Kentucky Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

About this form

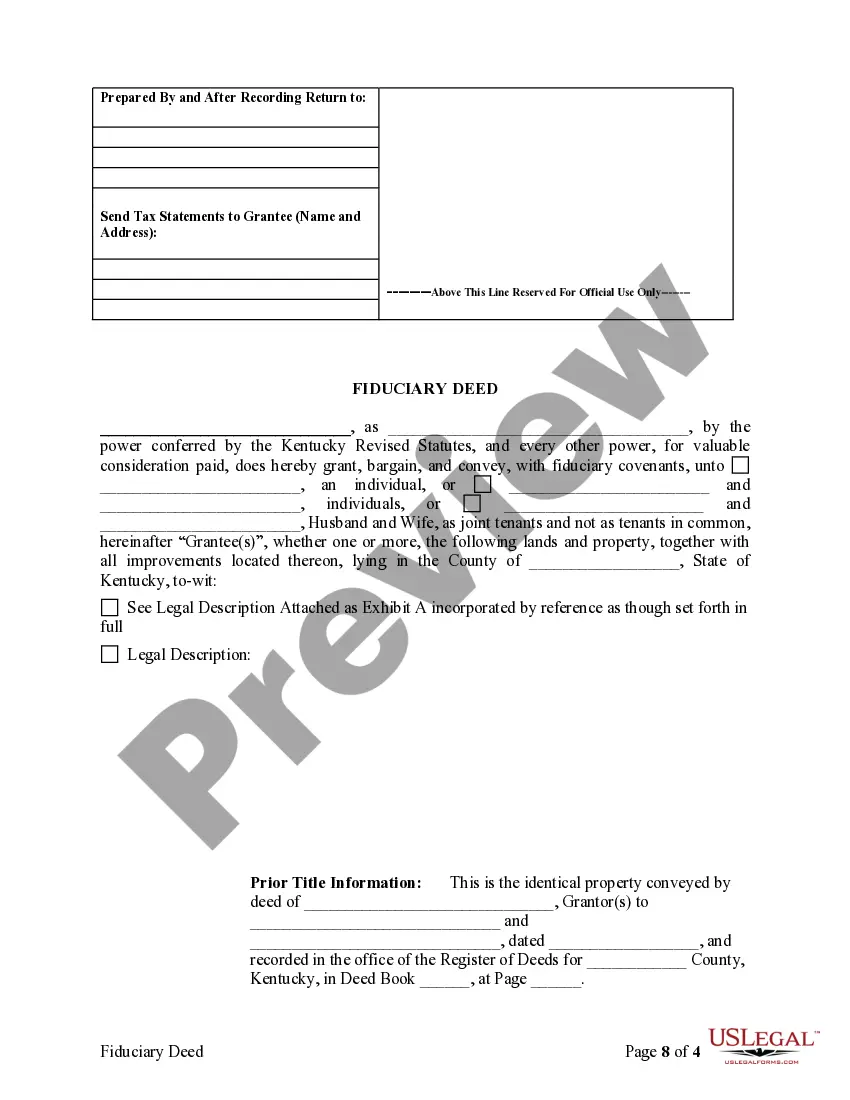

The Fiduciary Deed is a legal document used primarily by executors, trustees, trustors, administrators, and other fiduciaries to transfer real property in Kentucky. Unlike a standard warranty deed, this form conveys property based on a person's fiduciary role, such as acting under a will or trust. This form ensures the proper and legal transfer of property interests in accordance with the responsibilities of the fiduciary.

Key parts of this document

- Identification of the grantor and grantee, including their legal roles.

- Detailed legal description of the property being transferred.

- Statement of consideration, indicating the value exchanged for the property.

