Kentucky Notice that use of Website is Subject to Guidelines

Description

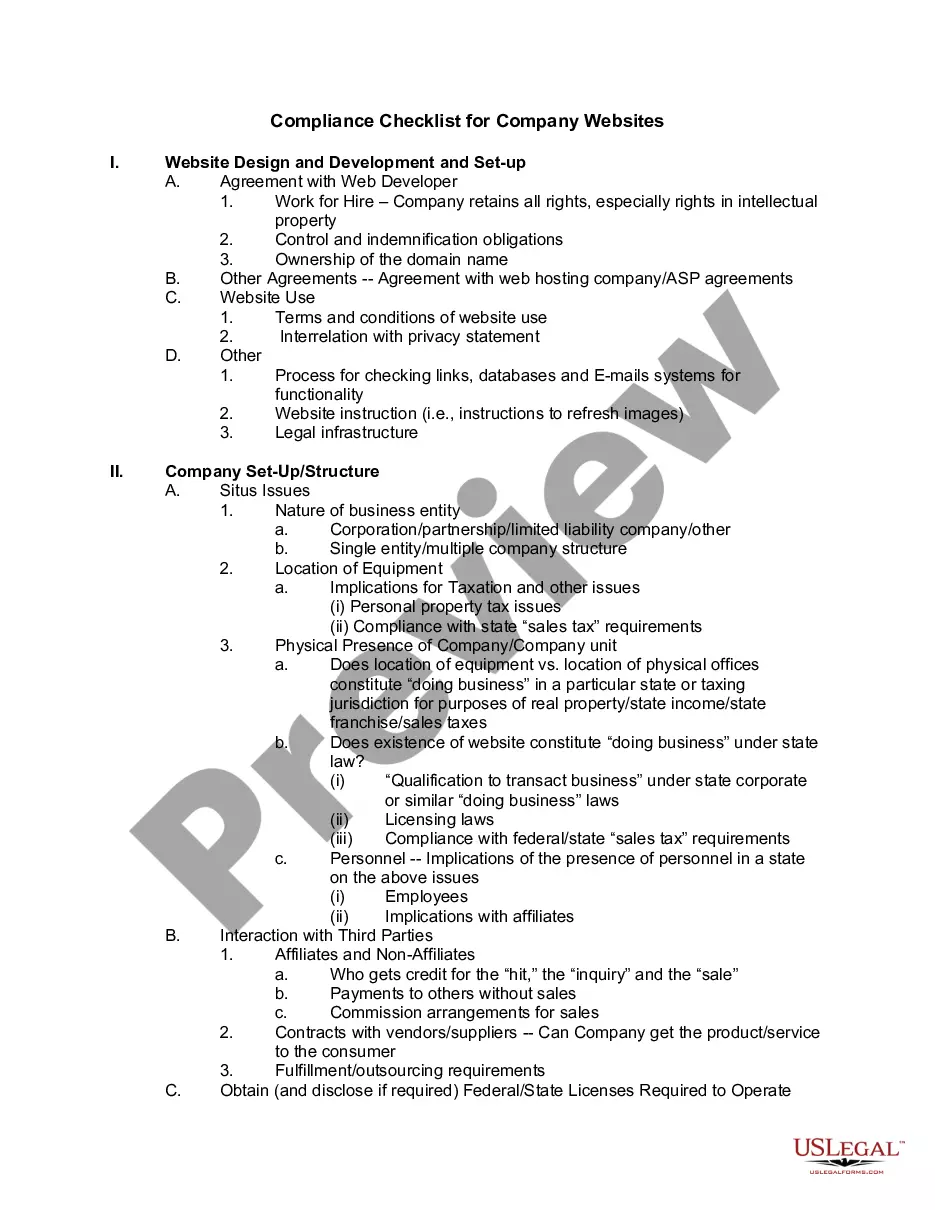

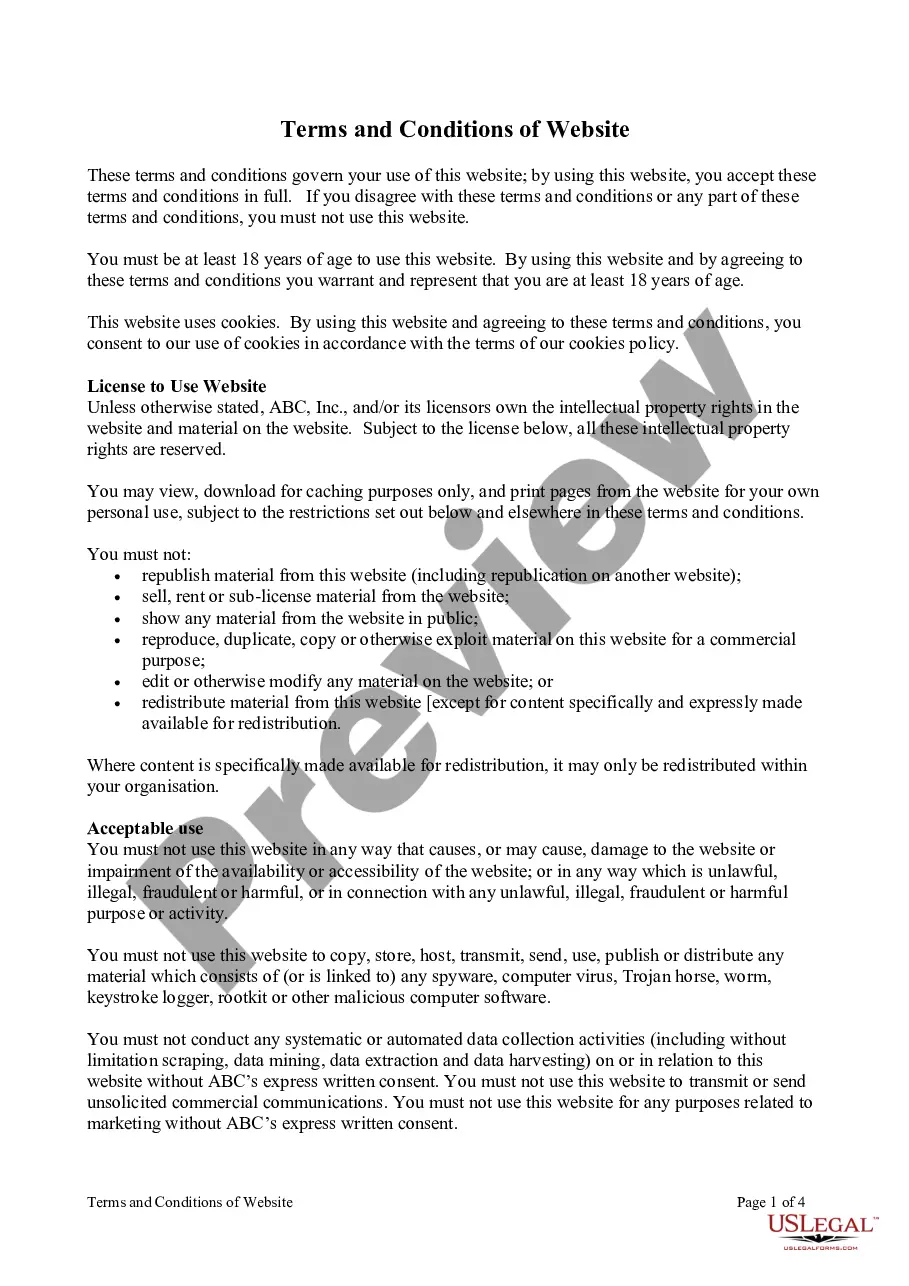

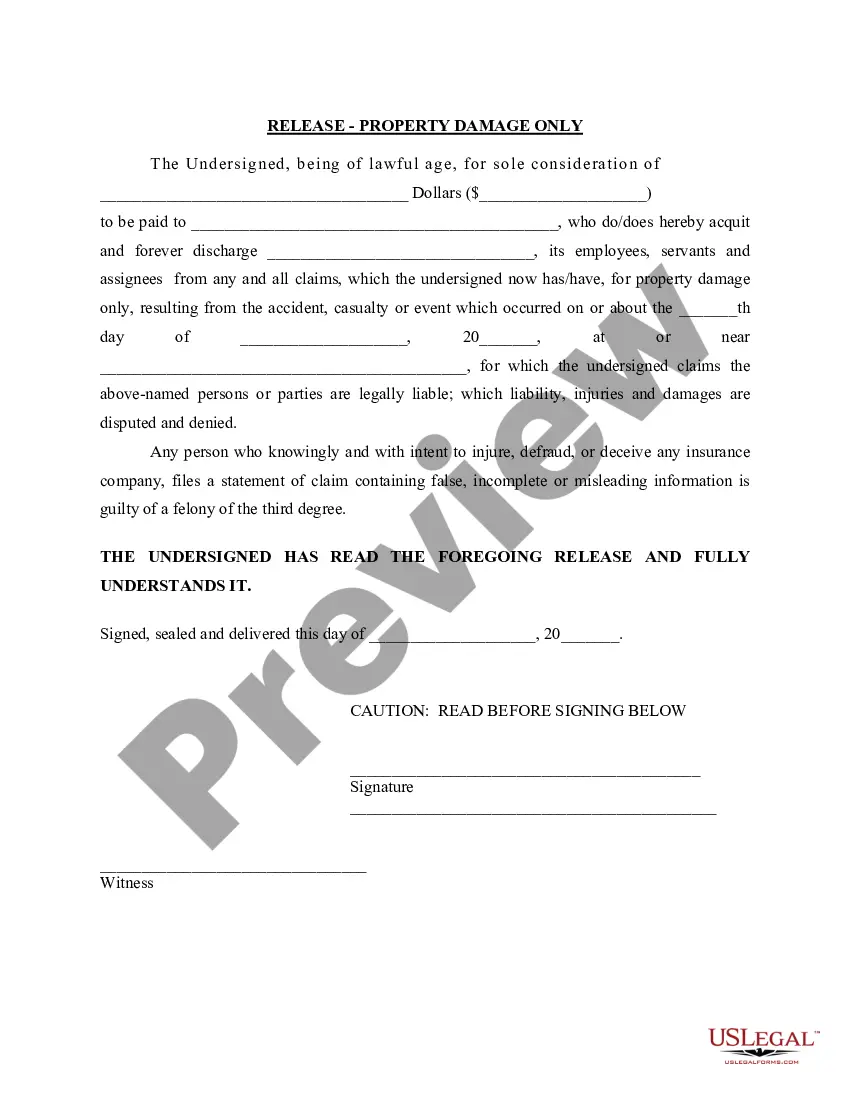

How to fill out Notice That Use Of Website Is Subject To Guidelines?

You can spend numerous hours online attempting to locate the right legal document template that meets your state and federal requirements.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You may obtain or create the Kentucky Notice that use of Website is Subject to Guidelines from my service.

If available, use the Review option to browse through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Acquire button.

- After that, you can complete, modify, create, or sign the Kentucky Notice that use of Website is Subject to Guidelines.

- Every legal document template you purchase is yours to keep indefinitely.

- To get another copy of the purchased form, visit the My documents section and click the relevant option.

- If you're using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/area of interest.

- Read the form description to confirm you have selected the accurate template.

Form popularity

FAQ

Kentucky state tax is calculated based on your taxable income and follows a graduated tax rate schedule. Deductions and credits may apply, impacting the overall tax liability. It's advisable to keep updated with the Kentucky Notice that use of Website is Subject to Guidelines for the latest tax calculation methods and guidelines.

