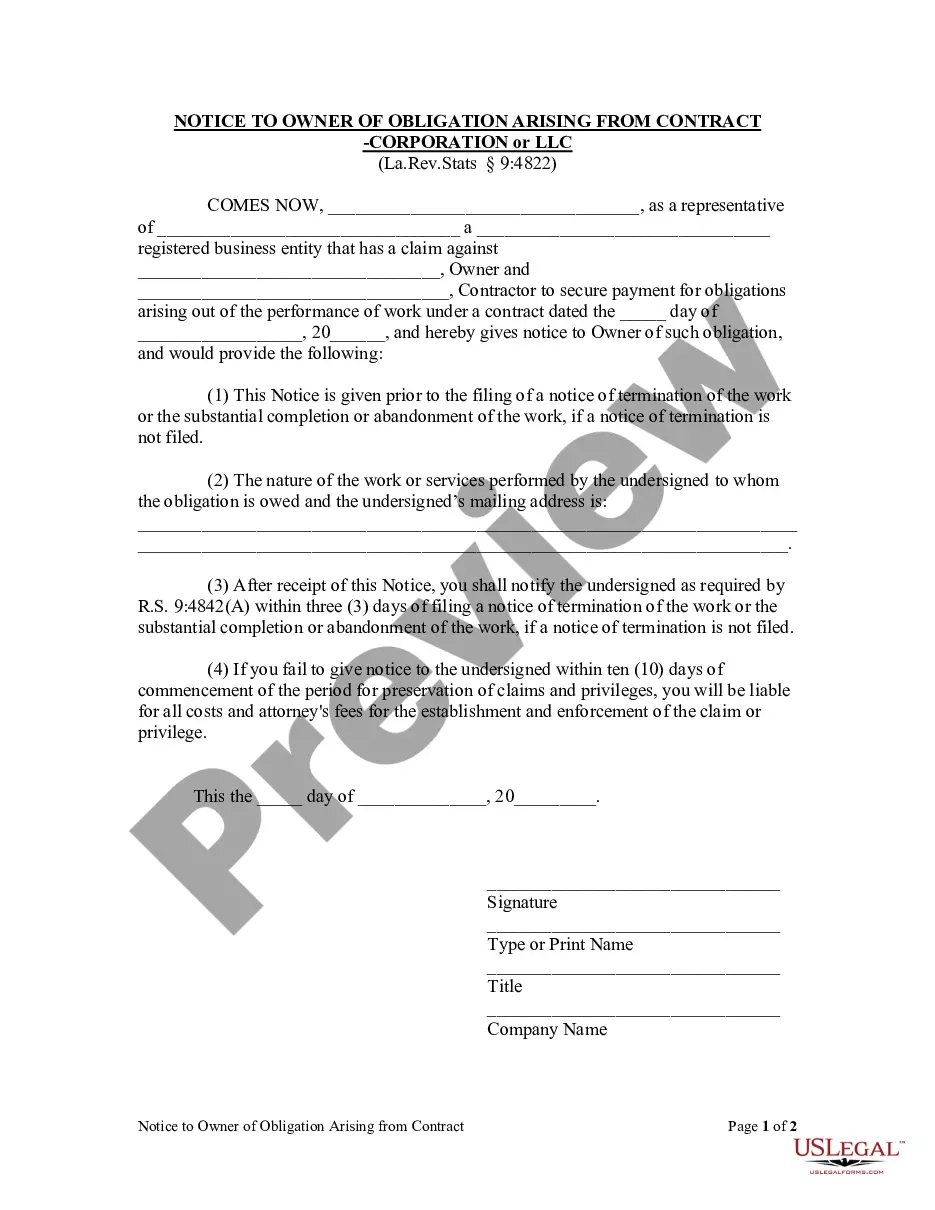

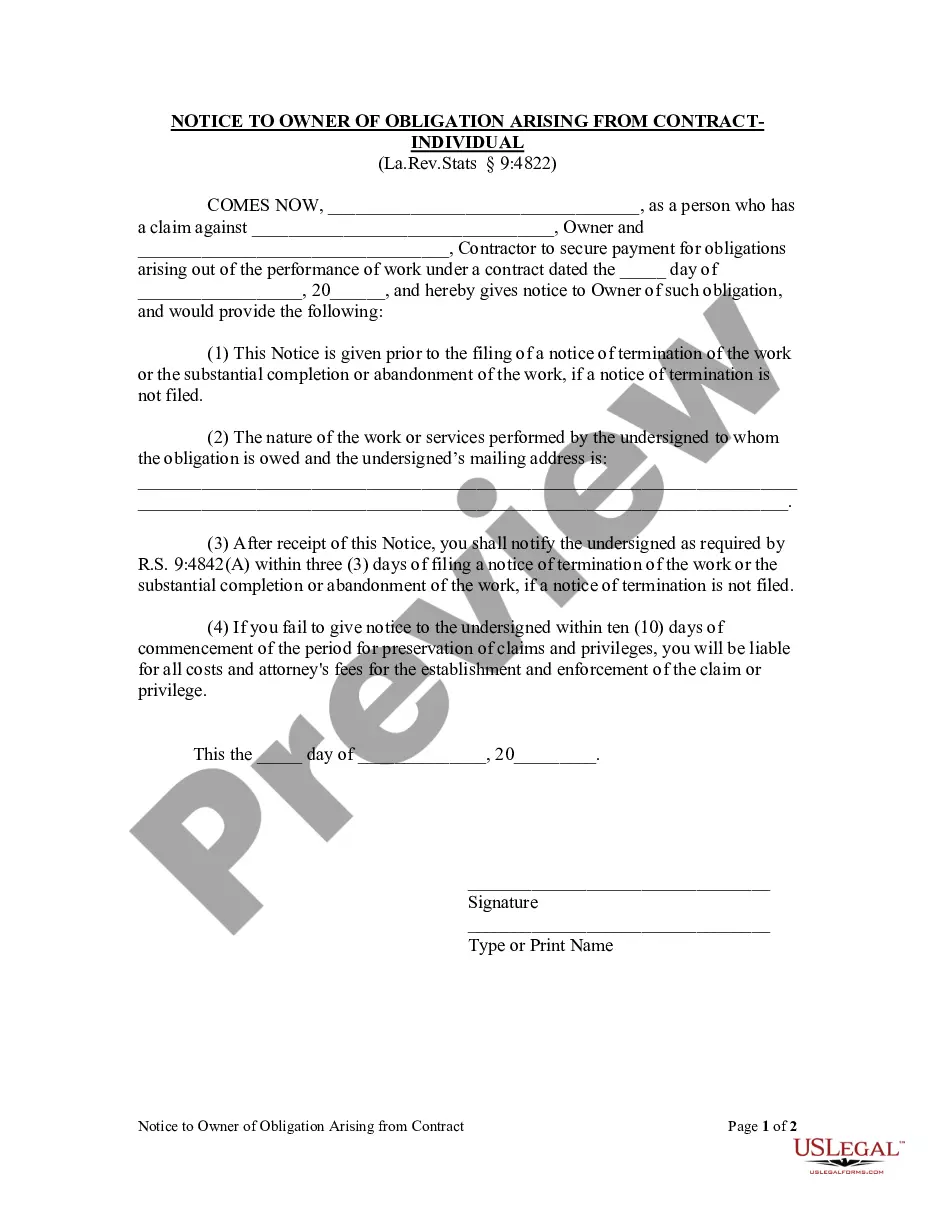

This Notice to Owner of Obligation Arising from Contract is for use by a corporation or LLC who has a claim against an owner and a contractor to secure payment for obligations arising out of the performance of work under a contract to provide notice to the owner of such obligation prior to the filing of a notice of termination of the work or the substantial completion or abandonment of the work, if a notice of termination is not filed. The notice includes the nature of the work or services performed by the corporation to whom the obligation is owed and the corporation's mailing address. After receipt of this notice, the owner must notify the corporation as required by R.S. 9:4842(A) within three days of filing a notice of termination of the work or the substantial completion or abandonment of the work, if a notice of termination is not filed. If the owner fails to give notice to the corporation within ten days of commencement of the period for preservation of claims and privileges, the owner will be liable for all costs and attorney's fees for the establishment and enforcement of the claim or privilege.

Louisiana Notice to Owner of Obligation Arising from Contract - Corporation or LLC

Description

How to fill out Louisiana Notice To Owner Of Obligation Arising From Contract - Corporation Or LLC?

Attempting to locate the Louisiana Notice to Owner of Obligation Arising from Contract - Corporation or LLC template and completing it could pose an issue.

To conserve time, expenses, and effort, utilize US Legal Forms to select the appropriate template tailored for your state in just a few clicks.

Our legal professionals create every document, so you simply need to complete them. It’s incredibly easy.

You can now print the Louisiana Notice to Owner of Obligation Arising from Contract - Corporation or LLC template or complete it using any online editor. There's no need to worry about errors since your form can be utilized, submitted, and printed multiple times as required. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Access your account via Log In and navigate back to the form's page to save the sample.

- All your stored templates are found in My documents and are available at any time for future reference.

- If you haven’t registered yet, it’s important to sign up.

- Review our detailed instructions on how to obtain the Louisiana Notice to Owner of Obligation Arising from Contract - Corporation or LLC template in a matter of minutes.

