Kansas Employment Services Agreement - Self-Employed Independent Contractor

Description

How to fill out Employment Services Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you frequently require documents for either business or personal reasons.

There are numerous legal document templates available online, but finding trustworthy ones is not straightforward.

US Legal Forms offers thousands of form templates, such as the Kansas Employment Services Agreement - Self-Employed Independent Contractor, that are designed to comply with federal and state regulations.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Kansas Employment Services Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/county.

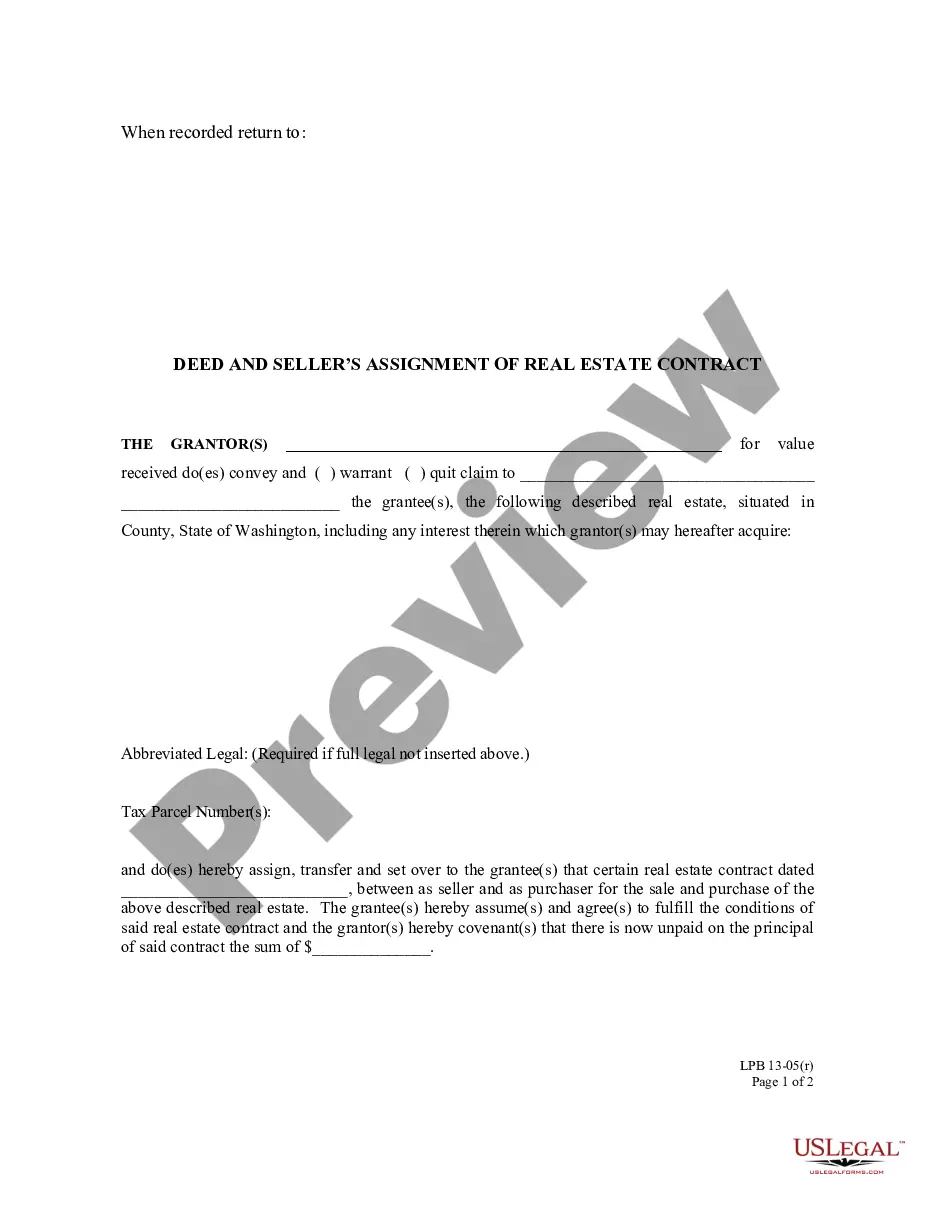

- Use the Review option to evaluate the form.

