Louisiana Revocable Inter Vivos Trust

Overview of this form

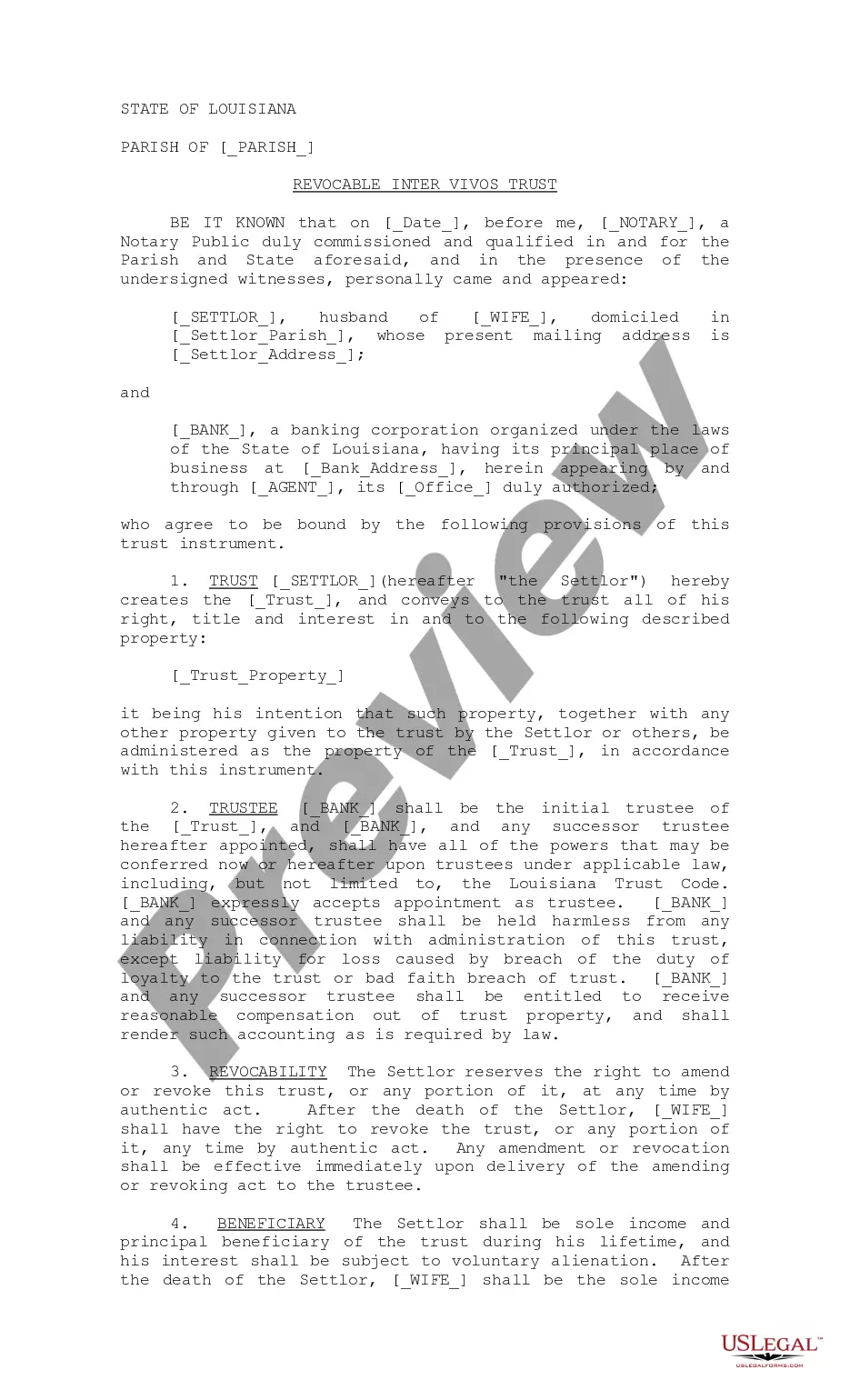

The Revocable Inter Vivos Trust is a legal document that establishes a trust during the settlor's lifetime. This trust allows the settlor to maintain control over their assets, serving as both the principal and income beneficiary while retaining the ability to amend or revoke the trust as needed. This form is distinct from irrevocable trusts, as it offers flexibility to adjust or terminate the trust at any time before the settlor's death.

What’s included in this form

- Trust Creation: Details on how the settlor creates the trust and conveys their property into it.

- Trustee Appointment: Identifies the initial trustee and outlines their powers and responsibilities.

- Revocability Clause: Specifies the settlor's right to amend or revoke the trust during their lifetime.

- Beneficiary Provisions: Defines the income and principal beneficiaries and their rights over time.

- Termination Conditions: Outlines when the trust will terminate, typically upon the death of the settlor and wife.

When this form is needed

This form is utilized when an individual wants to establish a trust to manage their assets while allowing for flexibility during their lifetime. It is particularly useful in scenarios where individuals wish to plan for their estate, provide for beneficiaries while retaining control, or simplify the distribution of assets after their death.

Who can use this document

- Individuals looking to create a trust to manage their assets effectively.

- Couples who want to ensure that their partner is the primary beneficiary of their estate.

- Anyone who desires the ability to modify or revoke a trust as personal circumstances change.

Steps to complete this form

- Identify the parties involved, including the settlor and the bank serving as trustee.

- Specify the property being placed into the trust.

- Enter the date and location of the trust's execution.

- Complete the necessary signatures from the settlor, witnesses, and the notary.

- Ensure that all amendments or revocations are documented according to the trust provisions.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to clearly identify the property transferred to the trust.

- Not understanding the implications of revocability versus irrevocability.

- Omitting signatures of necessary witnesses or the notary public.

- Neglecting to update the trust after significant life changes.

Benefits of using this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows you to tailor the trust to your specific needs easily.

- Reliable access to attorney-drafted forms ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

A Revocable Living Trust Defined Assets can include real estate, valuable possessions, bank accounts and investments. As with all living trusts, you create it during your lifetime.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

No separate tax return will be necessary for a Revocable Living Trust. However, even though the Grantor is taxed on the Trust income, the assets are legally held by the Trust, which will survive the Grantor's death. That is why the assets in the Trust do not need to go through the probate process.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

A revocable trust becomes a separate entity only after the death of the grantor. At this point, the beneficiary must obtain an employer identification number and file a separate tax return for the entity if the income exceeds $600 in a year. To file a tax return for a separate trust entity, you must use Form 1041.

In order to set up a living trust, you should first create a document stating your intention to create a trust, and name the people who you want to benefit from the trust. You should then create another document that states the property that you want to begin the creation of the trust with.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.