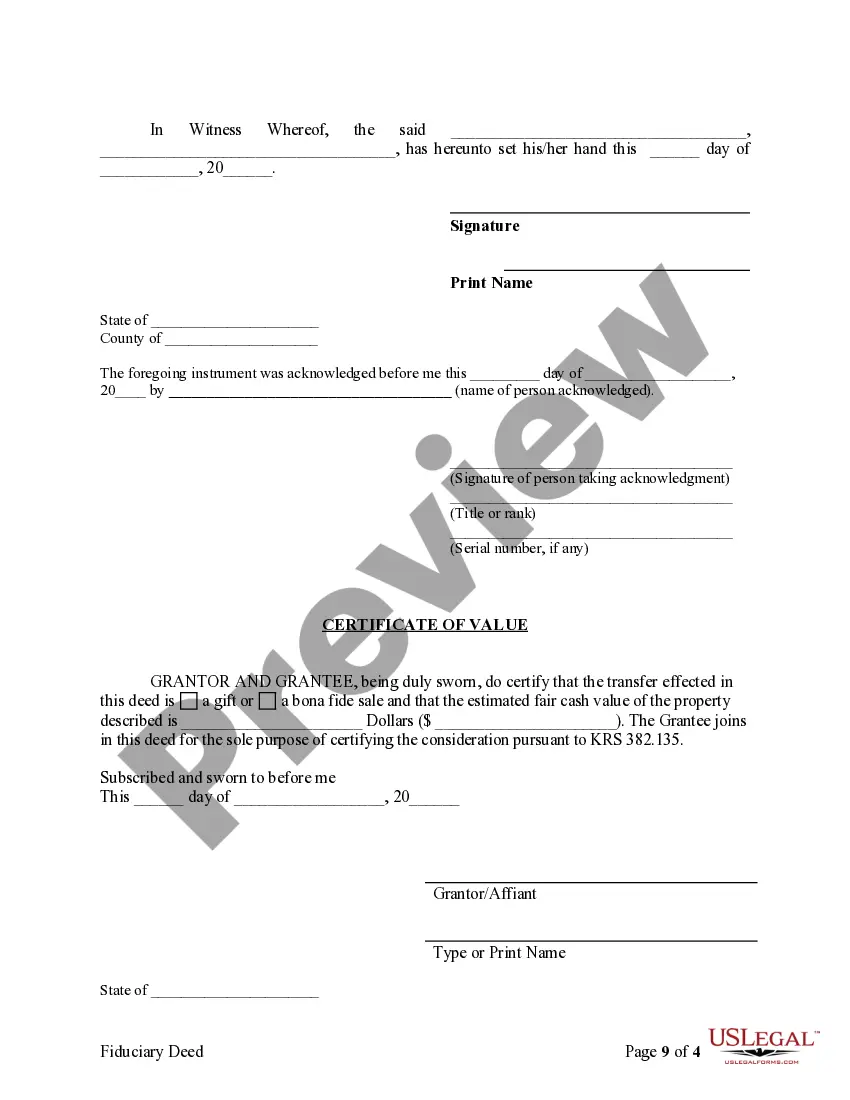

- Notarization requirements to validate the deed.

- Signature lines for the grantor and notary public for legal acknowledgment.

Common use cases

This Fiduciary Deed should be used when a fiduciary needs to transfer property under their authority, such as in the following scenarios:

- When an executor distributes property from an estate as outlined in a will.

- When a trustee conveys property held in a trust to beneficiaries.

- When a guardian or conservator is transferring property on behalf of a minor or an incapacitated individual.

Who needs this form

- Executors managing the estate of a deceased person.

- Trustees overseeing the distribution of trust assets.

- Administrators of an estate when there is no will.

- Guardians appointed by the court to manage the affairs of a minor or incapacitated person.

- Conservators managing the financial affairs of individuals unable to do so themselves.

Steps to complete this form

- Identify all parties: the grantor (fiduciary) and grantee (recipient).

- Provide the legal description of the property to be transferred.

- Complete the statement of consideration, specifying the value of the property.

- Sign the form in the presence of a notary public to validate the deed.

- Ensure all required fields are filled accurately before submitting for recording.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include the proper legal description of the property.

- Not having the deed notarized, which can invalidate the transfer.

- Incorrectly stating the consideration amount, which must match the statement of consideration.

- Leaving blank fields that are necessary for the legal validity of the deed.

Why complete this form online

- Convenient access to legal forms that can be downloaded immediately.

- Editability allows users to enter specific information directly into the form.

- Security in handling sensitive legal documents without needing to visit an office.

- Reliability, as forms are drafted by licensed attorneys to ensure legality.

Legal use & context

- The Fiduciary Deed is enforceable under Kentucky law when properly completed and recorded.

- Failure to comply with notarization or property description requirements may render the deed void.

- Certain exemptions may apply under Kentucky law for specific transactions, such as transfers between family members.

What to keep in mind

- Use the Fiduciary Deed for property transfers by executors, trustees, and other fiduciaries in Kentucky.

- Ensure all parties are accurately identified, and the property is correctly described.

- Notarization is necessary to validate the deed.

- Utilizing online forms can provide convenience and legal security.

Looking for another form?

Form popularity

FAQ

Executors can use the money in the estate in whatever way they determine best for the estate and for fulfilling the decedent's wishes. Typically, this will amount to paying off debts and transferring bequests to the beneficiaries according to the terms of the will.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

The executor can be removed by the judge on the case. The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot give away property because the property belongs to someone else. Unless he pays full price for it.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

Yes, It's Possible for an Executor to Sell Property To Themselves Here's How. If you've been named the executor of an estate, you have a crucial job.In most cases, the executor sets about putting the house on the market and selling it so the proceeds can be distributed to any heirs.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

As an Executor, what you cannot do is go against the terms of the Will, Breach Fiduciary duty, fail to act, self-deal, embezzle, intentionally or unintentionally through neglect harm the estate, and cannot do threats to beneficiaries and heirs.