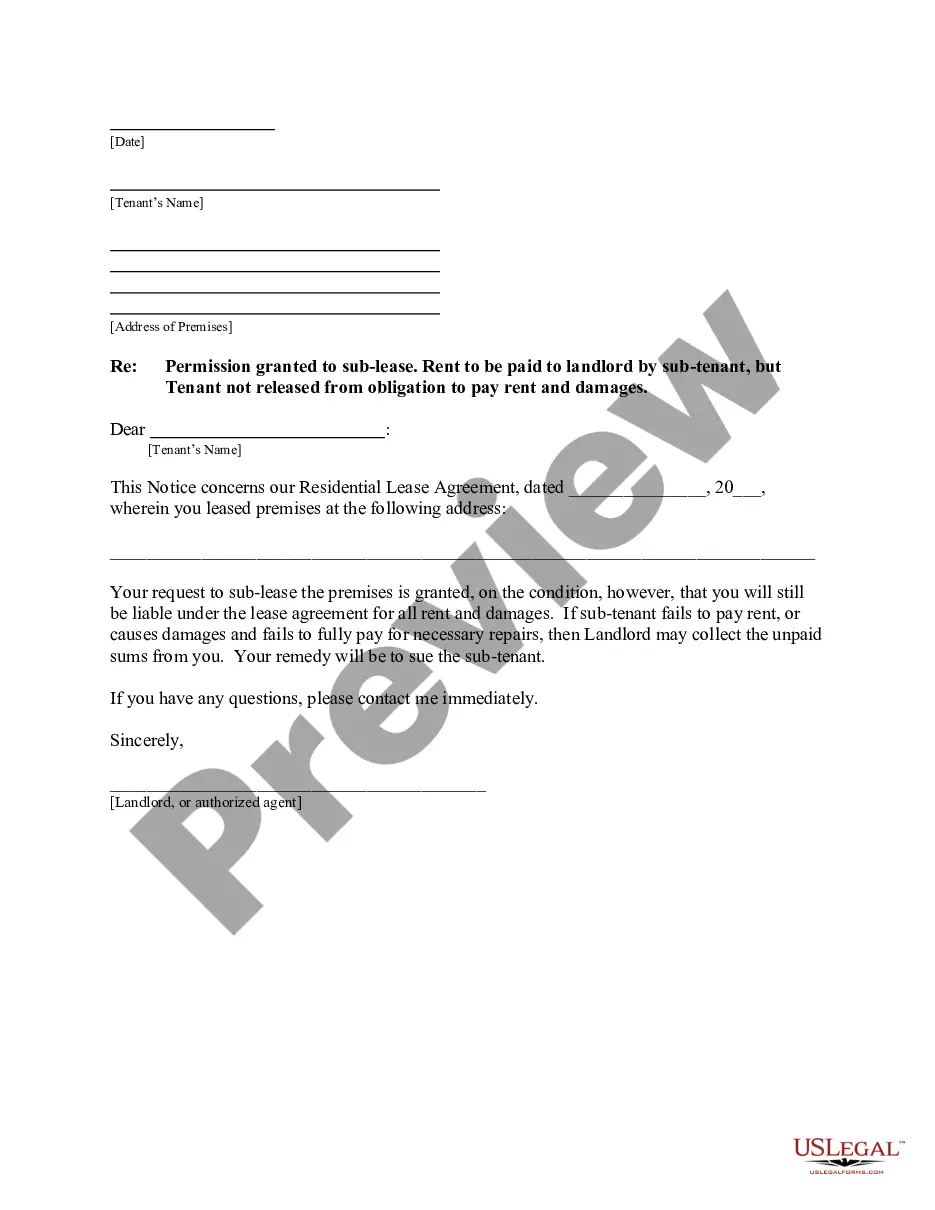

- Use the Review button to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to locate the form that meets your requirements.

Form popularity

FAQ

An independent contractor agreement between an individual independent contractor (a self-employed individual) and a client company for consulting or other services. This Standard Document is drafted in favor of the client company and is based on federal law.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Contractors, freelancers, and consultants are self-employed individuals who work alone or as part of other businesses. These terms cause a great deal of confusion because they are often used interchangeably when discussing self-employment.

The contractor isn't an employee of the company but works independently. The contractor provides services to the client under an Independent Contractor Agreement.

Generally, a Consultant is a self-employed independent businessperson who has a special field of expertise or skill.