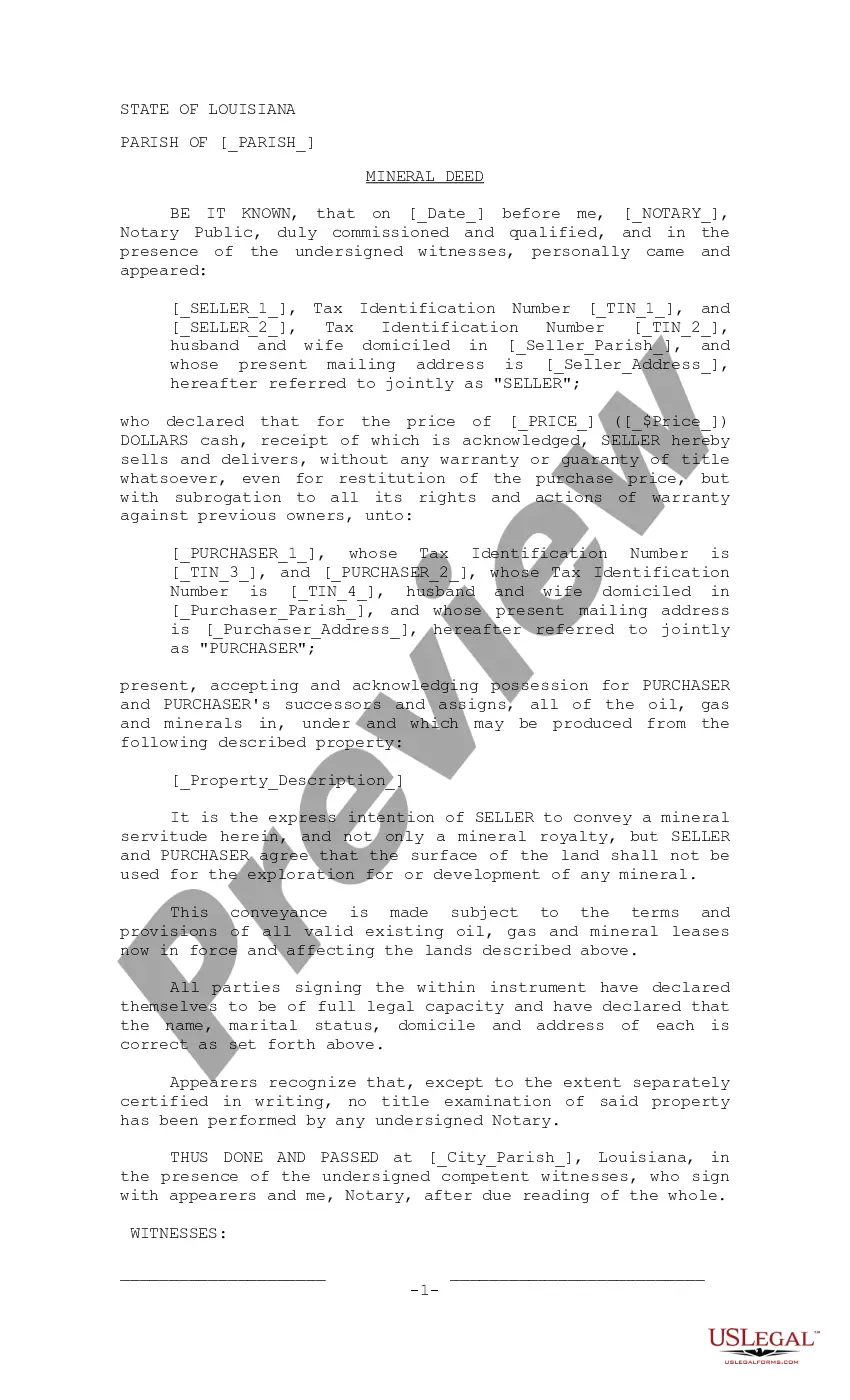

Louisiana Mineral Deed

What this document covers

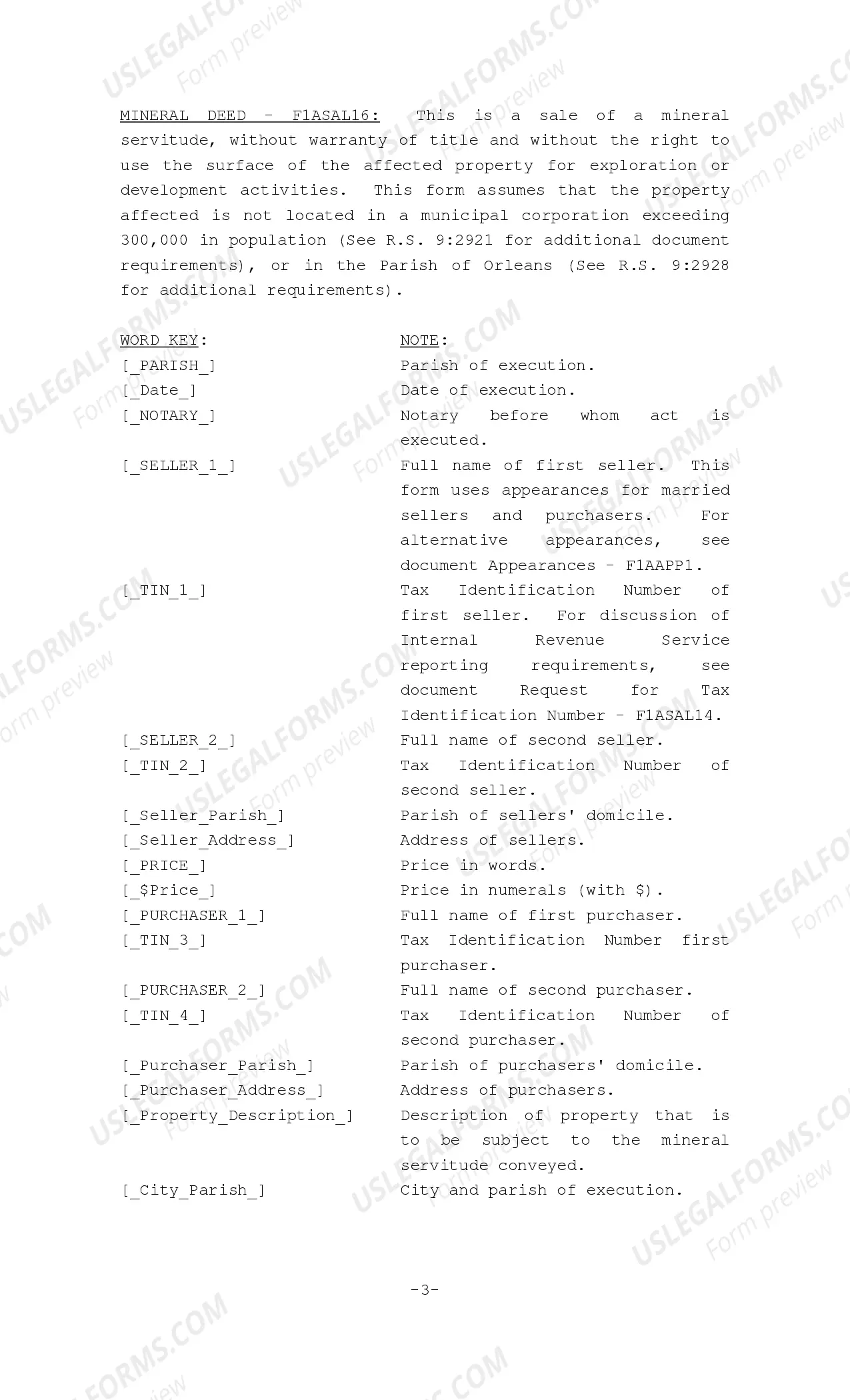

A mineral deed is a legal document used to sell a mineral servitude, which grants the purchaser rights to the minerals beneath a specified property. This form does not provide any warranty of title nor allows the purchaser to use the surface for exploration or development activities. It is different from a mineral royalty, as it focuses on servitude rights instead of revenue rights from mineral extraction. This form is particularly relevant in Louisiana law, requiring specific attention to local regulations regarding population limits and property location.

Main sections of this form

- Identification of the sellers and purchasers, including their Tax Identification Numbers.

- Declaration of the property to which the mineral rights are being conveyed.

- Statement that the sale is without warranty of title.

- Acknowledgment of existing oil, gas, and mineral leases affecting the property.

- Signatures of all parties and witnesses, along with notary certification.

When to use this form

This form should be used when a property owner wishes to sell mineral rights without transferring ownership of the surface land. It is applicable in situations where the seller wants to retain surface rights while allowing the buyer to obtain rights to explore for and extract minerals. It is especially relevant in areas governed by Louisiana law where detailed provisions exist regarding mineral deeds.

Intended users of this form

- Property owners looking to sell mineral rights while retaining surface ownership.

- Buyers interested in acquiring rights to minerals under a specific property.

- Legal professionals assisting clients with real estate and mineral transactions.

- Individuals in parishes of Louisiana who meet the specific legal criteria outlined in state statutes.

How to complete this form

- Enter the date of the transaction and the parish where it takes place.

- Fill in the full names and Tax Identification Numbers of both the sellers and purchasers.

- Specify the price of the sale, written out in words and numerals.

- Describe the property for which the mineral servitude is being conveyed.

- Ensure that all parties sign the document in the presence of competent witnesses and a notary public.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide accurate Tax Identification Numbers for all parties.

