Kansas Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

Selecting the best valid document template can be quite a challenge.

Naturally, there are numerous templates accessible online, but how can you acquire the valid form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Kansas Lab Worker Employment Agreement - Self-Employed, which can be utilized for business and personal purposes. All of the forms are verified by experts and meet federal and state regulations.

If the form does not meet your expectations, make use of the Search area to find the appropriate form. When you are confident that the form is correct, proceed through the Get now option to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete your purchase using your PayPal account or Visa or Mastercard. Select the document format and download the valid document template for your device. Complete, modify, and print and sign the acquired Kansas Lab Worker Employment Agreement - Self-Employed. US Legal Forms is indeed the largest collection of valid forms where you can find various document templates. Use the service to obtain professionally-crafted paperwork that adhere to state requirements.

- If you are already registered, Log In to your account and click the Obtain button to locate the Kansas Lab Worker Employment Agreement - Self-Employed.

- Use your account to search for the valid forms you may have acquired previously.

- Visit the My documents section of your account and download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region.

- You can preview the document using the Review option and examine the form summary to confirm that this is indeed the right one for you.

Form popularity

FAQ

Absolutely, a self-employed person can and should have a contract. A Kansas Lab Worker Employment Contract - Self-Employed outlines the terms of your work and protects your rights. It clearly defines your role, responsibilities, and compensation, ensuring both parties understand expectations. Using a reliable platform like uslegalforms can simplify the process of drafting a contract that meets your unique needs.

In Kansas, misclassifying employees as independent contractors can lead to significant penalties. If a company fails to properly classify a worker, it may face back taxes, fines, and potential legal actions. This is crucial because it affects the rights and benefits of the affected workers. To avoid these issues, consulting a Kansas Lab Worker Employment Contract - Self-Employed can provide clarity on your obligations.

Yes, contract work typically qualifies as self-employment. When you take on a Kansas Lab Worker Employment Contract - Self-Employed, you operate your own business, managing your hours and tasks. This arrangement allows you to work independently while fulfilling your clients' needs. Understanding this classification can empower you to maximize your earning potential.

