Kansas Auctioneer Services Contract - Self-Employed Independent Contractor

Description

How to fill out Auctioneer Services Contract - Self-Employed Independent Contractor?

If you require extensive, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Every legal document format you acquire is yours permanently. You have access to every form you saved in your account. Click the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Kansas Auctioneer Services Contract - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Employ US Legal Forms to retrieve the Kansas Auctioneer Services Contract - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Kansas Auctioneer Services Contract - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

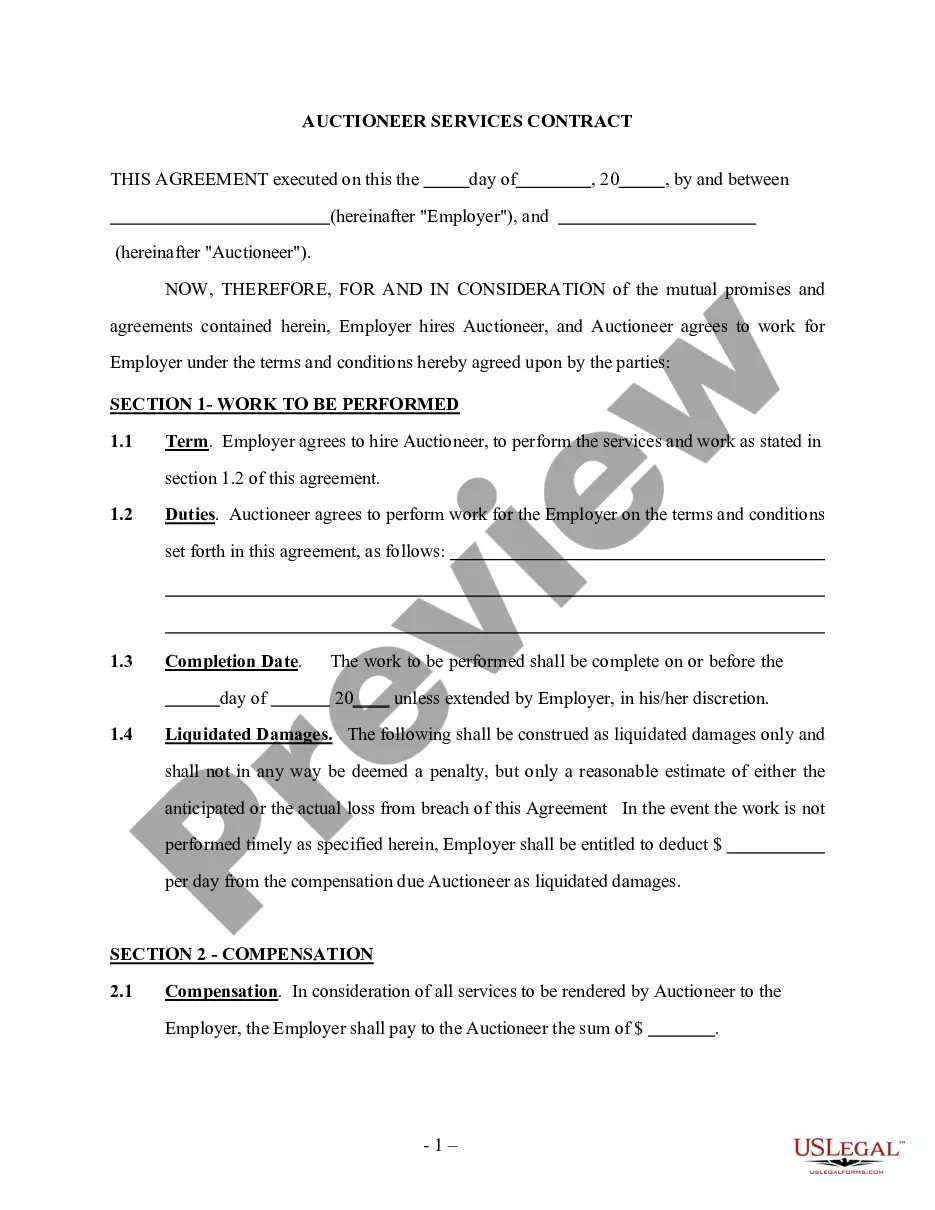

- Step 1. Ensure you have selected the form for the correct state/city.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions in the legal form format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred payment plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to make the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Kansas Auctioneer Services Contract - Self-Employed Independent Contractor.

