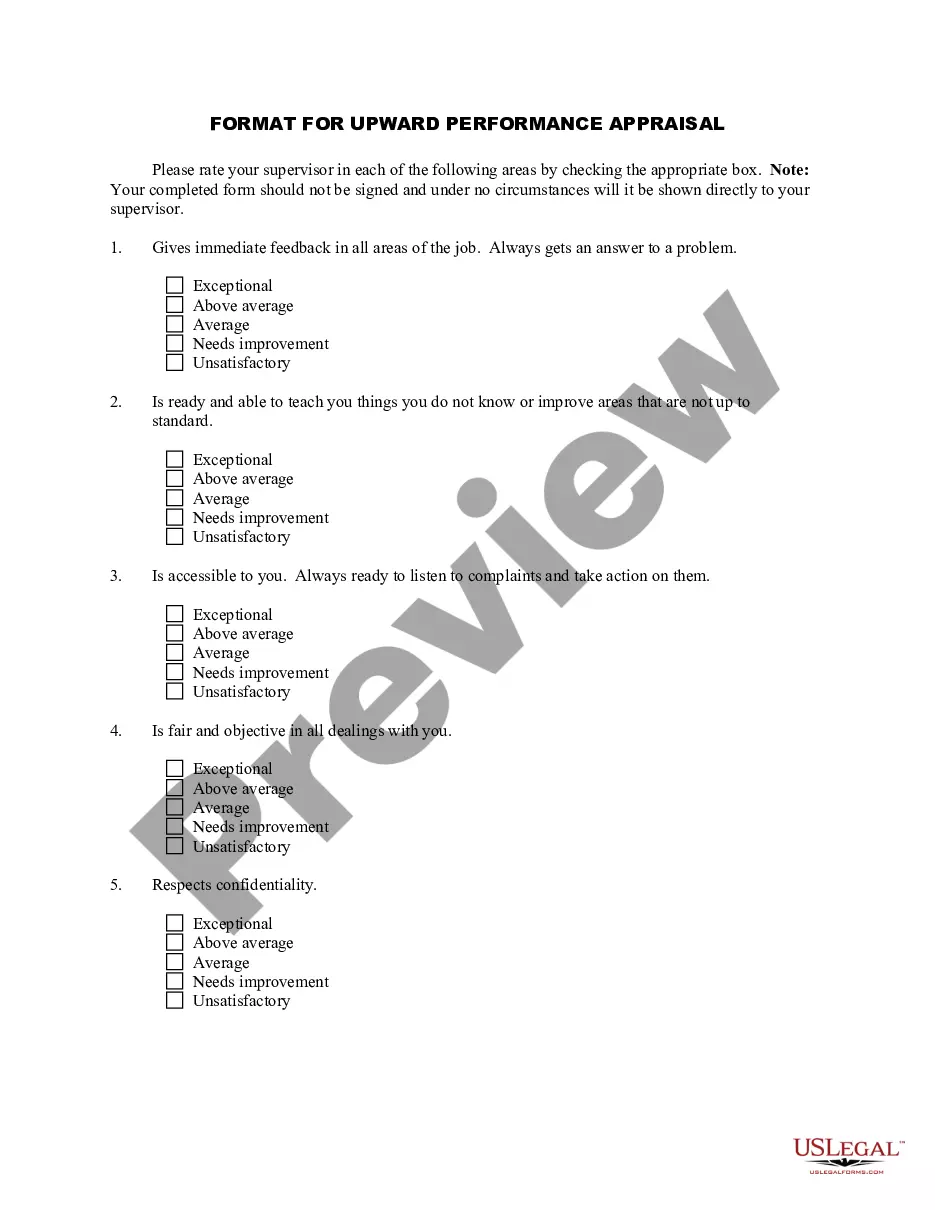

Kentucky Letter regarding trust money

Description

How to fill out Letter Regarding Trust Money?

You are capable of investing hours on the web searching for the authentic document template that conforms to the state and federal requirements you require.

US Legal Forms offers thousands of authentic forms that have been reviewed by professionals.

You can easily download or print the Kentucky Letter concerning trust money from my services.

If available, utilize the Preview button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, modify, print, or sign the Kentucky Letter concerning trust money.

- Each authentic document template you acquire belongs to you indefinitely.

- To obtain another copy of any acquired document, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have chosen the correct document template for the county/region of your preference.

- Review the document description to confirm you have selected the appropriate document.

Form popularity

FAQ

Inheritance TaxAll property belonging to a resident of Kentucky is subject to the tax except for real estate located in another state. Also, real estate and personal property located in Kentucky and owned by a nonresident is subject to being taxed.

There is no federal inheritance taxthat is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022. The tax is assessed only on the portion of an estate that exceeds those amounts.

The tax due should be paid when the return is filed. However, if the beneficiary's net inheritance tax liability exceeds $5,000 and the return is filed timely, an election can be made to pay the tax in 10 equal annual installments.

Anyone who doesn't fall into Class A or Class Bfor example, cousins, friends, and corporationsis part of Class C. For Class C members, only $500 is exempt from Kentucky's inheritance tax. After that, the tax rate falls between 6% and 16%.

Inheritance TaxAll property belonging to a resident of Kentucky is subject to the tax except for real estate located in another state. Also, real estate and personal property located in Kentucky and owned by a nonresident is subject to being taxed.

Money taken from a trust is subject to different taxation than funds from ordinary investment accounts. Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets.

Exempt beneficiaries under KRS 140.080 include spouse, children, stepchildren, grandchildren, parent, brother, and sister.

How to avoid inheritance taxMake a will.Make sure you keep below the inheritance tax threshold.Give your assets away.Put assets into a trust.Put assets into a trust and still get the income.Take out life insurance.Make gifts out of excess income.Give away assets that are free from Capital Gains Tax.More items...?

What assets are not in your estate? Some assets fall outside of your estate and are therefore not subject to inheritance tax. This includes most types of pension plans, life insurance (held in trust) and trusts generally. When someone dies, their outstanding liabilities will be repaid from their existing assets.