Kansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

How to fill out Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

If you wish to total, down load, or produce lawful document layouts, use US Legal Forms, the biggest selection of lawful kinds, that can be found on-line. Use the site`s basic and practical research to find the files you require. Numerous layouts for organization and person purposes are categorized by groups and states, or keywords and phrases. Use US Legal Forms to find the Kansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan in a few clicks.

In case you are presently a US Legal Forms customer, log in in your account and then click the Down load switch to have the Kansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan. You can even gain access to kinds you earlier saved from the My Forms tab of your respective account.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape for that right city/land.

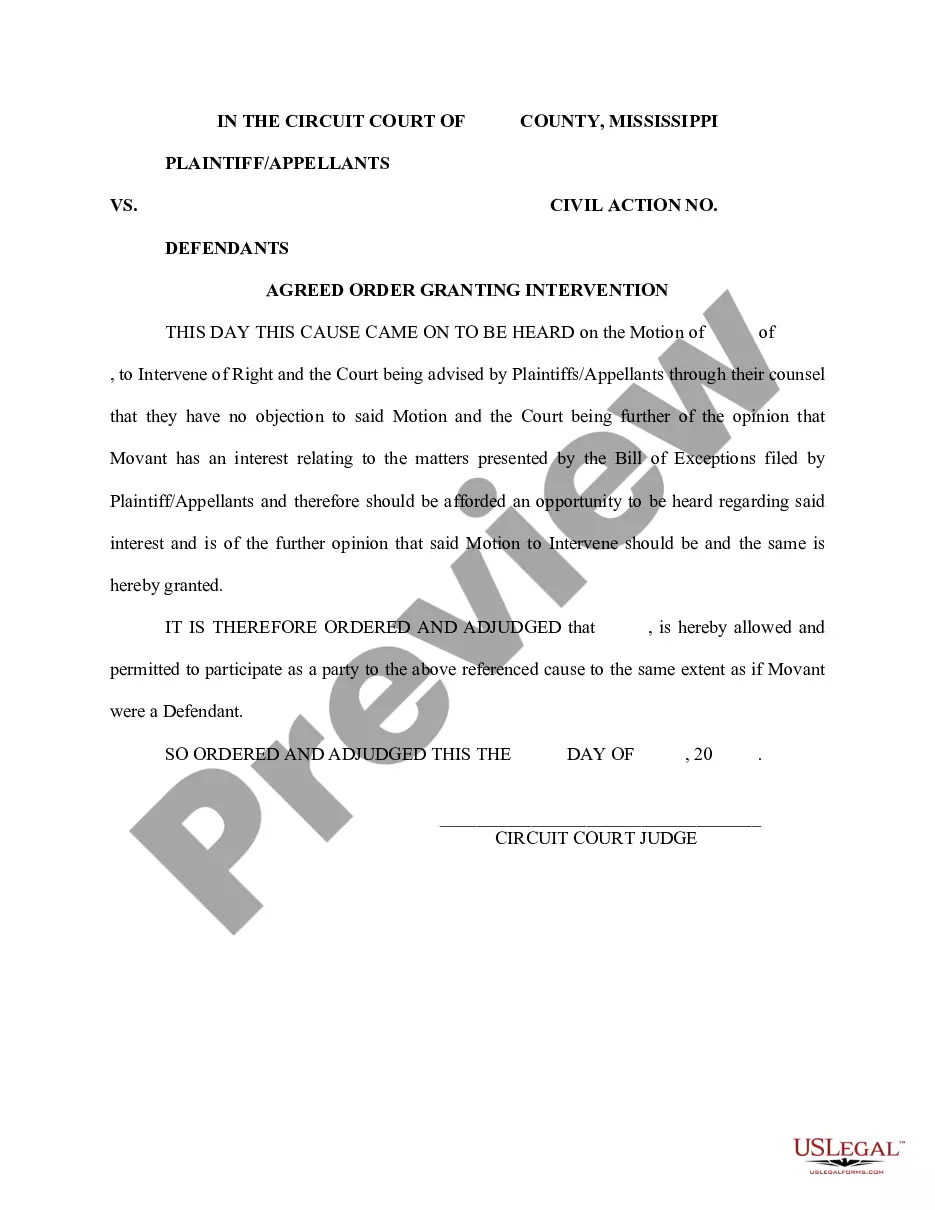

- Step 2. Use the Preview option to look over the form`s content. Don`t neglect to learn the description.

- Step 3. In case you are not satisfied together with the develop, make use of the Lookup industry near the top of the display to locate other models of the lawful develop web template.

- Step 4. After you have identified the shape you require, click the Get now switch. Opt for the rates program you prefer and add your references to register for an account.

- Step 5. Process the purchase. You may use your charge card or PayPal account to complete the purchase.

- Step 6. Select the format of the lawful develop and down load it in your gadget.

- Step 7. Comprehensive, revise and produce or indicator the Kansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan.

Every lawful document web template you buy is the one you have permanently. You might have acces to every develop you saved inside your acccount. Go through the My Forms area and select a develop to produce or down load once again.

Contend and down load, and produce the Kansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan with US Legal Forms. There are thousands of skilled and condition-specific kinds you can utilize to your organization or person requirements.

Form popularity

FAQ

Under federal law, employers must pay employees for hours worked, including certain time that an employer may designate as "breaks." For example, if an employee has to work through a meal, that time must be paid.

Kansas requires that final paychecks be paid on the next scheduled payday, regardless of whether the employee quit or was terminated. Believe it or not, you just can't keep a paycheck that an ex-employee doesn't take. Even if a check is abandoned, the employer has no right to void the check and keep the funds.

Only if your employer has a policy or practice that employees will be paid for unused vacation time.

If I quit or am fired, am I entitled to payment for my unused accrued vacation time? Only if your employer has a policy or practice that employees will be paid for unused vacation time.

Funeral Leave: Eligible employees are provided up to 6 days of leave with pay upon the death of a close relative.

(h) "Occasional or part-time basis" means any employee working less than 40 hours per week and, for the purposes of this definition, students 18 years of age and under working between academic terms shall be considered part-time employees regardless of the number of hours worked.

The bottom line: Studies show that employees who are taking vacation days, even if they don't go on vacation, are more productive in the office. However, there are situations where cashing out PTO can be beneficial and stress-reducing, like paying debts or covering needed repairs.