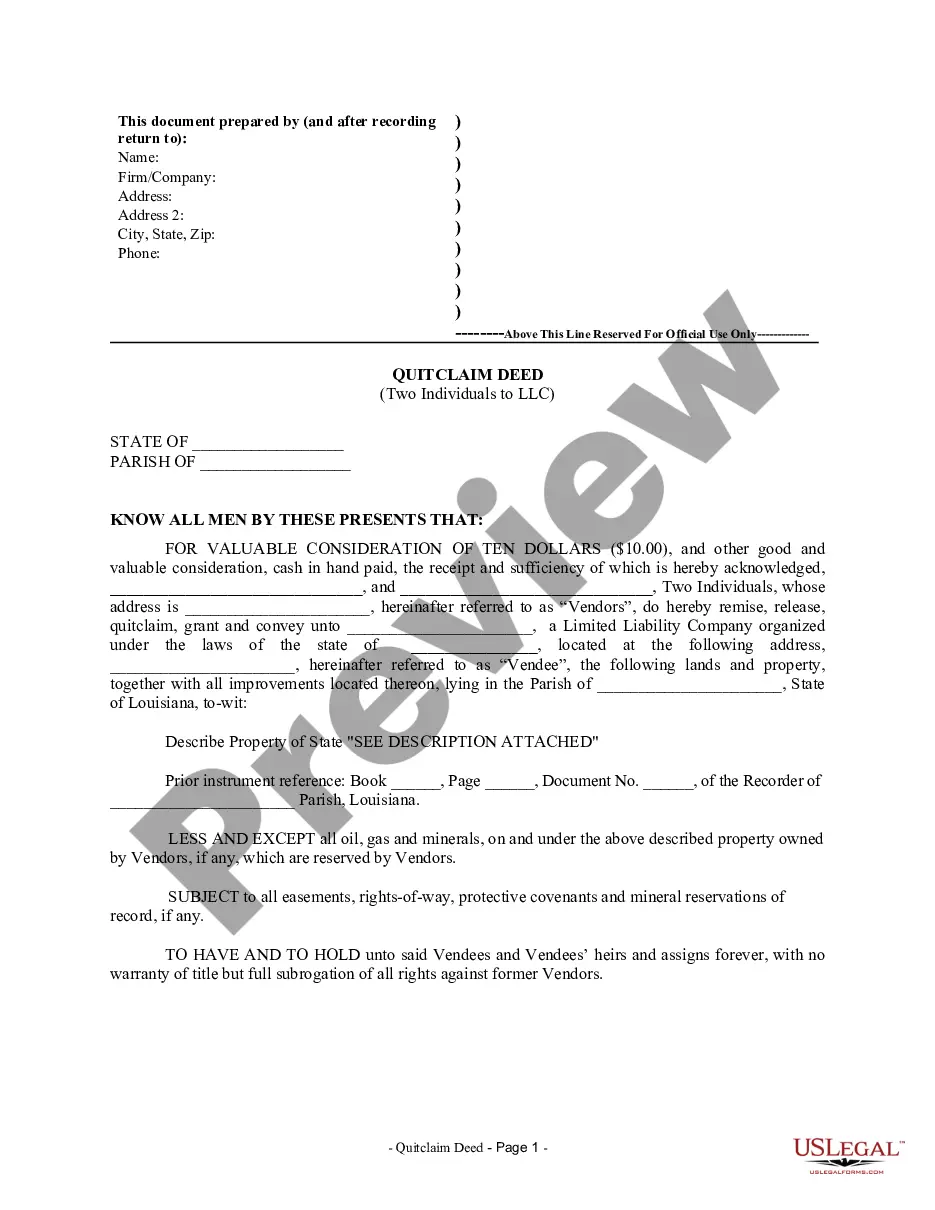

Louisiana Quitclaim Deed by Two Individuals to LLC

Understanding this form

The Quitclaim Deed by Two Individuals to LLC is a legal document that allows two individuals (the Grantors) to transfer their interest in a property to a limited liability company (the Grantee). This form is distinct from other types of deeds, such as warranty deeds, because it does not guarantee the title's validity or the absence of liens on the property. Instead, it conveys whatever interest the Grantors have in the property, subject to any existing encumbrances and reservations.

Key parts of this document

- Identification of the Grantors and Grantee, including their names and addresses.

- Description of the property being transferred, along with any attached legal descriptions.

- Statement of reservation of rights regarding oil, gas, and minerals, if applicable.

- Legal language affirming the transfer of property without warranty of title.

