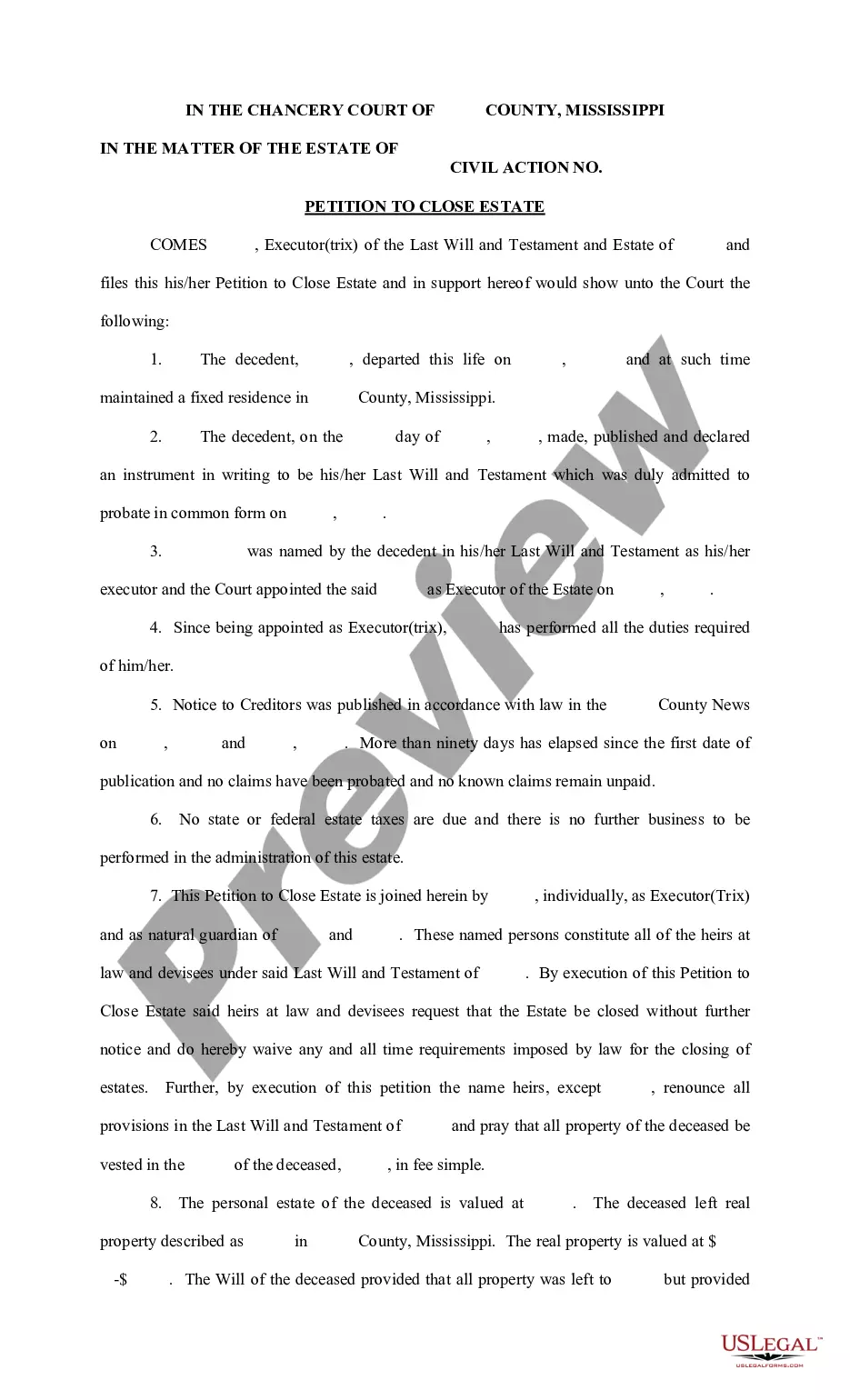

Mississippi Petition to Close Estate by Executor

Overview of this form

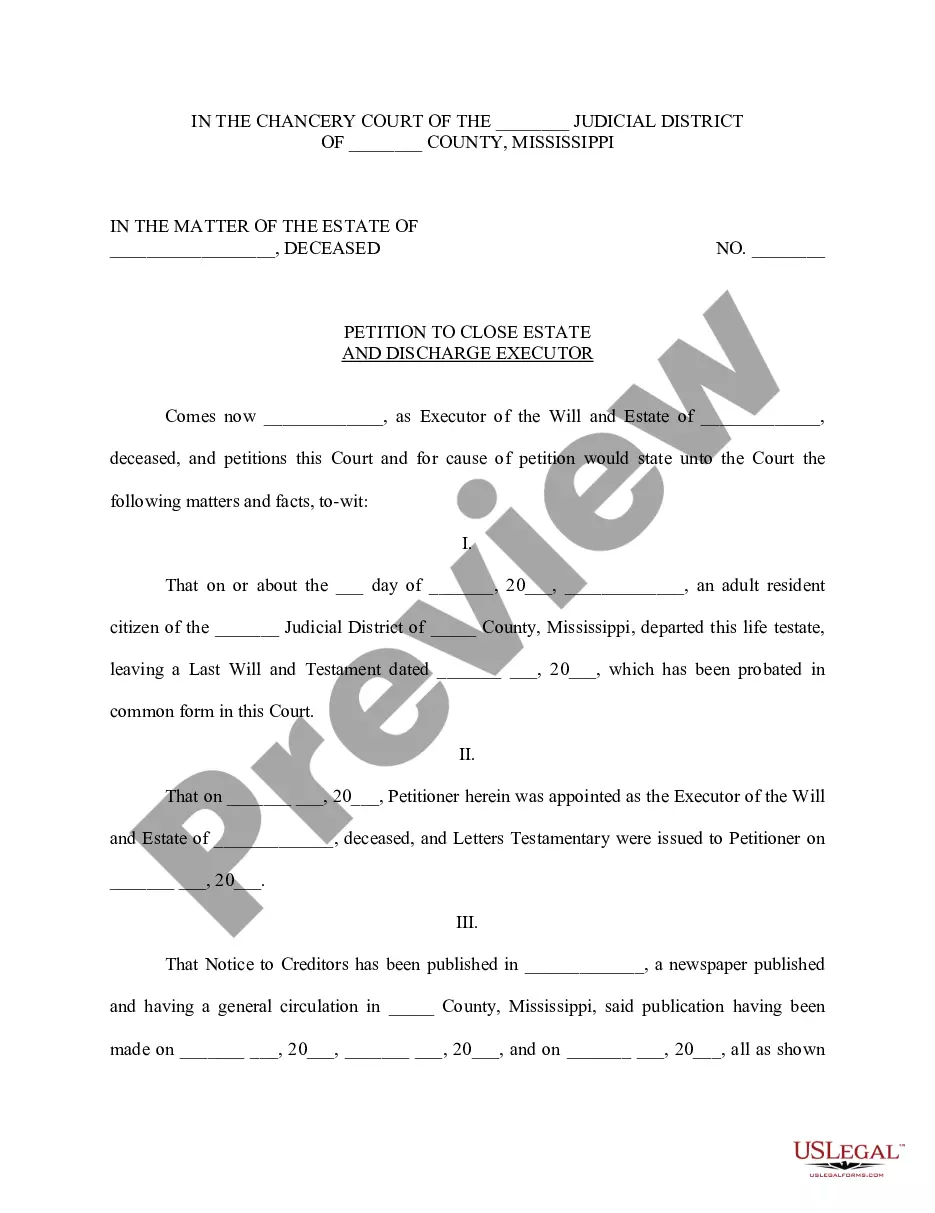

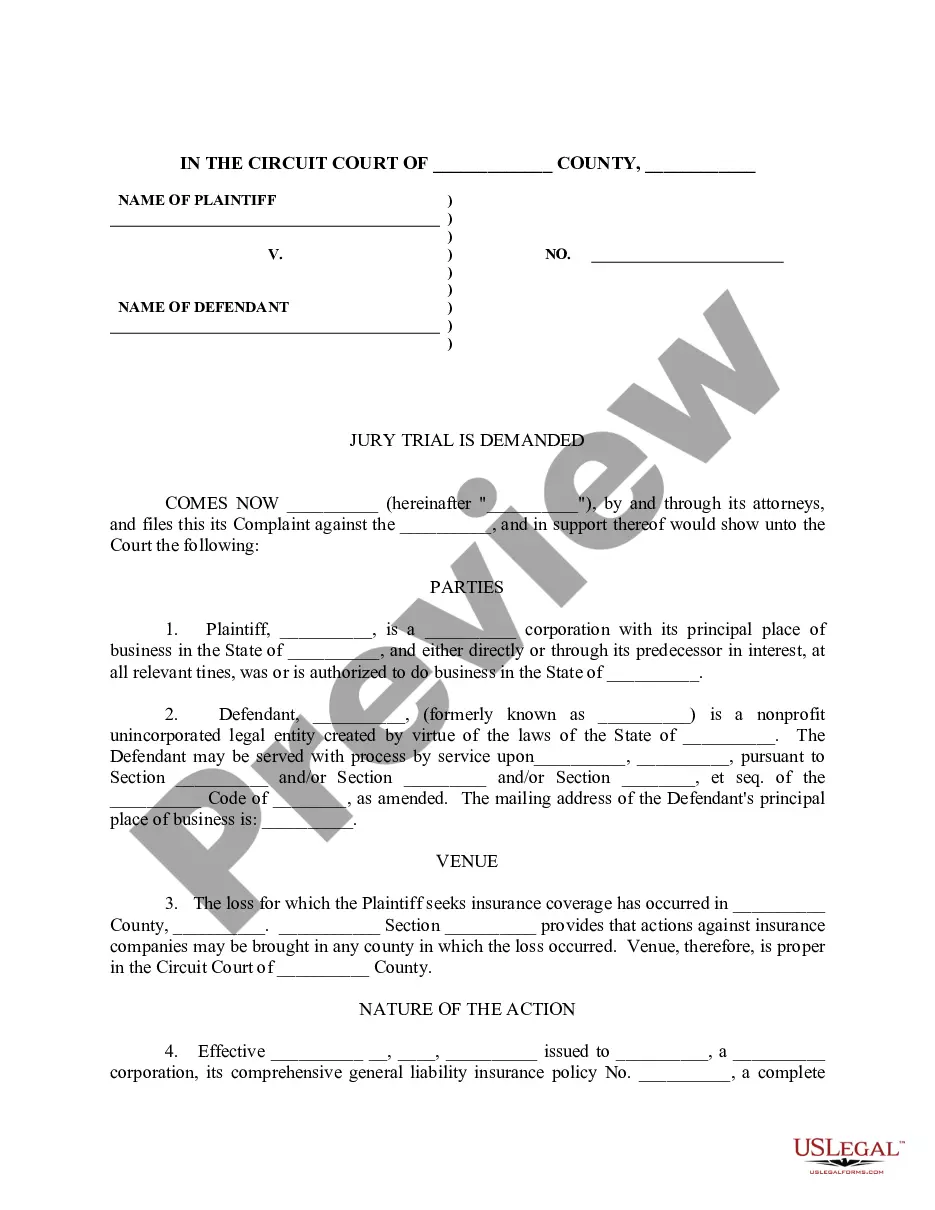

The Petition to Close Estate by Executor is a legal document used to request that a court officially close an estate after the executor has fulfilled their duties. This form is specifically designed for executors who have completed the administration of an estate and need to confirm that no state or federal estate taxes are due. It is distinct from other estate forms as it focuses solely on closing the estate rather than initiating probate or managing estate assets.

Form components explained

- Confirmation that no estate taxes are due

- A declaration that there is no further business to be performed in the estate administration

