Kentucky Compliance Checklist For Company Websites

Description

How to fill out Compliance Checklist For Company Websites?

Are you presently in a scenario where you require documentation for both organizational or personal purposes nearly every working day.

There are numerous legitimate document templates available online, but finding ones you can trust is not straightforward.

US Legal Forms offers a wide array of form templates, such as the Kentucky Compliance Checklist for Company Websites, which can be formatted to comply with federal and state regulations.

Select the pricing plan you require, complete the necessary information to create your account, and finalize the payment using your PayPal or credit card.

Choose a convenient file format and download your copy. Retrieve all the document templates you have purchased in the My documents section. You can obtain another copy of the Kentucky Compliance Checklist for Company Websites at any time if needed. Simply click the desired template to download or print the document.

Utilize US Legal Forms, the most extensive collection of lawful forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply sign in.

- Afterward, you can download the Kentucky Compliance Checklist for Company Websites template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Acquire the form you need and ensure it is for the correct city/state.

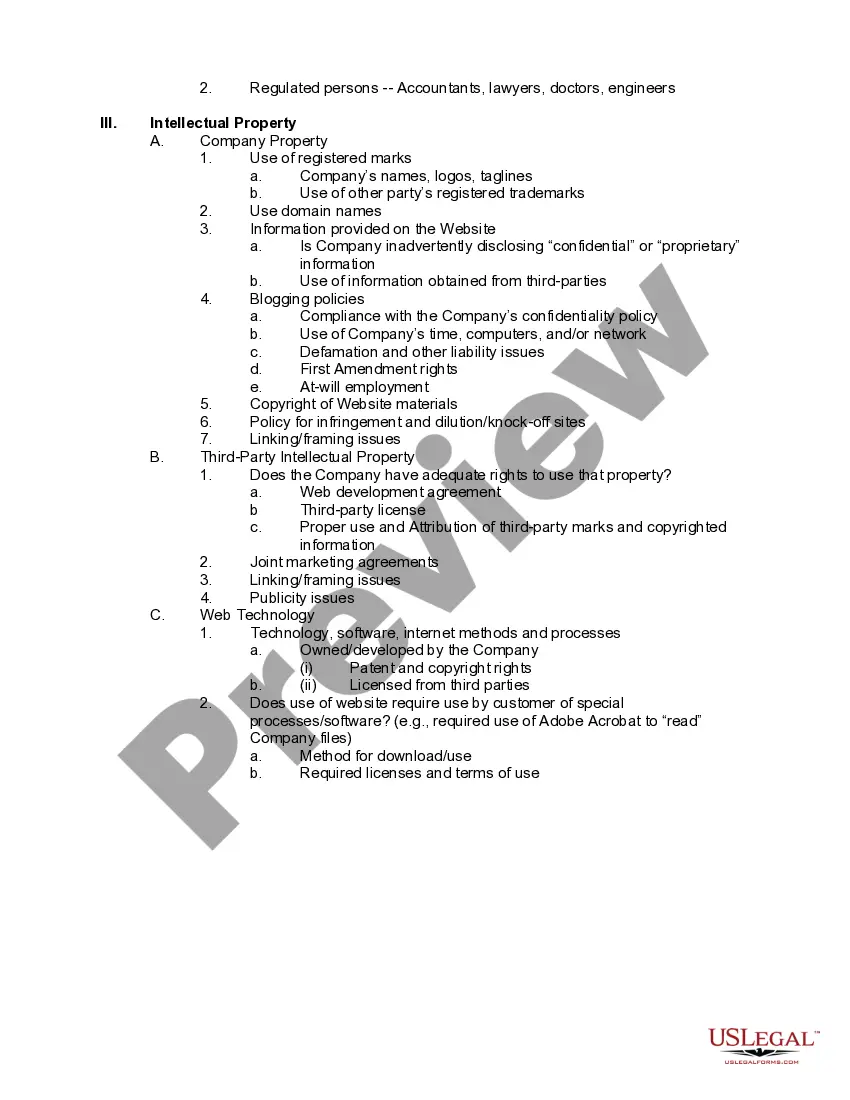

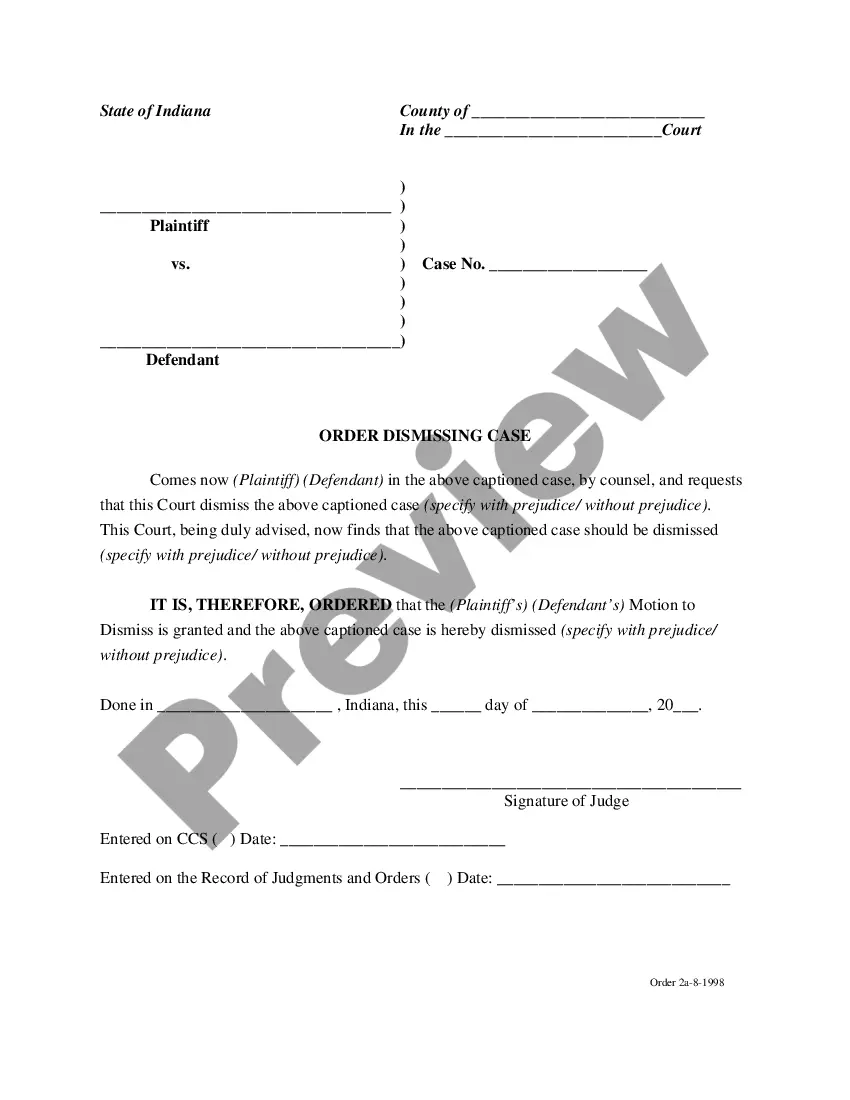

- Utilize the Preview button to review the document.

- Check the description to confirm that you have selected the correct template.

- If the template does not match your requirements, use the Search field to find the form that fits your needs.

- When you find the correct template, click Buy now.

Form popularity

FAQ

Yes, Kentucky requires most businesses to obtain a business license to operate legally. Depending on your location and industry, you may need additional permits. It is essential to verify these requirements to avoid potential fines. Utilizing the Kentucky Compliance Checklist For Company Websites helps ensure that you have all necessary licenses, allowing you to focus on growing your business confidently.

In Kentucky, a small business is typically defined as a company with fewer than 100 employees. These businesses often operate independently and focus primarily on local or regional markets. Understanding this classification helps employers align with regulations and resources available for small businesses. The Kentucky Compliance Checklist For Company Websites can guide small business owners through necessary compliance steps, ensuring they meet legal requirements.

Yes, Kentucky is a member of the Streamlined Sales Tax (SST) agreement, which aims to simplify sales tax collection. This means that when selling products or services online, businesses must comply with specific rules and rates. Understanding these requirements is vital for operational success. The Kentucky Compliance Checklist For Company Websites is an excellent resource to help businesses stay compliant with these sales tax standards.

