Kentucky Private Placement Subscription Agreement

Description

How to fill out Private Placement Subscription Agreement?

Choosing the best authorized file format can be a have difficulties. Of course, there are a lot of templates available on the Internet, but how do you find the authorized develop you need? Use the US Legal Forms site. The service offers a large number of templates, such as the Kentucky Private Placement Subscription Agreement, which you can use for organization and private needs. Each of the varieties are checked out by professionals and meet up with state and federal specifications.

Should you be currently authorized, log in to the bank account and click on the Acquire button to have the Kentucky Private Placement Subscription Agreement. Make use of your bank account to check throughout the authorized varieties you might have bought previously. Check out the My Forms tab of your bank account and get another duplicate of your file you need.

Should you be a new user of US Legal Forms, here are straightforward recommendations that you should comply with:

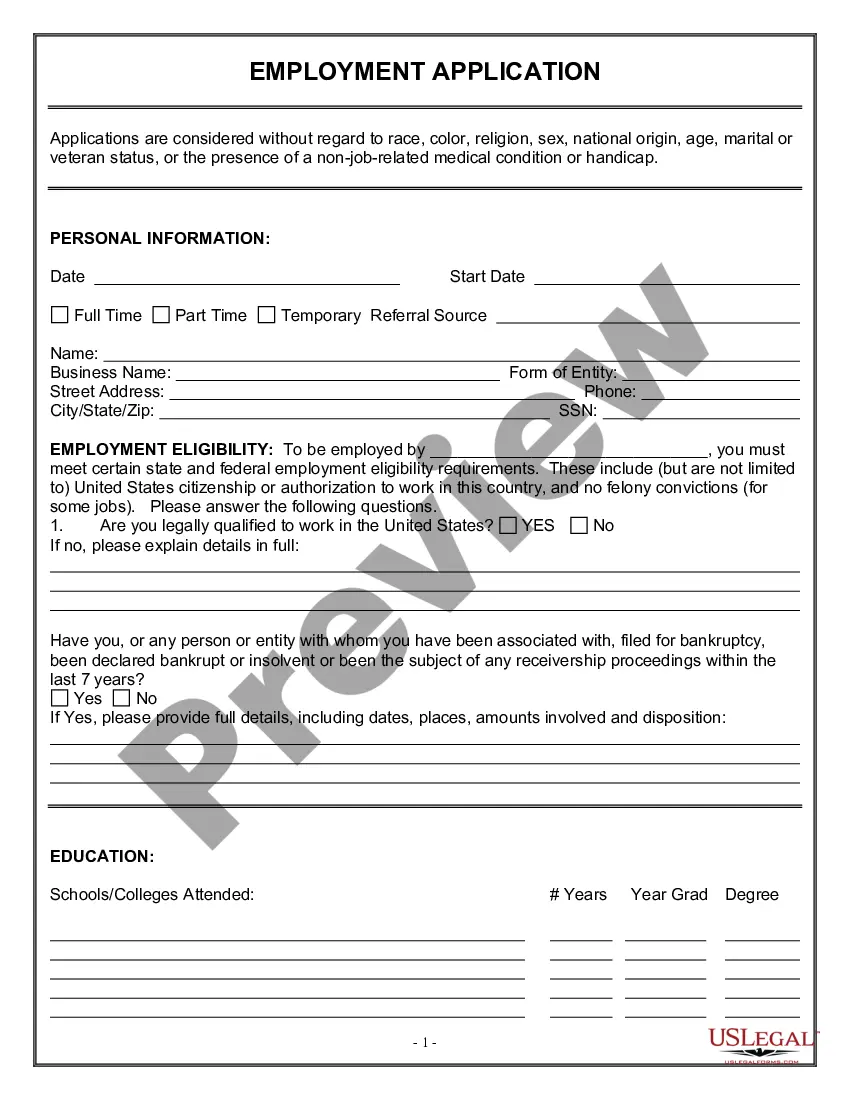

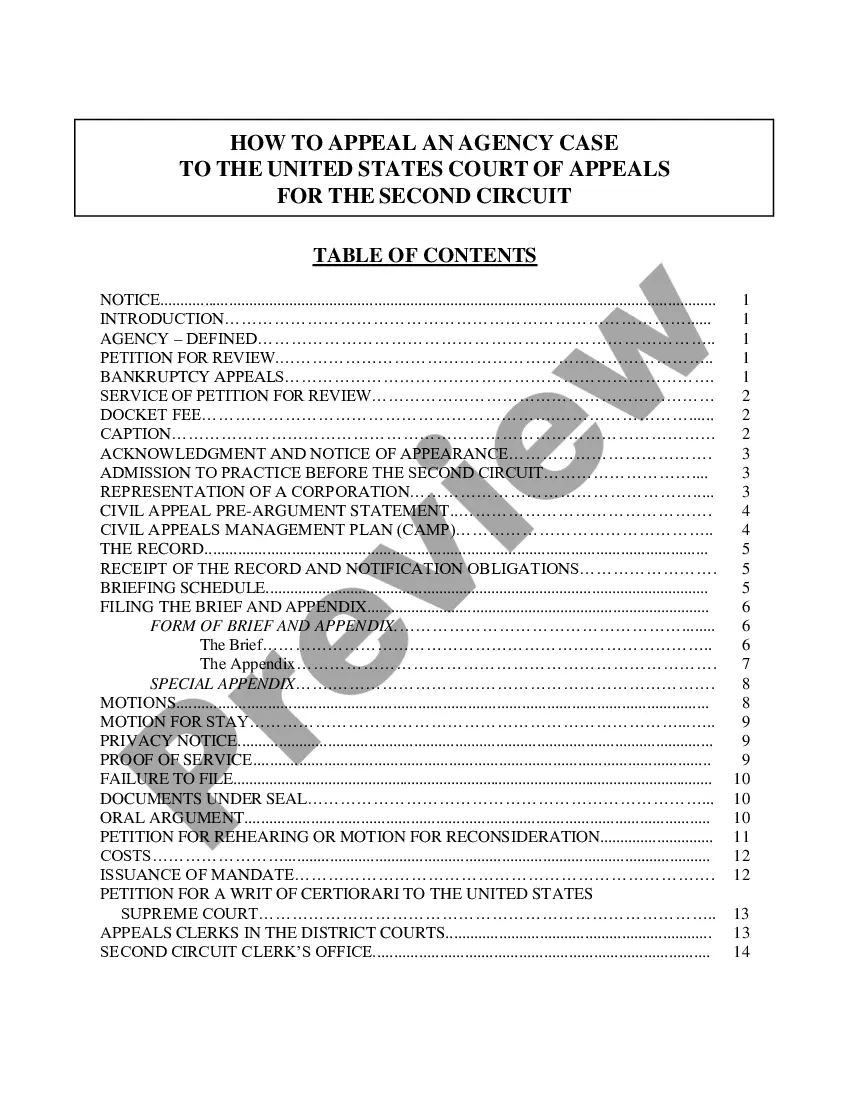

- Initial, make certain you have selected the correct develop for your personal town/region. You may look over the shape while using Preview button and study the shape information to ensure this is basically the right one for you.

- When the develop will not meet up with your expectations, make use of the Seach discipline to get the right develop.

- Once you are sure that the shape is proper, click the Get now button to have the develop.

- Choose the pricing plan you want and enter in the needed information and facts. Make your bank account and purchase your order with your PayPal bank account or charge card.

- Pick the document formatting and acquire the authorized file format to the system.

- Full, edit and print out and sign the acquired Kentucky Private Placement Subscription Agreement.

US Legal Forms may be the most significant local library of authorized varieties in which you will find numerous file templates. Use the service to acquire expertly-manufactured documents that comply with express specifications.

