Kansas Web Site Use Agreement

Description

How to fill out Web Site Use Agreement?

Have you been in the position in which you need to have files for sometimes organization or specific uses almost every time? There are a variety of legitimate papers layouts available on the net, but finding types you can trust is not easy. US Legal Forms provides thousands of type layouts, like the Kansas Web Site Use Agreement, that are published to fulfill federal and state specifications.

In case you are currently informed about US Legal Forms internet site and have your account, just log in. Following that, it is possible to obtain the Kansas Web Site Use Agreement template.

Unless you come with an account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the type you will need and ensure it is to the right city/county.

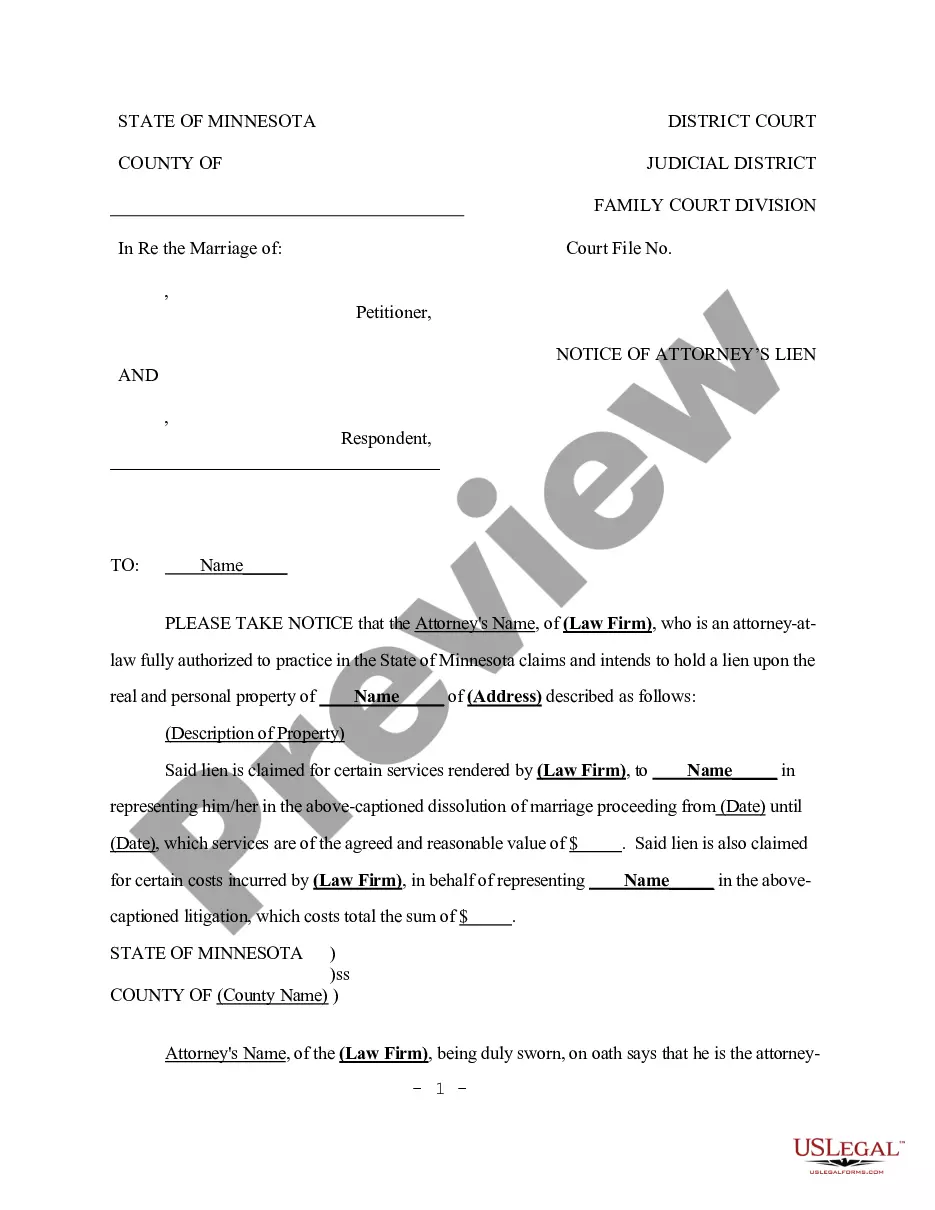

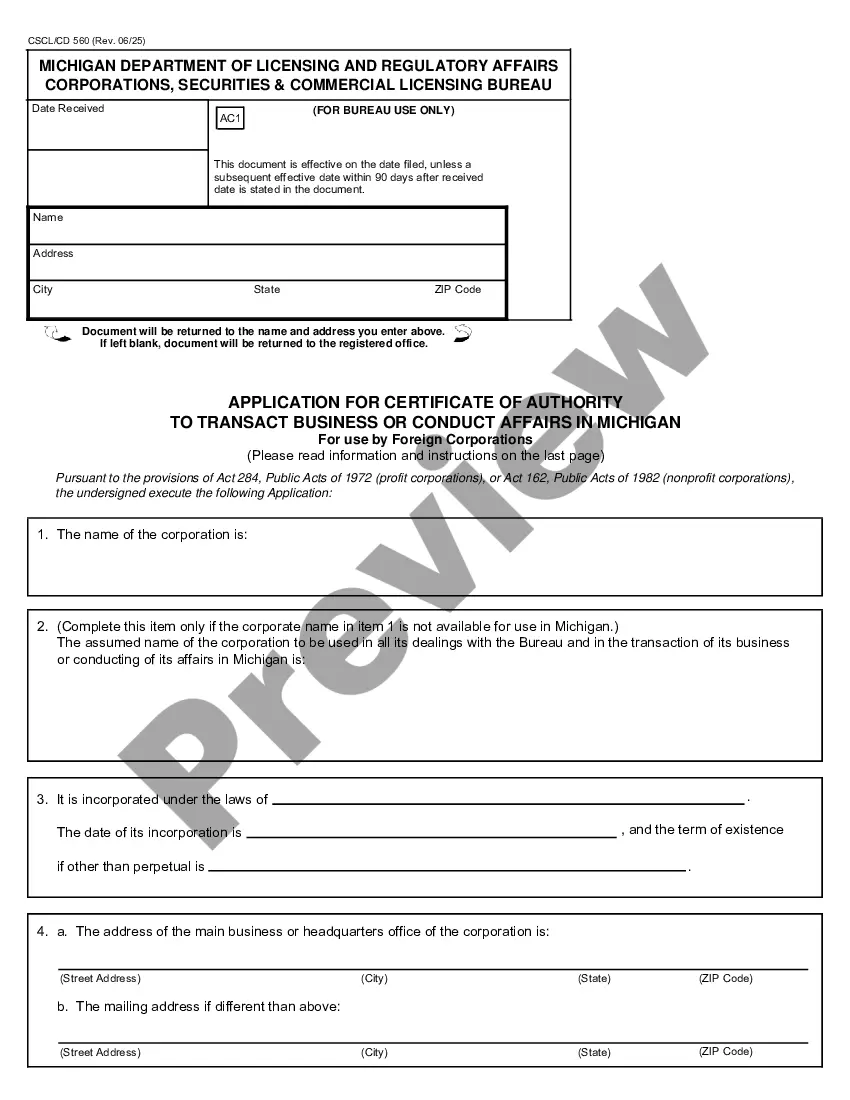

- Use the Review key to analyze the form.

- Browse the explanation to ensure that you have chosen the right type.

- If the type is not what you`re seeking, make use of the Research area to obtain the type that suits you and specifications.

- When you obtain the right type, click Acquire now.

- Opt for the rates prepare you want, fill out the desired information to create your bank account, and purchase the transaction utilizing your PayPal or charge card.

- Decide on a convenient paper format and obtain your backup.

Get all of the papers layouts you might have bought in the My Forms menu. You may get a further backup of Kansas Web Site Use Agreement whenever, if necessary. Just select the needed type to obtain or print out the papers template.

Use US Legal Forms, by far the most comprehensive selection of legitimate varieties, to save efforts and prevent mistakes. The service provides skillfully manufactured legitimate papers layouts which you can use for a range of uses. Make your account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

