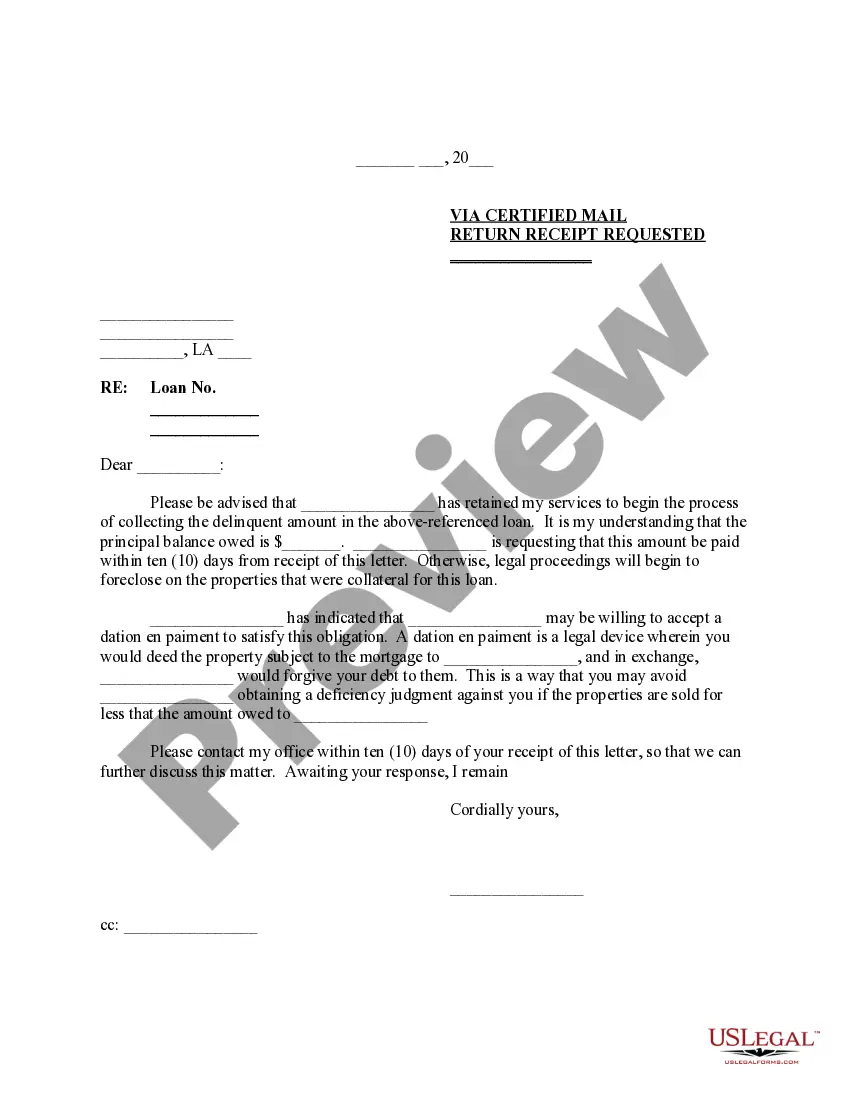

Louisiana Demand Letter - Repayment of Loan, with Dation En Paiement option

Description

How to fill out Louisiana Demand Letter - Repayment Of Loan, With Dation En Paiement Option?

Seeking Louisiana Demand Letter - Loan Repayment with Dation En Paiement option forms and completing them can be quite challenging.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the appropriate template specifically for your state within just a few clicks.

Our lawyers prepare every document, so you only need to fill them out. It’s genuinely that straightforward.

Select your package on the pricing page and create an account. Decide whether to pay with a card or PayPal. Download the form in your desired file format. You can print the Louisiana Demand Letter - Loan Repayment with Dation En Paiement option form or complete it with any online editor. Don’t worry about typos since your template can be utilized, sent, and printed as often as needed. Explore US Legal Forms for access to around 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the sample.

- All your saved samples are kept in My documents and they are accessible at all times for future use.

- If you haven’t signed up yet, you will need to register.