Form popularity

FAQ

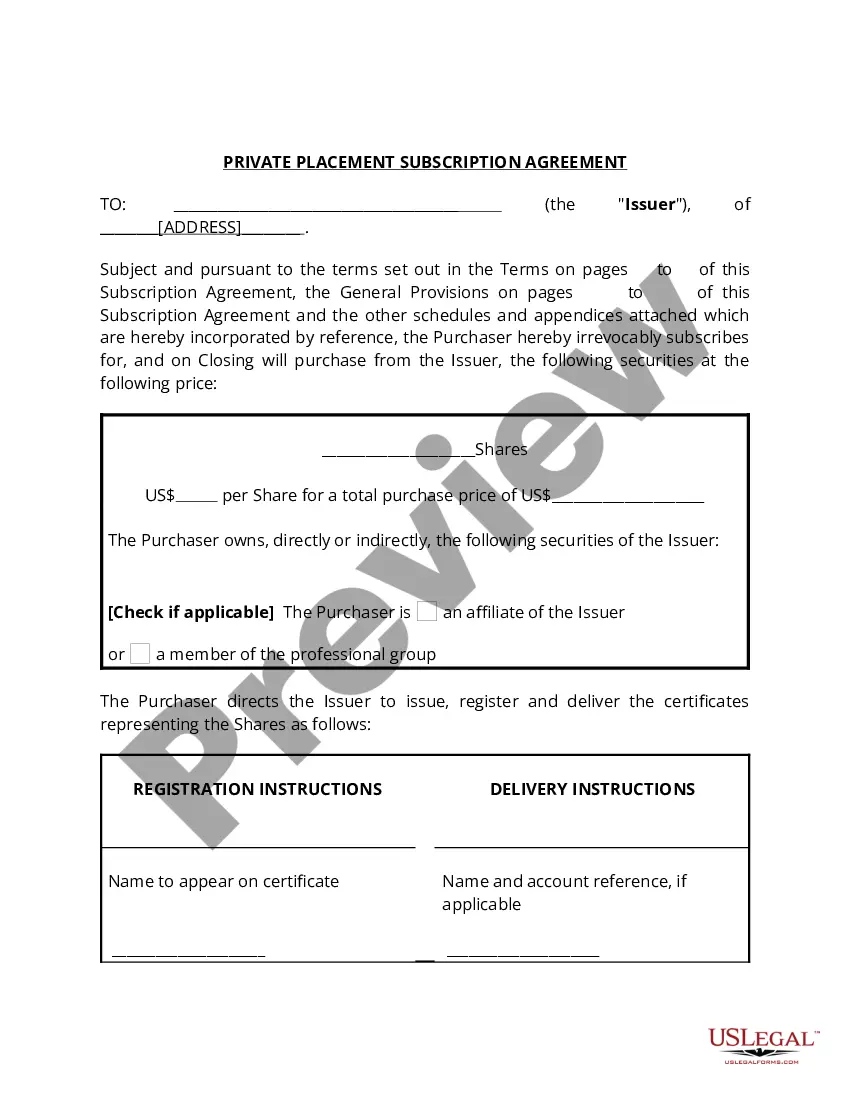

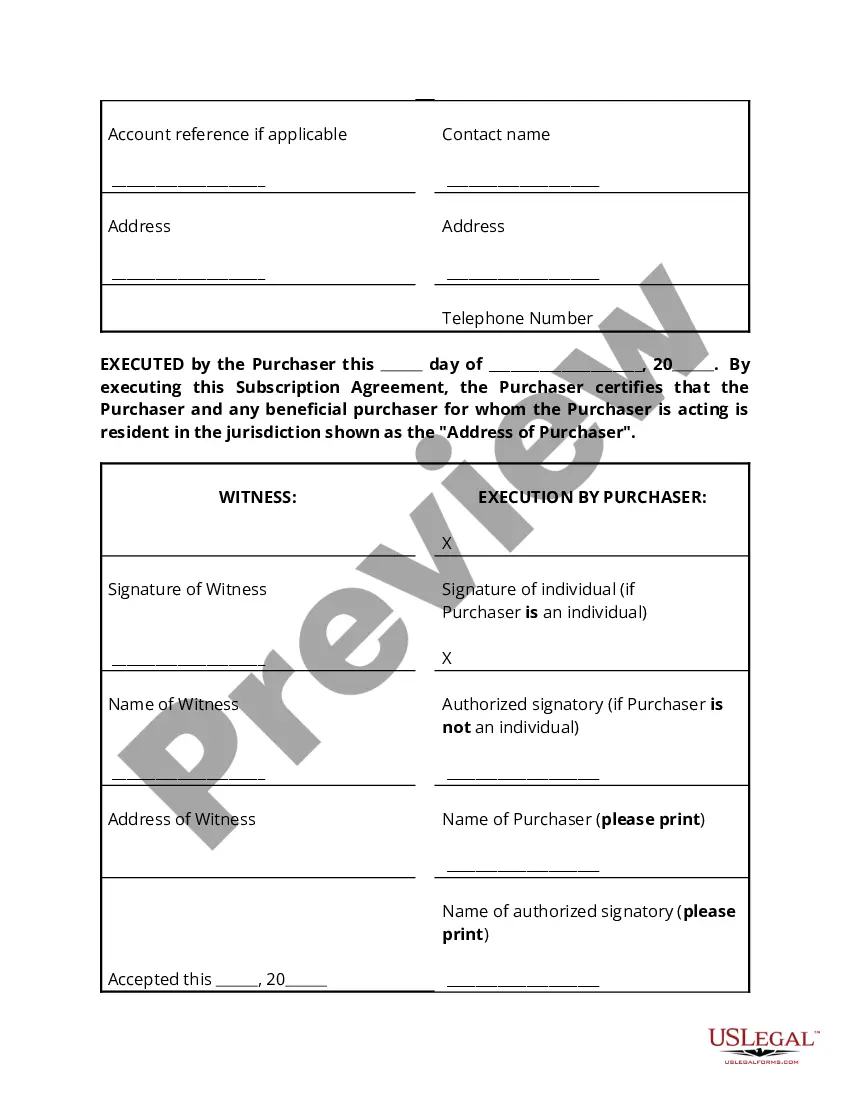

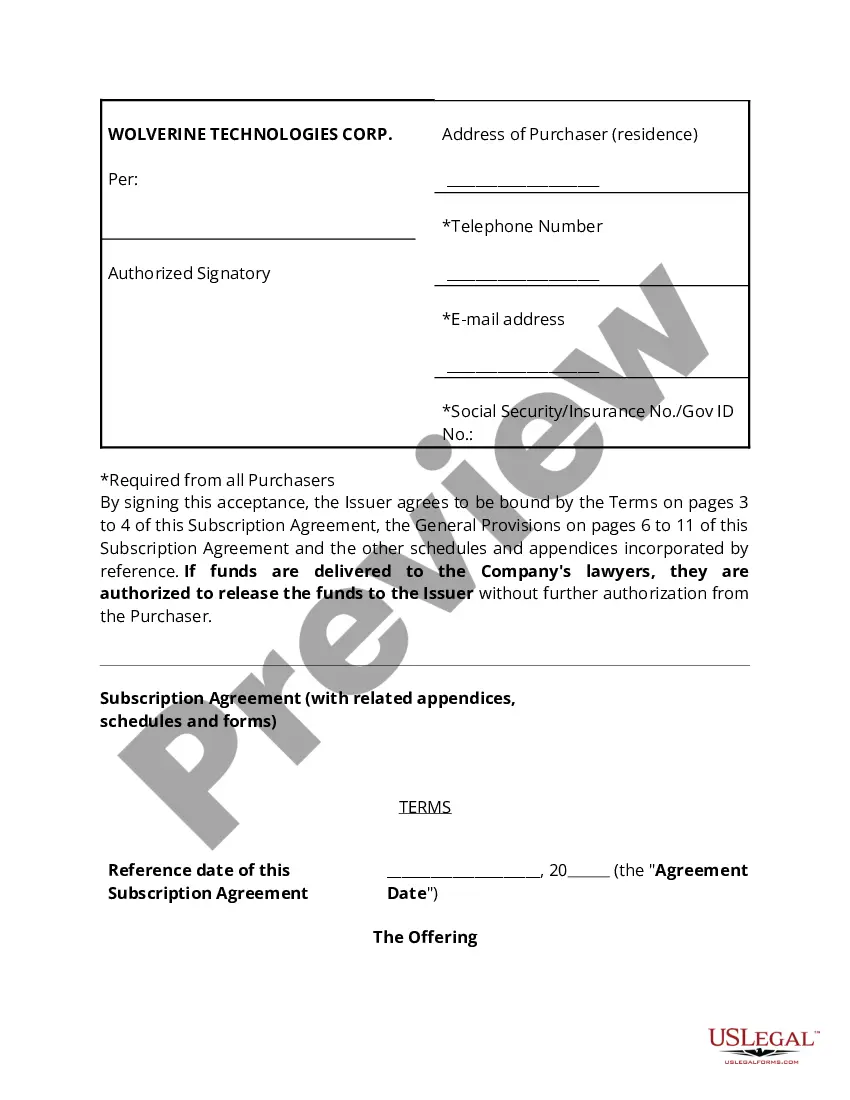

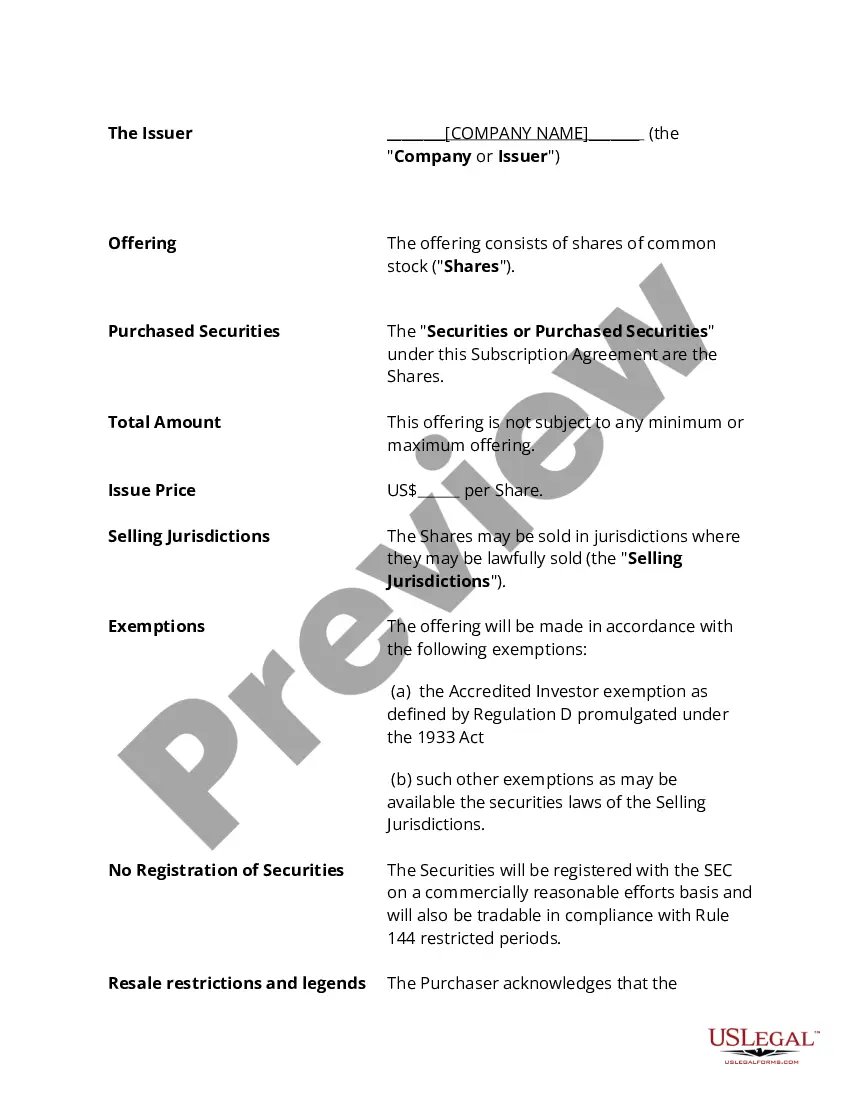

What information is typically included in a subscription agreement? Company information. Expectations of both parties. Agreement to subscribe (this includes the number of shares and price) Rights attached to the subscription. ... Terms for termination before completion. Nomination onto board. Confidentiality provisions.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

A subscription agreement is between a company and a private investor to sell a specific number of shares at a specific price. This investor fills out a form documenting his or her suitability for investing in the partnership. A subscription agreement can also be used to sell stock in a privately owned business.

The PPM goes into the specifics of the offering, whereas the Subscription Agreement acts as the purchase agreement to acquire interests in the offering.

A Subscription Agreement is a formal agreement between a company and an investor. They establish the capital contribution as well as terms and conditions around key provisions of the transaction.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

A limited partnership is when private investors or partners own the company. Under the subscription agreement, the terms are set for the company to sell a certain number of shares in return for a predetermined amount from the private investor.

The subscription agreement is the principal agreement between the issuer and the investor or substitute purchasers in a private placement of debt obligations or equity securities.