In Kentucky, the taxation of software as a service (SaaS) can be a complex issue, often depending on how the software is delivered and used. Generally, SaaS is considered taxable in Kentucky unless specific exemptions apply. For accurate guidance, review the Kentucky Notice that use of Website is Subject to Guidelines or consult a legal expert.

Yes, Kentucky has a state income tax, which varies based on your income level. Additionally, residents must also adhere to local taxes and any applicable sales taxes on purchases. For more detailed tax information, refer to the Kentucky Notice that use of Website is Subject to Guidelines.

As of 2024, the sales tax in Kentucky remains at a rate of 6%. However, it's important to stay informed about any upcoming changes, as tax laws can vary each year. The Kentucky Notice that use of Website is Subject to Guidelines offers updated information regarding any alterations to tax rates.

Kentucky sales tax exemptions cover specific categories of items, including educational materials and nonprofit organization purchases. Even some services, like certain healthcare services, are exempt. To ensure compliance, refer to the Kentucky Notice that use of Website is Subject to Guidelines for clarity on what qualifies for tax exemption.

In Kentucky, certain items are exempt from sales tax, including groceries, prescription medications, and some agricultural products. Additionally, items for resale and certain types of manufacturing equipment may also qualify for exemptions. It's essential to consult the Kentucky Notice that use of Website is Subject to Guidelines for a comprehensive list of exempt items.

The Kentucky Limited Liability Entity credit reduces the tax liability for certain business entities subject to the LLET, providing financial relief for qualifying applicants. This credit enhances the business environment by promoting economic growth. To ensure you meet the requirements, please check the Kentucky Notice that use of Website is Subject to Guidelines for the latest eligibility criteria.

A Kentucky K4 form is an Employee's Withholding Allowance Certificate, used by employees to determine the amount of state income tax to withhold from their paychecks. Filling out this form accurately ensures you do not underpay or overpay your state taxes. Refer to the Kentucky Notice that use of Website is Subject to Guidelines for comprehensive instructions on completing this form.

The KY 740 form is the primary individual income tax return used by Kentucky residents to report their income and calculate their tax liability. It's essential to fill out this form accurately to avoid issues with the state. For those unfamiliar with the process, the Kentucky Notice that use of Website is Subject to Guidelines can provide further clarification on the required details.

The Kentucky Limited Liability Entity Tax (LLET) applies to entities such as limited liability companies and partnerships grossing at least $3 million annually. Understanding your obligations under this tax is vital for compliance. For more guidance, consult the Kentucky Notice that use of Website is Subject to Guidelines which details entity responsibilities.