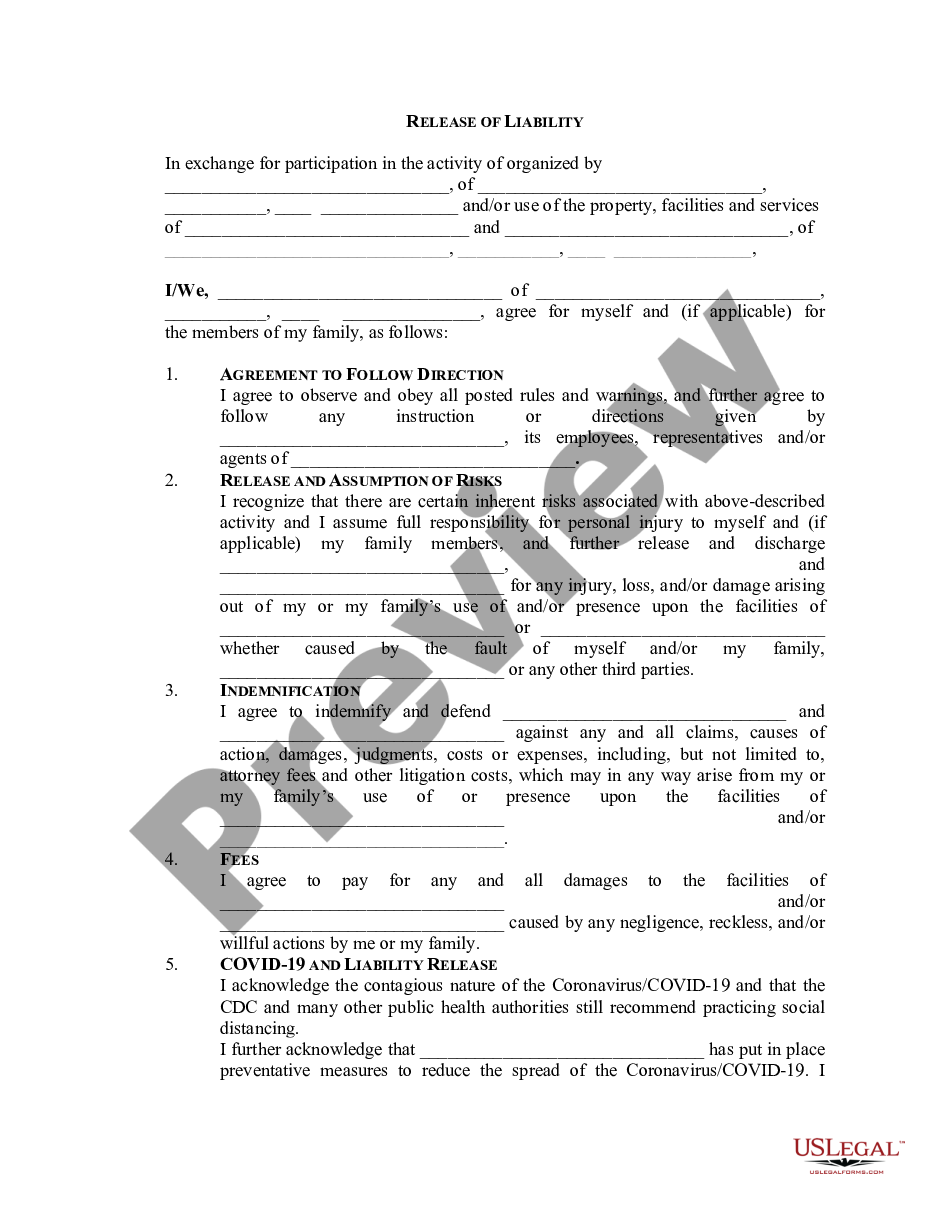

Filling out a contract of employment template requires careful attention to detail. Start by providing the necessary information about both parties, including names, addresses, and the scope of work. Make sure to incorporate clauses from a Kansas Lab Worker Employment Contract - Self-Employed to ensure compliance and clarity. Review the document thoroughly before signing to confirm that all terms meet your and your client's expectations.

A contract employee is generally not considered self-employed in the traditional sense. While they operate under a contract, they may still fall under the employment of a company. In contrast, self-employed individuals manage their own businesses and often use contracts like the Kansas Lab Worker Employment Contract - Self-Employed to specify their terms. Understanding this distinction can help you navigate your work situation more effectively.

Creating a private contract with yourself can be a way to outline your personal commitments to your business. While it may seem unusual, it can help clarify your goals and tasks. However, a Kansas Lab Worker Employment Contract - Self-Employed is typically designed to formalize relationships with clients or companies, which provides more benefits. It is important to focus on external contracts for greater legal protections.

Writing a self-employed contract involves several key steps. Start by outlining the services you will provide, payment terms, and any deadlines involved. Incorporate elements from a Kansas Lab Worker Employment Contract - Self-Employed to ensure all legal bases are covered. Having clear, specific terms in your contract enhances understanding for both you and your client.

Both terms, self-employed and independent contractor, can refer to similar work arrangements but have distinct connotations. Self-employed generally refers to someone who owns their business, while independent contractor usually describes a worker who contracts with clients or companies. In many cases, using terms like Kansas Lab Worker Employment Contract - Self-Employed can clarify your status. Choose the term that most accurately reflects your work situation.

New rules for self-employed individuals are evolving as regulations adapt to modern work environments. For instance, recent changes emphasize the importance of clear contracts like the Kansas Lab Worker Employment Contract - Self-Employed. These rules often focus on tax responsibilities, benefits eligibility, and the criteria that define self-employment. Staying informed about these changes helps you remain compliant and protects your rights.

Absolutely, having a contract as a self-employed individual is both common and advisable. A Kansas Lab Worker Employment Contract - Self-Employed serves to formalize your work agreement, detailing payment terms, work scope, and other key elements. This clarity helps prevent misunderstandings and can strengthen your business relationships. Remember, a well-organized contract can provide legal protection if disputes arise.