- Read the description to confirm you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to locate the form that suits your needs and requirements.

- Once you find the right form, click Acquire now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Kansas Employment Services Agreement - Self-Employed Independent Contractor at any time, if needed. Just click on the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Independent contractors must meet specific legal requirements to operate correctly. They should have a written agreement, like a Kansas Employment Services Agreement - Self-Employed Independent Contractor, that defines their relationship with the hiring entity. Additionally, they must comply with tax obligations, including registering for any necessary business licenses. Understanding these legal aspects helps both parties maintain a professional relationship and avoid potential disputes.

For a 1099 employee, you will need to provide a completed W-9 form, which collects the contractor's taxpayer identification information. At the end of the year, you will issue a Form 1099-NEC to report payments made to the contractor. This form is crucial for tax reporting purposes. Using a Kansas Employment Services Agreement - Self-Employed Independent Contractor can also simplify tracking payments and ensuring compliance.

Yes, independent contractors file as self-employed individuals. They report their income and expenses on a Schedule C form, which is part of their personal tax return. It's essential for contractors to maintain accurate records of their earnings and business expenses. Utilizing a Kansas Employment Services Agreement - Self-Employed Independent Contractor can help streamline this process by clearly defining the terms of their work.

To hire an independent contractor, you will need to complete a Kansas Employment Services Agreement - Self-Employed Independent Contractor. This document outlines the scope of work, payment terms, and deadlines. Additionally, you should obtain a W-9 form from the contractor for tax purposes. This paperwork ensures clarity and protects both parties involved in the agreement.

Being self-employed typically means you work for yourself rather than for an employer. You may operate a business, freelance, or provide services as an independent contractor. Key indicators include having control over how you work, being responsible for your business expenses, and receiving payment directly from clients. To formalize your self-employment status, consider using a Kansas Employment Services Agreement - Self-Employed Independent Contractor, which can guide you in establishing clear terms with your clients.

Yes, an independent contractor is indeed considered self-employed. This status means you operate your own business, set your own hours, and have the freedom to choose your clients. It's essential to recognize this distinction, as it affects your tax status and eligibility for certain benefits. A Kansas Employment Services Agreement - Self-Employed Independent Contractor can help you navigate these responsibilities.

Both terms are often used interchangeably, but they can imply slightly different things. 'Self-employed' broadly describes anyone running their own business, while 'independent contractor' specifically refers to a contractual relationship with a client. Regardless of the term you choose, it's important to have a Kansas Employment Services Agreement - Self-Employed Independent Contractor to clearly define your role and responsibilities. This clarity enhances your professional image and protects your rights.

Yes, receiving a 1099 form typically indicates that you are self-employed. This tax form is issued to independent contractors who earn income outside of traditional employment. As a self-employed individual, you manage your own business expenses and tax obligations. Thus, understanding your status is crucial for managing your finances effectively.

Yes, having a contract as an independent contractor is essential. A Kansas Employment Services Agreement - Self-Employed Independent Contractor outlines the terms of your work, payment, and responsibilities. This contract protects both you and your client by clarifying expectations and legal obligations. Therefore, using a well-structured agreement can prevent misunderstandings and disputes in the future.

Filling out an independent contractor agreement requires attention to detail. Start by entering the names and addresses of both parties involved. Then, outline the specific services provided, payment terms, and the duration of the agreement, ensuring all aspects align with the Kansas Employment Services Agreement - Self-Employed Independent Contractor. Finally, both parties should review the document before signing to confirm mutual understanding and agreement.