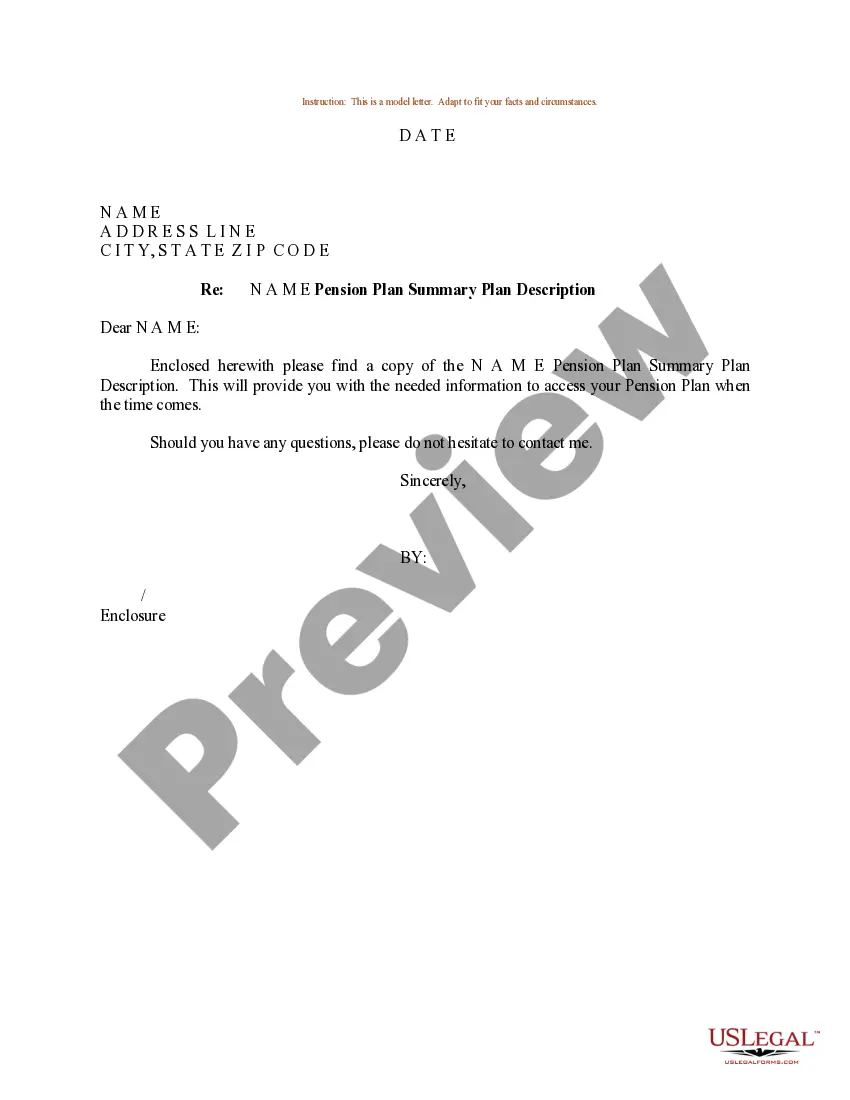

Kentucky Sample Letter for Pension Plan Summary Plan Description

Description

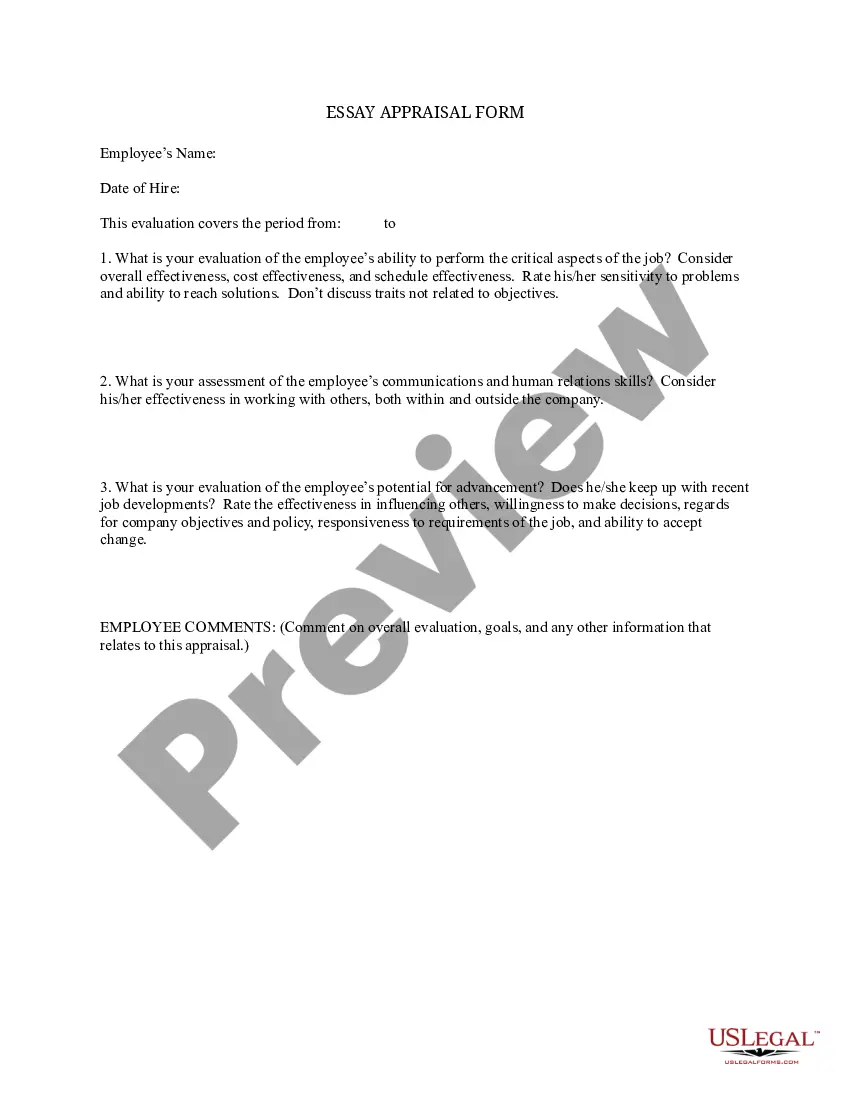

How to fill out Sample Letter For Pension Plan Summary Plan Description?

You may commit several hours on the Internet trying to find the legal record web template that suits the federal and state needs you need. US Legal Forms gives 1000s of legal types which can be evaluated by experts. It is simple to download or printing the Kentucky Sample Letter for Pension Plan Summary Plan Description from the support.

If you already possess a US Legal Forms profile, you are able to log in and click the Download key. After that, you are able to complete, edit, printing, or indication the Kentucky Sample Letter for Pension Plan Summary Plan Description. Each legal record web template you acquire is your own property forever. To get another backup associated with a obtained type, check out the My Forms tab and click the related key.

If you use the US Legal Forms internet site the first time, adhere to the straightforward recommendations below:

- Initial, be sure that you have selected the best record web template for your county/town of your liking. Browse the type outline to make sure you have selected the appropriate type. If offered, use the Preview key to check through the record web template as well.

- If you would like find another variation in the type, use the Research area to discover the web template that fits your needs and needs.

- Once you have identified the web template you would like, click Get now to move forward.

- Find the costs strategy you would like, type in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You may use your bank card or PayPal profile to purchase the legal type.

- Find the structure in the record and download it in your device.

- Make alterations in your record if necessary. You may complete, edit and indication and printing Kentucky Sample Letter for Pension Plan Summary Plan Description.

Download and printing 1000s of record layouts while using US Legal Forms Internet site, that offers the most important assortment of legal types. Use specialist and state-distinct layouts to tackle your business or person demands.