- Follow our comprehensive instructions on how to obtain the Louisiana Demand Letter - Loan Repayment with Dation En Paiement option form in a few minutes.

- To get a qualified form, verify its validity for your state.

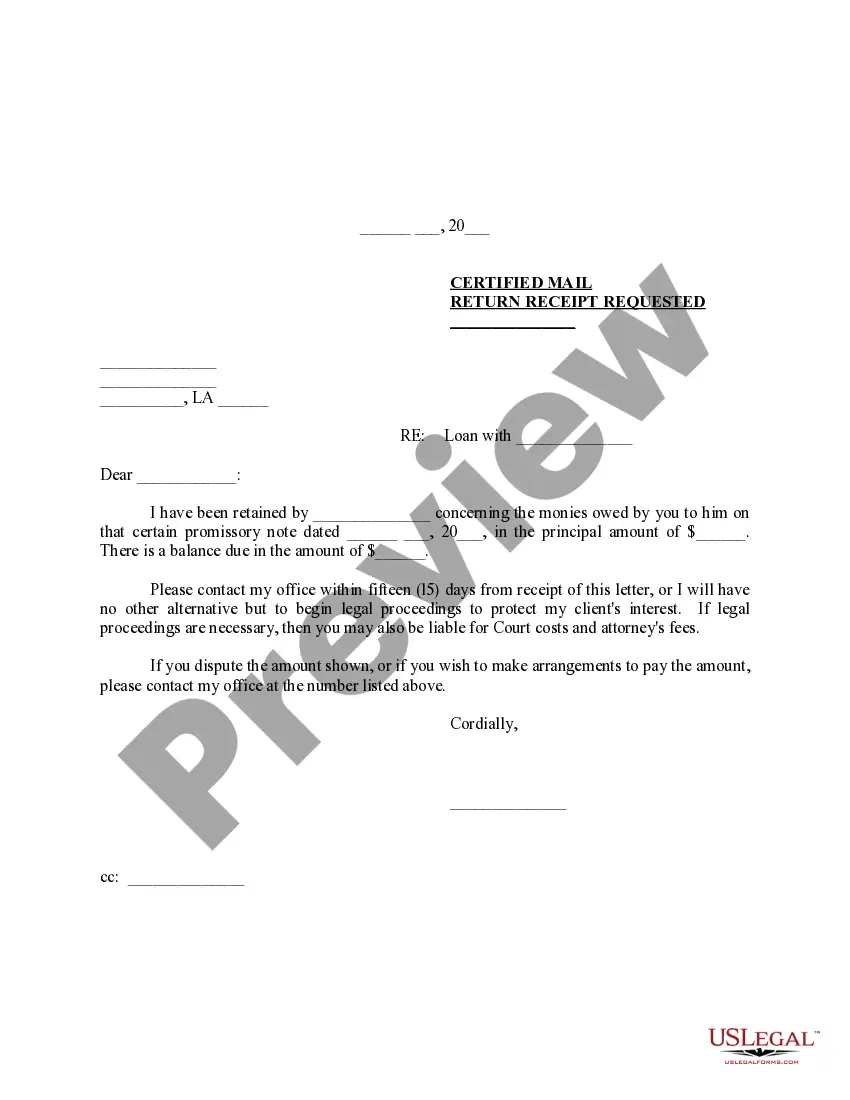

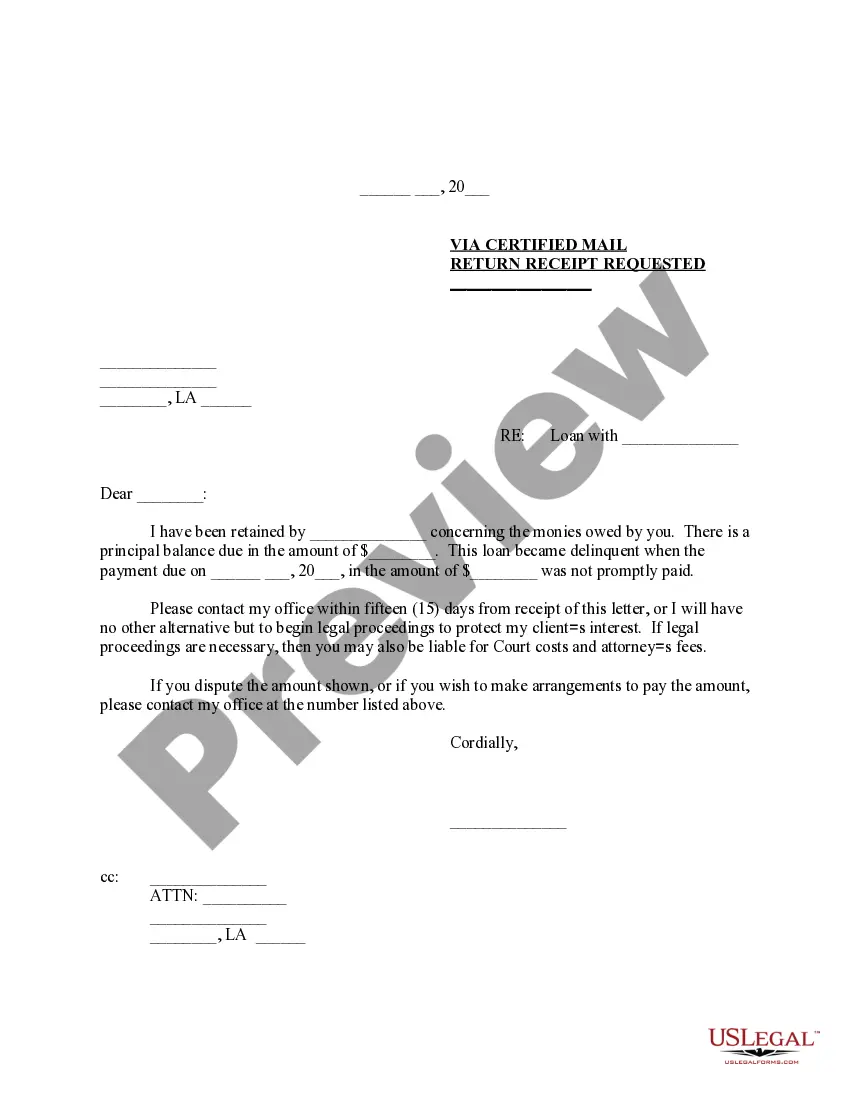

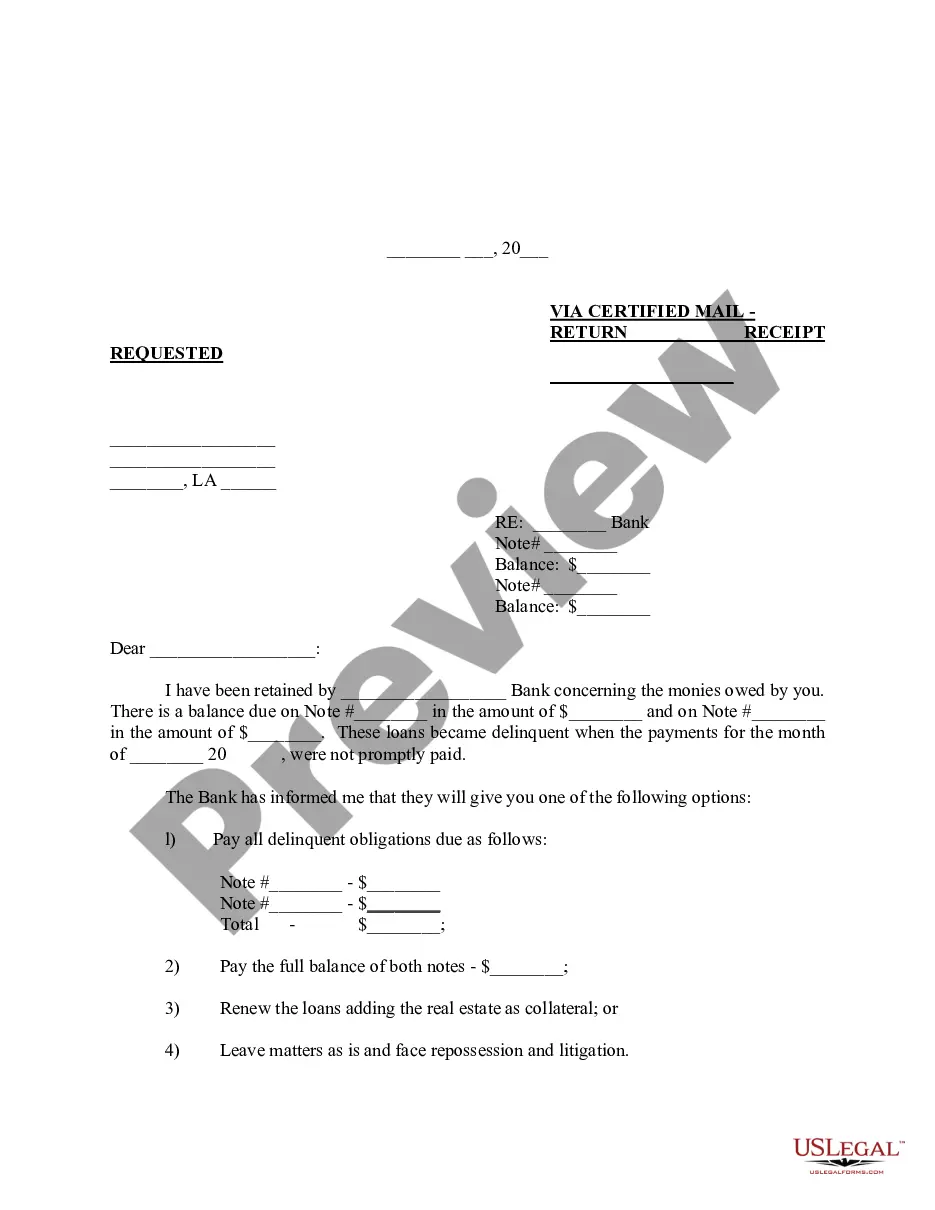

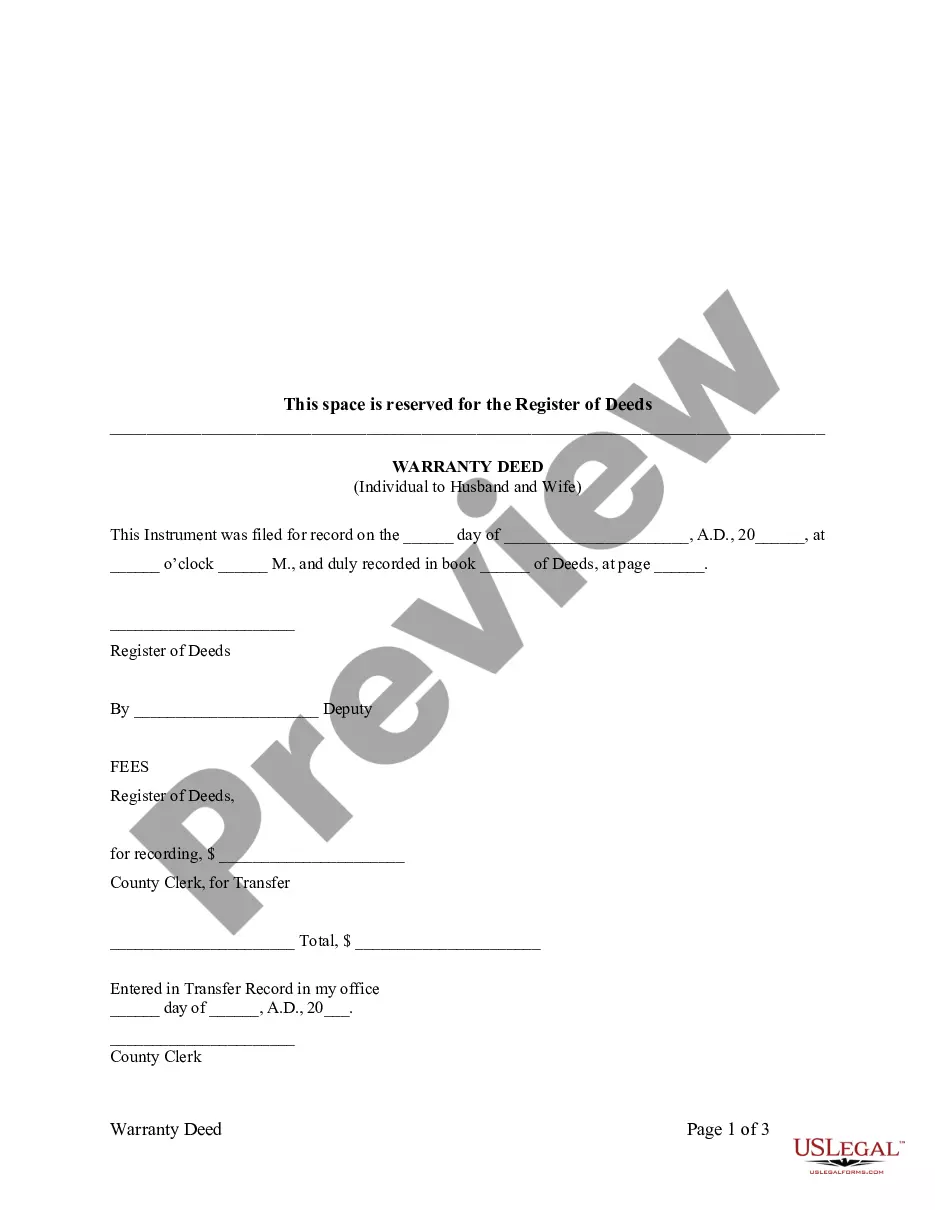

- View the sample using the Preview option (if available).

- If there’s a description, read it to understand the details.

- Click Buy Now if you have found what you are looking for.

Form popularity

FAQ

Dacion en pago translates to 'giving in payment' and is similar to the concept of dation in paiement. This legal term allows a debtor to transfer property in satisfaction of a debt. Understanding dacion en pago is essential when considering options such as the Louisiana Demand Letter - Repayment of Loan, with Dation En Paiement option to resolve payment issues.

