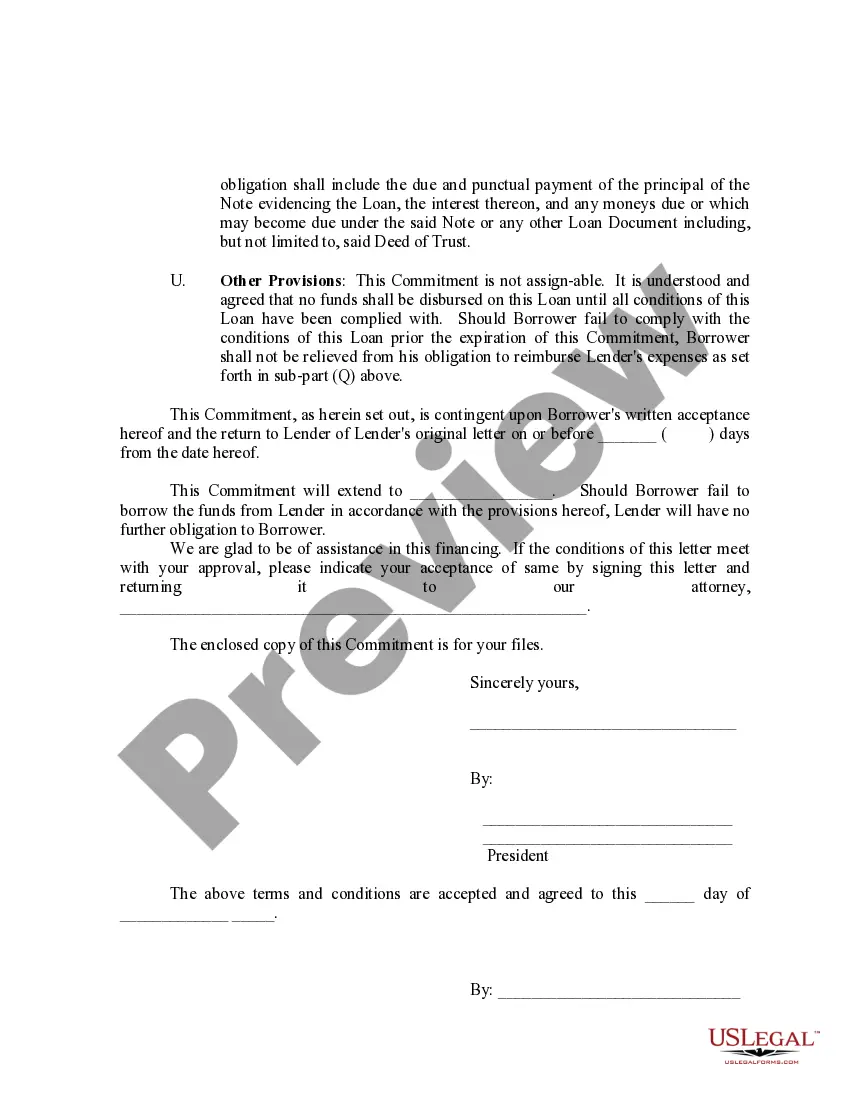

Kentucky Loan Commitment Agreement Letter

Description

How to fill out Loan Commitment Agreement Letter?

US Legal Forms - one of many greatest libraries of authorized types in the States - gives a wide range of authorized papers layouts you can down load or printing. Making use of the site, you can find a huge number of types for company and individual purposes, sorted by classes, states, or search phrases.You will discover the most recent variations of types much like the Kentucky Loan Commitment Agreement Letter in seconds.

If you already possess a membership, log in and down load Kentucky Loan Commitment Agreement Letter through the US Legal Forms collection. The Obtain option will show up on every single type you view. You gain access to all in the past acquired types from the My Forms tab of the accounts.

If you would like use US Legal Forms initially, listed here are simple guidelines to get you started out:

- Make sure you have chosen the correct type for your city/region. Click the Preview option to check the form`s articles. Read the type explanation to actually have chosen the proper type.

- If the type does not satisfy your needs, take advantage of the Research area towards the top of the monitor to obtain the one who does.

- If you are content with the form, verify your decision by visiting the Buy now option. Then, opt for the prices prepare you like and provide your credentials to sign up for an accounts.

- Approach the deal. Make use of bank card or PayPal accounts to perform the deal.

- Find the formatting and down load the form on your product.

- Make modifications. Fill out, revise and printing and indication the acquired Kentucky Loan Commitment Agreement Letter.

Every single format you put into your account lacks an expiration date and is your own property eternally. So, if you would like down load or printing an additional duplicate, just check out the My Forms section and click in the type you require.

Gain access to the Kentucky Loan Commitment Agreement Letter with US Legal Forms, by far the most comprehensive collection of authorized papers layouts. Use a huge number of specialist and status-distinct layouts that meet your company or individual requires and needs.

Form popularity

FAQ

We can define a commitment letter as a formal and legally binding document that a lender issues to a loan applicant. The commitment letter indicates that a loan applicant has passed the various underwriting guidelines and that their loan agreement or mortgage note has been approved.

How long does it take to get a mortgage commitment letter? It can take 20 ? 45 days to receive a mortgage commitment letter from the time the paperwork is submitted.

The letter of commitment specifies the amount of a loan that the bank is willing to offer the borrower. The amount may be below or above what the borrower requested. The loan commitment serves as a formal record of the loan processing but is not the loan contract.

Because commitment letters are legally binding agreements, terms should be precise and detailed and include all material terms. Any ambiguity in the terms outlined in the commitment letter will often be construed against the lender.

Stating that you've been approved to receive a home loan. Commitment letters are offered to applicants who've successfully navigated their way through the loan preapproval process.

You can get a mortgage commitment letter (conditional version) by going through the mortgage preapproval process. Usually, that involves filling out a form with your lender and providing them with some basic financial information. Most people take this step near the beginning of their home search.

While a commitment letter indicates that a lender is willing to provide funding, it is usually contingent upon certain conditions being met. These conditions may include satisfactory property appraisal, verification of income and assets, and fulfillment of any other requirements specified by the lender.

To obtain a conditional or final commitment letter, you'll need to go through your chosen lender's mortgage preapproval process. Doing so may require you to provide documentation such as pay stubs, bank statements, and other materials that provide proof of employment and earnings.