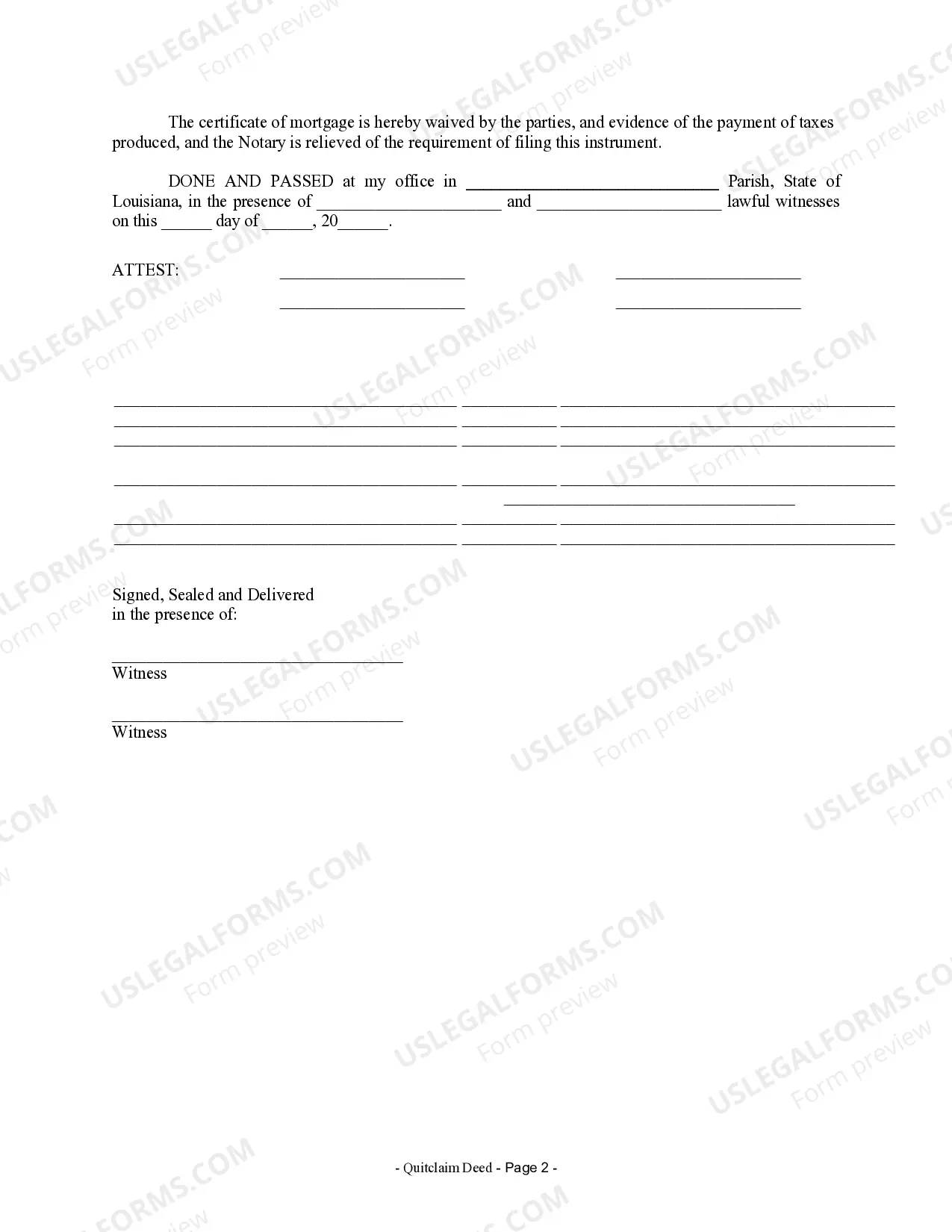

- Spaces for signatures of Grantors, witnesses, and a notary public.

When to use this form

This Quitclaim Deed is appropriate in situations where two individuals wish to transfer property ownership to a limited liability company, such as when combining individual assets into a business entity. It is commonly used in estate planning, asset protection strategies, or when individuals wish to formalize their contributions to a shared business venture. This form should be considered when the Grantors are not seeking the warranties of a traditional deed.

Who can use this document

- Individuals transferring property to their LLC.

- Business partners who want to formalize property contributions to their company.

- Estate planners organizing assets for inheritance.

- Anyone interested in simplifying the transfer of property between private parties and business entities.

Instructions for completing this form

- Identify the Grantors by providing their full names and address.

- Specify the Grantee as the Limited Liability Company, including its name and state of incorporation.

- Describe the property being transferred with clear details, using any attached legal descriptions if necessary.

- Collect signatures from each Grantor, along with the date of signing.