- To secure an eligible template, verify its relevance for your state.

- Preview the form utilizing the Preview option (if available).

- If there's a description, read it to understand the specifics.

- Click Buy Now if you found what you were looking for.

- Choose your plan on the pricing page and create your account.

- Indicate whether you wish to pay via a card or PayPal.

- Download the form in your preferred format.

Form popularity

FAQ

1Complete the Louisiana Statement of Claim and Privilege form.2Record the claim form with the recorder of mortgages office in the parish where the property is located.3Serve notice of the lien claim to the property owner.

Even though these states may permit project participants to secure lien rights and claim a mechanics lien even without a written contract, it is generally best practice to have a signed written contract for work provided.

California Mechanics' Lien law provides special protection to contractors, subcontractors, laborers and suppliers who furnish labor or materials to repair, remodel or build your home.The mechanics' lien is a right that California gives to workers and suppliers to record a lien to ensure payment.

When a contractor files a mechanics' (construction) lien on your home, the lien makes your home into what's called security for an outstanding debt, which the contractor claims is due and unpaid for services or materials.

In California, money judgments are enforceable by a writ of execution. In order to enforce the judgment lien, the judgment creditor must obtain a writ of execution, levy and then sell the real property at an execution sale.

A mechanics lien is a legal claim on the property for unpaid construction work or supplies. Once claimants file a mechanics lien in California, the owner's property turns into collateral, allowing claimants to secure the service they rendered or the supplies they provided.

To enforce the lien, the contractor must file a lawsuit within 90 days from the date of recording the lien. If this deadline is passed, the contractor may not be able to enforce the lien and may be required to remove the lien.

If the Notice of Contract is filed, a contractor has 60 days from the filing of a Notice of Acceptance to file a Louisiana mechanics lien. If no Notice of Contract has been filed, a contractor has 60 days from completion on the project to file a Louisiana mechanics lien if the contract amount is less than $25,000.