A demand letter for payment serves as a formal request for the repayment of a loan before initiating any legal proceedings. This document outlines the terms of the debt and emphasizes the borrower's obligation. Including details about the Louisiana Demand Letter - Repayment of Loan, with Dation En Paiement option can help clarify the repayment route and encourage cooperation.

In Louisiana, a dation en paiement is a legal mechanism that allows borrowers to satisfy their debt by transferring ownership of property. This transfer serves as payment, freeing the borrower from their financial obligation. Utilizing a Louisiana Demand Letter - Repayment of Loan, with Dation En Paiement option can streamline this process, making it easier for both parties involved.

200badmit you owe some or all of the money. deny you owe the money and explain why you don't owe it. ask for more information, without admitting or denying you owe the money. offer to pay a different amount. offer to pay some or all of the money in instalments.

Don't Blow It Off. You or your business can suffer consequences from failing to answer a demand letter in a timely fashion. Assess the Validity of the Arguments. Understand the Obligee's Motives. Determine Whether or Not You Need a Lawyer. Respond Formally, Factually, and Professionally. Get Verification of Receipt.

After you send a demand letter, one of several things can happen: The insurance company accepts your demand, and the settlement goes forward. You'll receive the compensation you asked for and sign a release of liability in exchange.

The purpose of a demand letter is to begin legal negotiation between opposing parties that will result in dispute resolution rather than litigation, and to influence the recipient's understanding of the dispute's risks and rewards in a way that favors the client's interests.

Once you've written your demand letter and sent it on to the insurance company, the response time may vary. Typically, you can expect an answer within a few weeks. However, sometimes this process can take as long as a few months.

A demand letter is a formal, professional document sent by one party to another requesting payment or other action to right a wrong. The recipient may be in financial default, may have breached a contract, or may not have followed through with an obligation.

Never ignore a demand letter.If you receive one, contact your attorney immediately. Some people think if they don't respond, the sender will go away. This is usually not the case especially if the other party has retained an attorney. Respond and try to resolve the issue or you run the risk of going to court.