- Neglecting to describe the property clearly and accurately.

- Omitting signatures from all necessary parties or witnesses.

- Not recognizing specific local laws that may affect the deed's validity.

Why complete this form online

- Convenience of accessing and completing the form from home.

- Editable fields allow for customization to suit specific transactions.

- Immediate availability of up-to-date legal guidelines and requirements.

- Reduction of errors through guided completion.

Looking for another form?

Form popularity

FAQ

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.

Unlike other states, Louisiana mineral rights revert back to the original owner after 10 years from the date of sale or from the date of last production. Special care must be taken when dealing with Louisiana Mineral Rights in Louisiana because of Louisiana's Napoleonic law system.

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.

A Mineral Deed typically applies to rights under the land itself. It provides the buyer with the option to extract those minerals, but the deed does not contain title to the surface land or any of the buildings attached to the property. The Mineral Deed does contain certain rights.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller. An owner can separate the mineral rights from his or her land by:Conveying the land to one person and the mineral rights to another.

You can retain your mineral rights simply by putting an exception in your sales contract, provided that the buyer agrees to it, of course. If you sell your house with no such legal clarification, then those mineral rights automatically transfer to the buyer.

A mineral rights agreement may range from a few to 20 years. Oil and gas leases often have two terms: a primary and a secondary term. If no drilling or production activity has taken place at the end of a primary term, the lease will expire.

Unlike in other states, you can not own the minerals under your land in Louisiana. Under our law you can not own minerals under your land.A mineral servitude is the right to explore for minerals and bring them to the surface. The landowner usually leases this right to companies in the exploration business.

Hence, mineral rights. Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas.