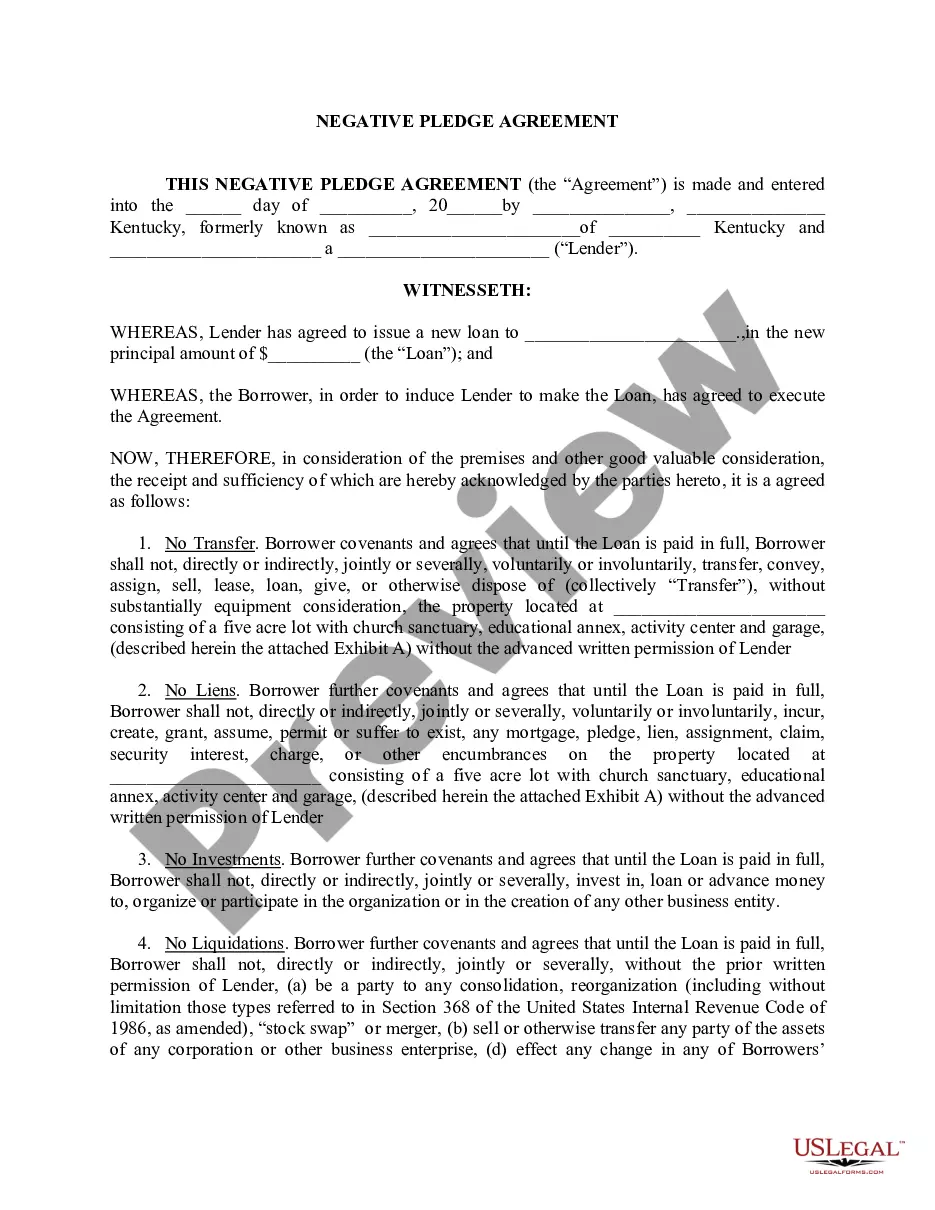

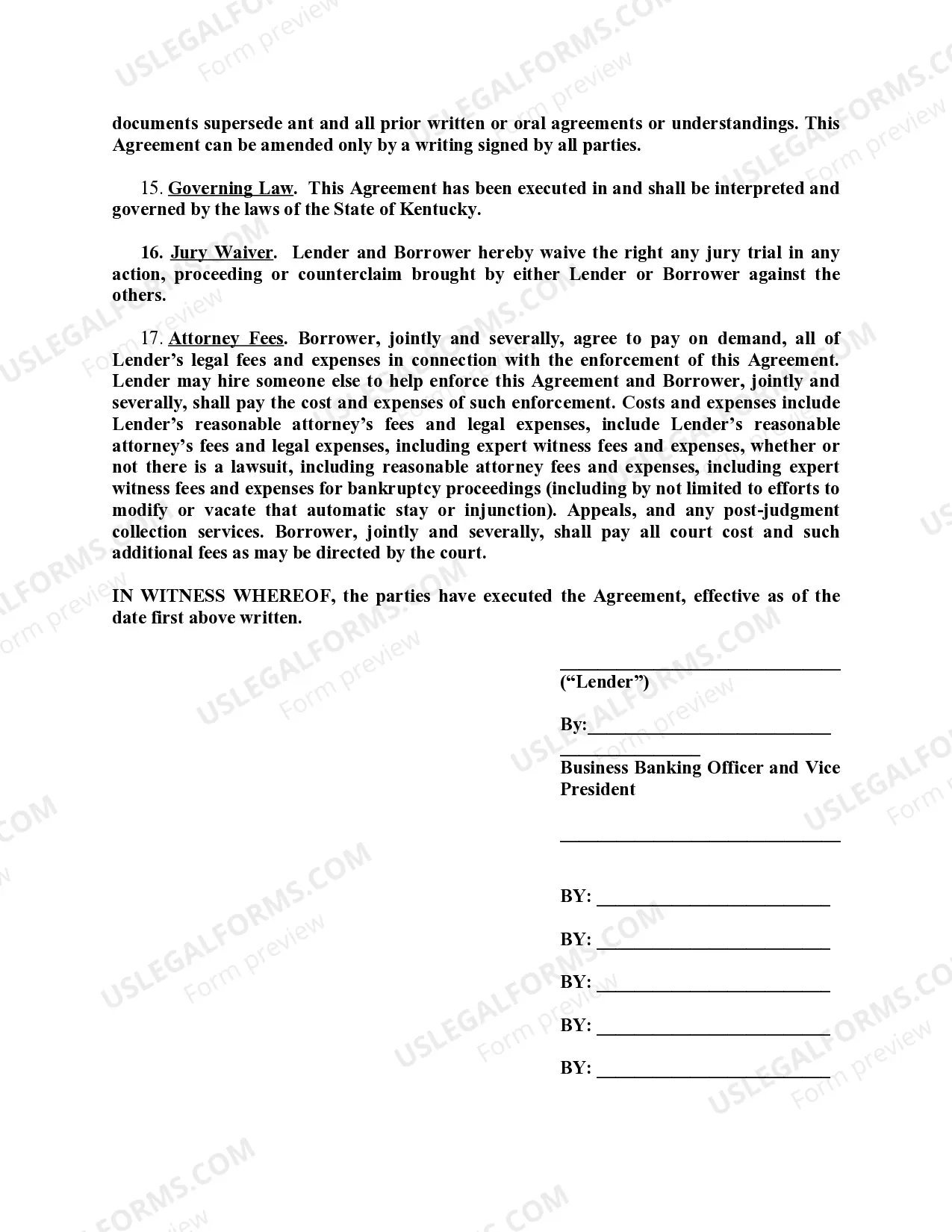

Kentucky Negative Pledge Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kentucky Negative Pledge Agreement?

Utilize US Legal Forms to obtain a printable Kentucky Negative Pledge Agreement.

Our court-acceptable forms are created and frequently refreshed by expert attorneys.

Ours is the most comprehensive Forms repository on the internet and offers affordably priced and precise templates for individuals and legal practitioners, as well as small to medium-sized businesses.

- The templates are organized into state-specific categories.

- Many of them can be previewed prior to downloading.

- To download templates, users are required to have a subscription and to Log In to their account.

- Click Download next to any template you require and locate it in My documents.

- For those lacking a subscription, follow these steps to swiftly locate and download the Kentucky Negative Pledge Agreement.

- Verify that you have the correct template according to the required state.