Kansas Percentage Exchange Agreement

Description

How to fill out Percentage Exchange Agreement?

If you require to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the most extensive collection of authentic forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require. Numerous templates for business and personal purposes are organized by categories and claims, or keywords.

Utilize US Legal Forms to obtain the Kansas Percentage Exchange Agreement with just a few clicks.

Every legal document format you obtain is yours indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Be proactive and acquire, and print the Kansas Percentage Exchange Agreement with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Kansas Percentage Exchange Agreement.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct state/country.

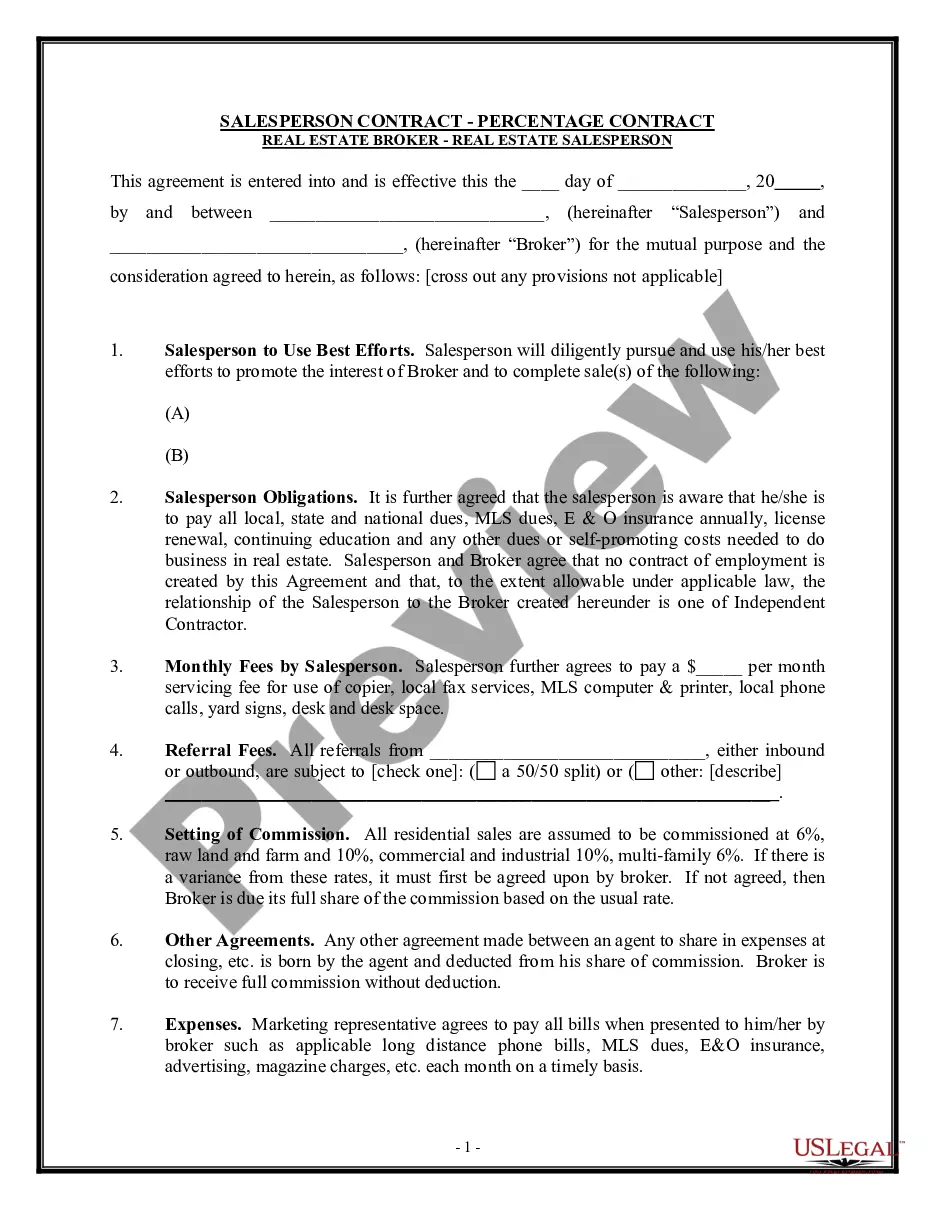

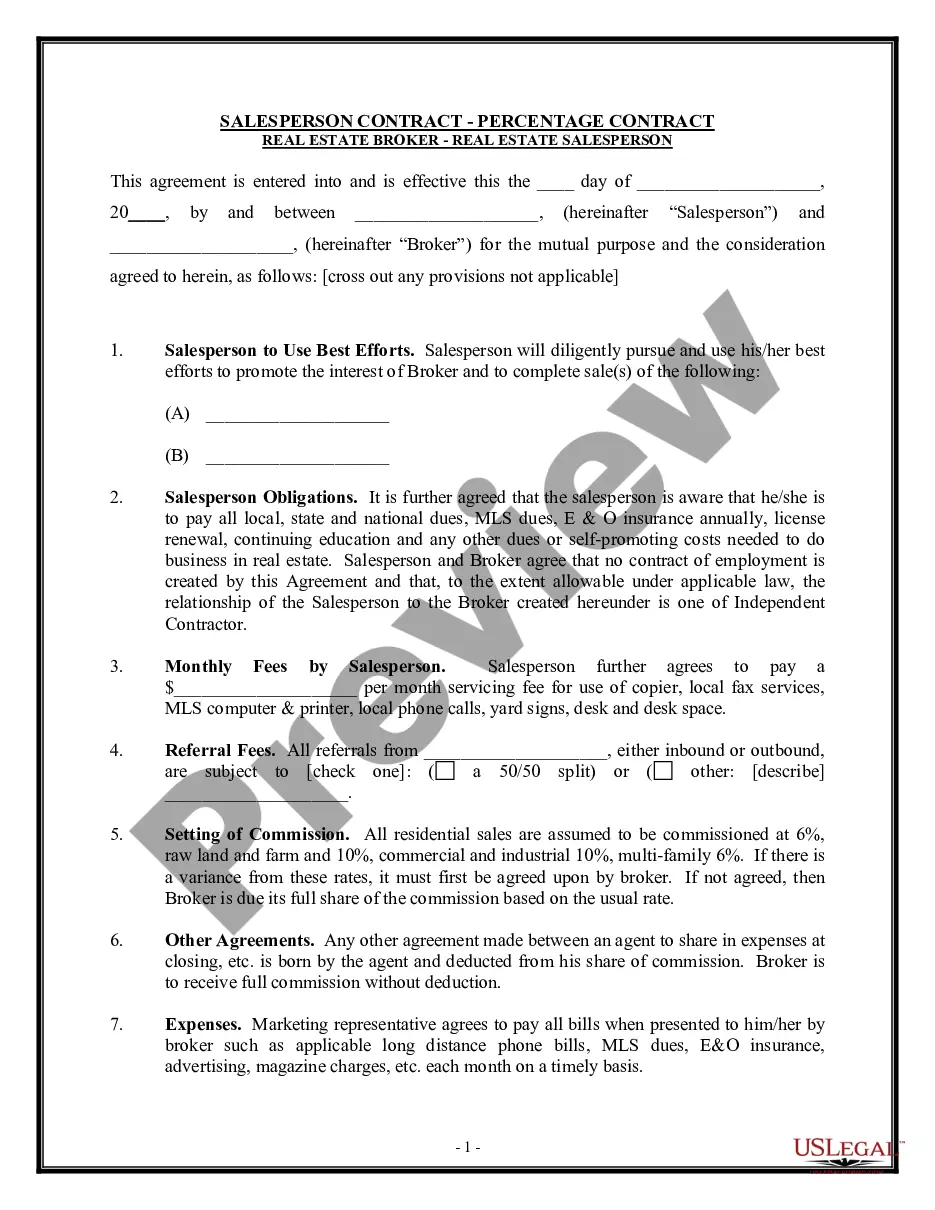

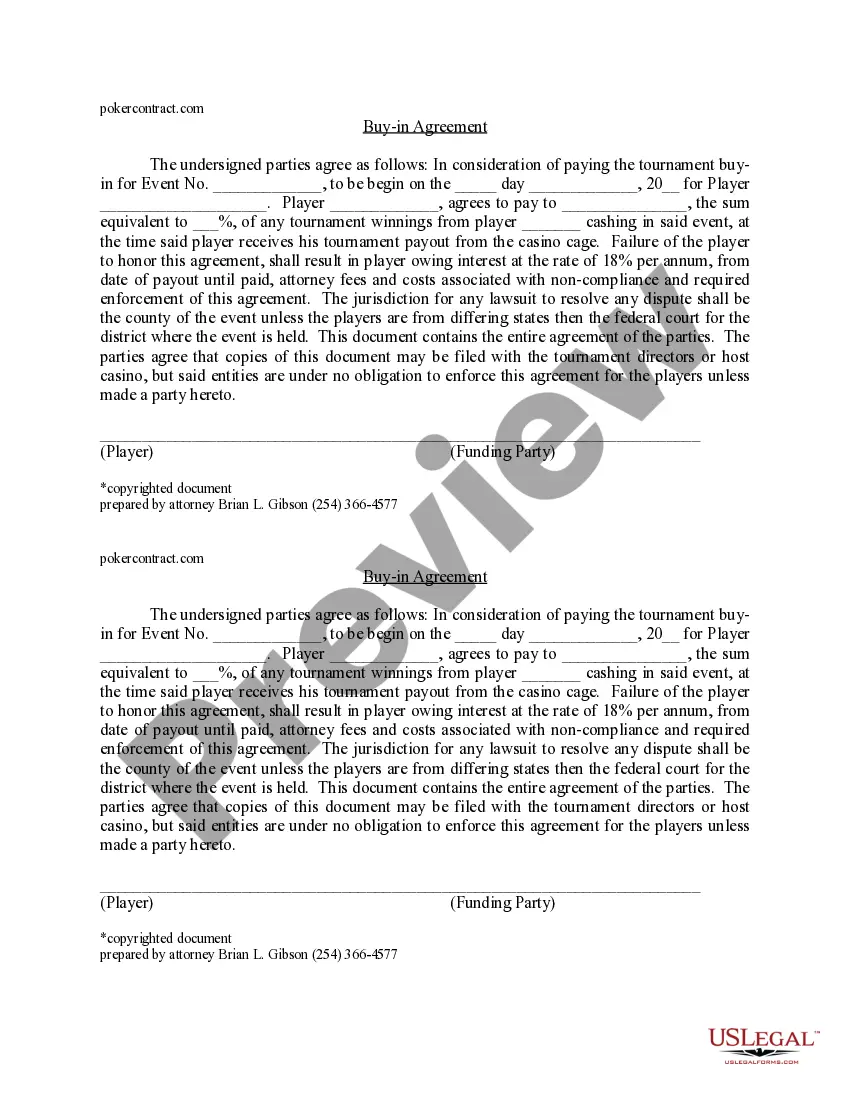

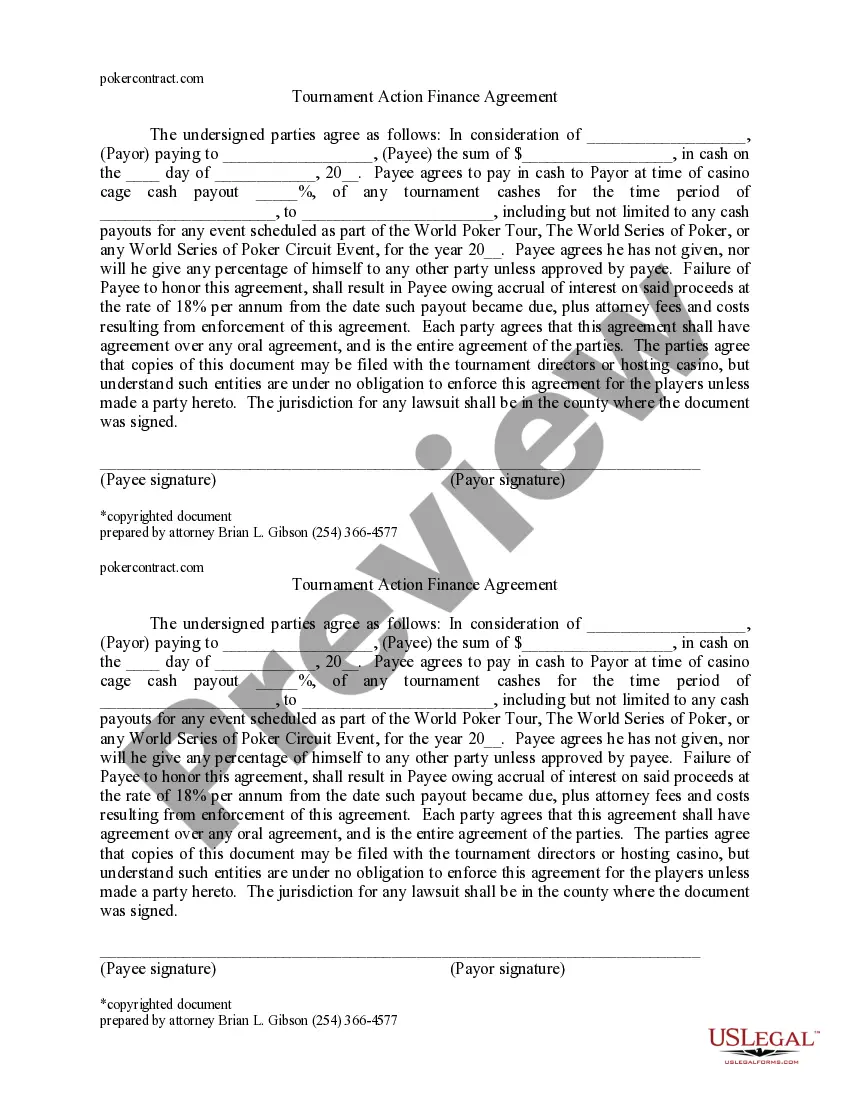

- Step 2. Use the Preview feature to review the form's content. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form format.

- Step 4. Once you've found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your system.

- Step 7. Complete, modify, and print or sign the Kansas Percentage Exchange Agreement.

Form popularity

FAQ

In Kansas, the state income tax takes a percentage of your paycheck, which can range from 3.1% to 5.7%, depending on your income level. Additionally, federal taxes and other deductions may apply. Knowing these figures is essential when entering into a Kansas Percentage Exchange Agreement, as it affects your overall financial planning. Use resources like uslegalforms to navigate these calculations effectively.

Kansas offers various relocation incentives to attract new residents and businesses. These incentives can include tax credits, grants, or assistance with housing costs. If you are considering a Kansas Percentage Exchange Agreement, understanding these incentives can help you make an informed decision about your move. Check with local authorities for the latest programs available.

In Kansas, the maximum interest rate allowed by law typically caps at 15% for consumer loans. However, specific types of loans may have different limits. Understanding these rates is crucial, especially if you are entering into a Kansas Percentage Exchange Agreement. Always consult legal resources to ensure compliance with current regulations.

The single entity apportionment method in Kansas allows businesses to report their income based solely on sales generated in the state. This method simplifies tax calculations by focusing on a single factor rather than multiple criteria. For entities involved in a Kansas Percentage Exchange Agreement, this approach can streamline their tax process and enhance clarity in reporting.

An apportionment formula is a mathematical method used to allocate a business's income among different states for tax purposes. The formula typically takes into account factors such as sales, property, and payroll. For businesses operating under a Kansas Percentage Exchange Agreement, understanding the apportionment formula is crucial for accurate tax reporting and compliance.

Yes, Kansas does accept federal extensions for partnerships. If you file for a federal extension, you can use it to also extend your Kansas tax return filing deadline. This can be particularly useful for partnerships that engage in a Kansas Percentage Exchange Agreement, as it allows for more time to gather necessary financial information.

The most commonly required apportionment method for state income tax calculations is the three-factor formula, which considers property, payroll, and sales. However, many states, including Kansas, allow for single factor apportionment based on sales. This option can be beneficial for businesses that primarily generate revenue through sales, particularly those involved in a Kansas Percentage Exchange Agreement.

To file an amended Kansas tax return, you must complete a specific form designated for amendments, typically the Kansas Individual Income Tax Return. After filling out the form with the correct information, submit it along with any necessary documentation, such as W-2s or 1099s. Utilizing resources from USLegalForms can help guide you through this process, especially if your amendments relate to a Kansas Percentage Exchange Agreement.

In Kansas, single factor apportionment focuses solely on the sales of a business within the state. This means that only the sales revenue generated in Kansas is used to apportion the business's total income for tax calculations. Understanding this process is vital for businesses entering into a Kansas Percentage Exchange Agreement, as it directly affects their tax liabilities.

Single factor apportionment is a method used to determine how much income a business must report to a particular state for tax purposes. This approach usually relies on a single factor, such as sales, to allocate income. In the context of the Kansas Percentage Exchange Agreement, businesses can effectively leverage this method to simplify their tax calculations and ensure compliance.