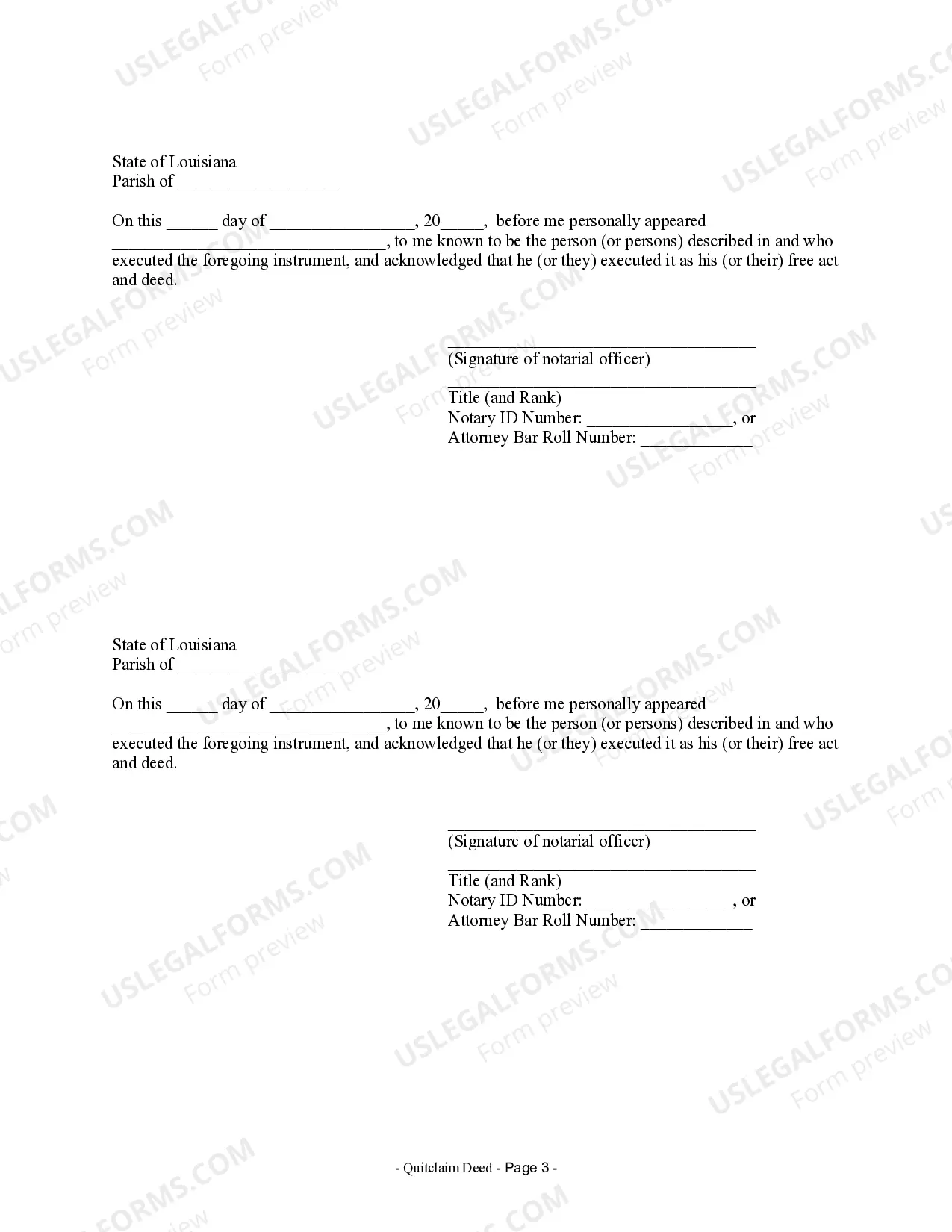

- Ensure a notary public witnesses the signatures and completes the notarization portion.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Mistakes to watch out for

- Failing to include a complete legal description of the property.

- Not obtaining signatures from all relevant parties.

- Omitting the notarization step, which can invalidate the document.

- Not reserving the appropriate rights related to oil, gas, and minerals when applicable.

Benefits of using this form online

- Quick access to a professionally drafted legal form suitable for your needs.

- The convenience of downloading and printing the form immediately after completion.

- Easy editing options to customize the form to your specific situation.

- Reliability, as the forms are created by licensed attorneys to meet legal requirements.

Form popularity

FAQ

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

The Louisiana quitclaim deed is used to transfer real estate in Louisiana from one person to another. A quitclaim has no guarantee or warranty attached to it.Signing A quitclaim deed must be authorized with the Grantor(s) (the Sellers) in front of two (2) witnesses and a notary public.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.