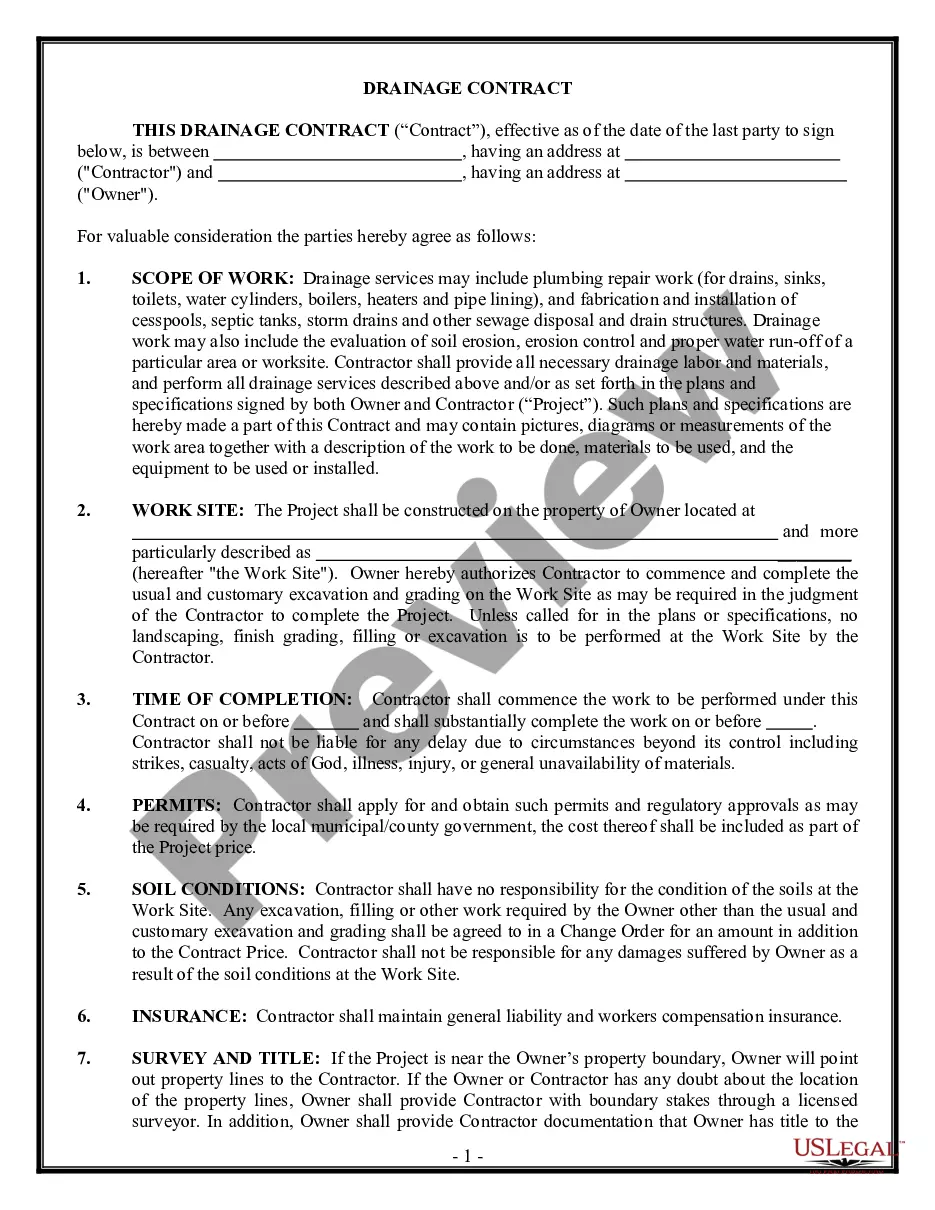

A Louisiana Surety Bond is a type of financial guarantee that is required in certain situations. It is an agreement between three parties— thobligedee, the principal, and the surety— that protects thobligedee from any financial losses they may incur as a result of the principal’s failure to fulfill their contractual obligations. The surety provides a guarantee to the obliged that the principal will fulfill their obligations and, in the event of a default, the surety will pay the obliged for any losses they have suffered. There are several types of Louisiana Surety Bond, including contractor bonds, license and permit bonds, court bonds, fidelity bonds, and public official bonds.

Louisiana Surety Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Surety Bond?

Completing official documentation can be quite a burden unless you have access to pre-prepared fillable forms. With the US Legal Forms online repository of formal paperwork, you can be assured of the details you receive, as all of them align with federal and state legislation and are verified by our experts. Therefore, if you require to fill out the Louisiana Surety Bond, our service is the ideal source to download it.

Acquiring your Louisiana Surety Bond from our repository is as easy as 1-2-3. Previously registered users with an active subscription only need to Log In and click the Download button once they identify the appropriate template. Later, if necessary, users can retrieve the same document from the My documents section of their account. However, even if you are new to our service, signing up with a valid subscription will only take a few minutes. Here’s a quick guideline for you.

Haven’t you experienced US Legal Forms yet? Subscribe to our service today to obtain any official document swiftly and effortlessly whenever you need to, and maintain your paperwork in order!

- Document compliance verification. You should carefully examine the content of the form you wish to ensure that it meets your requirements and adheres to your state's legal stipulations. Previewing your document and reviewing its general description will assist you in accomplishing this.

- Alternative search (optional). If there are any discrepancies, explore the repository through the Search tab above until you locate a suitable form and click Buy Now when you find the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After verifying your account, Log In and select your desired subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Louisiana Surety Bond and click Download to save it on your device. Print it to finish your paperwork manually, or utilize a comprehensive online editor to prepare an electronic copy more quickly and efficiently.

Form popularity

FAQ

Surety bonds are one of the most common legal documents that are used to protect consumers against damages that they can incur from negligent businesses. Louisiana surety bonds are issued across many different industries to protect consumers against damages, and businesses against costly claims from their customers.

The main difference between a cash bond and a surety bond is the number of parties involved. Cash bonds only involve two parties, you and the owner. In a surety bond, there is a third party, the surety company. The term surety refers to any party that guarantees the payment of a debt or performance of a contract.

What Do Louisiana Surety Bonds Cost? Surety bonds generally cost 1-15% of the required bond amount. Costs vary significantly depending on the bond amount you need and your rate (which is the percentage of the full bond amount you must pay).

What Do Louisiana Surety Bonds Cost? Surety bonds generally cost 1-15% of the required bond amount. Costs vary significantly depending on the bond amount you need and your rate (which is the percentage of the full bond amount you must pay).

What Are Surety Bonds. A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

How to Get a Surety Bond Find the bond requirements in your state for your specific business or industry. Confirm the bond coverage amount needed. Contact a surety company that's licensed to sell bonds in your state. Provide the business details and financial information needed for your quote. Receive your bond quote.

Surety Bond Requirements The bond must be issued by an insurer admitted to write surety business in Louisiana. Each bond must be executed on the form provided by the LDI. The original bond must be filed with the LDI. Each bond must provide for a cancellation notice of not less than thirty day.