State law does not require or permit the registration or filing of DBAs or fictitious names.

To renew by paper: Print the paper renewal form and mail to our Board office with a check or money order for $95.00.

Businesses must renew their Kansas Certificate of Authorization every two years to avoid expiration and/or cancellation. Each Certificate a business holds needs renewed separately by the Principal in responsible charge.

Due Date. Your Kansas LLC Annual Report is due every year on the 15th day of the 4th month following the tax closing month. Example: If your tax closing month is December (which it is for most people), your due date is April 15th of the following year.

To register a foreign LLC in Kansas, you must file an Application for Registration of Foreign Covered Entity with the Kansas Secretary of State. You can submit this document by mail, fax, or in person. The application costs $165 to file. (Add $20 if filing by fax.)

To revive or reinstate your Kansas LLC, you'll need to submit the following to the Kansas Secretary of State: a completed Certificate of Reinstatement of Limited Liability Company. all past due annual reports. the $35 filing fee plus fees for late annual reports, if needed.

An annual report may be filed beginning January 1 but must be filed by April 15. All for-profit entities with a tax period other than a calendar year must file an annual report no later than the 15th day of the fourth month following the end of the entity's tax period.

If you are a corporation, LLC, or partnership conducting business in Kansas, you must pay $50 to file an annual report every year. There is a $5 fee if you choose to submit your report by mail.