Most states recognize S corporations, but not all. Some states might impose additional requirements or taxes that affect S corp status, while others like Iowa and New Jersey have specific rules. Thus, it's essential to research each state's regulations. To navigate these complexities, the Kentucky Compliance Checklist For Company Websites provides important guidelines for compliance and structuring your business correctly.

A few states do not recognize S corporations, such as Nevada, Texas, and Washington. In these states, businesses must operate as C corporations or LLCs. Ensuring compliance with state regulations is crucial, and the Kentucky Compliance Checklist For Company Websites can guide you in understanding which entity type best suits your specific needs.

Yes, Kentucky recognizes S-corporations, which can provide certain tax benefits to shareholders. When you elect S corp status, your business can avoid double taxation, meaning profits are only taxed at the personal level. This makes it an appealing option for many business owners. Using the Kentucky Compliance Checklist For Company Websites will help ensure you meet all necessary state requirements for your S corp.

In Kentucky, both LLCs and S corps provide liability protection but differ in taxation and management structure. An LLC offers flexibility in management and allows members to choose how to distribute profits. In contrast, an S corp has specific requirements for ownership and must follow formalities like regular meetings. For businesses aiming to comply with Kentucky laws, the Kentucky Compliance Checklist For Company Websites can help you navigate these differences effectively.

Doing business in Kentucky generally includes activities such as having a physical presence, selling goods or services, or generating revenue within the state. Registering with the Secretary of State is crucial for compliance. The Kentucky Compliance Checklist for Company Websites can help clarify what constitutes doing business and ensure you understand your obligations. Staying compliant protects your interests and facilitates smooth business operations.

Yes, most businesses in Kentucky require a business license to operate legally. This license can vary depending on your business structure and location. By utilizing a Kentucky Compliance Checklist for Company Websites, you can easily determine if you need a license and how to apply for one. This checklist helps streamline the compliance process while keeping your business in good standing.

To operate a business in Kentucky, you typically need a valid business license issued by the state or your local county. The specific requirements may vary based on the type of business you are running. A Kentucky Compliance Checklist for Company Websites can guide you through understanding the necessary licenses. Adhering to these regulations ensures your business meets the legal standards required for success.