Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What this document covers

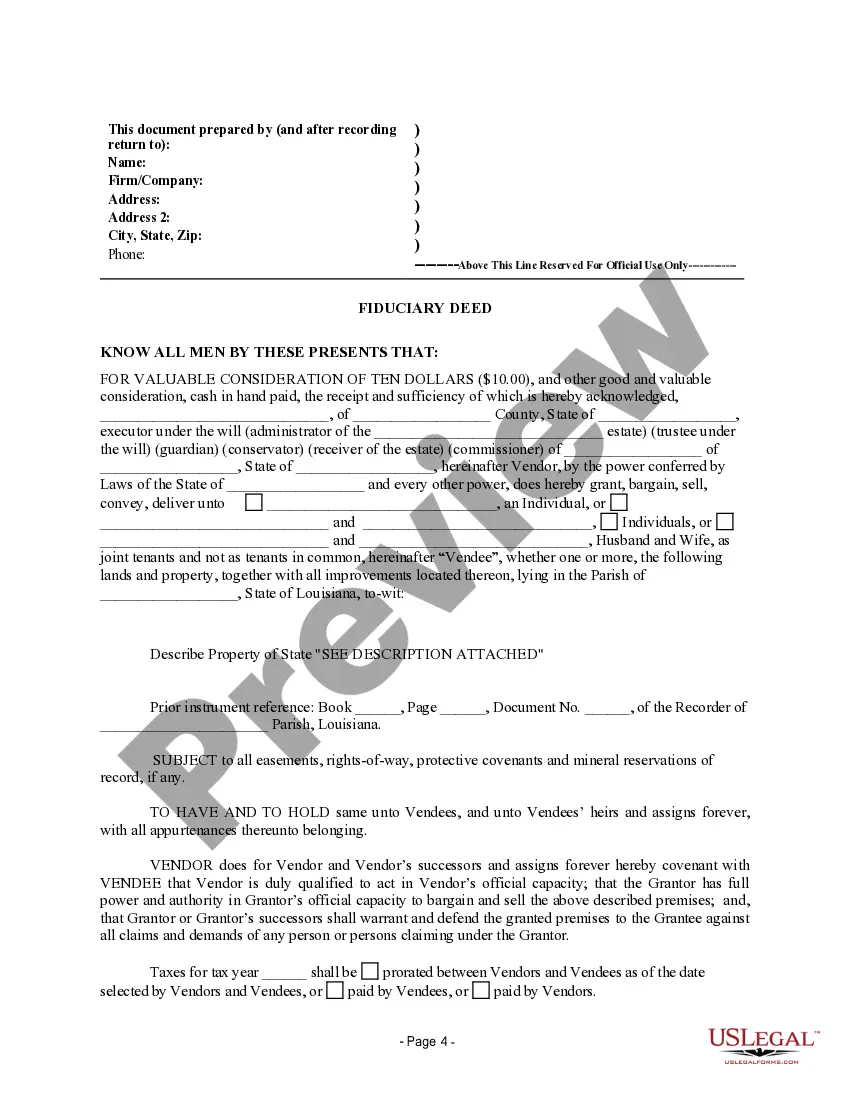

The Fiduciary Deed is a legal document used by executors, trustees, trustors, administrators, and other fiduciaries to transfer property rights from the fiduciary to another party. This form serves a specific purpose distinct from other property transfer documents by acknowledging the fiduciary role and authority over the property in question, ensuring all legal obligations are followed during the conveyance process.

Form components explained

- Identification of the vendor as the executor, trustee, or other fiduciary.

- Description of the property being conveyed, including its legal description.

- Statement of the consideration received for the property transfer.

- Covenants and assurances regarding the authority to conduct the transaction.

- Tax obligations related to the property transfer.

