Kentucky Stop Annuity Request

Description

How to fill out Stop Annuity Request?

Finding the appropriate genuine document template can be a challenge.

Of course, there are many templates accessible online, but how do you acquire the genuine design you require.

Utilize the US Legal Forms website. This platform provides thousands of templates, such as the Kentucky Stop Annuity Request, that you can utilize for both business and personal purposes.

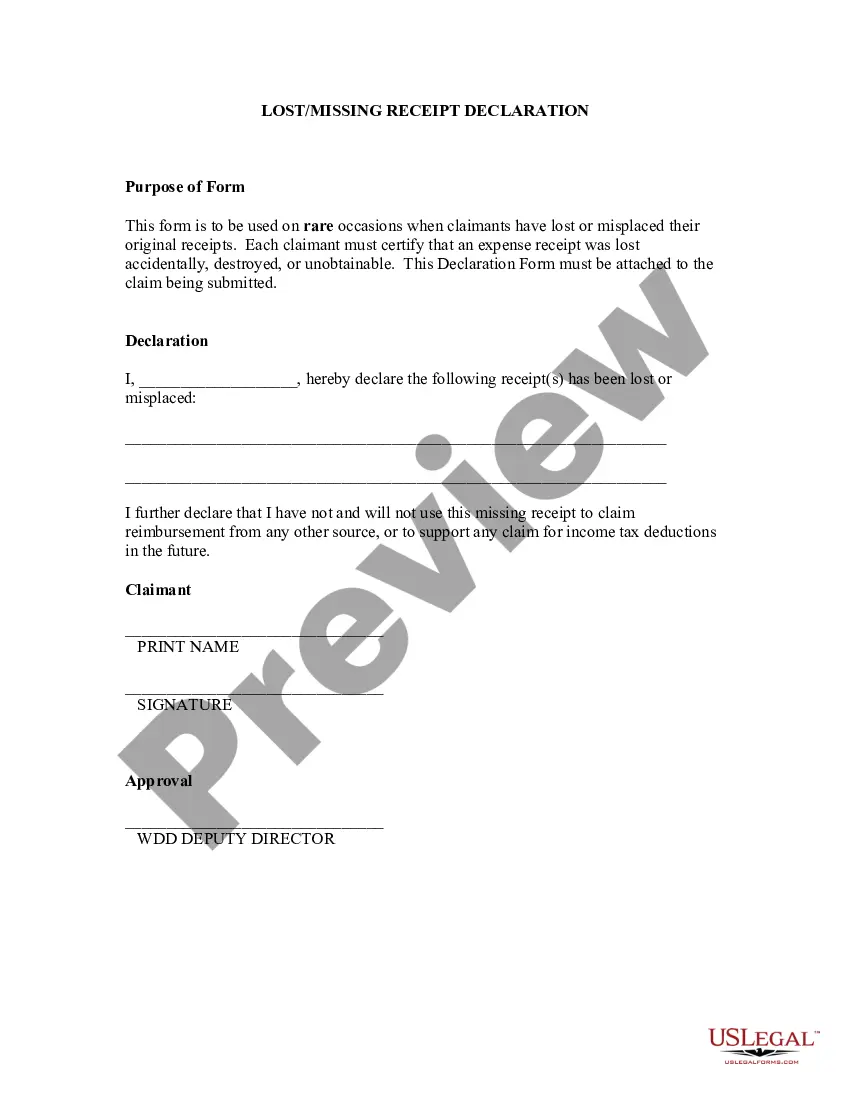

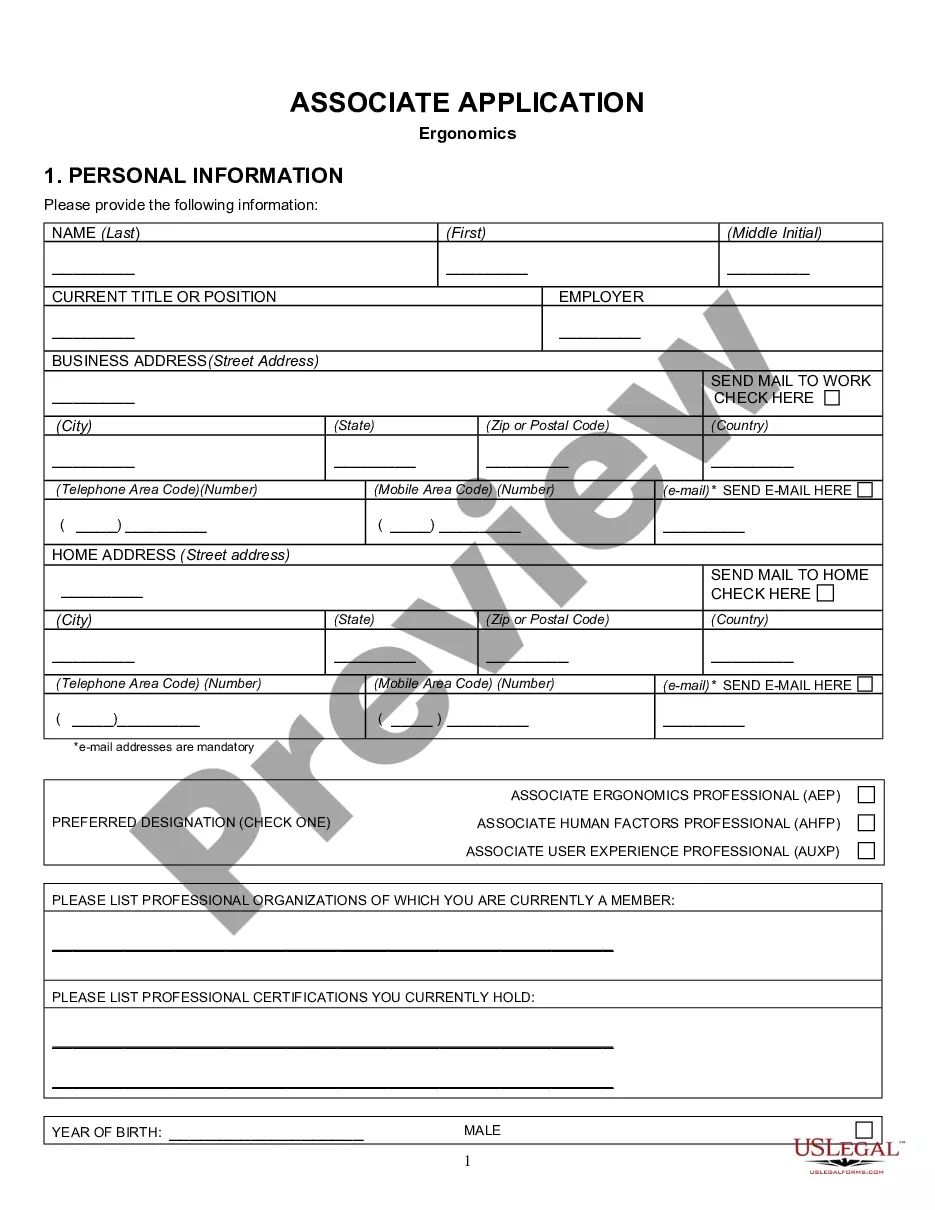

You can utilize the Preview button to view the form and check the document summary to confirm it is the correct one for your needs.

- All templates are reviewed by experts and meet federal and state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the Kentucky Stop Annuity Request.

- Use your account to view the legal documents you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- For new users of US Legal Forms, here are some simple instructions to follow.

- First, ensure you have selected the correct form for your region/county.

Form popularity

FAQ

If you are interested in taking a refund you should contact KPPA for more information, or to obtain a Form 4525, Application for Refund of Member Contributions. You may also call us at 502-696-8800 or Toll-Free at 800-928-4646, or complete the request below to obtain a form via mail.

If you are interested in taking a refund you should contact KPPA for more information, or to obtain a Form 4525, Application for Refund of Member Contributions. You may also call us at 502-696-8800 or Toll-Free at 800-928-4646, or complete the request below to obtain a form via mail.

Withdrawal of funds cancels TRS membership and voids any future benefit eligibility. A refund would consist of your contributions, plus any accumulated interest, less any statutory required contributions to the medical insurance fund. Refunds can be made 60 days after your termination date.

An employee who chooses to accept the voluntary retirement scheme (VRS) can opt out of it before it is accepted, the Supreme Court ruled last week.

Can I borrow money from my account with KPPA? No. There are no provisions in State statutes or regulations that allow KPPA to administer loans from member accounts.

Withdrawal of funds cancels TRS membership and voids any future benefit eligibility. A refund would consist of your contributions, plus any accumulated interest, less any statutory required contributions to the medical insurance fund. Refunds can be made 60 days after your termination date.

You can typically expect to receive your refund within 30 to 45 days from the date we receive all your necessary forms. However, timeframes can vary if there are holds or other restrictions on your account that require review and action.

There's still no early payment penalty as there is for withdrawals from traditional 401(k) accounts. According to the TCRS survey, among workers who've taken a hardship withdrawal from their retirement plan, almost one in four said the primary reason for doing so was to pay for medical expenses.