Form popularity

FAQ

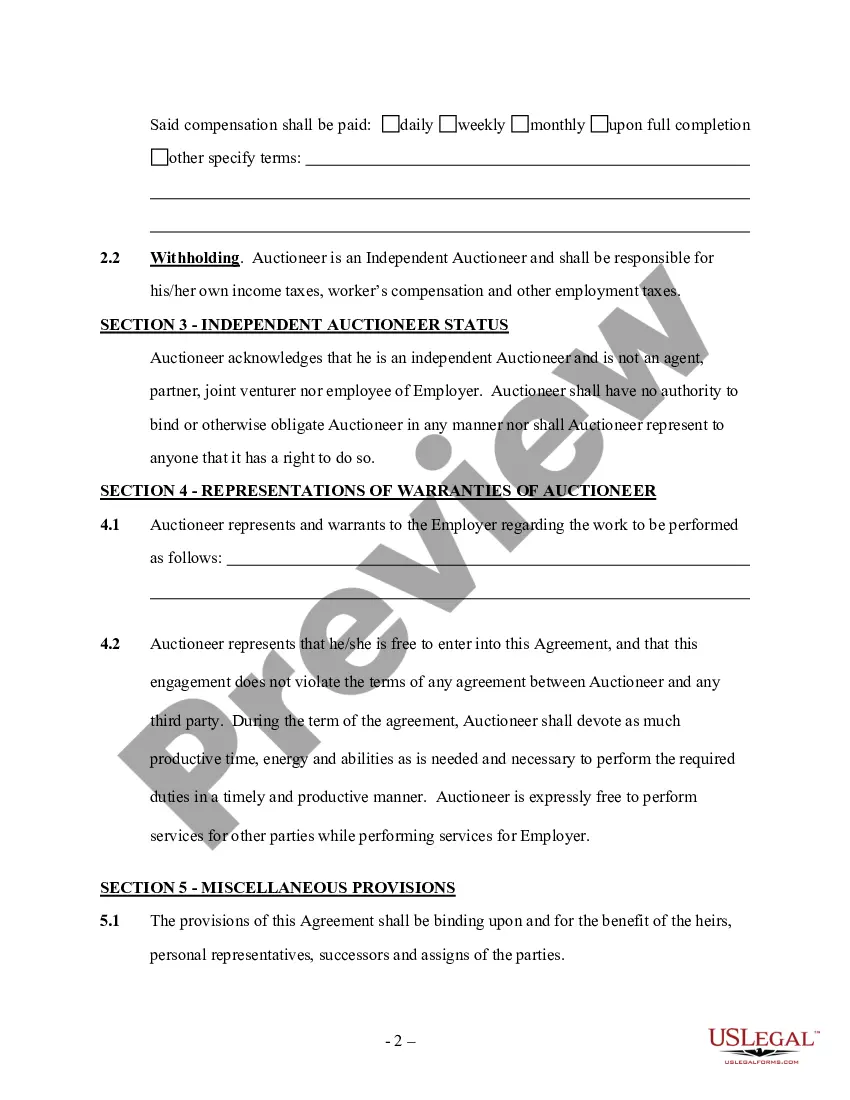

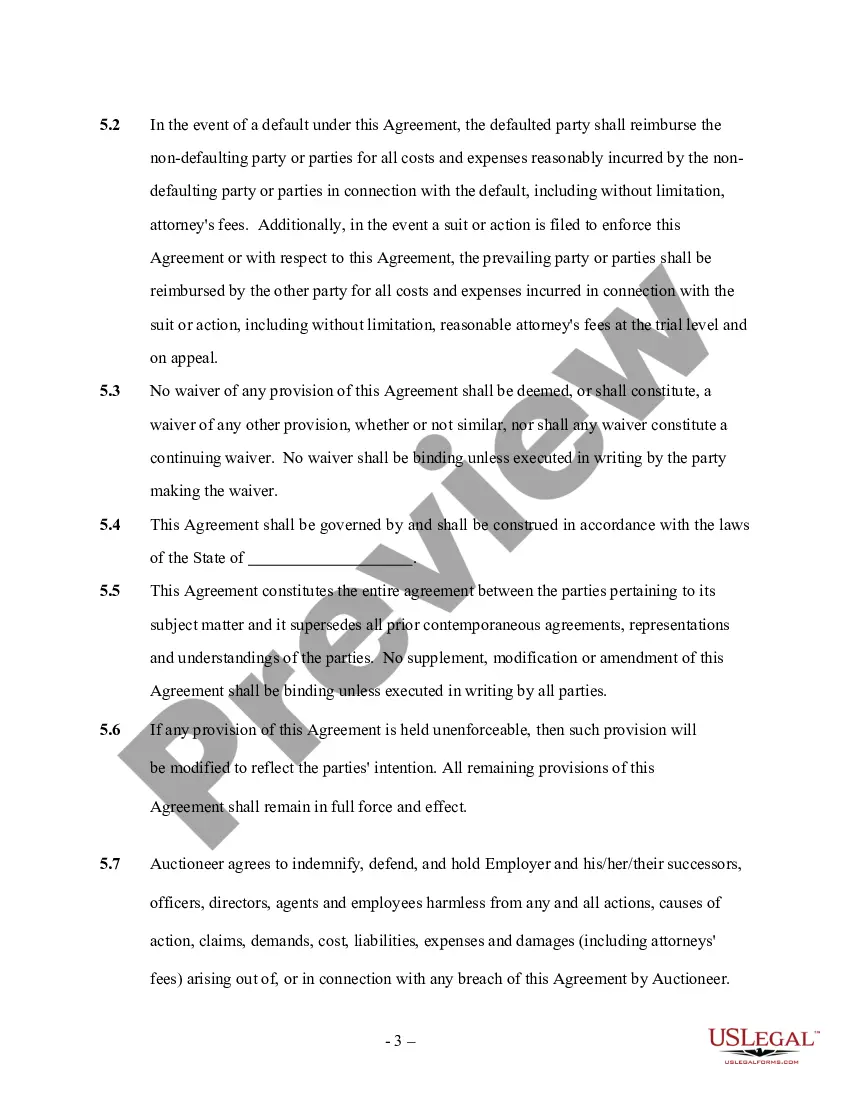

To protect yourself as an independent contractor, always use a well-drafted Kansas Auctioneer Services Contract - Self-Employed Independent Contractor. This contract should outline payment terms, duties, and confidentiality agreements. Additionally, consider obtaining liability insurance and keeping accurate records of your business transactions to safeguard your interests and enhance your credibility.

Yes, contractors may need to be licensed depending on the type of work they perform in Kansas. For example, those engaged in auctioneer services should be aware of specific regulations and licensing requirements. It’s vital to understand these requirements to ensure compliance, particularly for those looking to enter a Kansas Auctioneer Services Contract - Self-Employed Independent Contractor arrangement.

Hiring independent contractors as a sole proprietor involves a few key steps. First, clearly define the scope of work for the Kansas Auctioneer Services Contract - Self-Employed Independent Contractor you need. Next, conduct thorough research to find qualified individuals who meet your requirements. Always ensure that you have proper documentation in place to protect both parties, making the process smooth and professional.

To fill out an independent contractor agreement, begin by entering both parties' information and the project's scope. Clearly outline deliverables, payment schedules, and any necessary confidentiality clauses related to the Kansas Auctioneer Services Contract - Self-Employed Independent Contractor. Always review the agreement for completeness, as this clarity mitigates misunderstandings. You can also seek assistance from uslegalforms to ensure compliance with state requirements.

Filling out an independent contractor form involves providing accurate personal and business information, including your name, address, and the nature of services offered. Ensure you detail the compensation structure clearly to reflect your rate for the Kansas Auctioneer Services Contract - Self-Employed Independent Contractor. This transparency helps build trust and clarity in the working relationship. Platforms like uslegalforms can provide helpful templates for this process.