Form popularity

FAQ

In order to process a refund of their accumulated account balance, members must complete a Form 4525, Application for Refund of Member Contributions and Direct Rollover/Direct Payment Selection?. The member's employer is also required to report the termination date on the monthly report to KPPA.

Final compensation is determined by dividing the total salary earned (5-High or 3-High) by the total months worked, then multiplying by twelve (12) to annualize. Nonhazardous retirement benefits are based upon 5-High Final Compensation.

The average pension benefit in Kentucky is $1,727, ing to the National Institute on Retirement Security. Pensions support local economies and help Kentucky communities thrive. Each $1 paid out in pension benefits supports $1.43 in total economic activity in Kentucky.

??The last retiree Cost of Living Adjustment (COLA), or an ongoing retirement payment increase of 1.5% to account for cost-of-living changes, took effect in July 2011.

Final compensation is determined by dividing the total salary earned (5-High or 3-High) by the total months worked, then multiplying by twelve (12) to annualize. Nonhazardous retirement benefits are based upon 5-High Final Compensation.

????????????Nonhazardous A nonhazardous member, age 57 or older, may retire with no reduction in benefits if the member's age and years of service equal 87 ?(Rule of 87). A nonhazardous member, age 65, with at least 60 months of service credit may retire at any time with no reduction in benefits.

A nonhazardous member, age 57 or older, may retire with no reduction in benefits if the member's age and years of service equal 87 ?(Rule of 87). A nonhazardous member, age 65, with at least 60 months of service credit may retire at any time with no reduction in benefits.

Rule of 87: Retirement eligibility requirement defined as age 57 or older if the member's age and years of service equal 87. Under Tier 3, there are no early or reduced retirement benefits. Only members receiving a monthly pension benefit may participate in the health insurance program.