- Signature and verification by the executor

Situations where this form applies

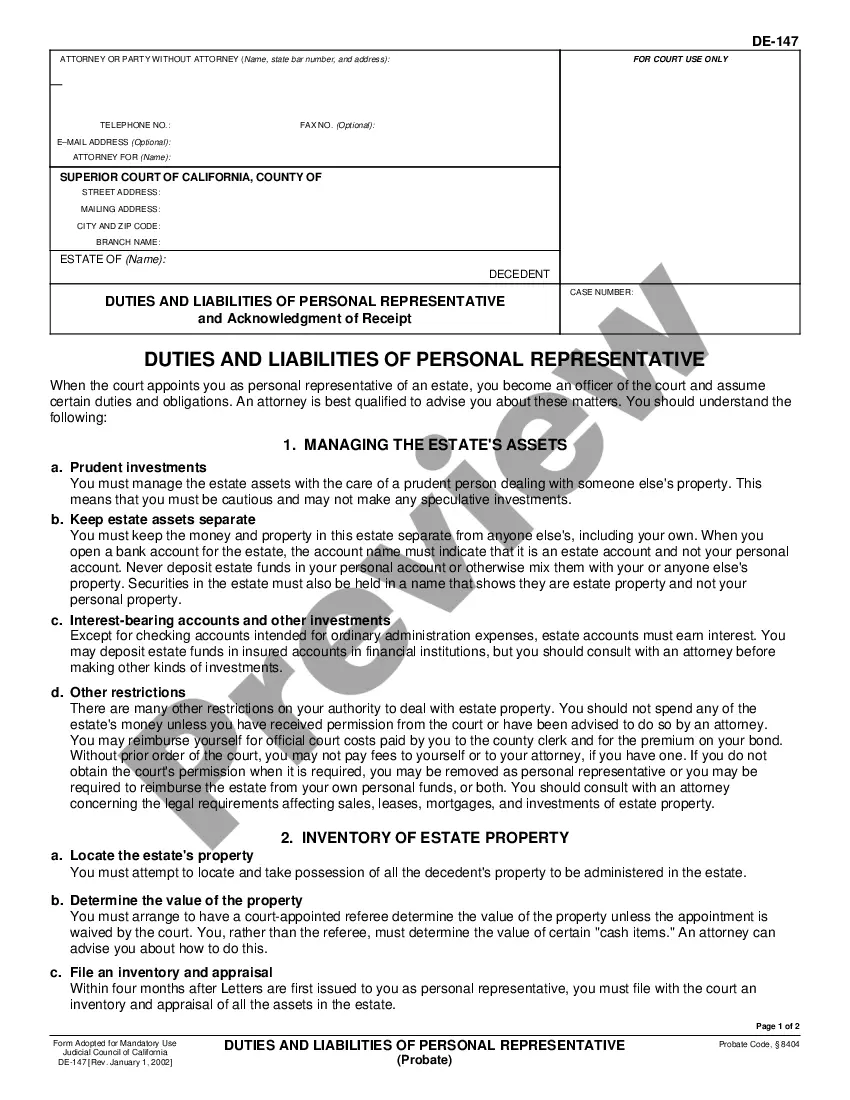

This form is necessary after the executor has settled all debts, distributed assets, and fulfilled their responsibilities in managing the estate. It is typically used when the executor is ready to officially close the estate and ensure that all legal requirements have been met.

Who can use this document

- Executors of estates who have completed their duties

- Individuals involved in the probate process who need to formally close an estate

- Legal representatives acting on behalf of the executor

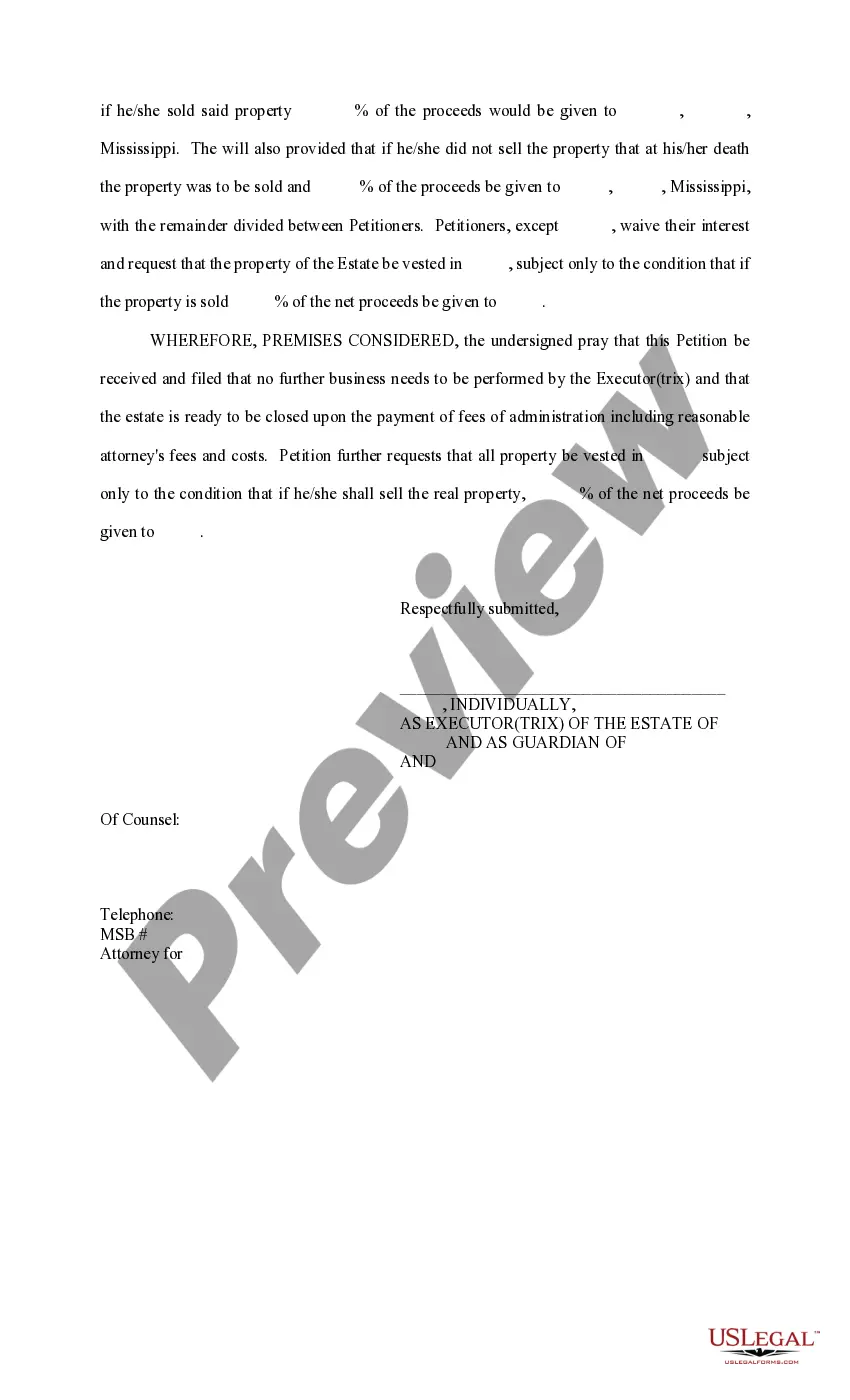

Instructions for completing this form

- Identify the executor and provide their contact information.

- Confirm that no state or federal estate taxes are owed.

- Declare that no further actions are required for the estate administration.

- Sign the petition to validate the information provided.

- File the completed petition with the appropriate court.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to confirm that no estate taxes are due.

- Not signing the form, which can invalidate the petition.

- Forgetting to file the form with the correct court.

Advantages of online completion

- Convenience of downloading and filling the form at your own pace.

- Editability to tailor the document to your specific needs.

- Access to legally vetted forms, ensuring reliability and compliance.

Legal use & context

- The form serves as official documentation to the court about the closure of the estate.

- Ensures that all parties involved in the estate are informed and in agreement with the closure.

- Helps prevent future disputes regarding the estate management and closure.

What to keep in mind

- The Petition to Close Estate by Executor is essential for formally closing an estate.

- Complete the form accurately to ensure compliance with legal requirements.

- Make sure to file the petition in the correct court for it to have legal standing.

Looking for another form?

Form popularity

FAQ

In the best of circumstances, the Mississippi probate process usually takes 4 to 6 months. This would only be possible if the estate was fairly simple, all interested parties are agreeable, and documents are signed and returned to the probate attorney in a timely manner.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

By Stephanie Kurose, J.D. Closing a person's estate after they die can often be a long, detailed process. This includes paying off debts, filing final tax returns, and, finally, distributing the estate's assets according to the wishes of the deceased.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.