To write a self-employed contract, start by clearly outlining the services provided and setting specific expectations. Include essential details such as payment terms, duration of the agreement, and provisions for termination. Also, specify that the contract is for Kansas Auctioneer Services Contract - Self-Employed Independent Contractor, ensuring all parties understand their roles. Utilizing a template can streamline this process and ensure completeness.

In Kansas, service labor can be taxable depending on the nature of the service provided. It's crucial to understand what services fall under the taxable category. As a self-employed independent contractor, knowing these tax implications can help you manage your finances and obligations associated with your Kansas Auctioneer Services Contract - Self-Employed Independent Contractor.

To prove your status as an independent contractor, maintain documentation such as contracts, invoices, and tax forms. You might also provide a letter from your clients confirming your status. This evidence will be vital for showing your role under the Kansas Auctioneer Services Contract - Self-Employed Independent Contractor.

Creating an independent contractor contract begins with identifying the parties involved and defining the services provided. Next, include payment structures, deadlines, and any confidentiality clauses. By utilizing resources from uslegalforms, you can draft a solid Kansas Auctioneer Services Contract - Self-Employed Independent Contractor that protects your interests.

To write a contract as an independent contractor, start by outlining the scope of work, including responsibilities and deliverables. Specify payment terms, timelines, and any conditions that may apply. You can enhance reliability by referencing templates for a Kansas Auctioneer Services Contract - Self-Employed Independent Contractor, making sure to cover all critical points.