Mississippi Petition for Authority to Convey Small Undivided Interest in Real Property Without Guardianship

Description

How to fill out Mississippi Petition For Authority To Convey Small Undivided Interest In Real Property Without Guardianship?

Obtain a printable Mississippi Petition for Authority to Convey Small Undivided Interest in Real Property Without Guardianship in just a few clicks from the largest collection of legal e-forms.

Discover, download, and print professionally crafted and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of cost-effective legal and tax templates for US citizens and residents online since 1997.

Once you have downloaded your Mississippi Petition for Authority to Convey Small Undivided Interest in Real Property Without Guardianship, you can fill it out in any online editor or print it and complete it by hand. Utilize US Legal Forms to gain access to 85,000 professionally drafted, state-specific documents.

- Users with an existing subscription must Log In to their US Legal Forms account, retrieve the Mississippi Petition for Authority to Convey Small Undivided Interest in Real Property Without Guardianship, and find it stored in the My documents section.

- Clients without a subscription need to follow the instructions below.

- Ensure your template complies with your state’s regulations.

- If available, read the description of the form to gather more information.

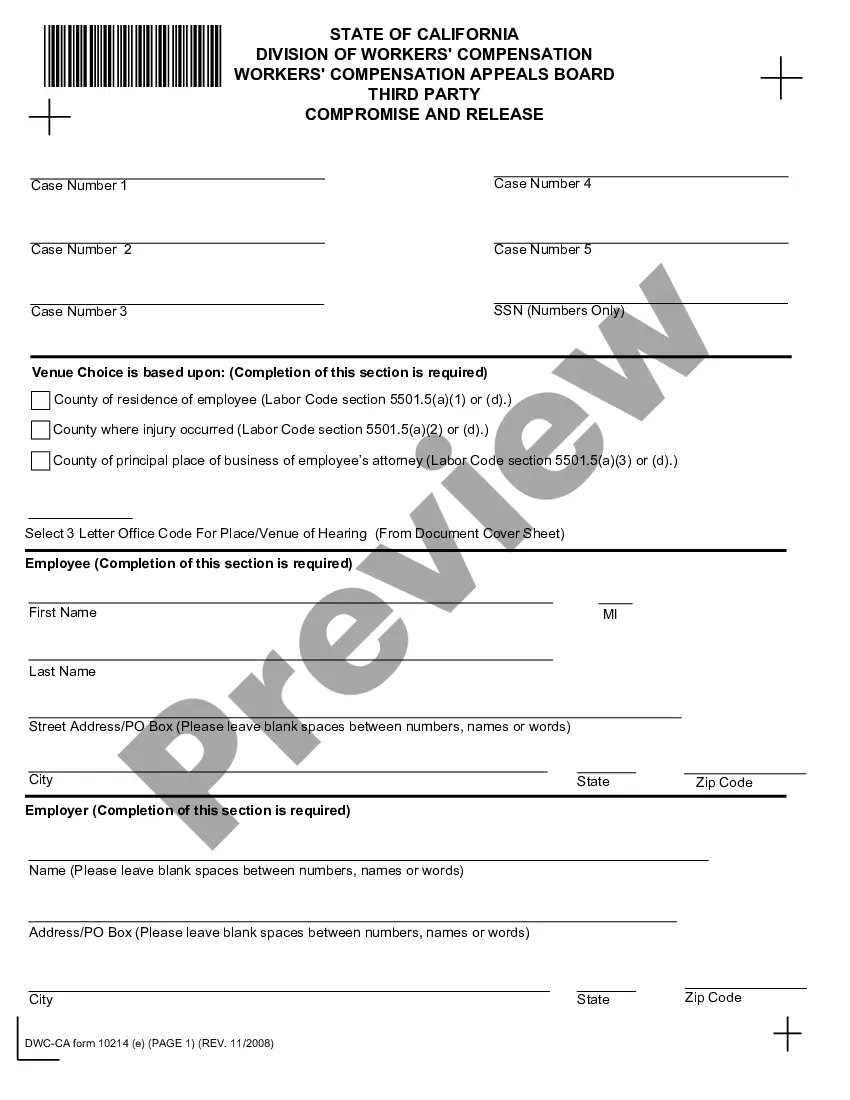

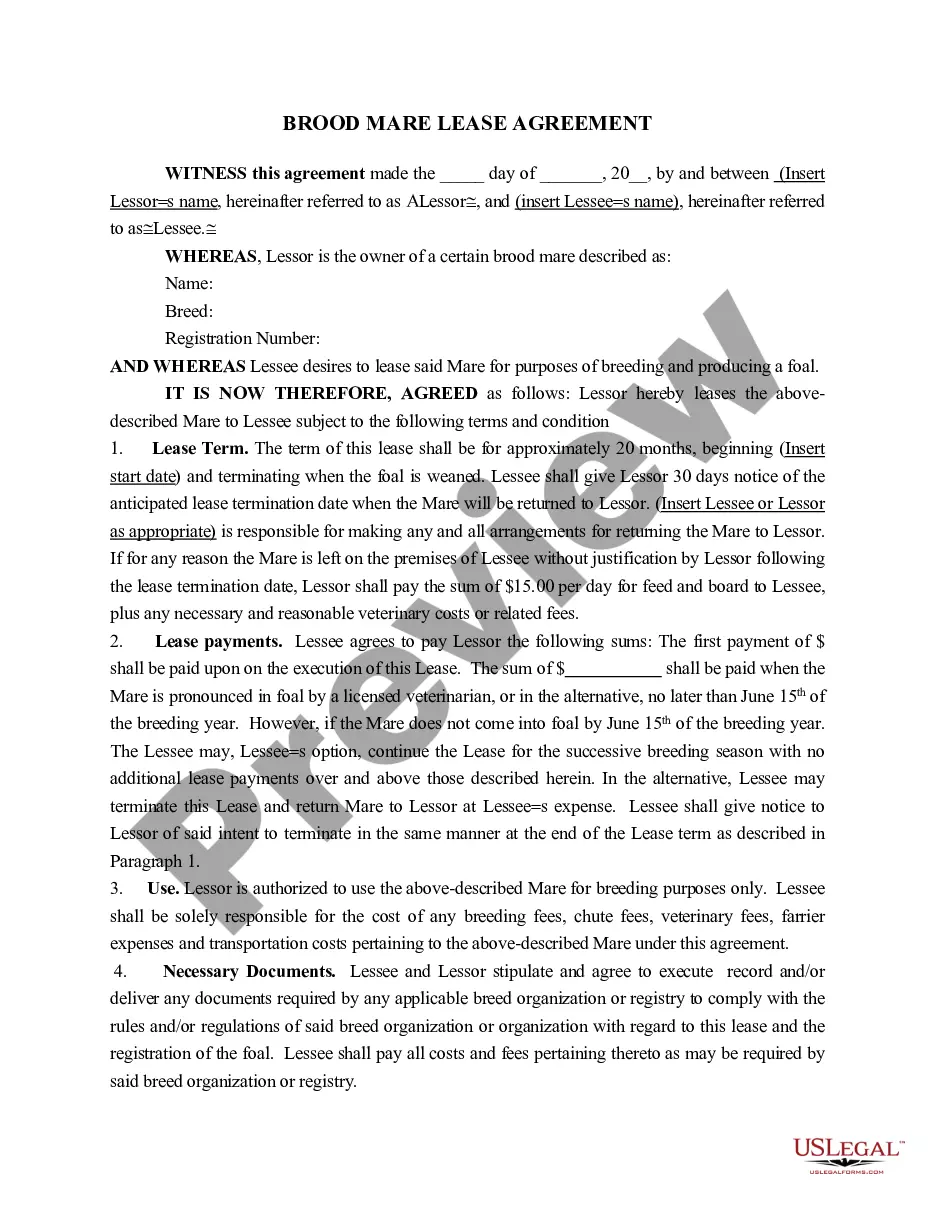

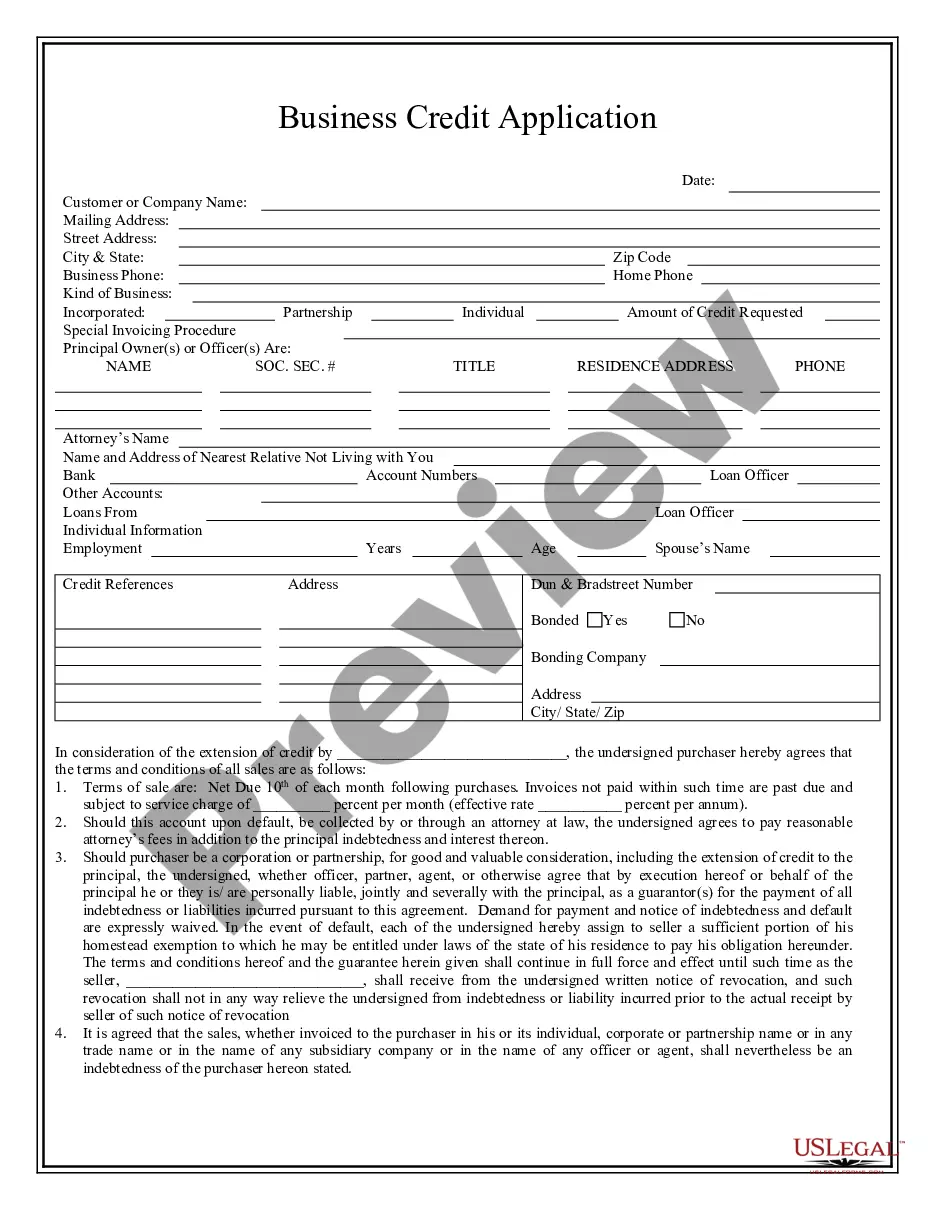

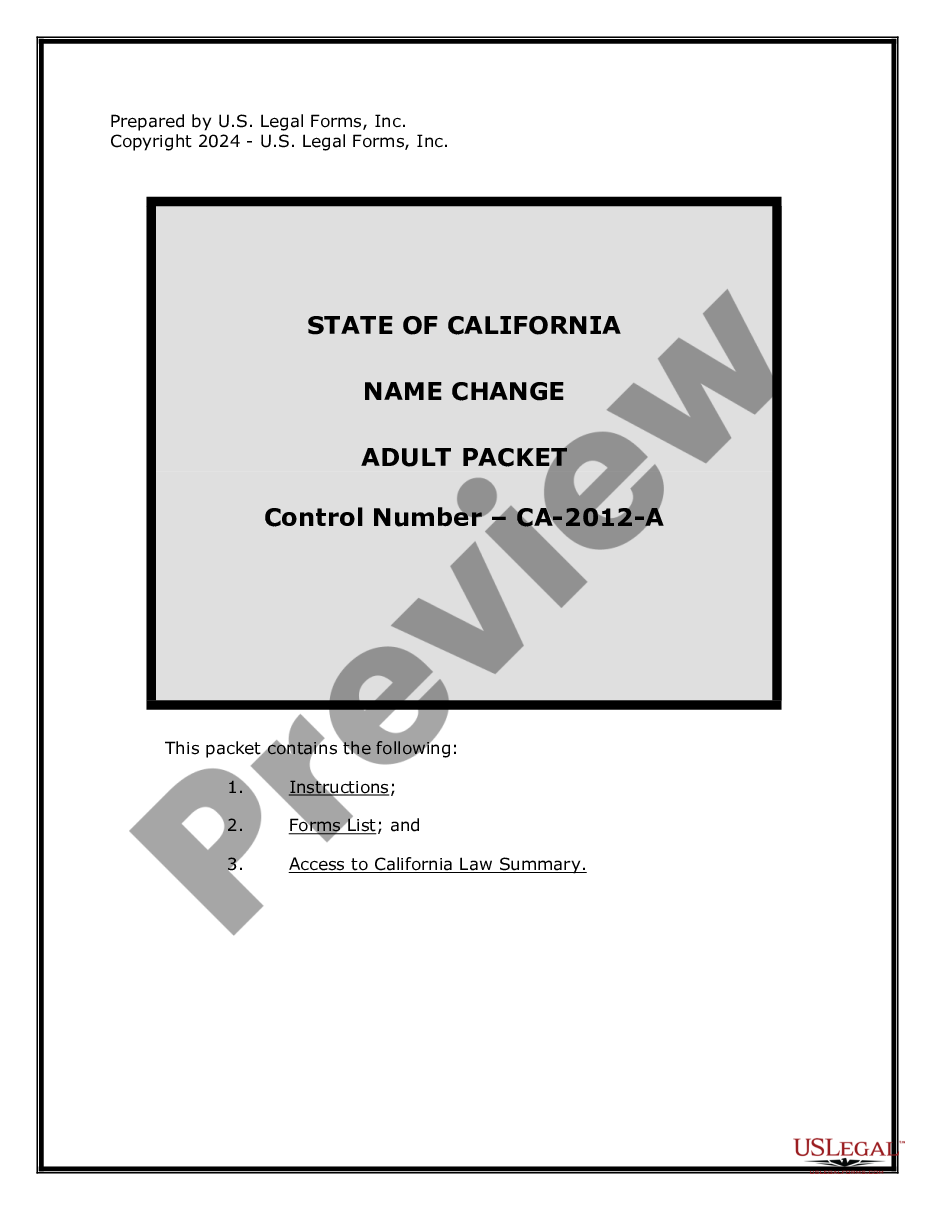

- If possible, preview the form to examine additional content.

- When you are confident the template is suitable for your needs, click Buy Now.

- Set up a personal account.

- Choose a plan.

- Make a payment using PayPal or credit card.

- Download the template in Word or PDF format.

Form popularity

FAQ

