North Carolina Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Assignment to Living Trust: This refers to the process of transferring ownership of an asset into a living trust. A living trust is a legal entity created to hold and manage assets, which can bypass probate, enhance privacy, and provide clear directives on asset management after one's death.

Step-by-Step Guide

- Identify Assets: Review and list the assets you intend to transfer into the living trust, such as real estate, stocks, or personal property.

- Prepare the Assignment Document: Draft an assignment document that legally transfers the ownership of the assets to the trust. This might require legal assistance.

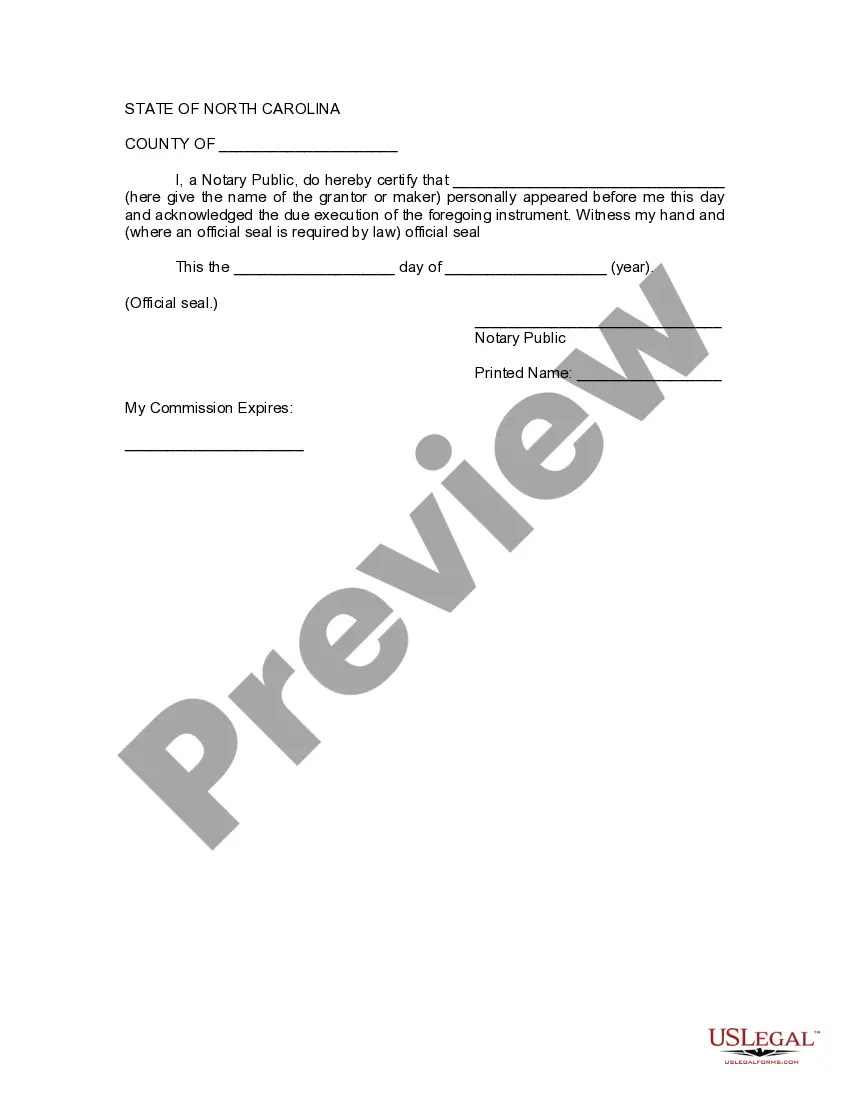

- Execute the Document: Both the grantor (you) and a notary must sign the assignment document to make the transfer official.

- Store Documents: Securely store the assignment document along with your trust documents for record-keeping and future reference.

Risk Analysis

- Improper Documentation: Failing to correctly execute or record the assignment might lead to disputes or failure in bypassing probate.

- Liquid Assets: Some assets, like certain insurance policies or retirement accounts, should not be transferred to a trust due to potential tax consequences and legal restrictions.

- Legal Advice: Lack of proper legal guidance can lead to errors in creating a valid living trust or in properly assigning assets.

Key Takeaways

Assigning assets to a living trust can provide benefits like avoiding probate and enhancing privacy, but must be done carefully to avoid common pitfalls like improper documentation or incorrect asset handling.

Common Mistakes & How to Avoid Them

- Not Reviewing Asset Types: Ensure that the assets you are transferring are appropriate for a living trust. Consult a financial advisor or lawyer.

- Forgetting to Update: Regularly review and update your living trust and related assignments as your financial situation or estate plan changes.

How to fill out North Carolina Assignment To Living Trust?

Steer clear of costly lawyers and discover the North Carolina Assignment to Living Trust you desire at a reasonable price on the US Legal Forms site.

Utilize our straightforward categories feature to search for and access legal and tax documents. Review their descriptions and preview them before downloading.

Choose to obtain the document in PDF or DOCX format. Simply click Download and locate your document in the My documents section. You may save the document to your device or print it. After downloading, you can fill out the North Carolina Assignment to Living Trust either manually or with an editing software program. Print it and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Moreover, US Legal Forms provides clients with step-by-step guidance on how to acquire and complete each form.

- Clients of US Legal Forms simply need to Log In and retrieve the specific form they require from their My documents section.

- Those who have not yet purchased a subscription should follow the instructions below.

- Verify that the North Carolina Assignment to Living Trust is suitable for use in your location.

- If accessible, read the description and utilize the Preview feature before downloading the document.

- If you are certain that the form meets your needs, click on Buy Now.

- If the form is incorrect, use the search bar to locate the appropriate one.

- Then, create your account and choose a subscription option.

- Pay using a credit card or PayPal.

Form popularity

FAQ

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Figure out the type of trust you'll need. Are you single? Take inventory of everything you own. Pick your trustee. Draw up the trust document, either by yourself or with a lawyer. Sign the trust document in front of a notary. Fund the trust this means putting your property into the trust.

A "living trust" (also called an "inter vivos" trust by lawyers who can't give up Latin) is simply a trust you create while you're alive, rather than one that is created at your death under the terms of your will. The beneficiaries you name in your living trust receive the trust property when you die.

It is true that in some states (such as California) probate administration can be lengthy and expensive. North Carolina is not one of those states. The maximum court cost that can be saved in North Carolina by using a funded living trust is $3,000, and those costs are generally much less in most estates.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.