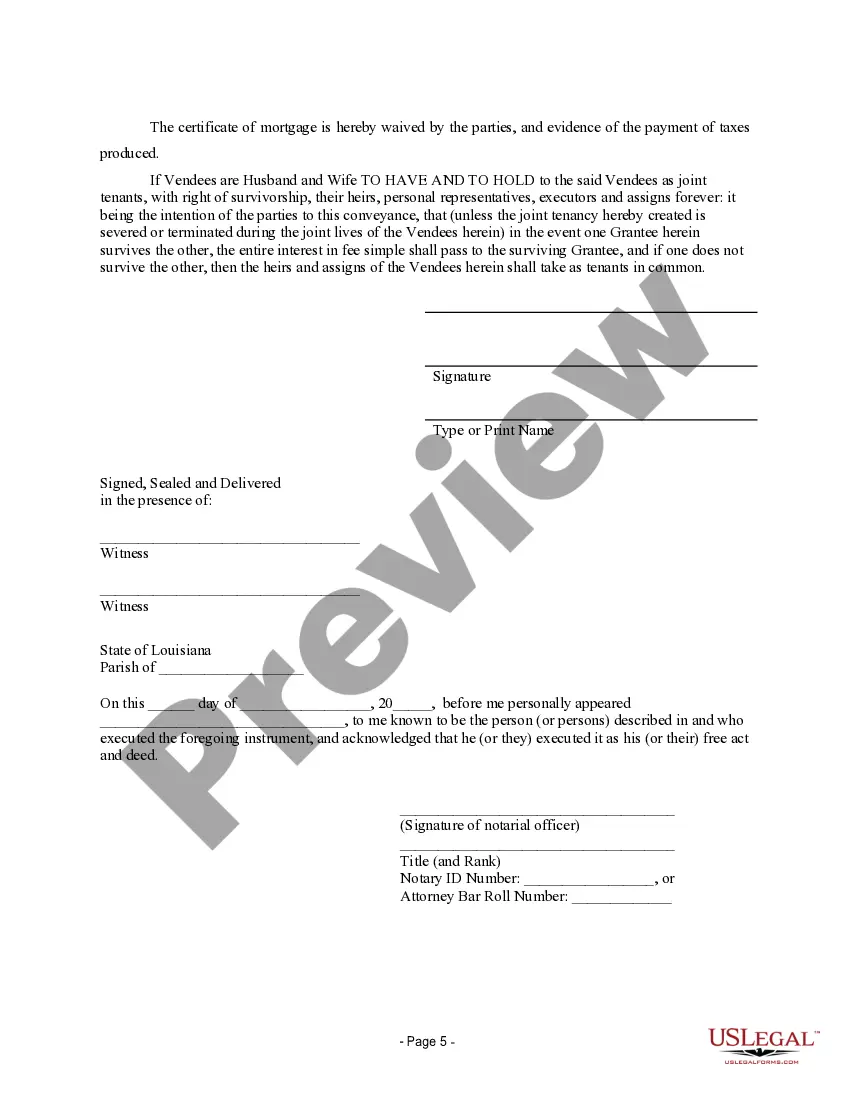

- Signatures of the vendor and a notary public for validation.

Situations where this form applies

You may need to use the Fiduciary Deed in situations where a fiduciary is acting on behalf of an estate, trust, or another party. Common scenarios include the transfer of property after the death of the original owner, when a trust is being dissolved, or in situations where a guardian needs to convey property on behalf of a minor or incapacitated individual. This form is crucial for ensuring that all legal requirements are met during the property transfer process.

Who this form is for

- Executors who are managing and distributing the estate according to a will.

- Trustees responsible for overseeing and distributing a trust's assets.

- Administrators appointed to manage an estate without a will.

- Guardians or conservators managing property on behalf of minors or incapacitated adults.

How to prepare this document

- Identify the vendor by entering the executor or fiduciary's name and title.

- Provide a clear description of the property being conveyed, including its legal description.

- Enter the consideration amount as agreed upon for the property transfer.

- Fill in the required parties' names who will receive the property (vendees).

- Obtain the necessary signatures from the vendor and a notary public.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide a thorough description of the property being transferred.

- Omitting signatures from one or more required parties, especially the notary.

- Not clearly stating the relationship between the vendor and the property owner.

- Overlooking tax obligations associated with the transfer.

Benefits of using this form online

- Convenience of completing the form from home without the need for an attorney.

- Editability allows you to adjust details as necessary before finalizing.

- Quick access to legally vetted documents ensuring compliance with local regulations.

- Downloadable and printable formats for easy record-keeping.

Looking for another form?

Form popularity

FAQ

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.

Beneficiaries' right to information enables them to act upon another right: to petition the court to remove the trustee if they are not properly carrying out their duties, or to terminate the trust altogether under some circumstances.

Once the contents of the trust get inherited, they're just like any other asset.As a result, anything you inherit from the trust won't be subject to estate or gift taxes. You will, however, have to pay income tax or capital gains tax on your profits from the assets you receive once you get them, though.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

If a trust pays out a portion of its assets as income, or holds assets that appreciate or generate interest income such as real estate or stocks, then the person receiving the money must pay income taxes. In a revocable trust, this is typically the grantor.

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.

How Long to Distribute Trust Assets? Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

The grantor is the initial trustee, but they name a succeeding trustee to manage the trust after their death. After the grantor dies, the trustee takes steps to settle the grantor's estate and distribute assets to the beneficiaries.