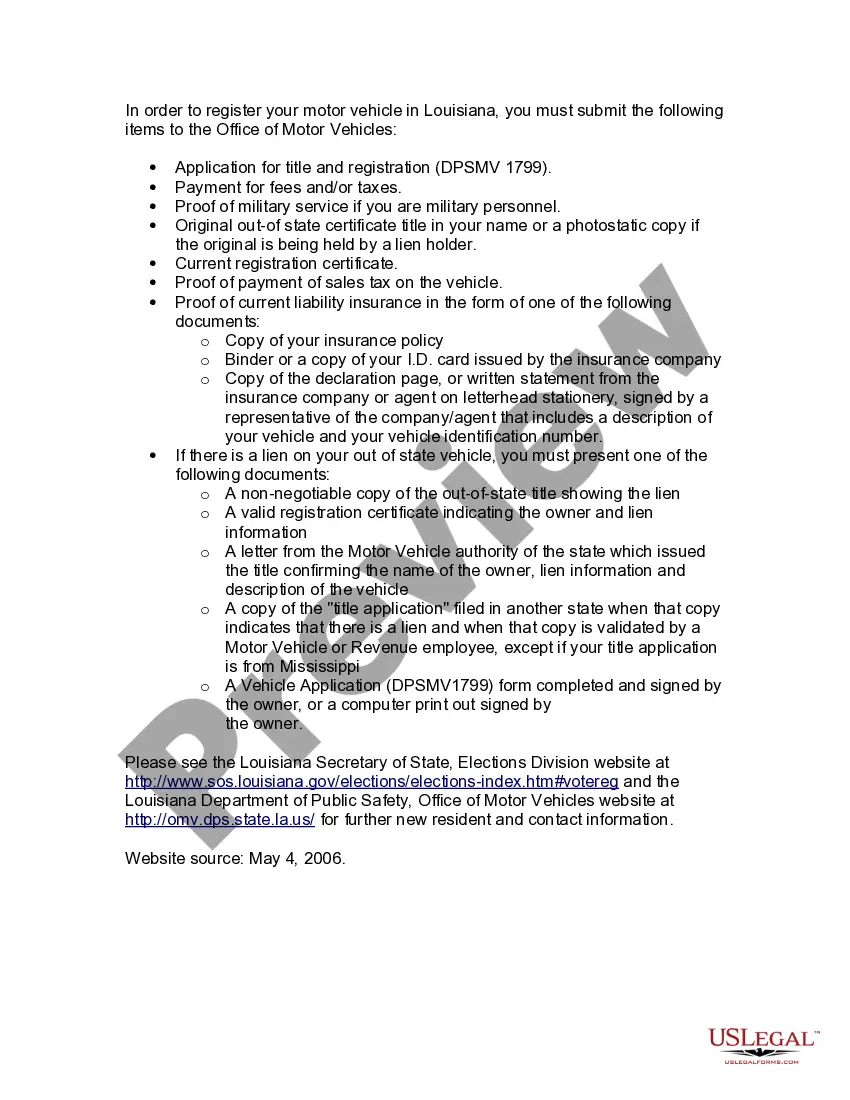

Louisiana New Resident Guide

Description

How to fill out Louisiana New Resident Guide?

You are invited to the largest legal document repository, US Legal Forms. Here you can obtain any template including Louisiana New Resident Guide samples and retain them (as many as you wish/require). Prepare official documents within a few hours, rather than days or even weeks, without spending a fortune on a lawyer. Acquire your state-specific example in just a few clicks and feel assured knowing that it was crafted by our experienced attorneys.

If you’re already a registered user, just sign in to your account and click Download next to the Louisiana New Resident Guide you need. Since US Legal Forms is online-based, you’ll typically have access to your stored documents, regardless of the device you’re using. Locate them in the My documents section.

If you don't have an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific template, verify its relevance in your state.

- Review the description (if available) to find out if it’s the correct sample.

- Explore more details using the Preview feature.

- If the template meets all your needs, simply click Buy Now.

- To create an account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Download the document in your preferred format (Word or PDF).

- Print the file and complete it with your/your business’s information.

Form popularity

FAQ

The non-resident form for Louisiana state taxes is known as Form IT-540B. This form is designed for individuals who earn income in Louisiana but do not reside in the state. For detailed guidance on filing and understanding your obligations, the Louisiana New Resident Guide can be a valuable resource.

Least one full year (365 days) prior to the first day of class of the beginning of a semester, may be classified as a Louisiana resident for tuition purposes.

APPLY IN PERSON. Visit your local Office of Motor Vehicles ( OMV). BRING DOCUMENTATION REQUIRED. Your valid out-of-state driver's license, or official driving record (Your previous driving authority may send it by fax to the OMV office.) PASS A VISION TEST. PAY THE FEE.

Find a new place to live in the new state. Establish domicile. Change your mailing address and forward your mail. Change your address with utility providers. Change IRS address. Register to vote. Get a new driver's license. File taxes in your new state.

Typical factors states use to determine residency. Often, a major determinant of an individual's status as a resident for income tax purposes is whether he or she is domiciled or maintains an abode in the state and are present" in the state for 183 days or more (one-half of the tax year).

Step 1: Visit your nearest LA OMV. Step 2: Surrender your out-of-state driver's license, present a driving record from your previous state, OR submit a clearance letter. Step 3. Provide proof of Louisiana auto insurance (if you have a car registered in LA).

Go to the local OMV office with your valid out-of-state driver's license or official driving record. You will need one primary document, your social security number, and proof of insurance if you own an automobile.

1. Physical presence. You must be continuously physically present in California for more than one year (366 days) immediately prior to the residence determination date of the term for which you request resident status.

According to the state of Louisiana: A Louisiana Resident is an individual that is domiciled in the state, maintains a permanent place of abode in the state, or spends more than 6 months of the tax year in the state.