Overview of Mississippi Taxes Average effective property tax rates in Mississippi are quite low at 0.79%. Also, the median annual property tax payment in Mississippi is just $1,009. That is less than half the national average.

Mississippi's counties and municipalities levy ad valorem motor vehicle property taxes, which owners must pay when paying the state road and bridge privilege license tax. Counties and municipalities set the tax rate, but the State Tax Commission sets a uniform statewide assessment rate (i.e., the portion of value

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

In Mississippi, all property is subject to a property tax unless it is exempt by law. Where do my property taxes go? Property tax revenues are used to support county and city governments, and local school districts.

Mississippi has a graduated tax rate. The graduated income tax rate is: 0% on the first $3,000 of taxable income.200b 3% on the next $2,000 of taxable income.200b 4% on the next $5,000 of taxable income. 5% on all taxable income over $10,000.

Homestead Exemption is a privilege offered to eligible taxpayers by the State of Mississippi. The exemption is not granted automatically. An application must be filed and each taxpayer must qualify for the exemption.The regular exemption is given to all eligible taxpayers.

All property, real and personal, is appraised at true value and assessed at a percentage of true value according to its type and use. Assessment ratios are 10%, 15%, and 30%.Qualified homeowners are allowed an exemption from certain ad valorem taxes based on the assessed value of their home.

It is also one the country's most tax-friendly states for retirees.Mississippi exempts all forms of retirement income from taxation, including Social Security benefits, income from an IRA, income from a 401(k) and any pension income. On top of that, the state has low property taxes and moderate sales taxes.