Louisiana Sample Letter for Tax Return for Supplement

Description

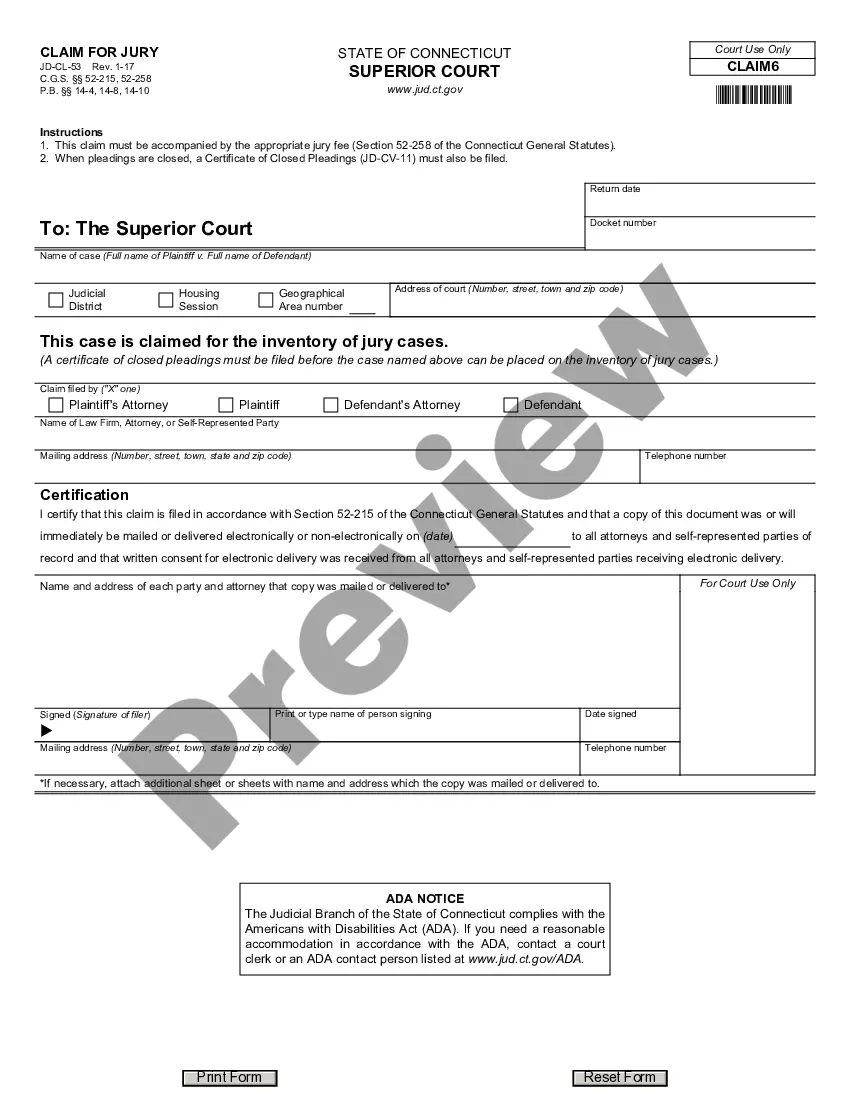

How to fill out Sample Letter For Tax Return For Supplement?

If you need to complete, acquire, or printing legitimate record templates, use US Legal Forms, the largest assortment of legitimate kinds, which can be found on the Internet. Use the site`s simple and easy handy research to obtain the files you need. A variety of templates for business and person uses are sorted by groups and suggests, or keywords. Use US Legal Forms to obtain the Louisiana Sample Letter for Tax Return for Supplement in a couple of mouse clicks.

When you are previously a US Legal Forms client, log in for your account and click on the Down load switch to get the Louisiana Sample Letter for Tax Return for Supplement. You may also gain access to kinds you previously saved from the My Forms tab of the account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form to the proper city/country.

- Step 2. Use the Preview option to examine the form`s content material. Don`t forget about to read the information.

- Step 3. When you are unhappy with all the form, make use of the Research area towards the top of the monitor to locate other models of the legitimate form design.

- Step 4. Upon having discovered the form you need, click the Acquire now switch. Select the pricing strategy you choose and put your credentials to sign up to have an account.

- Step 5. Approach the purchase. You may use your charge card or PayPal account to complete the purchase.

- Step 6. Pick the format of the legitimate form and acquire it in your system.

- Step 7. Total, modify and printing or indicator the Louisiana Sample Letter for Tax Return for Supplement.

Every legitimate record design you buy is yours for a long time. You possess acces to every form you saved in your acccount. Go through the My Forms area and decide on a form to printing or acquire yet again.

Be competitive and acquire, and printing the Louisiana Sample Letter for Tax Return for Supplement with US Legal Forms. There are many skilled and condition-specific kinds you can utilize for your personal business or person needs.

Form popularity

FAQ

If you are single, you should file Form IT-540, Louisiana Resident Individual Income Tax Return, reporting all of your income to Louisiana. If you are married and both you and your spouse are residents of Louisiana, you should file Form IT-540 reporting all of your income to Louisiana.

The rate for supplemental wages up to $1 million subject to a flat rate remains unchanged from 2022, at 22%.

Yes. Bonuses are taxed more than regular pay because they are considered supplemental income.

Although not subject to Unemployment Insurance, Employment Training Tax, or State Disability Insurance,* these payments are subject to PIT withholding and should be reported as PIT wages on the DE 9C.

Are supplemental wage and vacation payments subject to withholding? Yes. R.S. 1(A) defines wages as all compensation paid for services performed by an employee for an employer, including the cash value of all compensation paid in any medium other than cash.

You can withhold tax on supplemental wages using the percentage method. The federal supplemental tax rate is 22%. Use this method if you already withheld income tax from the employee's regular wages. This is the easiest method of dealing with taxes on supplemental wage payments.

10606 (1/17) Supplemental Worksheet for Credit for Taxes. Paid to Other States for IT540 and IT541. Tax Year. Social Security Number.

Form 4852 serves as a substitute for Form W-2, Form W-2c, and Form 1099-R (original or corrected), and is completed by taxpayers or their representatives when: Their employer or payer does not give them a Form W-2 or Form 1099-R. An employer or payer has issued an incorrect Form W-2 or Form 1099-R.