Louisiana Material Return Record

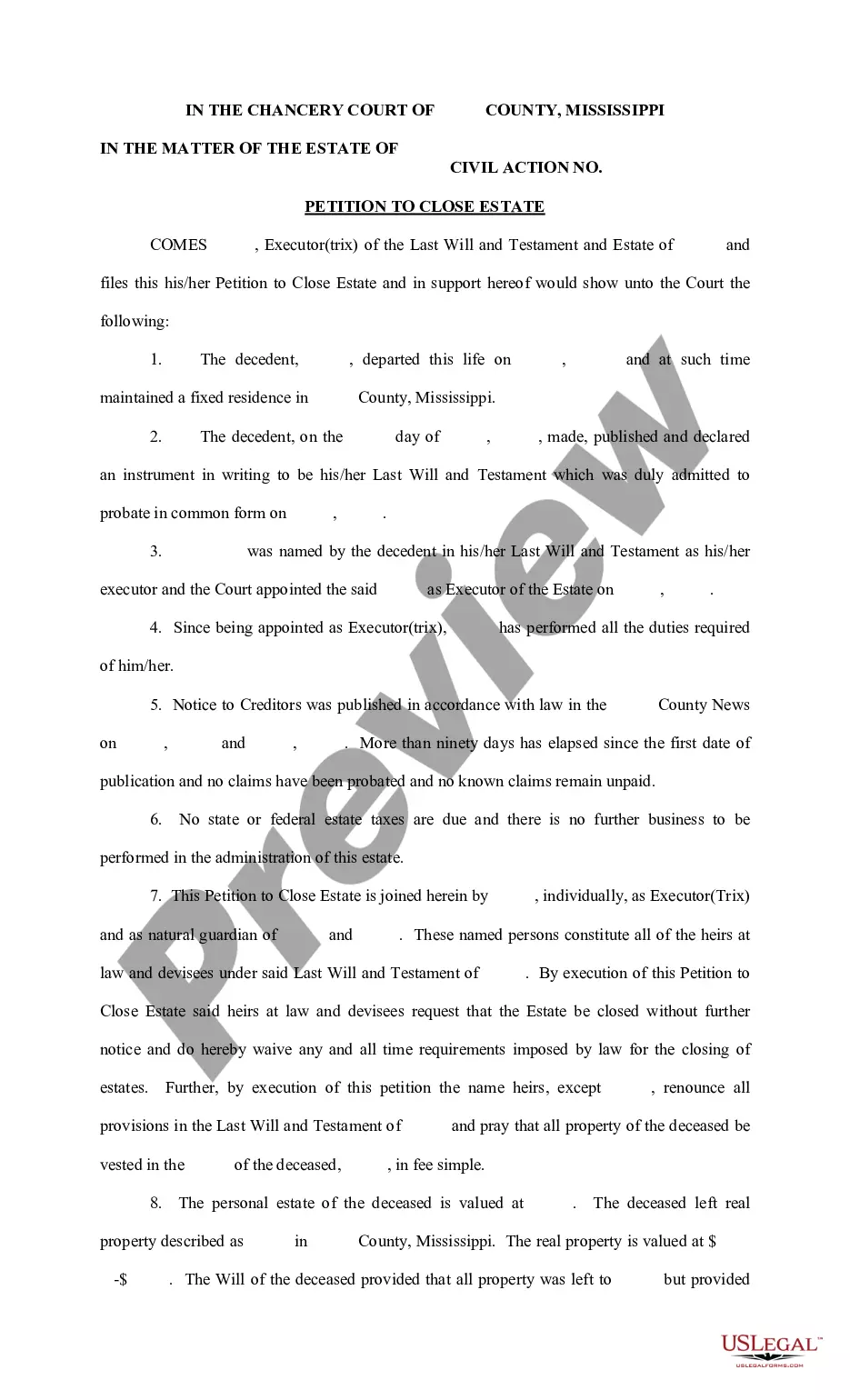

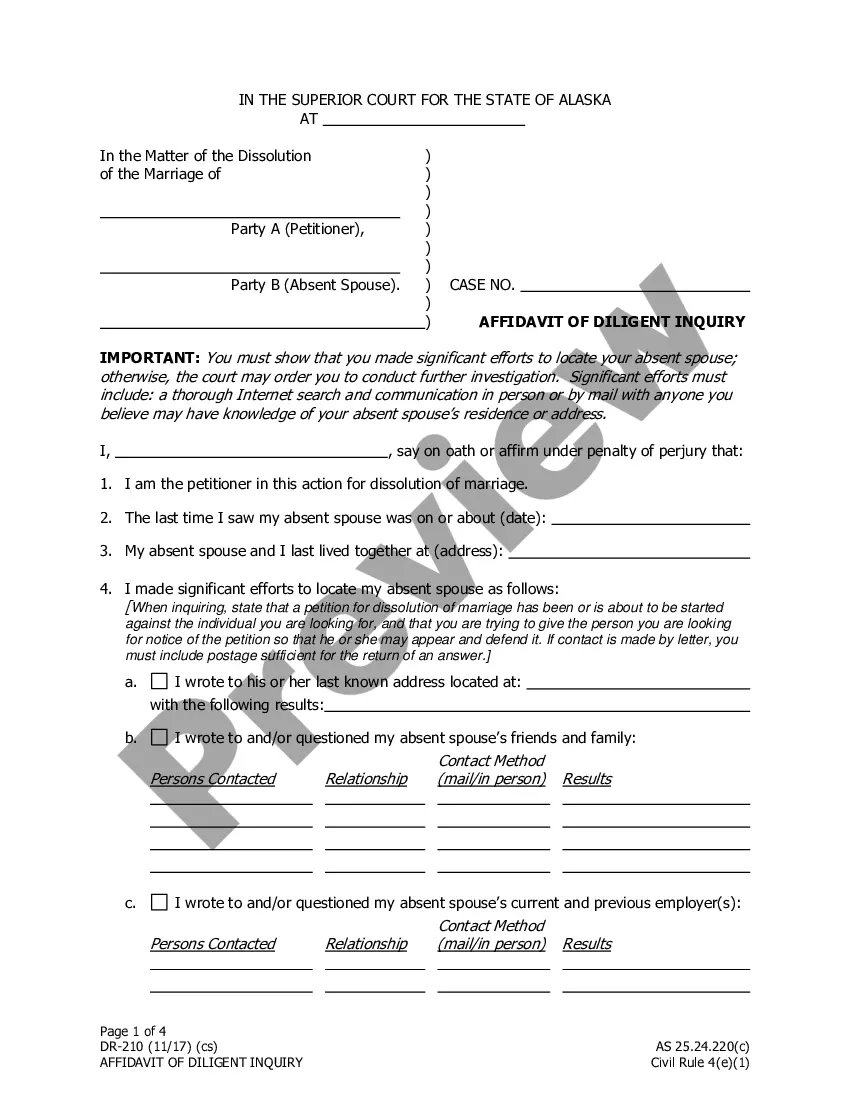

Description

How to fill out Material Return Record?

Have you encountered a scenario where you need documents for either business or personal reasons almost every time.

There are plenty of legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Louisiana Material Return Document, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click Download now.

Select the pricing plan you prefer, provide the necessary information to create your payment, and complete the order using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Louisiana Material Return Document template.

- If you do not have an account and want to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review feature to examine the form.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Once granted, Louisiana resale certificates are valid for up to two years. After that, you'll need to renew.

YES. State of Wisconsin requires it.

Resale Certificate ValidationEnter your sales tax account number (Seller's LA Account Number) as it appears on your sales tax registration certificate.Next, enter your business name (Seller's Business Name) as it appears on your sales tax registration certificate.Press "Enter."More items...

You can apply for a resale certificate through your state's tax department. Be sure to apply to the state tax department in the state you physically have an addressnot the state in which you are incorporated, if it's different.

To report Louisiana-sourced unrelated business income, exempt organizations are required to file Form CIFT-620. In instances when a multi-state exempt organization earns unrelated business income within Louisiana and outside of Louisiana, Form CIFT-620A, Schedules P and Q are also required.

Do not mail the federal and state returns together in the same envelope! They do not go to the same place. When you print out your returns there should be instructions that tell you where to mail them. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2's or any 1099's.

A Louisiana Resale Certificate is a document that allows a business to purchase goods and services tax-free from suppliers for the purpose of reselling those goods and services. In order to use one, the retailer will need to provide a Louisiana Resale Certificate to their vendor.

Do I have to include a copy of my Federal return with my Louisiana state tax, if I am filing by mail? Generally, your federal tax return should not be included with your Louisiana State Tax Return.

How can I get a copy of my Louisiana Resale Certificate(s)? Businesses may reprint their Louisiana Resale Certificate through LaTAP on the LDR website. If a business does not have a LaTAP account, they may also request a copy by completing a Form R-7004, Tax Information Disclosure Authorization.